Illinois’ economy on pace to shrink by 7.4% this year as the state approaches 1 million jobless claims

MEDIA CONTACT: Rachel Wittel (312) 607-4977

CHICAGO (May 7, 2020) – As the second month of the statewide lockdown comes to a close, new analysis from the nonpartisan Illinois Policy Institute finds Illinois’ economy is shrinking by $183 million per day. This is happening as nearly 1 million Illinoisans have claimed they are out of work.

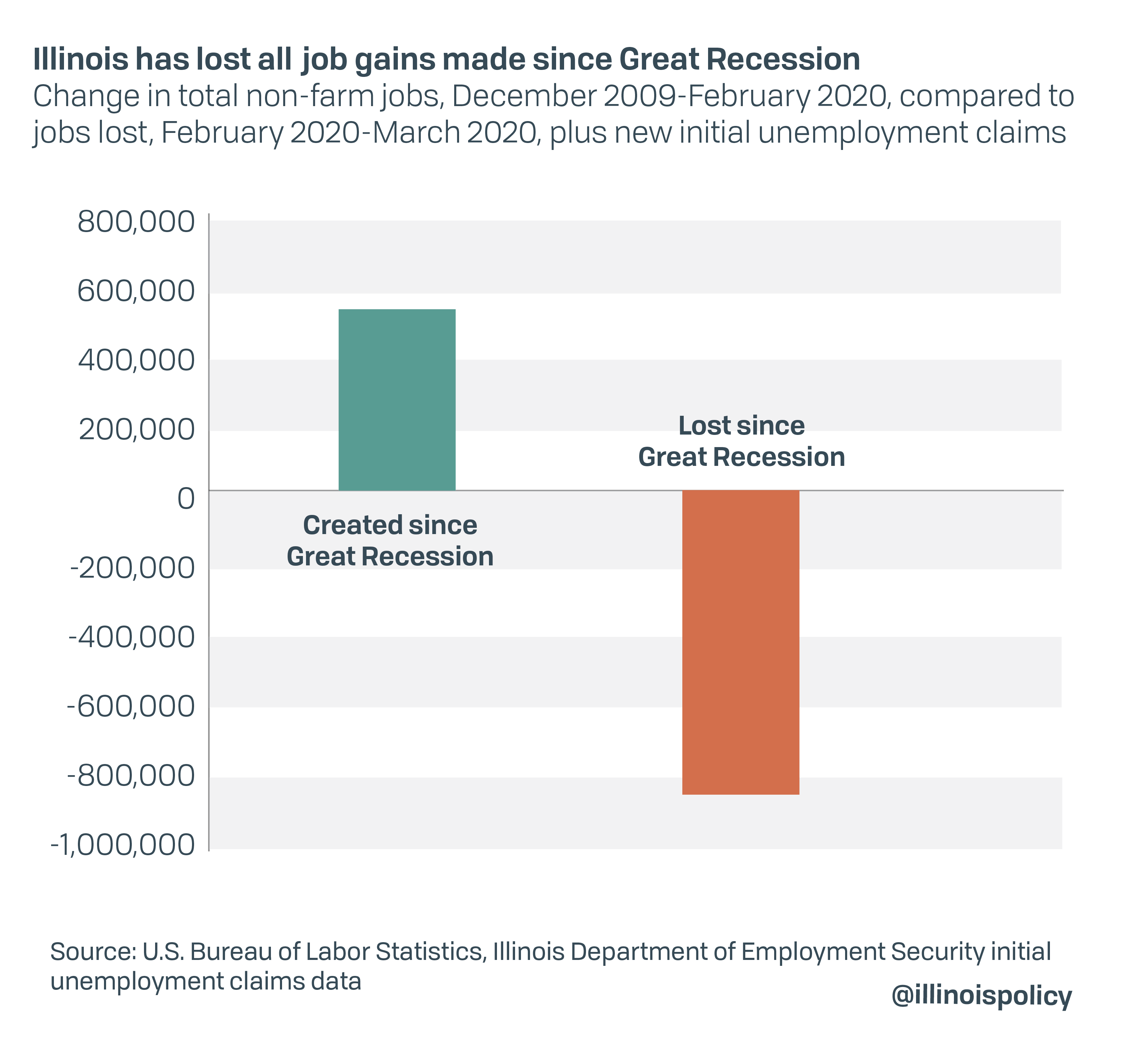

In a record-breaking spike, Illinois’ unemployment rate increased from 3.5% to 18% in the past two months. According to Institute experts, unemployment is not only around 50% higher than during the worst months of the Great Recession, but the current contraction has also erased all jobs created in Illinois since the end of that economic downturn.

While Illinois’ economy shrank by 5.5% during the length of the Great Recession, the state’s real gross domestic product (RGDP) is on pace to decline by 7.4% this year.

- Illinois’ economy shrank by 7.4% in the first quarter of 2020, or more than $183 million each day.

- The decline in economic activity has wiped out all of the jobs created in Illinois since the end of the Great Recession.

- The state’s unemployment rate is nearly 18% – around 50% higher than the worst months of the Great Recession.

- Nearly 1.5 million Illinoisans are at risk of losing their jobs because of the lockdown. Illinois shed 34,100 jobs from mid-February to mid-March, and since then an additional 819,268 Illinoisans have filed new unemployment claims.

- The number of jobless claims, nearing 1 million, is expected to grow as gig economy workers, independent contractors and freelancers on May 11 will be allowed to file for unemployment in Illinois.

Orphe Divounguy, chief economist at the nonpartisan Illinois Policy Institute, offered the following statement:

“Thousands of Illinoisans have been without a paycheck since March. Moving forward, Illinoisans need certainty. They need confidence that it will be safe to return to work. The governor’s outline for reopening provided some framework for what to expect, but for many workers and business owners it’s just another extension of the lockdown.

“Adding to the state’s economic uncertainty is a progressive income tax amendment that would grant broad new taxing authority to Springfield. The introductory rates would raise taxes by up to 47% on small businesses that survive the lockdown. In order to encourage a strong recovery, lawmakers should remove economically harmful obstacles like the progressive income tax hike.”

To read more about how the COVID-19 pandemic has affected Illinois’ economy, visit: illin.is/covidcost.

For bookings or interviews, contact media@illinoispolicy.org or (312) 607-4977.