The Policy Shop: Springfield’s big budget crunch

This week’s The Policy Shop is by Bryce Hill, director of fiscal and economic research at the Illinois Policy Institute.

With just a week left of session and a hard deadline of July 1 (the beginning of the new fiscal year) to pass a state budget, Springfield politicians are running out of time. As of writing, no budget has been presented for a vote. The latest rumors indicate a Senate vote may take place tomorrow with the House voting on Friday. Stay tuned.

In the meantime, here’s what we do know about the state of Illinois’ finances.

A Titanic revenue sinkhole. Coming off back-to-back budgets cushioned by federal COVID-19 dollars, Illinois is now facing the stark reality of post-pandemic budgeting on our own. The legislature’s Commission on Government Forecasting and Accountability has slashed fiscal year 2023 state revenue projections by a staggering $800 million. This seismic shift results from April 2023 revenue collections being $1.8 billion lower. And the biggest offender? Personal income tax, with collections dropping by $986 million.

Shorting pensions by $4.4 billion. As lawmakers worked to finalize a budget leading up to their final scheduled session day on May 19, they planned to short pension funding by $4.4 billion.

That means the budget they pass automatically will be unbalanced despite what Gov. J.B. Pritzker will assuredly claim. He’s claimed that every year. He did so again in his 2024 budget proposal.

That means the budget they pass automatically will be unbalanced despite what Gov. J.B. Pritzker will assuredly claim. He’s claimed that every year, and did so in his 2024 budget proposal.

A downward spiral. The decline isn't limited to personal income taxes. Taxes and fees on corporate income, corporate franchise, sales, liquor, inheritance and even cannabis were all down in April 2023 compared to the prior year. With revenues on a rollercoaster ride, we're looking at fiscal year 2024 with a sense of trepidation. While the legislature’s projections remain virtually unchanged for FY2024, a continuation of this downward trend could mean revenues come in lower than expected, even with tax disbursement changes.

Reality check for Pritzker. Despite Gov. J.B. Pritzker's rhetoric about an improved financial condition, the fiscal future of Illinois is far from rosy. Just a month after suggesting we should be discussing potential tax cuts because of stable revenue growth, year-over-year revenues took a nosedive.

Illinois was warned of a potential fiscal cliff once federal pandemic relief funding ran out. That should serve as a reality check: we can't sit back and expect revenues to keep climbing while ignoring much-needed reforms to our budgeting process, pension costs and overall financial management.

Why did the well run dry? Larger than expected April revenue declines were likely driven in large part because of a decline in capital gains, as the major indices recorded 2022 declines ranging from 9% for the Dow to 33% for the NASDAQ. Now, a growing list of concerns including congressional debates over the debt ceiling, uncertainty surrounding upcoming interest rate hikes and the looming possibility of a recession threaten not only capital gains but all major tax revenues for the upcoming fiscal year. Should these come to pass, state revenues would likely decline in FY2024, rather than remaining flat as currently forecast.

Action, not apathy. Under Pritzker, no attempts have been made to address the structural problems plaguing our budget, forecasting or pension crisis. Temporary federal relief and a buoyant national economy have kept us afloat, but this is a coming crisis. As these buffers begin to fade, Illinois risks sinking back into the fiscal abyss. We've been there before, thanks to decades of inaction by leaders in Springfield.

