False choice for Illinois: Pritzker’s budget ignores commonsense alternative

Facing down a $3 billion deficit, Illinois Gov. J.B. Pritzker offered an unbalanced budget including more tax hikes, borrowing and spending. He claimed severe cuts were the only alternative, but another option exists.

Optimism, bipartisan solutions to Illinois’ chronic problems were promised by Illinois Gov. J.B. Pritzker in his first budget address on Feb. 20, but take a close look and there are serious pitfalls along Pritzker’s chosen path.

Illinois should not repeat past mistakes, such as damaging a weak economy with tax and fee hikes. It should not, again, increase debt and push pension payments into the future.

Illinois leaders should have learned from these past mistakes. Pritzker has good goals: sound finances, a growing economy and tax relief for working families. But then details of his budget plans for fiscal year 2020 sabotage those goals when they don’t need to.

Pritzker’s address presented a false choice to lawmakers and residents. The governor claimed there were only two ways to close the state’s daunting $3 billion deficit: massive tax hikes or slashing core government services such as education, public safety and social services.

That’s not true. A third way exists: Illinois can make structural spending reforms to the core cost drivers of its overspending, protect essential services and reduce the tax burden on Illinois residents. The Illinois Policy Institute’s five-year plan, Budget Solutions 2020, consists of commonsense reforms that have received bipartisan support in the past. Structural spending reform would enable lawmakers to balance the state budget immediately. In fewer than five years, they could eliminate the state’s bill backlog and finance a deficit-neutral income tax cut. Contrary to the governor’s claims, this can be accomplished without cuts to services that provide value to Illinois residents.

Pritzker’s false choice is a budgetary gimmick that’s been used before

Past Illinois governors have presented a similar false choice between core service cuts and tax hikes.

The Illinois State Budget Law requires the governor to propose a budget in which expenditures do not exceed revenues expected to be collected under current law. In other words, governors are required to propose balanced budgets without pretending they are about to receive a tax hike. As a result of this requirement, governors who favor tax hikes in Illinois sometimes propose “not recommended” budgets, which include no new revenues and therefore meet the statutory mandate, and “recommended” budgets that include tax hikes. Former Gov. Pat Quinn proposed two budgets for fiscal year 2015, one in which the then-temporary income tax hike was made permanent and an alternative scenario in which Quinn exaggerated the ramifications of allowing the tax hike to expire by claiming it would result in dramatic cuts to core government services.

Pritzker relied on this same false choice gimmick to meet his statutory requirement. On page 32 of the formal budget proposal document, the Pritzker administration says that without $1.1 billion in tax and fee hikes, all spending would have to be cut by 4 percent across the board to balance the budget, excluding debt service, pensions and employee health care costs.

The first thing to note about Pritkzer’s cuts-only option is the hypocrisy of its vagueness. Former Gov. Bruce Rauner infamously included nearly $4.6 billion in savings from a vague line item titled “working together on ‘grand bargain.’” This was widely derided as smoke-and-mirrors budgeting, lacking the specific information necessary to make a budget work in practice. Pritzker himself took a shot at the “working together” line item in his budget speech, pausing for laughter and applause. And yet, the governor’s 4 percent across-the-board cuts include no detail about the statutory changes necessary to achieve them, and represent the exact same sort of smoke-and-mirrors accounting gimmick for which he criticized Rauner.

The second thing to note about the cuts-only option is that Pritzker uses sleight of hand to take two items off the table which must be addressed in order to achieve a balanced budget with no tax hikes. It makes sense that debt service would be exempted from cuts – failing to make payments on debt is default, and would seriously harm the state’s credit rating. But the governor and General Assembly together have the power to initiate reasonable changes to pension costs and government worker health insurance. These two items are the fastest growing areas of state spending.

