QUOTE OF THE DAY

The News Gazette: Governor says school cuts coming

Stepping up the campaign to make a temporary income tax increase permanent, Gov. Pat Quinn’s office today released figures showing how each school district in the state would fare with the loss of $875 million in education funding statewide.

But one area Republican legislator said he didn’t think the maneuver would be persuasive to state lawmakers facing a possible vote on extending the tax increase. State Rep. Chad Hays, R-Catlin, called it “a very distasteful tactic.”

The Danville school district would suffer the greatest loss of any East Central Illinois school system, losing $4.5 million, according to the Governor’s Office of Management and Budget. In order to make up for the loss in state aid, GOMB said, local property taxes would have to be increased 24.6 percent.

Northwest Herald: Some Illinois Democrats defy leaders on tax rises

“I think there’s support here to invest in areas of the state budget that need it the most,” he said.

The measure to make the tax increases permanent is expected to barely pass the Senate, where Democrats have a supermajority.

But Madigan said Monday that Democrats in his chamber, also holding a supermajority of seats, were still “significantly short” of the 60 votes he needs. All Republicans oppose the measure.

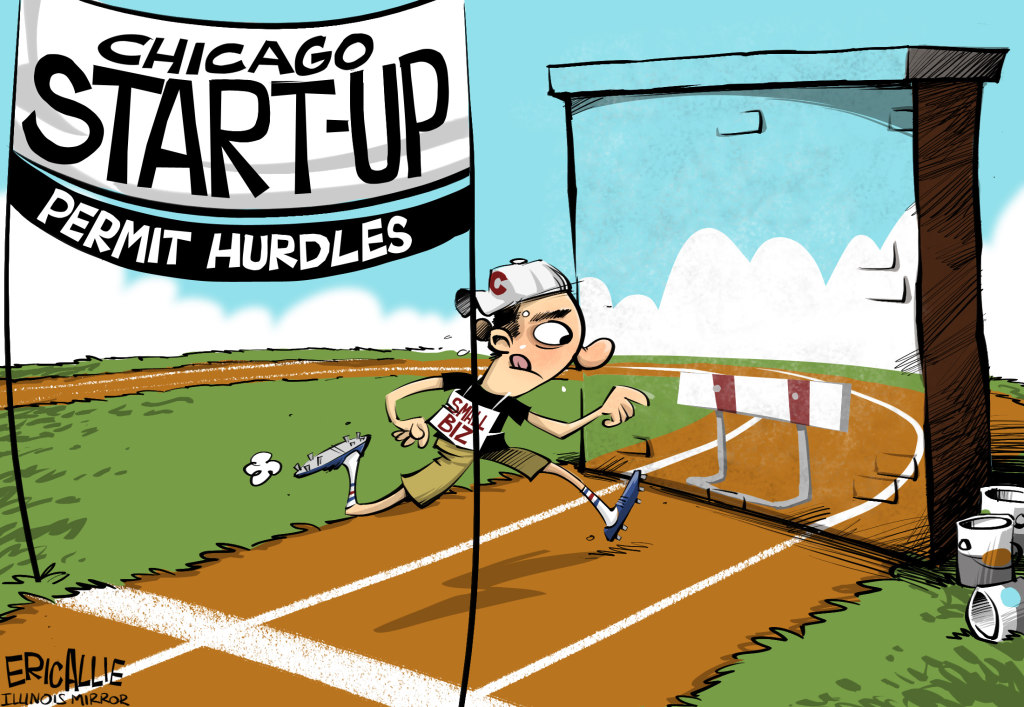

Crain’s: Pro-business tax changes vying for Springfield’s to-do list

After months of discussion, a small package of business-friendly tax reforms is making its way to the finish line in Springfield.

While details are still taking shape, lobbyists and one key lawmaker said there is broad support to repeal the Illinois corporate franchise tax and expand a sales tax exemption on equipment purchases for manufacturers, among other ideas.

It’s too early to say whether the proposals will get pulled along or trampled by the much bigger debate over the extension of the state’s income tax rate or proposals by House Speaker Michael Madigan to cut the corporate income tax in half or make credits for creating or retaining jobs more useful for small business.