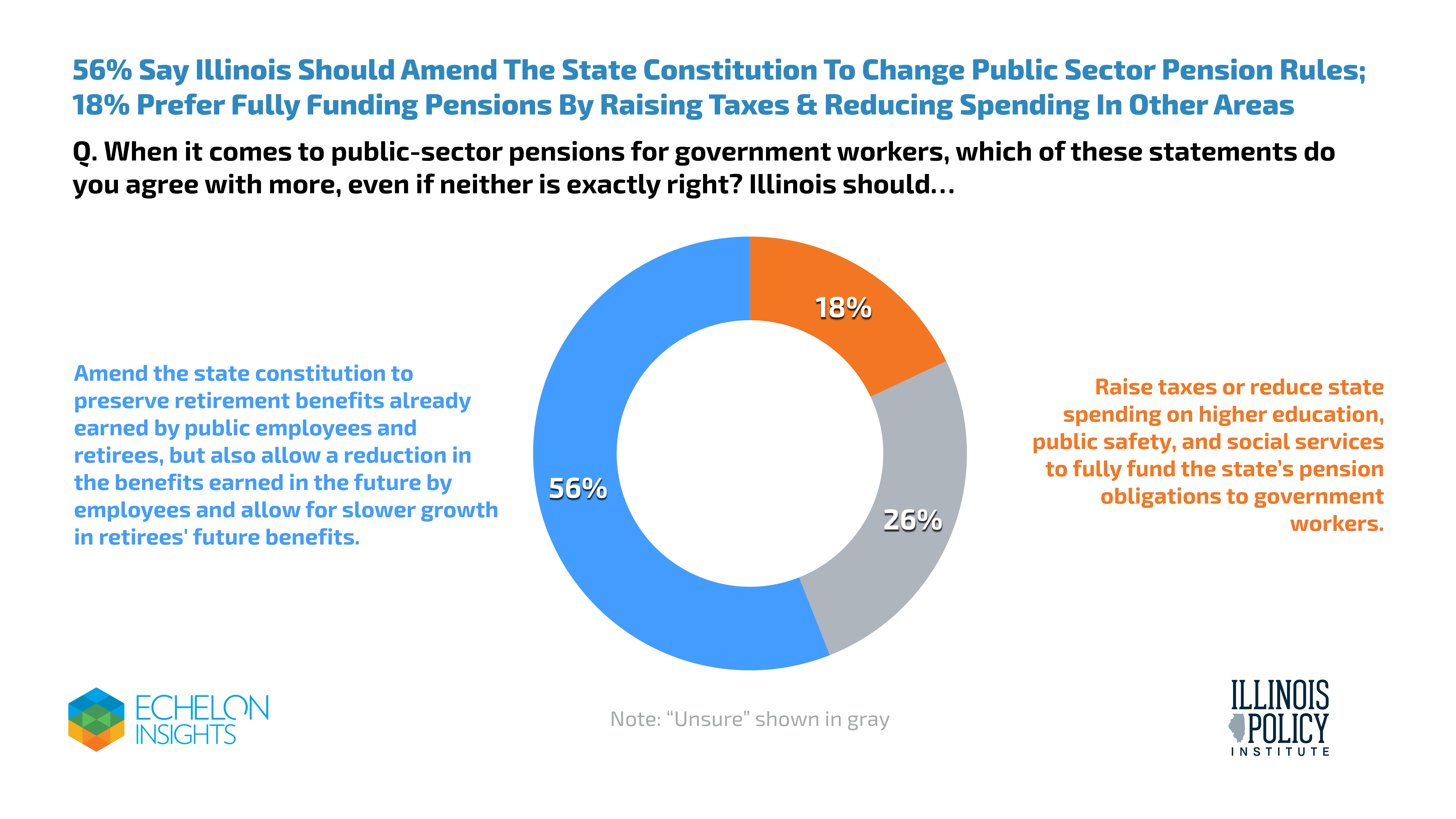

A ray of hope. Instead of shying away from difficult decisions, it's time for Pritzker and lawmakers to embrace commonsense reforms that have been on the table for years. We need to leverage revenue surges and one-time federal funds to overhaul the state’s fiscal practices. Our budgeting process, which has earned poor marks from fiscal watchdog organizations such as The Volcker Alliance, must be addressed. And most importantly, Illinois needs public pension reform. Polling shows Illinoisans support pension reform 3:1 over tax hikes and service cuts.

Looking to the future. With the economy showing signs of slowing down and recession a real possibility, it's imperative state leaders craft a responsible, sustainable long-term budget strategy. We can't afford to slip back into financial turmoil. Our pension debt remains a daunting $140 billion and, with record numbers of residents and businesses leaving Illinois, a downturn could exacerbate these losses.

Do better. We're facing a challenging fiscal landscape, but these problems can be solved. We need to look at this crisis not as a pit, but as an opportunity to reset and rebuild a stronger, more resilient Illinois. It's not just about balancing a budget, it's about creating a sustainable financial future all Illinoisans can live with.