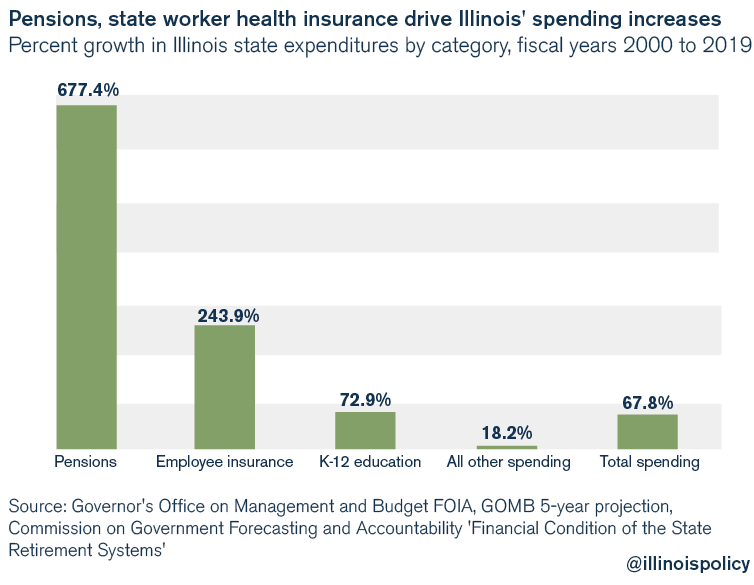

To create a balanced budget with no tax hikes, Pritzker simply needs to let the math lead his analysis and be willing to make difficult political decisions. Since fiscal year 2000, state spending on pensions has grown more than 677 percent, and spending on government worker health insurance has grown nearly 244 percent. Meanwhile, spending on K-12 education, often touted as a top priority by Illinois politicians, is up slightly less than 73 percent. All other spending, including social services for the disadvantaged, is up just over 18 percent. Total spending has risen by nearly 68 percent.

Pritzker’s proposed budget leaves untouched the two biggest cost-drivers in the state’s finances, offering cuts to a vast array of other programs and services as the only alternative to a new wave of tax hikes.

But the budget proposal is a bad deal for taxpayers for five other reasons as well.

1) Pritzker’s spending increases make the deficit harder to solve

The first step to getting out of any hole is to stop digging, but Pritzker has so far grabbed a bigger shovel.

According to projections from Pritzker’s administration, the structural deficit for fiscal year 2020 is $3.2 billion. This hole is $440 million more than projected in November by the Governor’s Office of Management and Budget, or GOMB. However, details of a report from the Pritzker administration show the deficit grew as a result of the administration’s plans to spend $440 million more than baseline projections on social services, education and public safety.

Pritzker also agreed to hand out at least $100 million of automatic raises to most Illinois state workers who belong to a union and pushed through a $15 minimum wage hike, set to ramp up over a number of years, which will cost the state $1.1 billion once fully implemented and more than $82 million for his first budget year.

2) Pritzker’s proposed budget is not truly balanced

The governor made a dubious claim that his proposed budget is balanced on a cash basis, relying on a lax accounting standard that hides the true size of deficits.

After claiming to have inherited a $3.2 billion deficit, the governor’s proposed budget takes only two main actions to narrow it: $1.1 billion in new revenue for tax and fee hikes, and shorting the pension funds by a little over $1 billion for a total deficit reduction of a little over $2 billion. From the details of the document, it is difficult to discern how the proposal closes the remaining $1 billion deficit.

Two major credit rating agencies have said the proposal does not achieve true structural balance.

Fitch Ratings has said the proposal “would not materially address the state’s structural budget issues” and that Illinois’ credit rating would drop if the plan were enacted as proposed. S&P Global Ratings said the proposed budget “punts measures to address fiscal progress to future years” and called the budget only “precariously balanced.”

3) Increased taxes and fees will harm the economy while failing to raise sufficient revenue to solve Illinois’ problems

High taxes are the No. 1 reason Illinoisans cite for wishing to leave the state. Outbound Illinoisans have generated five consecutive years of population loss.

Still, Pritzker’s preferred budget would ask taxpayers and employers to pay $1.1 billion more with no structural spending reform. Specifically, Pritzker wants to raise:

- $390 million from taxing Medicaid providers

- $175 million from a delinquent tax payment incentive program

- $170 million from selling marijuana licenses at $100,000 per license (for comparison, a liquor license is only $750)

- $89 million by expanding video gambling in the state and making the tax higher on larger operators

- $12 million by legalizing online sports betting and selling licenses, which would increase to $200 million in future years

- Between $19 million and $23 million from a statewide tax on plastic bags at grocery stores

- $75 million by removing a tax credit available to retailers, effectively increasing their taxes

- $55 million from increasing taxes on cigarettes

- $10 million from a new tax on e-cigarettes and vaporizers

As noted by Fitch, roughly a third of the proposed new revenues are one-time sources. This means they cannot be used for future budget proposals to close long-term deficits. Additionally, several of the revenue sources are “sin taxes” – such as the taxes on gambling, various types of cigarettes and marijuana – which would disproportionally hit low- to middle-income Illinoisans and contradict Pritzker’s goal of a fairer tax system that relieves the burden on the poor.

