Illinois sales tax revenues down 24% in May amid strict lockdown

Monthly sales tax collections in Illinois continued sharp declines compared to one year earlier amid strict COVID-19 restrictions. Neighboring states with more open economies fared better.

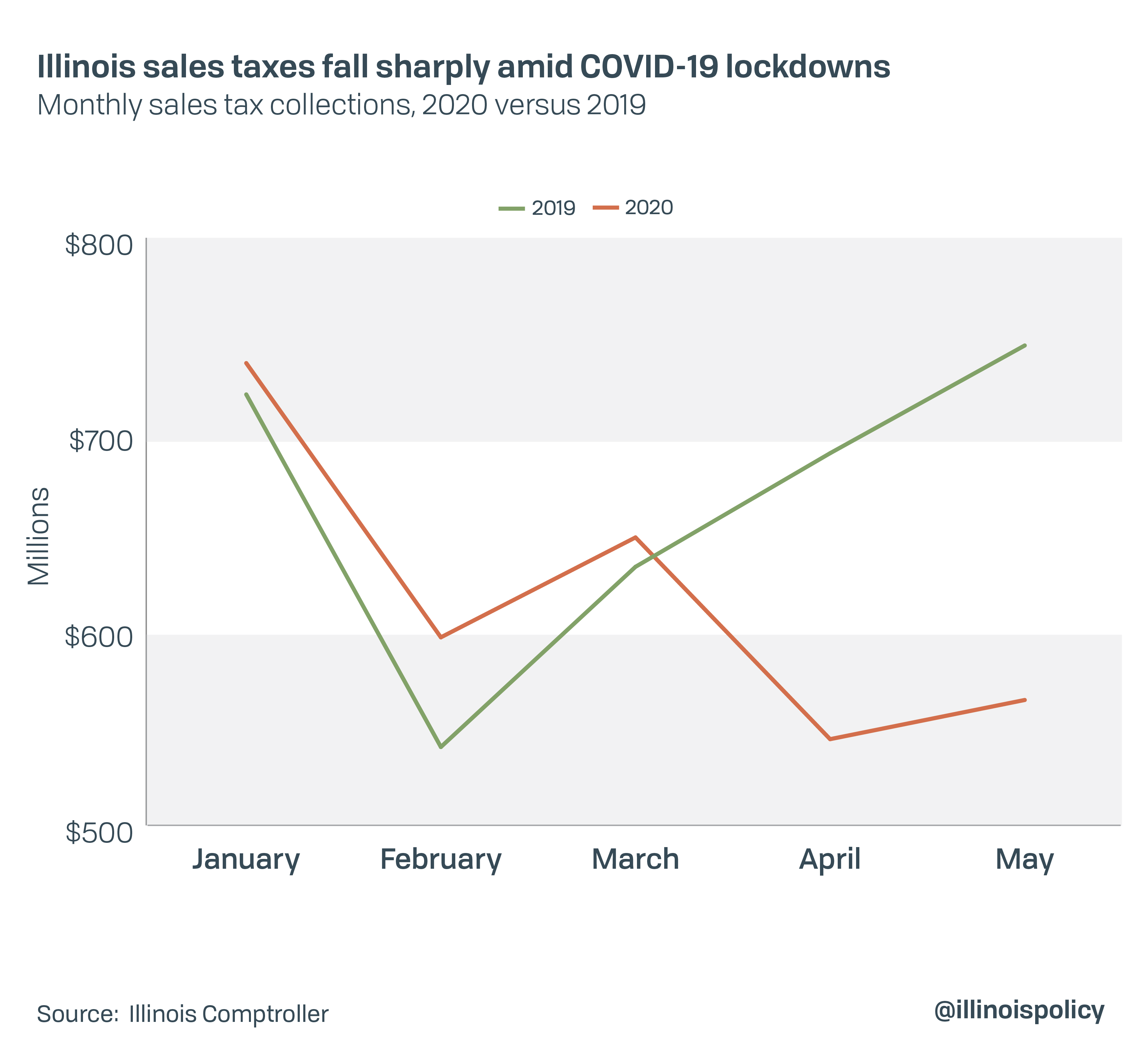

May sales tax collections in Illinois fell by $181 million compared to the same month one year earlier, a decline of more than 24%. That follows a 21% year-over-year decline in April of $146 million.

