QUOTE OF THE DAY

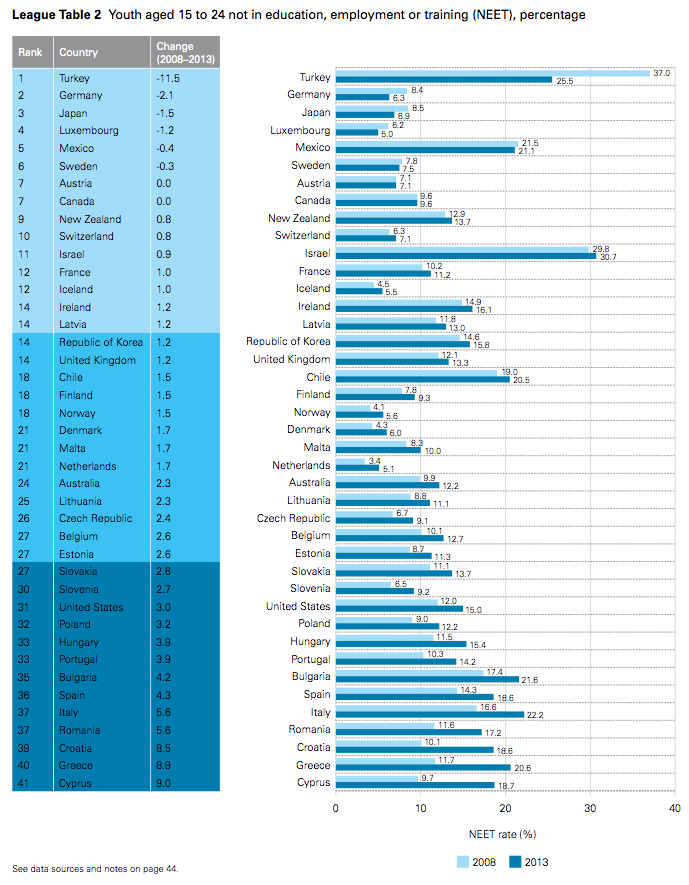

WSJ: Among Rich Countries, America’s Youth Took the Recession Especially Hard

Roughly 15% of U.S. youth aged 15 to 24 were not in school, a job or training in 2013, up from 12% in 2008—a bigger jump than in many other wealthy countries, according to a recent UNICEF report.

The figures underscore how much the recession, which lasted from December 2007 through June 2009, interrupted the lives of America’s children and young adults.

The News Gazette: Illinois tax ranking

Illinois ranked 31st among the 50 states in terms of how well it structures its tax system, according to the Tax Foundation’s 2015 State Business Tax Climate Index.

That’s not much different from the last four years when the state ranked either 29th or 30th.

The foundation looks at the five principal taxes that states use to raise revenue — individual income taxes, sales taxes, corporate taxes, property taxes and unemployment insurance taxes.

WSIL: One in Five Households on Food Stamps

New statistics show the state jobless rate is dropping but the number of people looking for food help is on the rise. Roughly one in five families in Illinois rely on food stamps.

September brought some good news for Illinois’ unemployment rate. Every single county in our region fell below nine percent. However, 5,000 families statewide signed up for SNAP in September.

Those numbers have some critics saying the state’s recovery is falling behind.

Chicago Tribune: Tinley Park Disposal received no-bid contracts for years

In 2011, Tinley Park concluded its residents were paying more for garbage collection than people in neighboring towns.

But instead of trying to find a less expensive alternative, the village rehired the same garbage collection company, a firm tied to a political insider, without any competitive bidding. That contract extension in 2011, worth an estimated $24 million, won’t expire until 2019.

A Tribune review of records found that the garbage company, Tinley Park Disposal, has continued to receive no-bid contract extensions for nearly two decades. The company was founded by Al Siegers, who has been a volunteer village commissioner since 1993, just a few months before his business inked its first deal with Tinley Park. Siegers also is a campaign contributor and friend to longtime Tinley Park Mayor Ed Zabrocki.

Chicago Sun Times: Clout consultants cash in on CPS rehabs

After five years as a top Chicago Public Schools executive, Sean Murphy now runs his own company.

