Inflation ensures progressive tax hike will hit an increasing number of Illinoisans

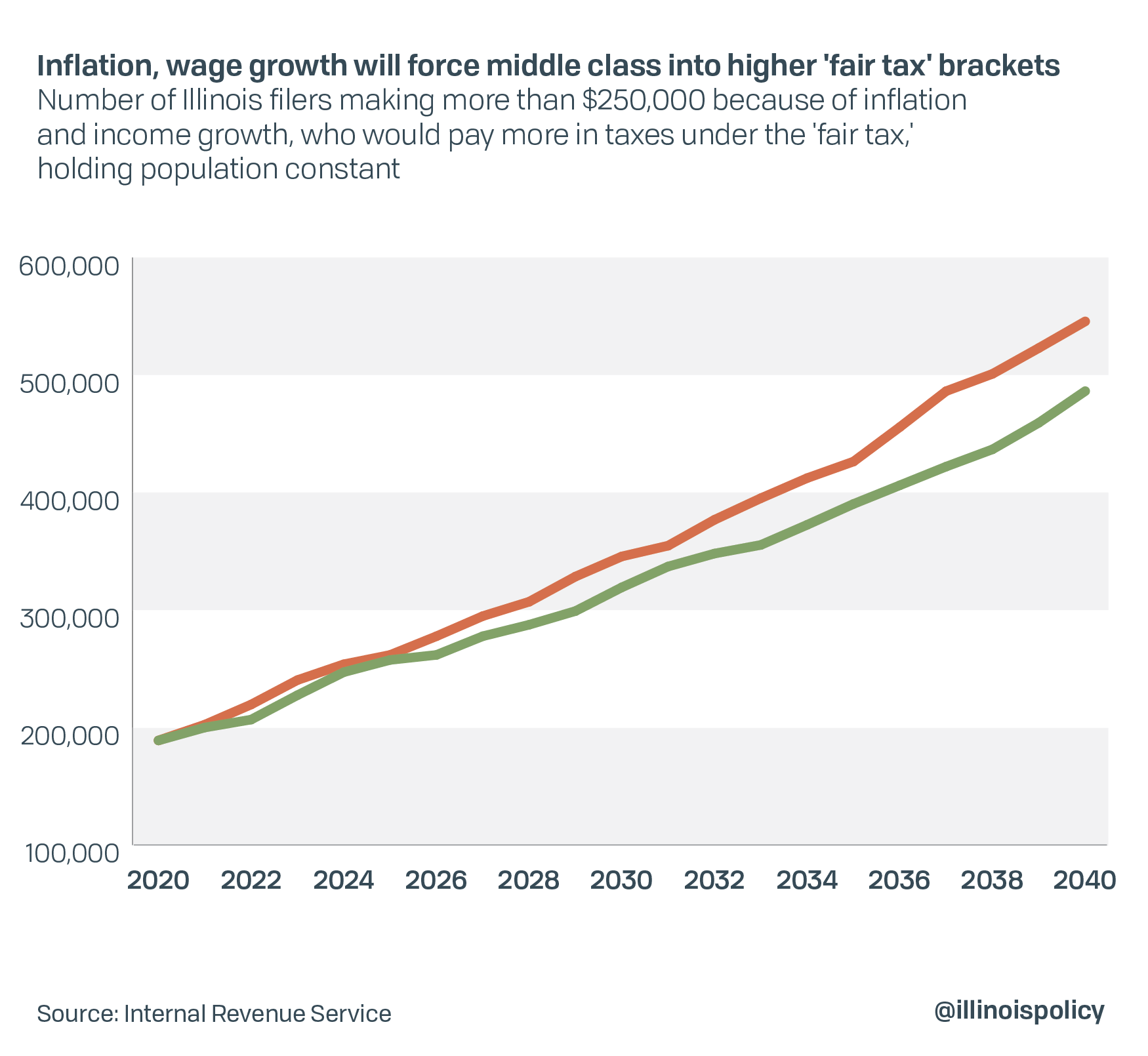

Within 20 years the portion of Illinoisans hit with the progressive tax hike would grow by over 150% if the rate of inflation mirrored the past two decades.

When they doubled the state gas tax, Illinois lawmakers made sure it would increase every year with inflation so they’d capture every penny. When they built the “fair tax,” they left out an inflation adjustment, so each year more and more Illinoisans will find themselves defined as “rich” by the state and taxed more.

