What’s driving Illinois’ $111 billion pension crisis

By Ted Dabrowski, John Klingner

Download Report

What’s driving Illinois’ $111 billion pension crisis

By Ted Dabrowski, John Klingner

Download Report

Executive summary

Since the Illinois Supreme Court ruled in its May 2015 decision on Senate Bill 1 that pensions for current government workers can’t be modified, debate over pension reform has faded from view.

But ignoring the problem won’t make it go away. In 2015, Illinois’ state pension debt reached a record $111 billion. Government-worker pensions already consume one-fourth of the state’s budget. And every day Illinois goes without a solution to its pension crisis, the state’s pension debt grows by over $20 million.

The state’s pension crisis threatens to burden taxpayers with massive, ever-escalating taxes to bail out a system that is simply not sustainable.

And while politicians’ underfunding the pension systems has aggravated the crisis, that’s not the main driver. The bigger problem facing Illinois’ five state-run pension funds is the unaffordable pension benefits politicians have given away to government workers and government unions over the past several decades.

The generous rules on retirement ages, cost-of-living adjustments, or COLAs, and employee contributions have caused pension benefits to grow by more than 900% since 1987.

Some of the biggest drivers include the following facts:

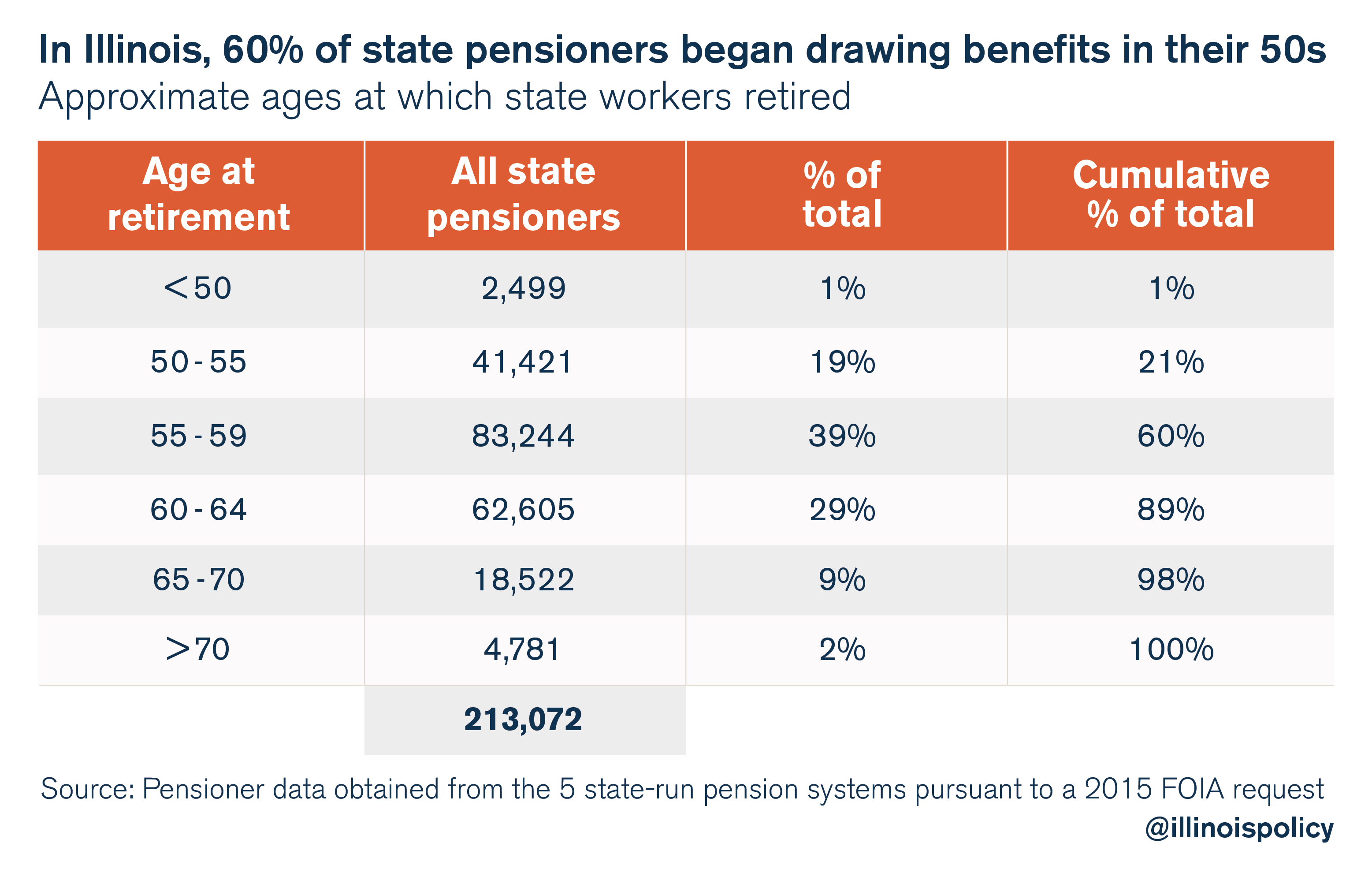

- 60 percent of state pensioners retired in their 50s, many with full pension benefits.

