Former Hinsdale superintendent collecting $315k pension

The former leader of a wealthy school district is receiving a massive pension boosted by a pair of 20% raises given during her final two years. Illinois needs pension reform.

Illinois has the worst pension crisis in the nation, a problem made worse when former public employees collect a $315,336-a-year pension.

Mary Curley, the former superintendent of Community Consolidated School District 181 in Hinsdale and Clarendon Hills, is currently receiving a pension of $315,336, according to the Patch. Curley’s pension began at $226,644 when she retired in 2007 at age 55 but has grown thanks to 3% compounding pension increases each year. By the end of her life, Curley could receive a pension upwards of $521,000 annually.

In Curley’s final two years with the district, she received two 20% salary increases. Between 2005 and 2007, her salary skyrocketed to $385,378 from $267,624. When adjusted for inflation, her final salary would have been $477,277 today. The current superintendent makes $249,832.

Former district board members expressed confusion at the time as to why these massive increases happened. They claimed they believed a 20% increase during each of Curley’s final two years was in keeping with state law and the Teachers Retirement System’s policies.

In 2005, a law was passed by the state that limited final year raises to 6%. That doesn’t make it any easier on taxpayers, however. Taxpayers across the state still pay towards the pensions of all school district employees in Illinois, except those in Chicago.

As Illinois’ pension debt grows – $137 billion by the state’s estimate, but $241 billion by an independent estimate – the need for reform becomes more desperate. The Illinois Supreme Court deemed reform unconstitutional in 2015, saying pension promises cannot be changed after the first day of employment.

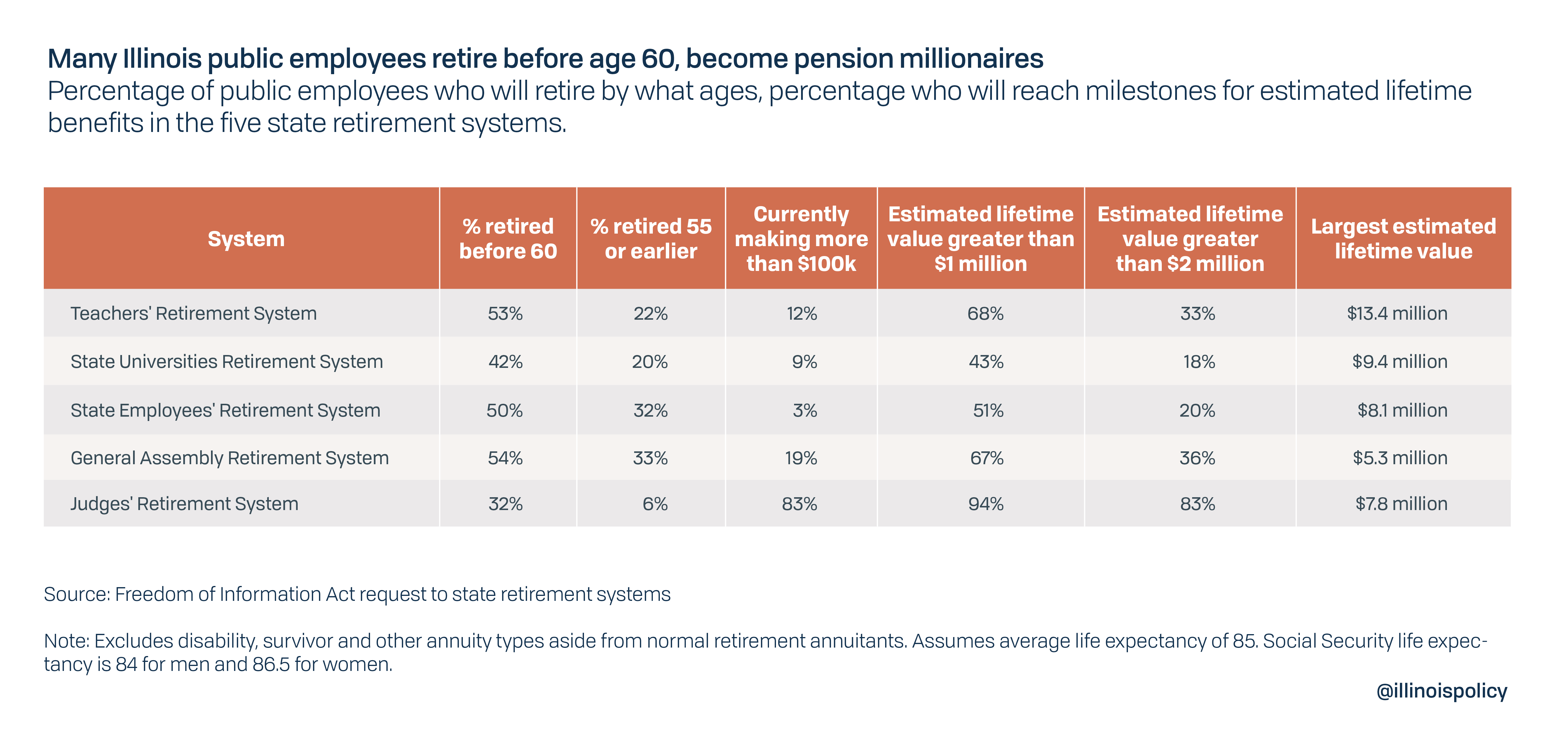

The lack of reform and early retirements coupled with large pre-retirement salary increases helps to create pension millionaires: retirees who become millionaires after receiving very generous pensions.

Sixty-eight percent of public employees in the Teachers Retirement System, or TRS, will become millionaires after they retire, thanks to early retirement ages and 3% compounding annual pension increases.

Over half of state workers will retire before they turn 60, potentially living through 30 years of retirement with six-figure pensions. Compare this to the private sector, where the average Social Security payout is just $17,532. Social Security recipients are not allowed to receive more than $36,132 in a year. Even when factoring in personal savings, CNBC reports the average 401(k) balance for those close to retirement, people aged 60 to 69, is just $195,500. The typical private sector worker would need to have saved $1.6 million in a personal retirement account by age 60 to receive the same $82,000 base pension as the average career teacher, or those with at least 30 years of experience. And 3% compounding post-retirement increases are not an option for private sector retirees.

Last year, the problem was made even worse. Gov. J.B. Pritzker removed one of the few protections for taxpayers against being further indebted to pension millionaires in the state budget for fiscal year 2020.

After lawmakers capped final year raises at 6% annually in 2005, the fiscal year 2019 budget brought it down to 3%. However, the 2020 budget once again lifted the cap for “pension spiking” to 6%.

Some claim pension spiking is an important tool to attract teachers to Illinois. The Illinois Education Association, or IEA, went as far as stating in a press release that returning the pension spiking cap to 6% would “save the teaching profession.”

IEA’s claim is untrue. While pension spiking certainly benefits some pensioners who collect inflated retirement earnings, demanding more from a deficient TRS puts the retirement security of the vast majority of current and future teachers in jeopardy. TRS is only 40% funded, and holds the most debt of all five state-run pension funds, at $75 billion.

Pension spiking only worsens property taxes for local residents. The more pensions are spiked at the end of a school employee’s career, the more residents in the school district will have to pay in property taxes. Illinois already has the second-highest property taxes in the nation for the third year running.

It is not fair that some retirees become pension millionaires at the expense of Illinois taxpayers and the long-term viability of the public pension systems. State lawmakers can change that by supporting a constitutional amendment that protects earned benefits but allows for changes to future, unearned retirement benefits.