Decline in food stamp benefits no excuse for losing focus on job creation

This month, the more than 2 million Illinoisans currently enrolled in the Supplemental Nutrition Assistance Program, or SNAP, will see a cut to their monthly food stamp benefits. An Illinois family of three will see their benefits decrease about $29. Currently, the average Illinois household receives $285 a month in benefits. The cut in benefits is due...

This month, the more than 2 million Illinoisans currently enrolled in the Supplemental Nutrition Assistance Program, or SNAP, will see a cut to their monthly food stamp benefits. An Illinois family of three will see their benefits decrease about $29.

Currently, the average Illinois household receives $285 a month in benefits.

The cut in benefits is due to a scheduled expiration of extra SNAP funding, which will return household and individual foodstamps benefits back to their pre-recession levels.

The current level of benefits was never meant to be permanent. They were meant to be a stimulus measure as part of the American Reinvestment and Recovery Act passed in 2009.

In total, Illinois’ SNAP benefits will be cut by about $220 million over the course of next year. That’s only a decline of 7 percent compared to the $3.1 billion in total SNAP funds the state received in 2012.

But while the cuts to SNAP will hurt some recipients, Illinois’ real problem is its lack of jobs.

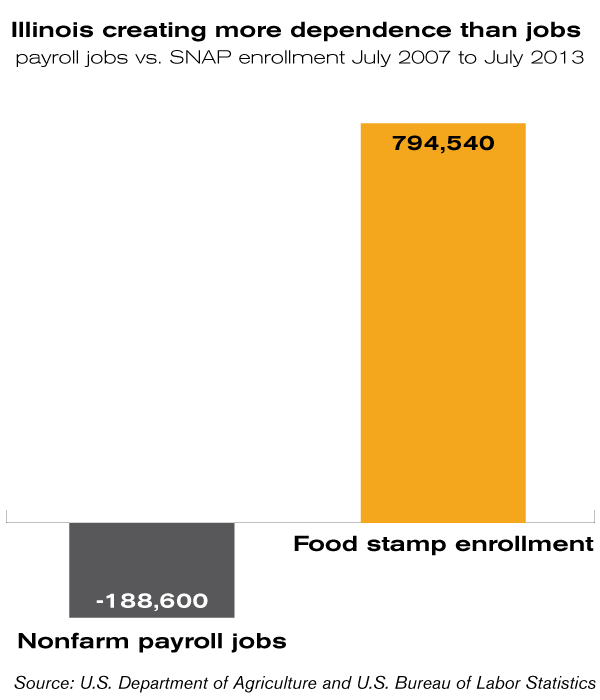

It’s been four years since the end of the Great Recession and yet Illinois is still adding more residents to SNAP than it is creating jobs. In fact, Illinois still had 188,000 fewer jobs in July 2013 than it did in July 2007. SNAP enrollment, on the other hand, has increased by nearly 800,000.

As a result, Illinois still has the second-highest unemployment rate in the nation, and more than 1 million Illinoisans are unemployed or underemployed.

If Illinois could start creating jobs, more Illinoisans could begin supporting themselves again instead of depending on the government for their next meal.

To jump-start job growth, Illinois must overturn the failed policies it has been following over the past decade and embrace pro-growth policies.

Illinois can do that by lowering its corporate income tax rate to encourage business investment, reducing onerous and costly regulations that stifle entrepreneurship and passing labor reforms to make Illinois a more attractive business destination.

Doing so will go a long way toward restoring prosperity to the state and freeing Illinoisans from the need to sign up for food stamps.