- Over half of state pensioners will receive $1 million or more in pension benefits over the course of their retirements. Nearly 1 in 5 will receive over $2 million in benefits.

- Almost 60 percent of all current state pensioners can expect to spend 25 or more years collecting benefits, based on approximate actuarial life expectancies. Due to automatic, 3 percent compounded COLA benefits, those pensioners can expect to see their annual pension benefits double in size.

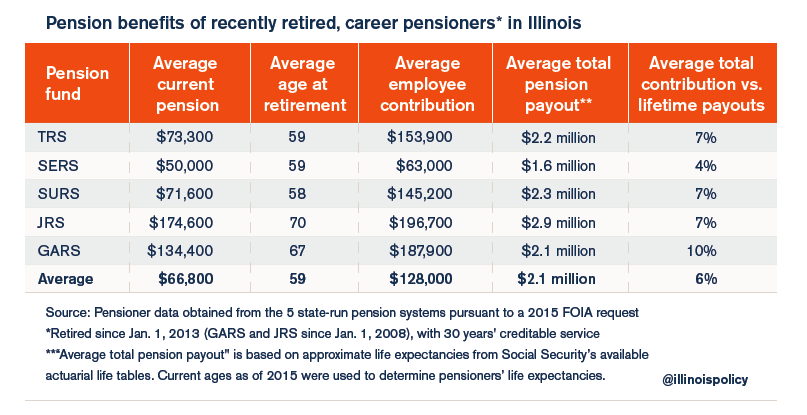

- The average career pensioner – retired after Jan. 1, 2013, with 30 years of service or more – receives $66,800 in annual pension benefits and will collect over $2 million in total benefits over the course of retirement.

- The average career pensioner will get back his or her employee contributions after just two years in retirement. In all, pensioners’ direct employee contributions will only equal 6 percent of what they will receive in benefits over the course of their retirements.

The generous retirement benefits pensioners receive are fundamentally unfair to the taxpayers who are forced to pay for them. Private-sector workers are expected to fund the pensions of state pensioners who can retire and draw benefits in their 50s, who can receive annual pension boosts that can double their pension benefits over the course of their retirements, and who get back what they contributed to pensions after only two years in retirement.

And while the teachers, state employees, university workers, judges and lawmakers of the state’s five pension funds have done nothing wrong in receiving these benefits, it’s clear that politicians made promises they couldn’t keep – promises Illinois taxpayers could not afford to fund.

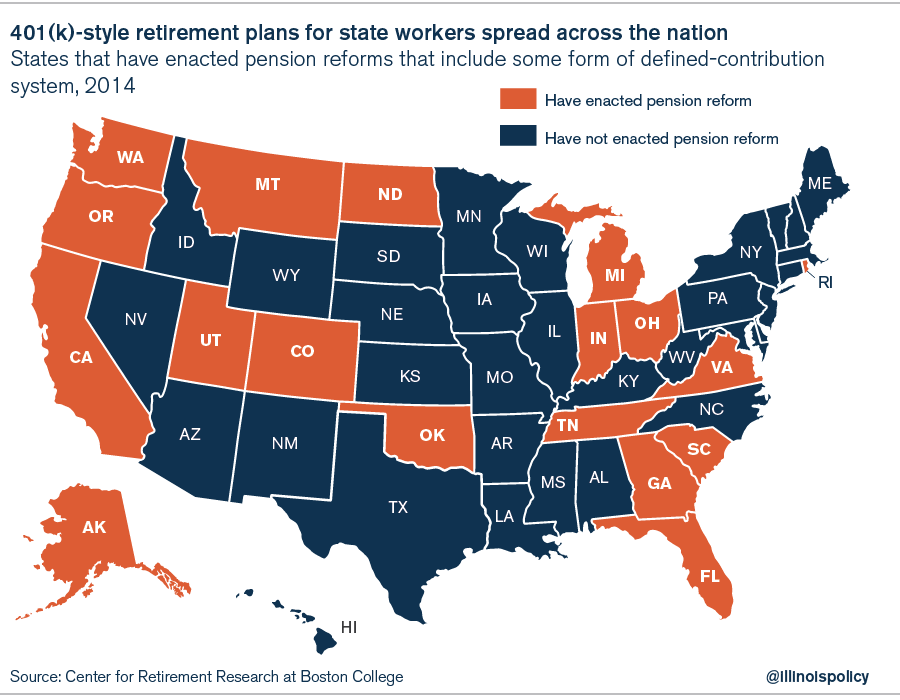

Illinois needs to begin moving away from its broken pension systems – starting by moving new government workers to 401(k)-style plans and giving existing workers the option to have their own self-managed accounts.

Doing that, in addition to enacting a constitutional amendment allowing Illinois to reform pension benefits going forward, is an important first step in fixing Illinois’ government-worker pensions.

