Potential tax hike for Illinoisans is staggering

A new report claims Chicagoans would face property-tax hikes nearing 50 percent to adequately fund city pensions.

Live in Chicago? A report by Nuveen Investments shows a pension payment spike looms in 2016, and describes the potential tax hike needed to fix it as “staggering.”

Titled “Chicago’s Fiscal Stress: New Term, Same Problems,” the report gives a chilling overview of the issue at hand:

“Years of poor funding exacerbated Chicago’s pension obligations so that it may be infeasible to keep them solvent without modifying benefits. Chicago’s four pension plans have a combined $20.1 billion unfunded liability and funded ratios ranging from just 24% to 57%.

“A state law enacted in 2010 requires Chicago to begin making actuarially-based annual contributions to its policemen’s and firemen’s pension funds in 2016, resulting in a payment increase of approximately $540 million. Due to the lag between when taxes are levied and collected, paying the required pension payments in 2016 would mean any property tax would have to be levied in 2015. However, the administration was reluctant to pass a budget with higher property taxes prior to the mayoral election. Based on state law and recent actuarial valuations, Chicago is required to contribute $839 million to its policemen’s and firemen’s pensions in 2016 (levy year 2015). But the city has only budgeted for a pension levy of $290.4 million.

“We note that the state law requiring full funding of annual pension payments beginning in 2016 applies not only to Chicago but to a number of overlapping taxing districts such as Chicago Public Schools, Cook County and a handful of other governmental entities. Without reforms, fully funding pension contributions for Chicago and its overlying taxing districts would require substantial revenue increases and/or expenditure cuts.

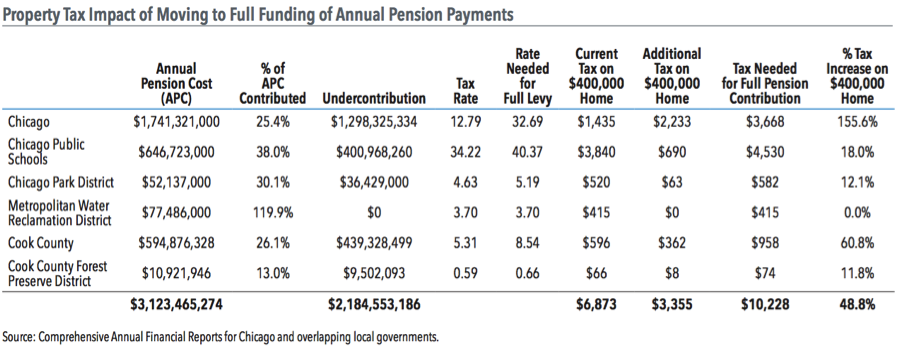

“To get a sense of the magnitude of the property tax increases necessary to move to full funding of annual pension payments, Nuveen Asset Management analyzed the 2013 property tax levies, pension payments and Annual Pension Costs (APC) for Chicago and its overlapping taxing districts as reported in their respective audited financial statements. We analyzed the tax bill of a theoretical $400,000 home in Chicago under current tax requirements and a scenario under which the city and its overlapping taxing districts all make full annual pension payments. The analysis does not include the impact of any specialized property tax exemptions like the homeowner’s exemption or the senior freeze exemption. All tax figures are from each entity’s 2013 fiscal year – the most recent fiscal year in common for all issuers.

“Based on our review of each government’s fiscal 2013 audited financial statements, the owner of a $400,000 home would have paid approximately $6,873 in property taxes. As was the case for Chicago, most of these government entities didn’t fully fund their pension payments, therefore maintaining property taxes at levels below where they otherwise should be. Chicago would need to increase its portion of the property tax levy 155.6% to make a full pension contribution and Cook County would need to increase its portion of the levy by 60.8%.

“Altogether, the owner of a $400,000 home in Chicago would need to pay $3,355 in additional property taxes to support full annual pension contributions – increasing the tax bill to $10,228 for a single year jump of nearly 49%. While home rule entities in Illinois, including the City of Chicago, are not subject to state imposed property tax caps, some overlapping tax districts such as Chicago Public Schools are limited to an increase of the lesser of 5% or the change in inflation.”

Shockingly bad fiscal health of Chicago

I’ve noted the shockingly bad fiscal health of Chicago, and the financial engineering Chicago uses to hide that fact.

That bad fiscal health was just related to Chicago schools. Of course, the pension funds are in dire straits as well. Chicago’s only possible salvation may be bankruptcy.

On April 21, a $295.7 million bond offering by the beleaguered Chicago Board of Education hit the market. The yield hit 5.63 percent. That is 285 basis points higher than Municipal Market Data’s benchmark triple-A scale.

Furthermore, Gov. Bruce Rauner has pledged that the “taxpayers of Illinois are not going to bail out the city of Chicago, that ain’t happenin’. But there are things we can do to help them restructure and get their government and their schools turned around, and I’d like to help them.”

What about the rest of Illinois?

Note the above woes are for Chicago only. Illinois has other massive funding problems. On March 2, I noted some of the problems in “Illinois pension plans 39% funded; taxpayers on the hook for $105 billion in liabilities; it will get worse.”

Illinois state budget deficit

Illinois’ budget deficit is in the order of billions of dollars.

When Nuveen came up with 50 percent property-tax hike, it did not include tax hikes to bail out other Illinois pension plans. Nor did it include the state’s budget deficit.

Lost cause

Not a penny of taxpayer money should go to fund these lost causes. I find it hard to believe that Mayor Rahm Emanuel himself does not know the school system is truly bankrupt.

To spare the citizens of Illinois massive tax hikes, the only reasonable course of action is as follows:

- Halt defined-benefit pension plans for new government employees

- Eliminate collective bargaining of public unions

- Scrap the Davis-Bacon Act and all prevailing wage laws so cities are not forced to overpay for services

- Enact Right-to-Work legislation

- Pass bankruptcy legislation allowing cities, municipalities and other taxing bodies the right to declare bankruptcy

Had the above been done a decade ago, Illinois would not be as bad off as it is today. Now, even those measures cannot and will not fix the problems.

Moody’s announcement: ‘Chicago’s pension pressures will grow for years’

Moody’s made the following announcement on May 1: “Regardless of legal and political outcomes, Chicago’s pension pressures will grow for years.”

Illinois desperately needs bankruptcy legislation. Tax hikes nearing 50 percent are not only amazingly unfair, they will drive both corporations and individuals out of the state.