Illinois school boards are under considerable pressure to balance the interests of key stakeholders in their districts. They want to offer competitive teacher salaries, better student outcomes and improve fiscal responsibility to taxpayers.

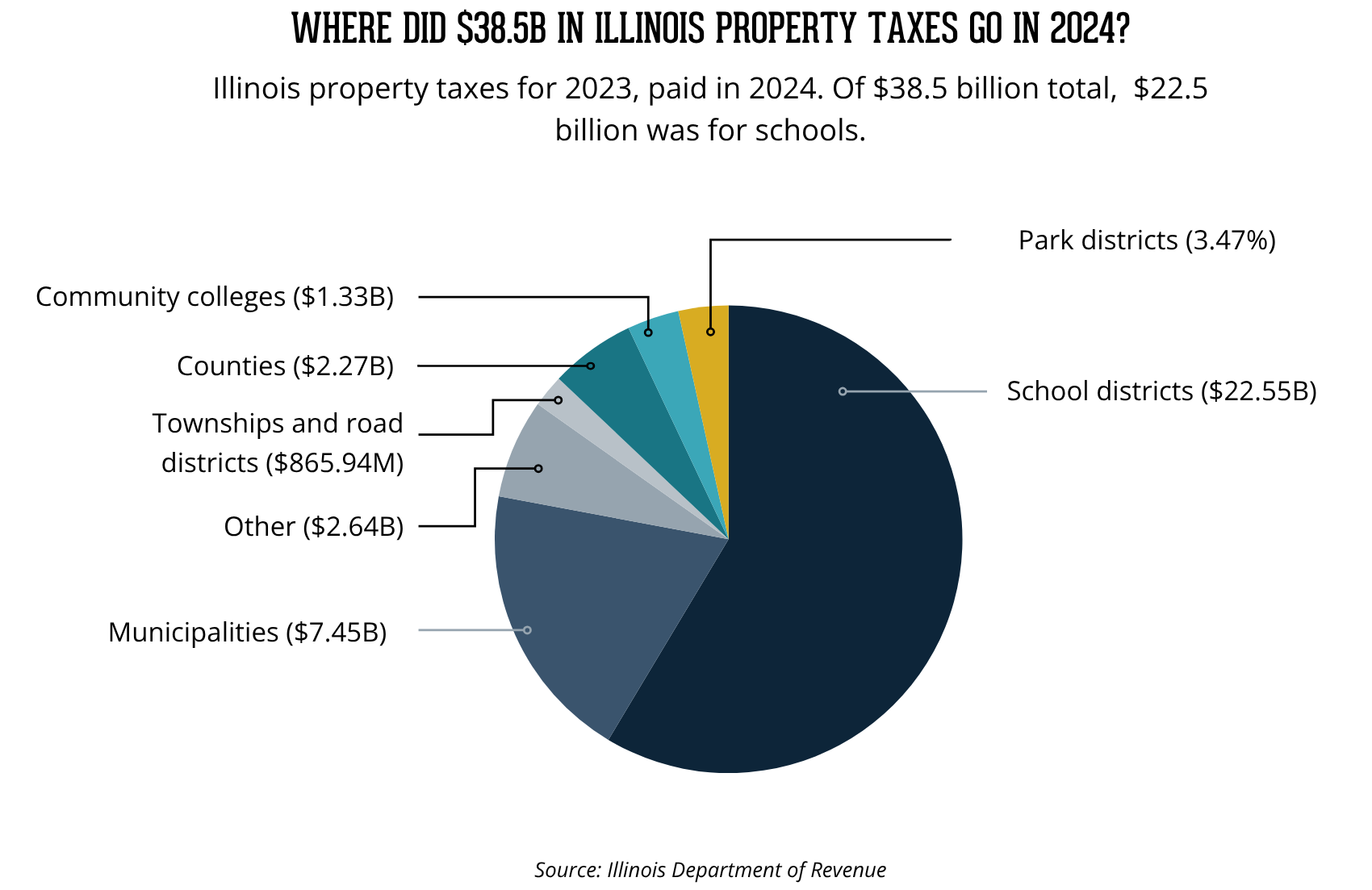

Too often those interests compete and taxpayers feel the crunch. Illinoisans pay the highest property tax rates in the nation relative to home values. Because taxes paid to school districts make up nearly 60% of all property taxes statewide, taxpayers – including parents of children within the district – want to know they are getting good value for their money.

Fortunately, Illinois school boards also have incredible discretion to create pro-parent, pro-transparency and pro-taxpayer policies aimed at balancing those interests.

The Illinois Policy Institute has created Building Better Schools: A pro-student, pro-community guide for Illinois school boards, which provides policies in five key areas to assist school board members ensure the best educational and financial outcomes in their districts:

- Kids first: Implementing effective literacy practices.

- Cost consciousness and responsible budgeting: Balancing district needs with taxpayers’ ability to pay.

- Fair contracts: Ensuring what’s best for both employees and the community.

- Transparency: Generating parental involvement through curriculum lists and access.

- Inclusiveness for all students in the district: Extending access to all district families through partial enrollment.

See the executive summary here.

Get the full guide here.

Are you a school board member interested in one or more of these reforms for your district? Schedule a virtual meeting with one of our attorneys here.

The Illinois Policy Institute is a nonpartisan research organization. Materials provided are for informational purposes only and are not intended as and do not constitute legal advice or the formation of an attorney-client relationship.