State-worker retirement ages

A majority of state workers in Illinois retire and begin collecting pension benefits in their 50s, well before their private-sector peers. In all, 60 percent of current state pensioners retired in their 50s, many receiving full pension benefits. Conversely, most private-sector workers retire in their early 60s, and many don’t plan to retire until after they turn 65.

This early-retirement benefit is one of the reasons why Illinois’ five state-run pension funds are in dire straits, with a record-high pension debt of $111 billion in 2015.

Within each state retirement system:

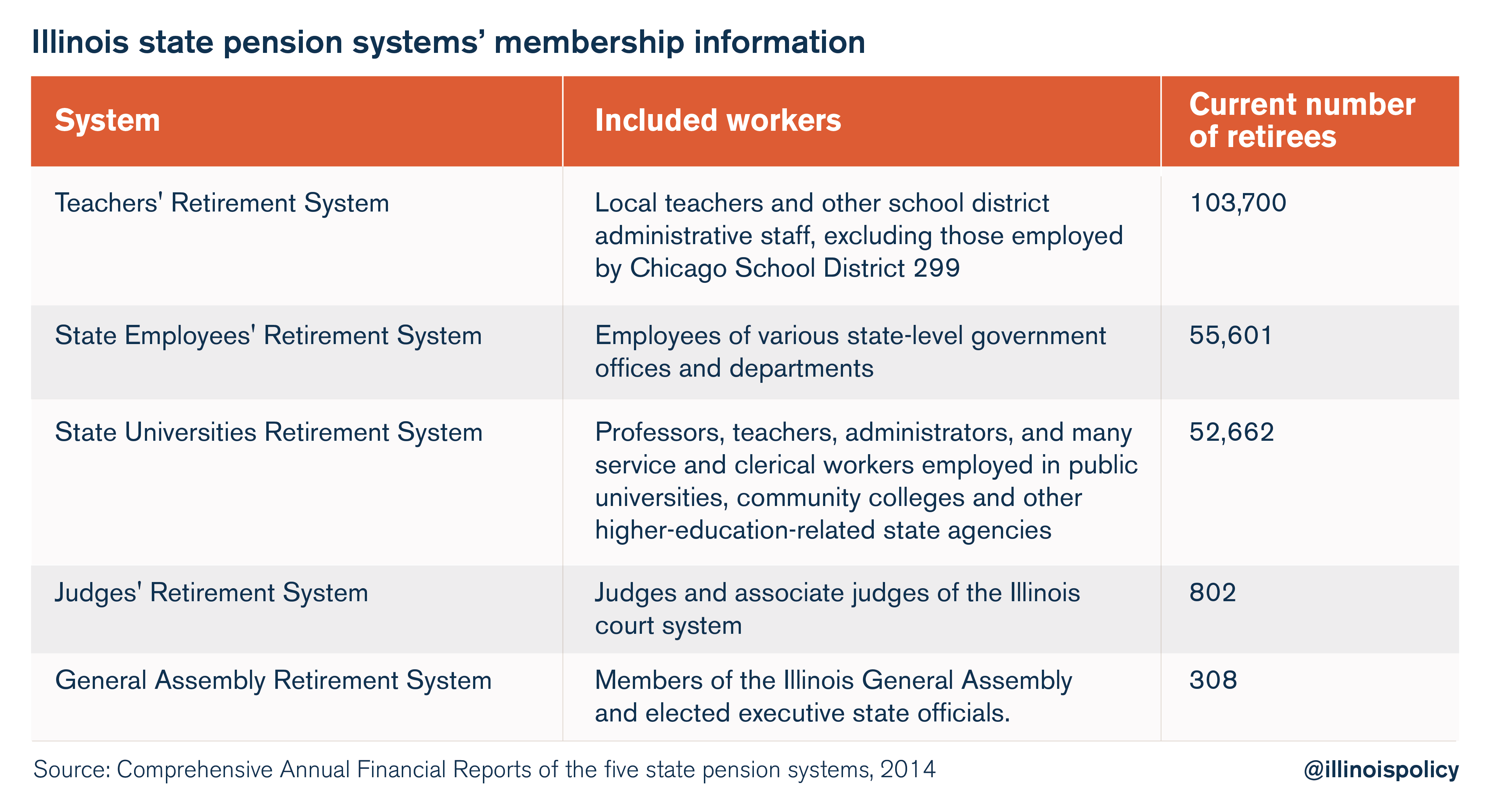

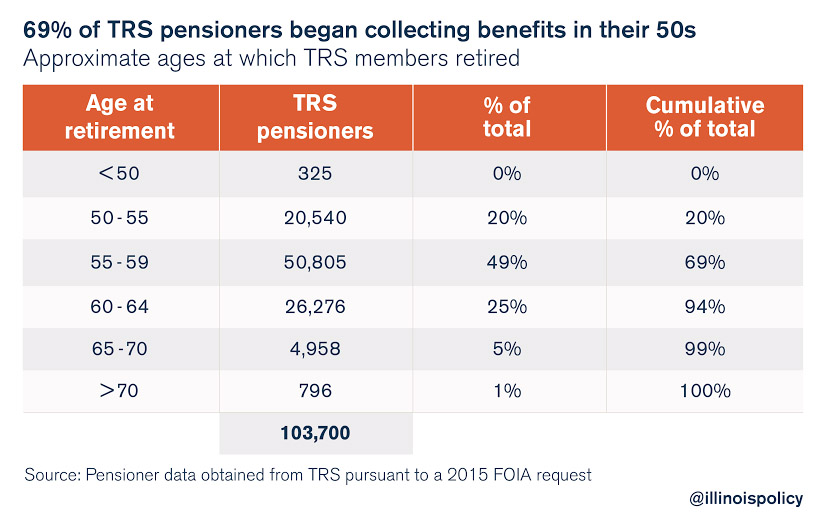

- 69 percent of Teachers’ Retirement System’s, or TRS’s, more than 103,700 current pensioners began collecting benefits in their 50s.

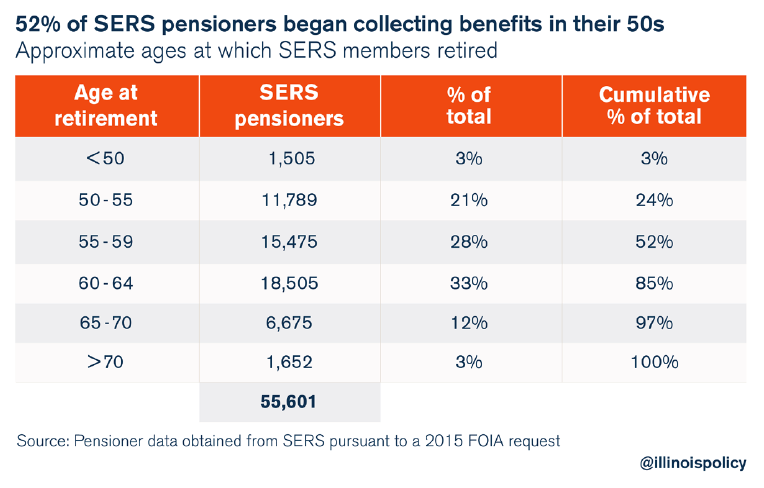

- 52 percent of State Employees’ Retirement System’s, or SERS’s, more than 55,600 current pensioners began collecting benefits in their 50s.