Washington Post: The latest sign that everyone has completely given up on a reasonable tax code

A new bill that Democratic senators introduced Tuesday regarding multinational mergers shows what a profound disaster the global corporate tax system has become.

In apparent desperation, the group of 13 Democrats and one independent, led by Sen. Carl Levin (D-Mich.), are proposing legislation that would make it more difficult for U.S. firms to buy a smaller foreign company in order to incorporate in countries with lower taxes. The practice is known as tax inversion, and companies are using it aggressively to avoid paying the U.S. corporate tax rate of 35 percent.

The rush to incorporate abroad can be seen a simple cost-cutting measure, but it’s also reflection of how just unlikely big companies think Congress is to pass any sort of tax reform. “I view tax inversions as motivated by existential tax despair,” said Ed Kleinbard, a law professor at the University of Southern California.

Pantagraph: IHSA chief defends executive salaries

The executive director of the Illinois High School Association defended the way the organization spends its money during sometimes testy testimony before a House panel on Tuesday.

The Bloomington-based organization, which regulates sports for many Illinois high schools, came under fire recently over concerns that too much of its money goes toward compensating its administrators, rather than funding high school athletics.

“I just want to be clear that I don’t think we need to apologize for the salaries our people make,” said IHSA Executive Director Marty Hickman. “They’re hard-working, competent, dedicated folks that bust their butts everyday.”

KMOV: Bill filed to give Ill. homeowners $500 tax refund

A proposal to give Illinois homeowners a $500 property tax refund has been introduced in the General Assembly.

House Speaker Michael Madigan filed the legislation Monday.

The measure was a key part of Gov. Pat Quinn’s budget address earlier this year. The Chicago Democrat also proposed making Illinois’ temporary income tax increase permanent.

Quinn says the $500 refunds would ease the burden of an unfair property tax system.

Chicago placed in the top 10 among 30 cities studied by PwC US in the sixth edition of its Cities of Opportunity report, released today. The Windy City performed impressively, recording top 10 scores in seven out of the 10 indicators and in over a third of the variables. Most notably, Chicago scored highest in the cost indicators category, moving up seven places from 2012 to become the second most affordable city globally, just behind Los Angeles.

Chicago ties London and Singapore for sixth place in health, safety and security, receiving a healthy boost in this indicator from its number one rank in hospitals and health employment. The city also scored high in sustainability, rising six places since 2012 to seventh place. Chicago made significant inroads against recycled waste, advancing to the 11th spot and jumping ahead of New York to tie San Francisco for third place in air quality.

Chicago improves on its 2012 scores in ease of doing business, coming in seventh place, tied with San Francisco, and performed well in several variables including employee regulations, shareholder protection and ease of starting a business. In terms of demographics and liveability, Chicago ties with New York for 10th place but outperforms in the areas of quality of life, ease of commute and traffic congestion.

Chicago Tribune: Cook County Board to take up e-cigarette regulation today

The Cook County Board will see proposals today to increase regulation of electronic cigarettes and to study legalizing marijuana for recreational use, along with a $2.4 million settlement for a patient’s death at a county hospital.

Board President Toni Preckwinkle plans to introduce at the board’s meeting an ordinance to ban the use of e-cigarettes in county facilities and vehicles. This follows on the heels of a vote by the City Council to prohibit e-cigarette use in most public places in Chicago.

And Commissioner John Fritchey, D-Chicago, is expected to introduce a resolution urging the state to study legalizing the recreational use of marijuana. That’s likely to be referred to committee.

Greg Hinz: Is Chicago’s population growing again?

The city of Chicago gained just under 6,000 residents in the year that ended last July 1 — better than the decline of the previous decade, but well below the growth in most other big American cities.

And the figures weren’t much better in the suburbs, as once high-flying edge cities such as Joliet, Naperville and Aurora saw their population grown slow to a crawl or even decline.

According to new estimates released overnight by the U.S. Census Bureau, the population of Chicago proper grew to 2,718,782 on July 1, up 5,862 since July 1, 2012, or about 0.2 percent. The city’s population has increased about 23,000 since the 2010 census, or just under 1 percent.

CARTOON OF THE DAY