Instead of a tax hike, consolidate Illinois’ 7,000 units of local government

As lawmakers consider massive tax hikes on Illinoisans, they should look to consolidate nearly 7,000 units of local government and to cut their high administrative costs.

Illinois Senate leaders in Springfield are fine-tuning a “compromise” budget that would impose massive income tax hikes on middle-class Illinoisans, without tackling foundational reforms, though the proposal does include a temporary, two-year property tax freeze. Though its policy prescription isn’t fully baked, the Senate’s plan does bring up one of the biggest cost drivers reflected in Illinois residents’ tax bills: the nearly 7,000 units of local government in Illinois, and the expensive bureaucracies that go with them.

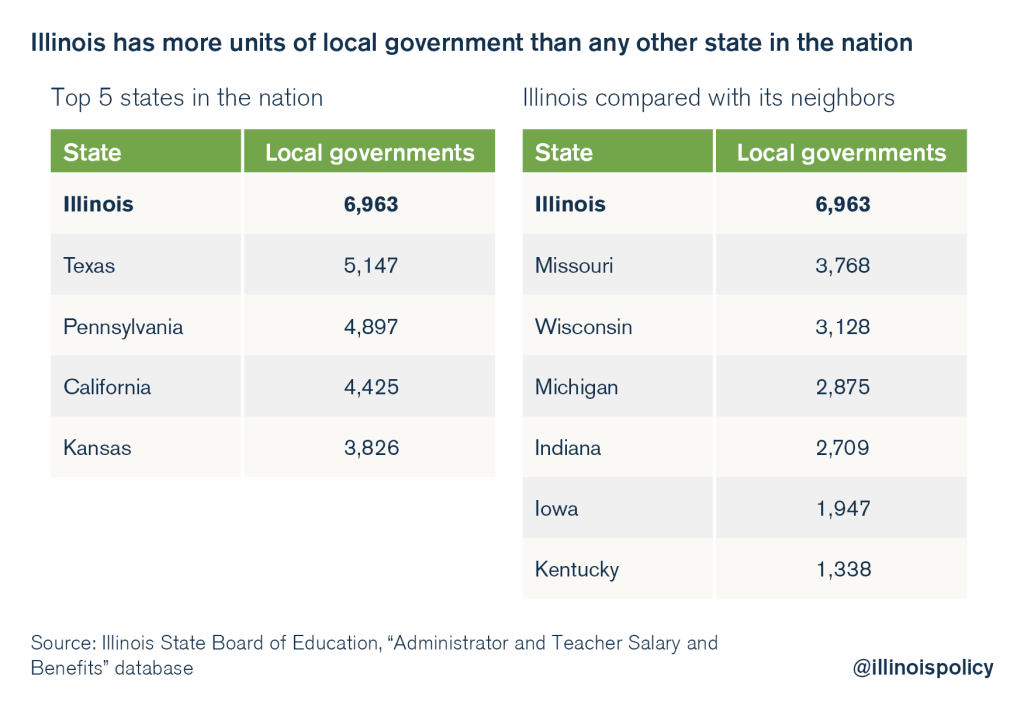

Illinois has more units of local government than any other state in the country and more than Indiana, Iowa and Kentucky combined. Texas, the state in second place, has more than 5,100 units of local government. The Land of Lincoln has more units of local government despite the fact that Texas’ population and landmass are much larger than Illinois’.

Not only does Illinois have too many layers of government, but it also infuses local governments with state subsidies that encourage wasteful spending.

Too many layers

This record number of local governments is one of the primary reasons Illinois homeowners’ property taxes are the highest in the nation.

Local government is funded primarily through property taxes and state subsidies. Each unit of local government has authority to tax properties in its jurisdiction, and since Illinois has so many taxing bodies, its property taxes are the highest in the nation.