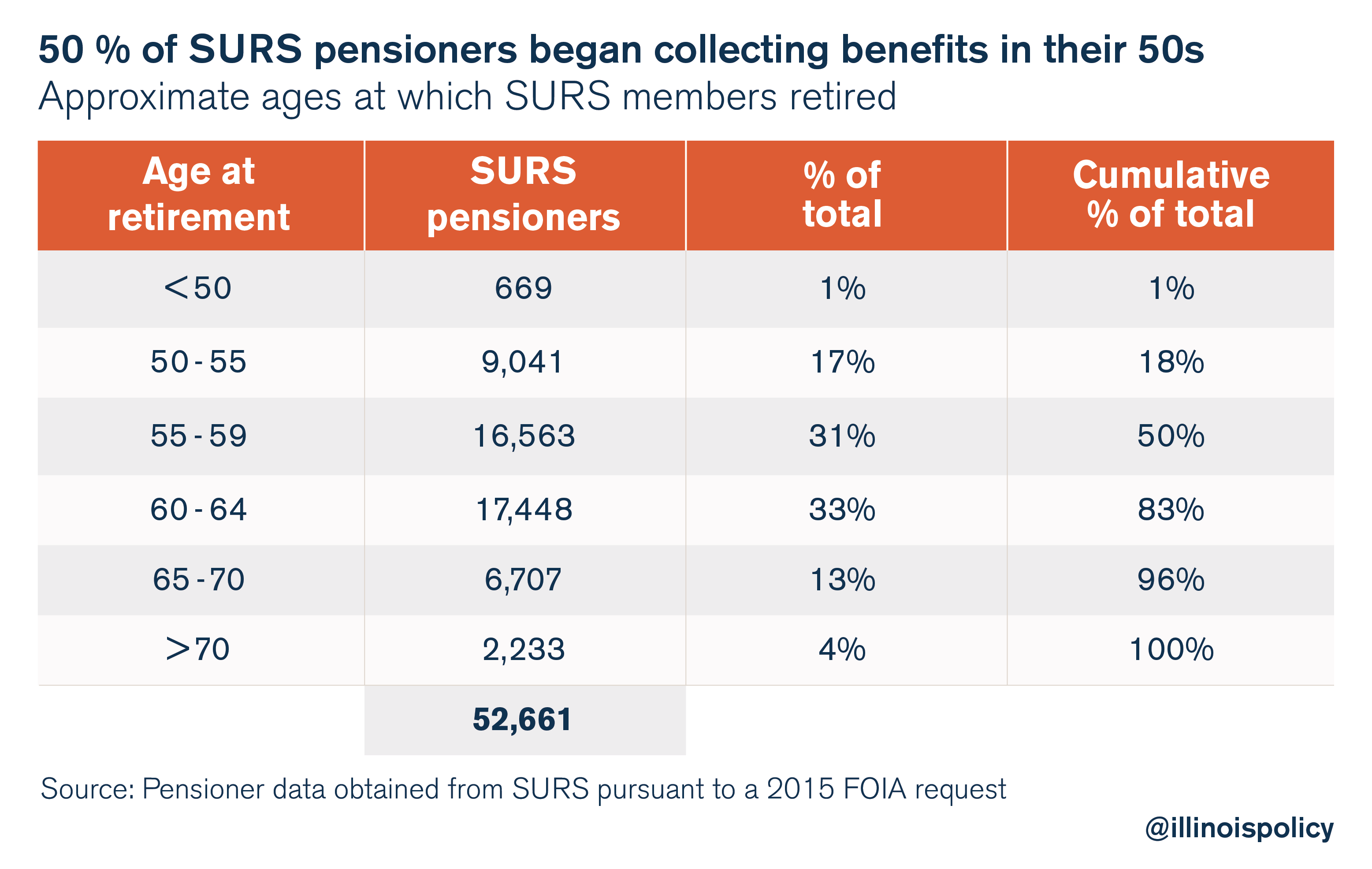

- 50 percent of State Universities Retirement System’s, or SURS’s, more than 52,600 current pensioners began collecting benefits in their 50s.