Sharp declines in sales tax collections are another sign of broader declines in overall economic activity and consumer spending stemming in large part from measures intended to slow the transmission of COVID-19. Many businesses, including dine-in restaurants and most retail stores, were ordered closed by Gov. J.B. Pritzker in March. An Illinois Policy Institute analysis estimated the overall state economy was shrinking by at least $183 million per day during the government-imposed lockdowns.

Data from the Illinois comptroller’s monthly revenue reports shows that in January through March 2020, sales tax collections were up compared to 2019. Because most sales taxes are collected roughly 20 days after the end of the month of sales they apply to, the data lags actual consumer activity by roughly one month.

A decline in April sales tax revenues indicates consumer spending began to decline in March.

In Illinois, the connection between consumer spending and tax collections is somewhat complicated by a COVID-19-related sales tax delay program the state made available for small restaurants and bars, those with less than $75,000 in tax liability for 2019. The program allows qualifying businesses to submit their sales taxes collected from February through April in four monthly installments through Aug. 20, rather than in one lump sum the month following the sales period.

However, because the program applies only to certain small businesses which may not all be making use of the delay, it is unlikely to account for a significant portion of the total revenue declines. The June revenue report will provide further clarification because May sales taxes are not eligible for the deferment.

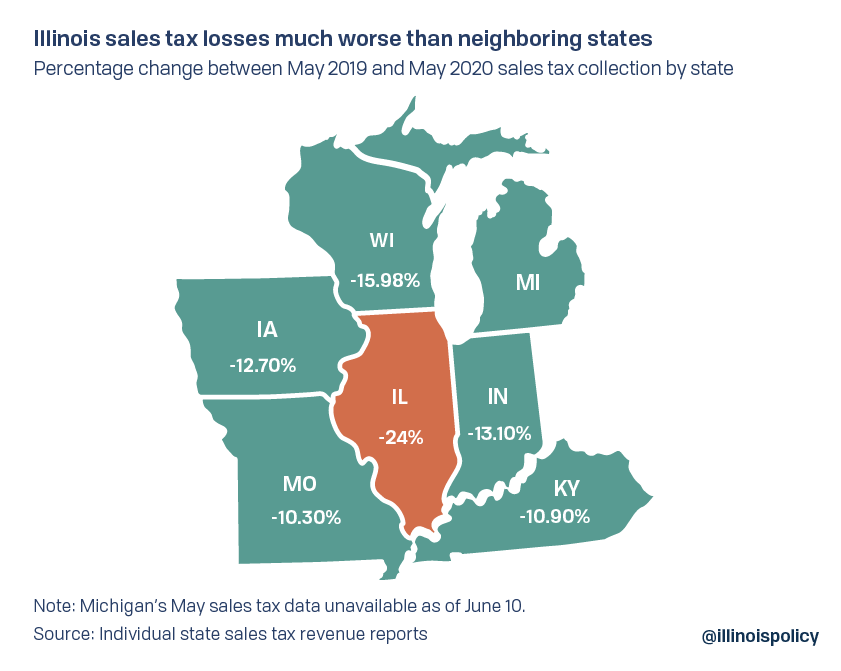

Some evidence is beginning to show economic fallout from COVID-19 is worse in states that are slower to reopen their economies. For example, a report published by the American Institute for Economic Research found that unemployment was significantly worse in states with more restrictive and longer-lasting lockdowns. A similar relationship may exist for consumer spending, which is the basis for sales tax collections.

According to rankings by WalletHub, Illinois had the most restrictive lockdown in the nation as of May 18, ranking 51st on their list of states and the District of Columbia. The speed and degree to which states lift COVID-19-related restrictions, or reopen their economies, will likely influence the relative strength of their economic recoveries. Neighboring Missouri was the fourth most open state according to WalletHub and their 10.3% May sales tax decline was less than half the drop in Illinois. Iowa ranked as the 10th least restrictive and also saw a much smaller drop of 12.7%.

Until Illinois businesses and consumers are allowed to resume more of their typical economic behavior, government revenues will continue to face losses. This could lead to further borrowing and tax hikes to close budget deficits. The state’s latest budget already faces a nearly $6 billion deficit and relies on $5 billion in borrowing authority.

More importantly, however, declining sales taxes are another indication of the harm being done to businesses and their employees across the private sector. More than 1.2 million Illinoisans are out of work since COVID-19 began shutting down Illinois’ economy and many businesses may never reopen their doors.