4) Proposed pension solutions will hurt Illinois’ credit rating and increase unfunded liabilities

Credit rating agencies have particularly criticized Pritzker’s pension plan.

As previously explained by the Illinois Policy Institute, proposals to issue pension obligation bonds and stretch out the payment ramp are not new ideas, but would repeat the past mistakes that helped create Illinois’ $134 billion in pension liabilities and poor credit rating. Although Moody’s Investors Service declined to weigh in on the full proposal, preferring to wait for an enacted plan, an analyst did make clear that including these two pension gimmicks in the budget would be a credit negative.

The biggest budgetary effects of Pritzker’s proposal come from extending the payment ramp by seven years, reducing the fiscal year 2020 pension contributions by $878 million, and extending a cost-of-living adjustment buyout program that is used to justify a further $125 million reduction. In total Pritzker wants to short the pension funds by more than $1 billion relative to the expected contribution.

Previously, GOMB estimated the costs of extending the pension payment ramp by 10 or 20 years. Assuming proportionality with those estimates, Pritzker’s extension would increase liabilities by $105 billion, not accounting for other pension changes.

5) A constitutional amendment to allow a progressive income tax hike will do particular harm to an already struggling economy without solving the state’s core problems

Pritzker has characterized his current budget as “austere” and a “bridge” until a progressive income tax will allow him to spend more. The governor also repeated a number of common myths about the progressive tax. The reality is that states with progressive income taxes see slower growth in jobs, wages and GDP, with no meaningful impact on income inequality.

While sold as a tax on the rich, progressive tax plans tend to be a Trojan horse for middle class tax hikes.

The last state to switch to a progressive income tax was Connecticut. Since the switch, the median family’s income taxes are up 13 percent, property taxes are up 35 percent, and poverty has increased by 47 percent. Meanwhile, Connecticut continues to struggle with problems very similar to Illinois’, including unbalanced budgets, massive unfunded pension liabilities and residents moving away.

A better way to accomplish Pritzker’s stated goals: economic growth and protecting taxpayers

Aspects of Pritzker’s budget address are praiseworthy.

First, the governor adeptly laid out the scope and severity of Illinois’ fiscal crisis, which is the worst in the nation. The Prairie State’s budget crisis is decades in the making – the state has not had a balanced budget since at least 2001. It will take years to achieve healthy finances and a good credit rating, which is currently the worst in the nation at just one notch above junk.

Second, the governor acknowledged the merits of bipartisanship and taking ideas from all sides of the debate. Pritzker declared that budgets under his tenure would be made “by debate and compromise” and that “[w]e are all here, Democrats and Republicans, with the common desire to serve the people of our state well. And we do that better when we talk to each other, and more importantly, listen to each other.”

Finally, and most importantly, Pritzker recognized that the rising cost of pensions is crowding out core spending priorities. In the speech, the governor correctly pointed out that when the current pension payment ramp was put in place in 1996, it was projected that Illinois would be spending just $4.9 billion on pension contributions in fiscal year 2020. Instead, the fiscal year 2020 payment was certified at $9.1 billion this year, which is $4.2 billion, or nearly 86 percent, higher than expected.

Unfortunately, the detailed budget documents released in conjunction with Pritzker’s speech do not match his rhetoric. Pritzker’s laudable goals – healthy state finances, a strong economy and a tax cut for the middle class – cannot be achieved by the means he’s proposed. Many of his proposed policies will undercut his goals and push Illinois in the wrong direction.

Instead, Pritzker should look to structurally reform Illinois’ spending to address the largest cost drivers of the state’s fiscal problems: government worker health care costs and pension benefits. The Illinois Policy Institute shows how necessary, commonsense reforms can be achieved in its recently released “Budget Solutions 2020: A 5-year plan to balance Illinois’ budget, pay off debt and cut taxes.”

Lawmakers have two options ahead of them: They can continue to rack up debt and pursue tax hikes that will further damage the state’s economy, or they can break with past practices and pursue responsible budgeting that protects both taxpayers and core government services.

It’s past time to end the state’s failed status quo, put the state on a path to deliver real tax relief and ensure a sound fiscal future for all Illinoisans.