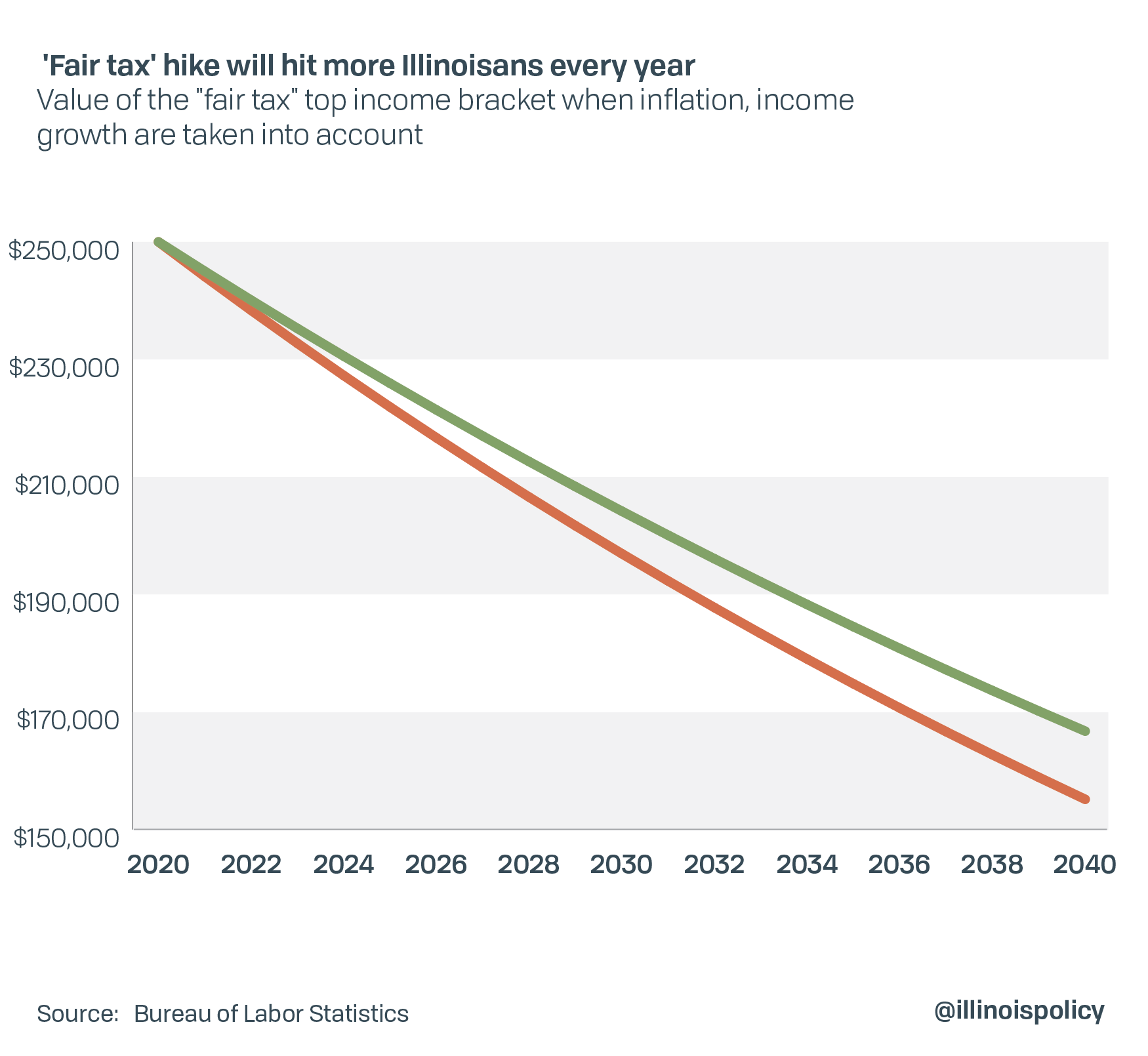

In 20 years, the “rich” will include those now making $167,000.

Gov. J.B. Pritzker is pitching the “fair tax” as a way to fund the state by taxing wealthy people like him at a higher rate than the average Illinoisan. Putting aside the fact that raising taxes on the rich alone cannot fund the spending that Pritzker has promised, much less the pensions the state has promised to public employees, Pritzker’s “fair tax” rates are designed to hike taxes on more and more people down the income brackets every year.

As inflation rises each year, the tax brackets remain unchanged. This phenomenon is known as “bracket creep,” and it means taxes rise on more and more people year after year as their nominal incomes increase due to inflation.

Pritzker’s proposed rates raise taxes on those making more than $250,000 per year. If inflation continues at the same average rate in the past 20 years, the tax hike would hit those paying the equivalent of around $167,000.

In terms of population, that translates to a 154% increase in the number of Illinoisans who would pay higher taxes, according to the most recent data from the Internal Revenue Service. And if real wages grew by the same average rate as they have in the past two decades, the number of Illinoisans hit would nearly triple.

To see how this works, look at West Virginia. In the year 2000, the top marginal state income tax hit those making over $60,000, according to data from the Tax Foundation. This was the equivalent of over $90,000 in today’s dollars. That top bracket, though, has remained unchanged during the past two decades. Because those income brackets were not pegged to inflation, those top rates hit more and more West Virginians as their incomes grew into the brackets.

For this reason, good government groups advocate pegging income tax brackets to inflation. According to the left-leaning Institute on Taxation and Economic Policy, or ITEP, these invisible tax hikes usually fall heavily on low- and middle-income taxpayers. ITEP recommends indexing taxes to inflation out of basic fairness. According to the Tax Foundation, most states surveyed in 2019 with progressive tax schemes indexed their brackets, deductions, or exemptions for inflation.

States with a flat income tax rate do not need to adjust their rates for inflation, because the single rate always remains the same, automatically accounting for inflation, but states with progressive tax rates need to take inflation into account to avoid unfairly hitting low- and middle-income taxpayers.

That Pritzker’s progressive tax makes no adjustments for inflation reveals “fairness” is not its primary purpose.