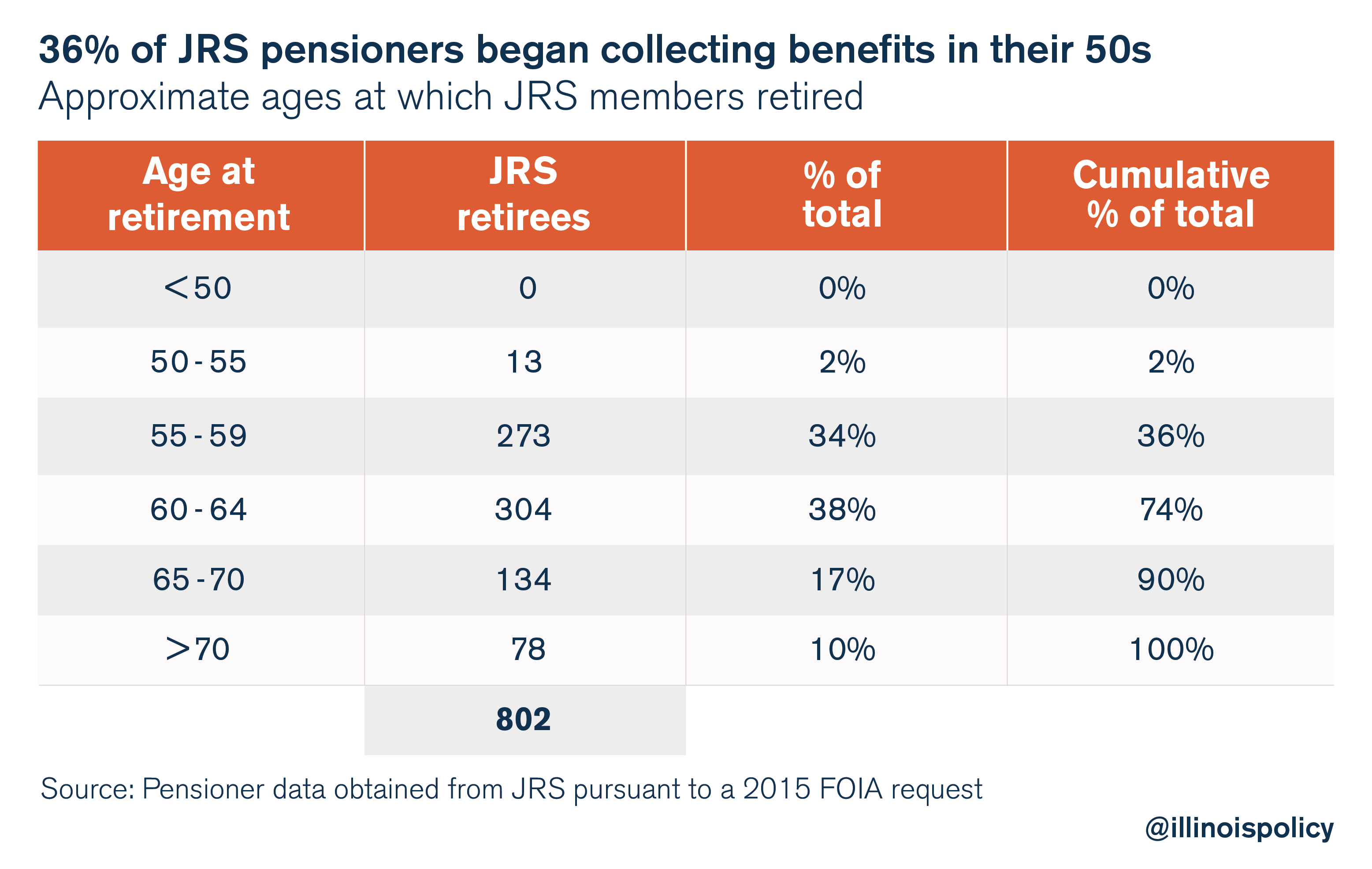

- 36 percent of Judges’ Retirement System’s, or JRS’s, more than 800 current pensioners began collecting benefits in their 50s.