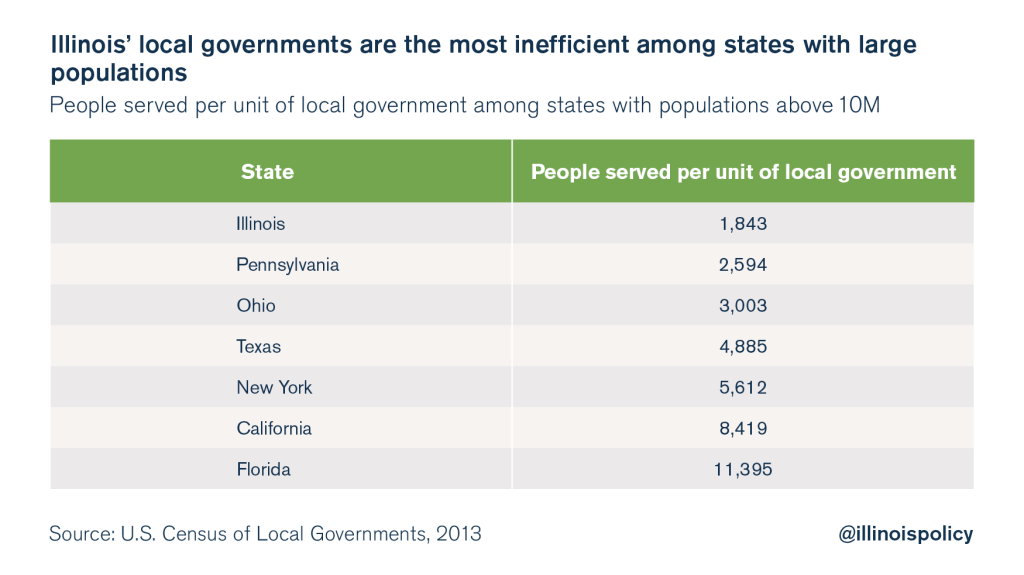

These overlapping and redundant layers of local government have led to an inefficient, top-heavy system in which the average local government in Illinois serves just 1,800 people. Other heavily populated states have local governments that serve more of their residents. An average local government in California, for example, serves more than 8,000 residents, nearly 4.5 times more than local governments in Illinois.

Too many expensive bureaucrats

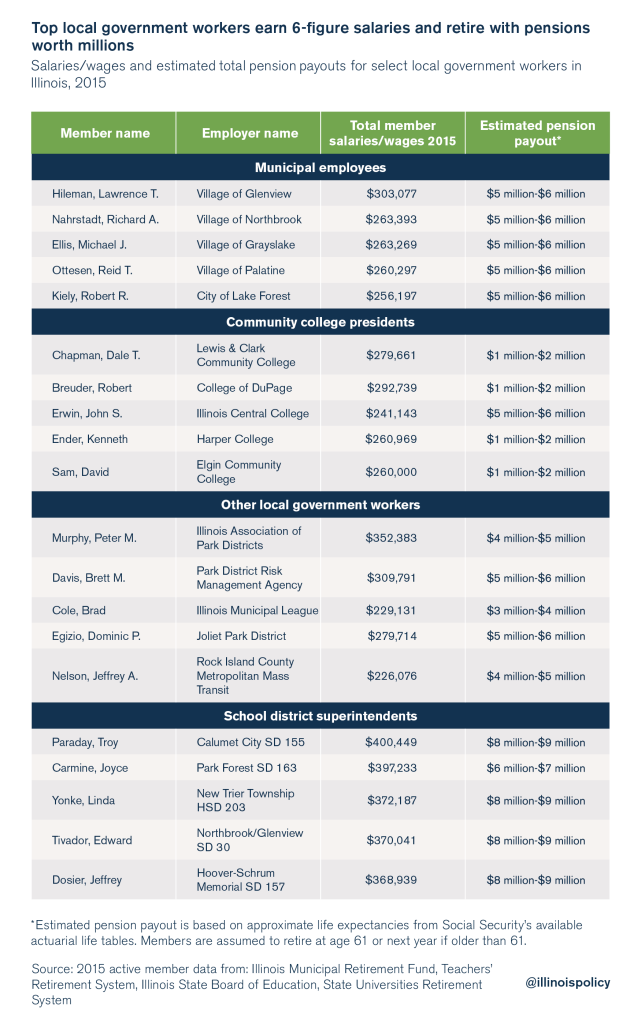

Each of Illinois’ nearly 7,000 units of local government requires a staff of well-paid administrators. These bureaucrats can receive six-figure salaries for their work and millions of dollars in pension benefits over the course of retirement. For example, the average Metropolitan Water Reclamation District, or MWRD, worker receives an average annual salary of nearly $100,000. All told, the MWRD cost $227 million in salaries and $947 million in pension costs in 2015. In Chicago alone, the number of six-figure pensioners has tripled in the last four years.

Cook County isn’t the only area suffering from too many highly paid government workers. Across the state, top administrators haul in six-figure salaries and pensions worth millions.

The superintendent of Calumet City School District 155, Troy Paraday, earns approximately $400,000 a year and will receive almost $9 million in pension benefits over the course of his retirement.

And Peter Murphy, head of the Illinois Association of Park Districts, earns $350,000 in wages and can expect more than $4 million in pension benefits over his retirement.

Consolidation makes local government more efficient and cost-effective

Consolidating and sharing services between units of government would help right-size costs stemming from employee compensation. As many of the administrators running these units of local government, such as Peter Murphy, make lucrative salaries and receive millions of dollars in pension benefits over the course of retirement, merging top administrative positions would save millions.

The idea is already catching on.

In 2016, voters in Naperville and Belleville both voted in favor of government consolidation in local referendums. On the Naperville referendum, one question asked whether residents approve of the dissolution of township governments if another unit of government could provide the same services at a lower cost. A resounding 78 percent of voters said yes. In August 2016, Gov. Bruce Rauner signed a bill giving McHenry and Lake counties the authority to consolidate and dissolve local units of government, along the lines of the successful cost-saving measures implemented in DuPage County. DuPage County is expecting to save $150 million via government consolidation and shared services.

Lawmakers in Springfield should support a plan that brings down homeowners’ property tax bills by pursuing local government consolidation and not raising other taxes. Illinoisans already face one of the highest combined tax burdens in the country; the last thing residents need is another tax hike. While the current Senate proposal does call for allowing all counties to follow DuPage’s consolidation model, it does not address the other major cost drivers around local units of government, such as government employee compensation.