Illinoisans to see increased gas taxes for the third year in a row

PRESS RELEASE from the

ILLINOIS POLICY INSTITUTE

CONTACT: Melanie Krakauer (312) 607-4977

July 1 gas tax hike will cost drivers $105 more per year

Illinoisans to see increased gas taxes for the third year in a row

CHICAGO (June 30, 2021) – As Illinois drivers head into the holiday weekend, gas taxes will increase across the state for the third time in three years. The average driver will pay more than $105 per year extra this year compared to before the gas tax doubled in 2019, according to the Illinois Policy Institute.

Since 2019, the state motor fuel tax has increased 206%, doubling from 19 cents per gallon to 39.2 cents per gallon, effective July 1. As part of state law, the tax automatically increases with inflation by a maximum of one cent each year.

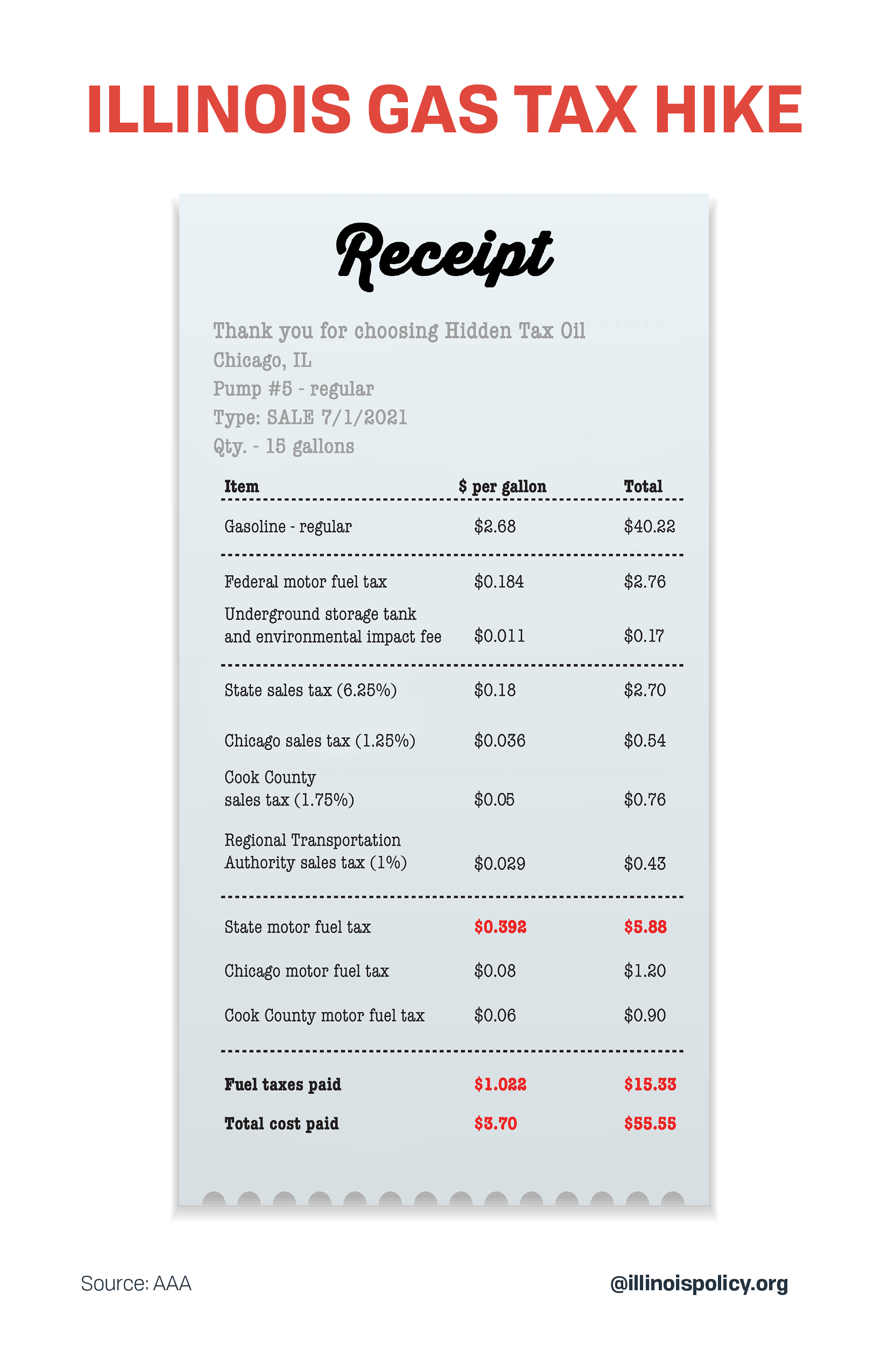

In Chicago, nearly 30% of drivers’ gas prices will go to taxes and fees. On an average price of $3.70 per gallon, that’s a total of $15.33 in taxes if drivers fill up a 15-gallon tank.

Illinois gas tax facts:

- In 2020, Illinois had the third highest gas prices in the nation, following only California and Pennsylvania.

- Every gallon of gas includes the 39.2 cent tax on top of the federal motor tax of 18.4 cents. Cook County adds an additional 6 cents and Chicago adds 8 cents per gallon.

- Illinois is one of just a few states that taxes its taxes on gas; the combined state, county, and municipal taxes total over $1 per gallon.

- The Illinois state government doubled the state gas tax to 38 cents from 19 cents on July 1, 2019. Then on July 1, 2020, the state gas tax automatically increased by 0.7-cents as part of a new annual hike.

Experts at the Institute recommend these solutions:

- Repeal the automatic annual gas tax increase and make lawmakers accountable for a yearly increase on drivers.

- Gov. J.B. Pritzker should sign House Bill 253, legislation that requires future infrastructure projects – which are funded by gas taxes – to be selected based on evidence about their costs and benefits to taxpayers. It passed the General Assembly unanimously.

Adam Schuster, senior director of budget and tax research at the nonpartisan Illinois Policy Institute, provided the following statement:

“Illinois’ gas tax hike comes at the same time crude oil is hitting a three-year high and Gov. Pritzker is pushing his ‘Time for Me to Drive’ campaign. Many Illinoisans are still recovering from the economic impact of COVID-19 and can’t afford any further pain at the pump. We can improve infrastructure by spending smarter, rather than always just spending more.

“Taxpayers deserve transparency about the projects that their fuel taxes are funding and to see a good bang for their buck. If Pritzker signs House Bill 253, at least Illinoisans will know their gas taxes are funding valuable projects, rather than being handed out as political favors.”

For bookings or interviews, contact media@illinoispolicy.org or (312) 607-4977.