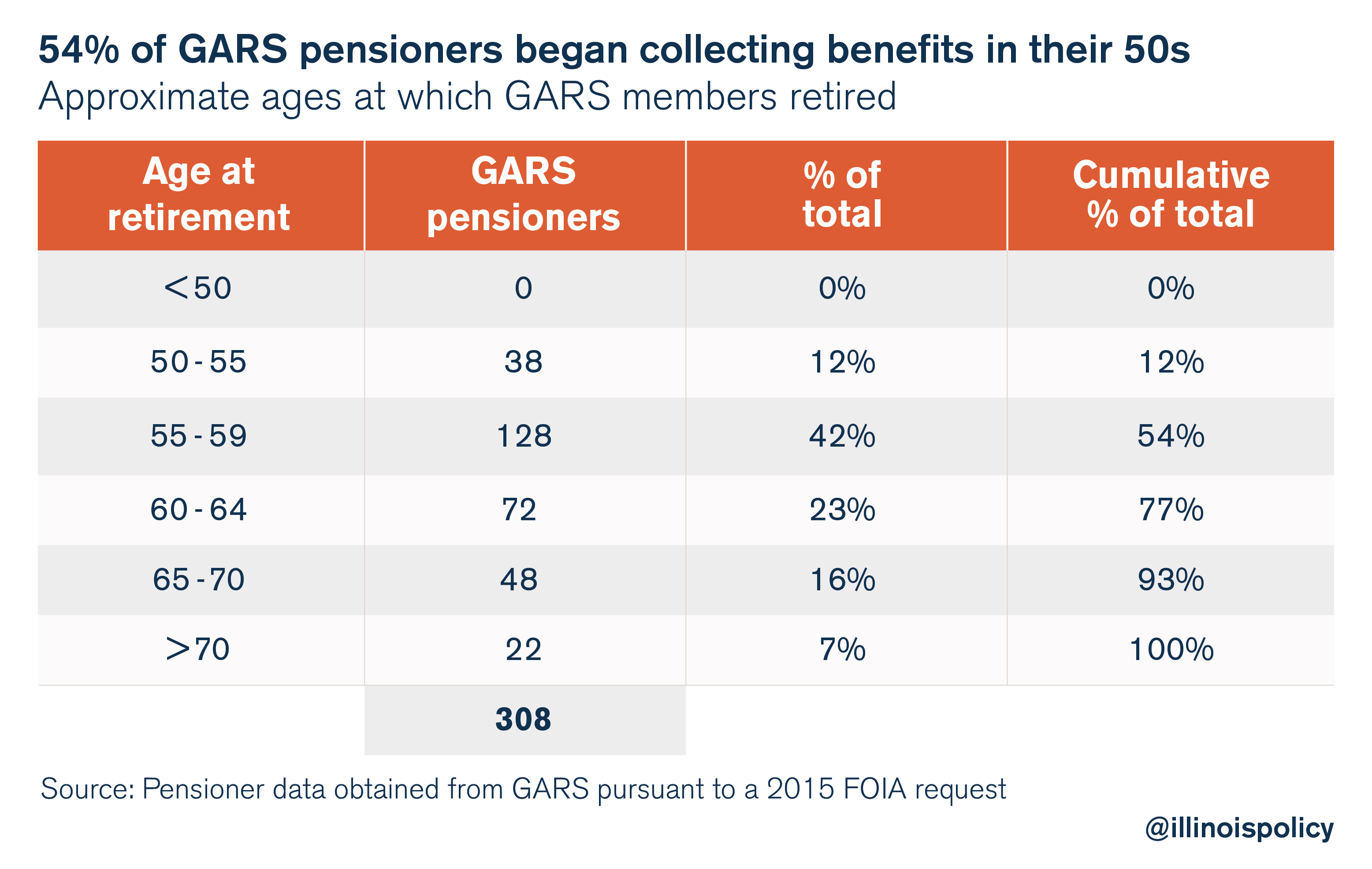

- 54 percent of the General Assembly Retirement System’s, or GARS’s, more than 300 current pensioners began collecting benefits in their 50s.

Due to a combination of workers retiring in their 50s, longer life expectancies, and generous cost-of-living, or COLA, increases, not only will a majority of state pensioners live to see their annual pension benefits double in size during their retirements, but they’ll also spend more years in retirement than they did working for the state. The combination of retiring early and living longer results in the average state pensioner’s spending 24 years working for the government but expecting to spend approximately 26 years drawing pension benefits.

In fact, nearly 1 of 5 state pensioners will receive over $2 million dollars in lifetime pension benefits, and over half of pensioners will receive $1 million or more – amounts far larger than what the average private-sector employee can ever hope to receive from Social Security.

