Fixing Illinois’ welfare cliffs

Work should, in fact, pay.

A review of the major programs making up the welfare system in Illinois shows that economic disincentives embedded in a welfare system cause that system to be dysfunctional. It traps families. It is inequitable to other families. It costs taxpayers more. It must be fixed.

Being poor is a struggle. But it is made even worse when people who want to move up the ladder are actually discouraged from doing so because of poorly designed public policies.

A fundamental principle for reforming the welfare system is that these economic disincentives must be removed. Work should, in fact, pay. This should hold true whether one supports a more expansive welfare system or a smaller one.

Which programs to focus on

The welfare programs causing the greatest problems are those with benefits that are too generous or taper off too quickly.

Refundable tax credits, such as the state and federal Earned Income Tax Credit, and Temporary Assistance for Needy Families, or TANF, grants are not very problematic from an economic disincentive standpoint. These benefits taper off, thus preserving the incentive to earn more money.

Housing benefits, child-care assistance and health-care assistance all have steep cutoff points. These programs are what cause the welfare cliffs:

- Housing benefits – The federal Department of Housing and Urban Development oversees the Housing Choice Voucher, or HCV, program, which is administered by housing authorities. The HVC program is funded totally by the federal government. Although housing authorities are creatures of state law, their funding sources are almost exclusively from the federal government. Consequently, program rules are dictated by federal law and regulations.

- Child-care assistance – Child-care services are jointly funded by state and federal governments. The federal Administration for Children and Families provides states grants from the Child Care Development Fund and each state must submit a state plan for approval in order to receive the federal funds.

- Health-care assistance – Each state runs its own Medicaid program and receives federal matching funds, provided the state adheres to federal rules and upon approval of a state program and waivers by the U.S. Secretary of Health and Human Services. Premium tax credits for health-insurance plans purchased through the exchanges are funded totally by the federal government.

Food assistance programs are not as bad as housing, child care or health care, but they have drop-offs in benefits. Food packages through the Special Supplemental Nutrition Program for Woman, Infants, and Children as well as the National School Lunch Program have hard cutoffs. However, Supplemental Nutrition Assistance Program benefits, commonly known as food stamps, do taper off, but they can drop off steeply in the upper limits, depending on the circumstances.

How to eliminate welfare cliffs

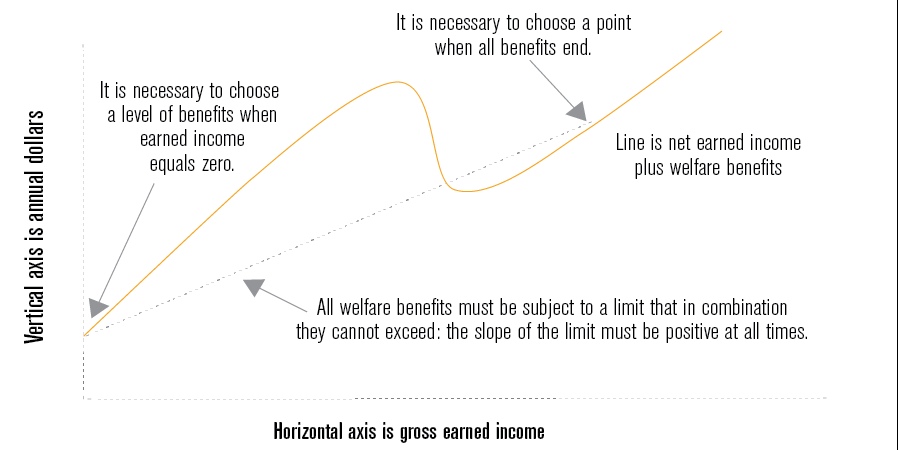

The reform effort should adhere to a fundamental principle: no household should have less in combined net earned income and welfare benefits than a household in the same situation that earns less.

As visualized here, the combination of net earned income and welfare benefits from all programs, if graphed relative to gross earned income, must have a positive slope at all times. Under no circumstance should an increase in earned gross income cause a household’s combined net earned income and welfare benefits to decline.

Implementing reform will require coordination and cooperation from various federal, state and local government officials.

What federal officials can do

The greatest thing the federal government can do is to give states flexibility to combine all welfare programs to allow coordination and cooperation, including the housing-assistance program, over which states currently have no control.

There are several good reasons why it makes sense for the federal government to relinquish control to the states:

- First, from an administrative point of view, states run most of the programs now anyway. States run the TANF programs, the child-care programs and Medicaid/State Children’s Health Insurance Program. Even with food-stamp benefits, where the federal government funds 100 percent of the benefits, the states run the program.

- Second, from the principle of governance, states are closer to the people and better understand the geographic and demographic differences. In other words, one size does not fit all and it makes sense to allow states to customize the programs to fit their special circumstances.

- Third, states have a clearer constitutional duty to address issues of welfare policy. In contrast, the federal government does not have a clearly enumerated power in its Constitution for public assistance.

The flexibility can take different forms. There may be more than listed here, but here are a few approaches:

- First, Congress can expand waiver powers of the federal agencies, allowing states to craft proposals to combine all programs into an integrated plan.

- Second, Congress can use its appropriation power to create block grants, allowing states to innovate.

- Third, Congress can streamline its programs so that states are required to develop plans to integrate the programs.

What state officials can do

Seeking a solution to the welfare system requires cooperation between federal and state officials, but this does not mean that state officials must wait for federal officials to initiate action. Here are a couple steps they can take:

- First, state officials can express their interest in reform to their Congressional delegation. This can be done through informal means, such as meeting personally with federal officials, or more formally, such as the Illinois General Assembly passing resolutions imploring Congress to act.

- Second, a number of federal programs already have waiver capabilities. State officials can begin the process of researching its powers to request waivers alongside proposing an overall plan to integrate the welfare programs. State officials need to understand that participation in the federal programs is voluntary and they may be able to leverage cooperation.

Creative thinking and research may be able to discover possible solutions that are not apparent now. These may include relatively small changes in federal or state law, enabling programs to be integrated into a greater reform effort.

The bottom line is that any welfare system should promote earned success instead of forced dependency. Further insight and shrewd reform will be necessary to make this a reality.