But he’s still doing work for the school system, overseeing design for small remodeling projects at schoolter five years as a top Chicago Public Schools executive, Sean Murphy now runs his own company.

The pay: $338,000 a year.

State Journal Register: Several issues await Quinn-Rauner winner

The next governor of Illinois could decide a raft of big issues, from how to close a multibillion-dollar state budget gap to whether businesses must pay a higher minimum wage and whether to put more restrictions on guns. As voters head to the polls Tuesday, here’s a look at where Democratic Gov. Pat Quinn, of Chicago, and GOP challenger Bruce Rauner, of Winnetka, stand on some of the top issues:

Income tax

Quinn wants to make the income tax increase that Democrats passed in 2011 permanent rather than let the rate fall from 5 percent to 3.75 percent for individuals, as scheduled, on Jan. 1. He says that would lead to “severe” cuts to schools, social services and other areas.

Rauner wants to return the tax rate to its pre-2011 level of 3 percent within four years. He hasn’t outlined specific areas where he’d cut to make up for the billions in lost revenue, contending that economic growth would help fill the gap.

Chicago Tribune: Can Illinois survive an income tax rollback?

A week ago we explained why the race for governor of Illinois isn’t only about whether incumbent Pat Quinn or challenger Bruce Rauner will be Illinois’ CEO for four years. This contest also is a referendum on the future of the 67 percent personal income tax increase that Democrats enacted in 2011. Will that tax hike start to roll back on Jan. 1, as the law Quinn signed four years ago provides?

Quinn and many of his fellow Democrats will tell you that if they don’t make their temporary tax increase permanent, the loss of that revenue will leave Illinois, and especially its schools, savaged. As if the state would have no other way to meet its commitments and balance its budget.

The assertion that there’s only one way for Illinois to survive and thrive — We must set our tax hike in concrete! — isn’t true. Quinn, House Speaker Michael Madigan and other Democrats at various times have advocated other tax plans. Those plans have included such measures as cutting tax rates, applying the state sales tax not only to goods but to services, and reducing spending.

State Journal Register: Comment period extended on raw-milk regulation

State health regulators have extended the comment period for proposed regulation of raw milk products in Illinois as a result of hundreds of comments already received.

The Illinois Department of Public Health also has set aside seven hours for comments at a public hearing scheduled for Thursday at the state fairgrounds in Springfield.

Department spokeswoman Melaney Arnold said more than 800 comments were received as of Friday.

QC Online: Illinois business owners feel harassed by state regulations

Jerry Huot knows the frustration of dealing with state bureaucrats first hand.

The Kankakee-area businessman operated a chain of convenience stores across eastern Illinois for decades. In fact, his family has been in the petroleum-marketing business for 103 years.

The company has the oldest motor fuel tax number in Illinois. So regulations were nothing new for Huot. But he said over the past decade Illinois’ business climate has become repressive.

Forbes: The Pension Crisis In Illinois

Cities across the country are finding ways to deal with their pension crises.

San Jose increased city-worker pension contributions and cut their pay to make ends meet. Atlanta required workers to contribute more to their pensions as well, but also cut cost-of-living adjustments. Others, such as Lexington managed to bargain their way, at least for the time being, out of their pension crises.

And, where reform and bargaining were no longer options, cities such as Stockton, Cedar Falls and most notably, Detroit, turned to bankruptcy. Bankruptcy in federal court allowed those cities to bypass state constitutional protections and cut pension benefits.

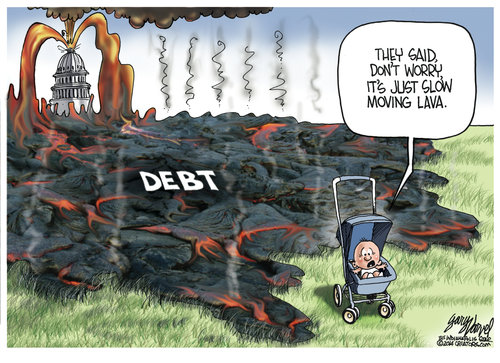

CARTOON OF THE DAY