These generous retirement benefits are fundamentally unfair to Illinois taxpayers. Private-sector workers – many of whom expect to delay their own retirements into their late 60s – are expected to fund the pensions of state pensioners who can retire and draw benefits an entire decade before private-sector workers do.

And while the teachers, state employees, university workers, judges and lawmakers of the state’s five pension funds have done nothing wrong in receiving such benefits, it’s clear that the early-retirement benefit is no longer fair or affordable for Illinois taxpayers.

The only real solution is for Illinois to reform its state pension system – starting with enacting a constitutional amendment allowing Illinois to reform pension benefits going forward, moving new government workers to 401(k)-style plans and giving existing workers the option to have their own self-managed accounts.

Government-worker retirement ages

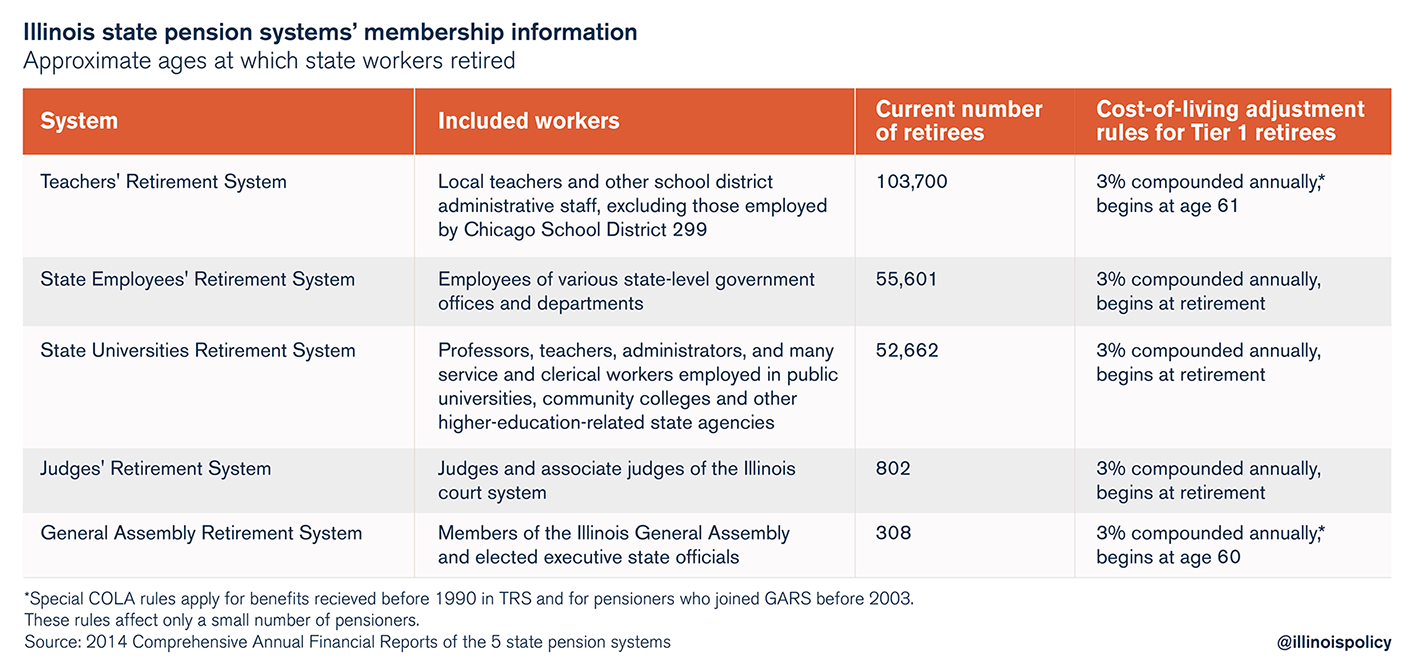

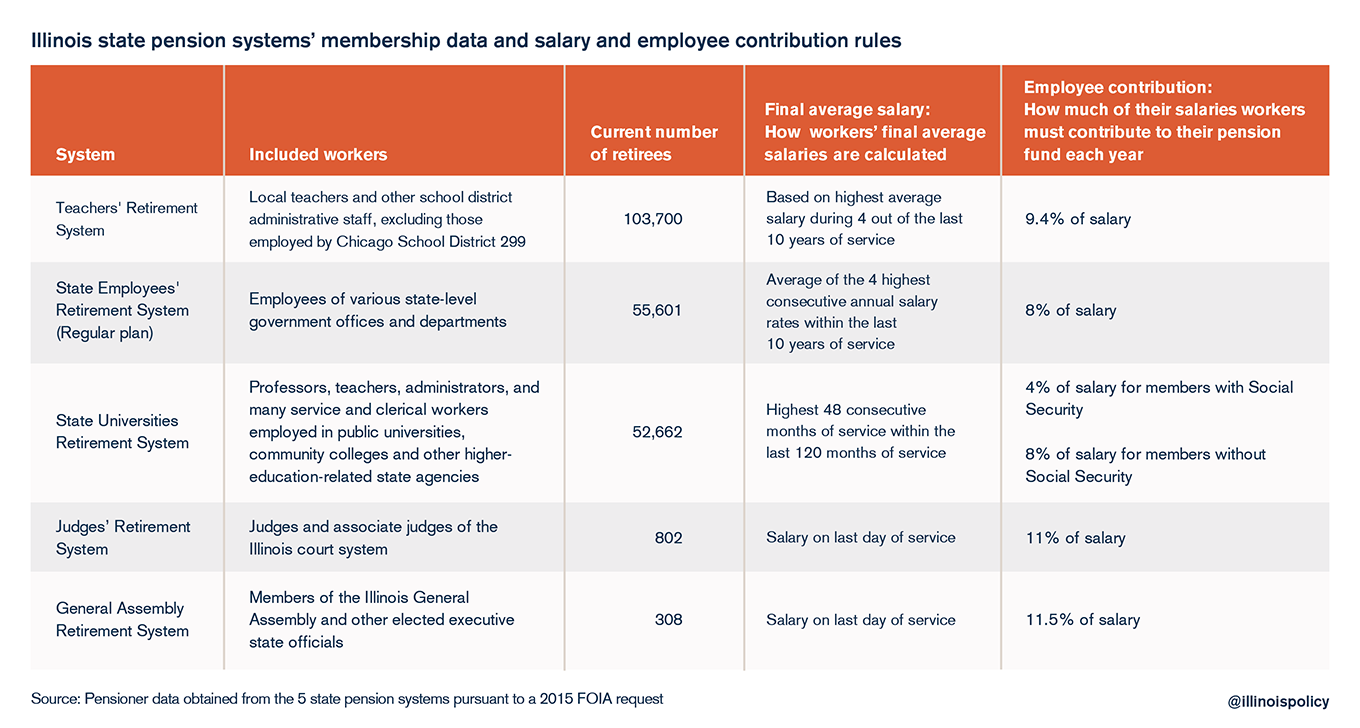

Illinois provides retirement benefits to more than 213,000 government workers who participate in the five state-run pension systems.

According to detailed member data from all five state pension funds, 60 percent of all current state pensioners retired and began to draw benefits in their 50s.

Despite their relatively young ages at retirement, those state pensioners also receive generous annual pensions. The average annual pension payment for a state worker who retired in his or her 50s is $50,000 a year. In all, such state pensioners can expect to receive nearly $1.5 million in lifetime pension benefits. However, those benefits are skewed downward by employees who did not work full careers in government.

The average pension benefits for recently retired, career state workers – defined in this report as pensioners who retired as of Jan. 1, 2013, with 30 years of service – provide a more accurate look at what Illinois’ state pensioners can receive. On average, career state pensioners who retired at age 59 currently receive $66,800 in annual pension benefits and will collect over $2 million in total benefits over their lifetimes.

In all, 53 percent of the over 213,000 state pensioners in Illinois can expect to receive lifetime pension benefits of more than $1 million. Almost 40,000 (18 percent of all pensioners) will receive $2 million or more in benefits.

Government-worker vs. private-sector retirements

The retirement experience for the average private-sector worker is quite different.

The average annual Social Security payment for a current private-sector retiree is only $15,936, and the average retiree will receive approximately $400,000 in lifetime retirement benefits from Social Security, assuming that person starts drawing benefits at 64, has a life expectancy of about 21 years, and has an average annual COLA of 1.2 percent (the average annual Social Security COLA granted over the past seven years).

And the disparity between the retirements of public- and private-sector workers doesn’t end there.

The combination of retiring early and living longer results in the average state pensioner’s spending 24 years working for the government but expecting to spend approximately 26 years drawing pension benefits.

And while that doesn’t apply to all workers – some employees work for the state for only a few years later in their careers, for example – the fact remains that the average state pensioner will likely spend about the same number of years drawing pension benefits as he or she did working for the state.

By contrast, most private-sector workers won’t get to spend equal parts of their lives working and in retirement.

Americans in the private sector have had to accept a reality in which they retire later and are not able to fully leave the workforce even while receiving benefits.

The average U.S retirement age has risen to 62 – but many private-sector workers don’t see themselves retiring at that age. According to a 2015 Gallup poll, 37 percent of current workers expect to retire after age 65. That’s nearly three times more than the 14 percent of workers who said the same in 1995.

It’s important to note that just because a private-sector worker retires, that does not mean he or she will begin drawing benefits from Social Security. Some private-sector workers retire in their early 60s but rely on savings or private retirement accounts until they can begin collecting full benefits from Social Security at age 66 or 67.

And while drawing Social Security benefits, many private-sector workers have to continue working in retirement to supplement their incomes. A poll from the Associated Press found that 59 percent of working Americans age 50 or older say it is at least somewhat likely they will work during retirement.

The results of government workers retiring early and living longer

The longer time during which state workers collect pension benefits also imposes a growing financial burden on the state pension systems, in part due to the pension-boosting, annual, 3 percent compounded COLAs that all state pensioners receive automatically.

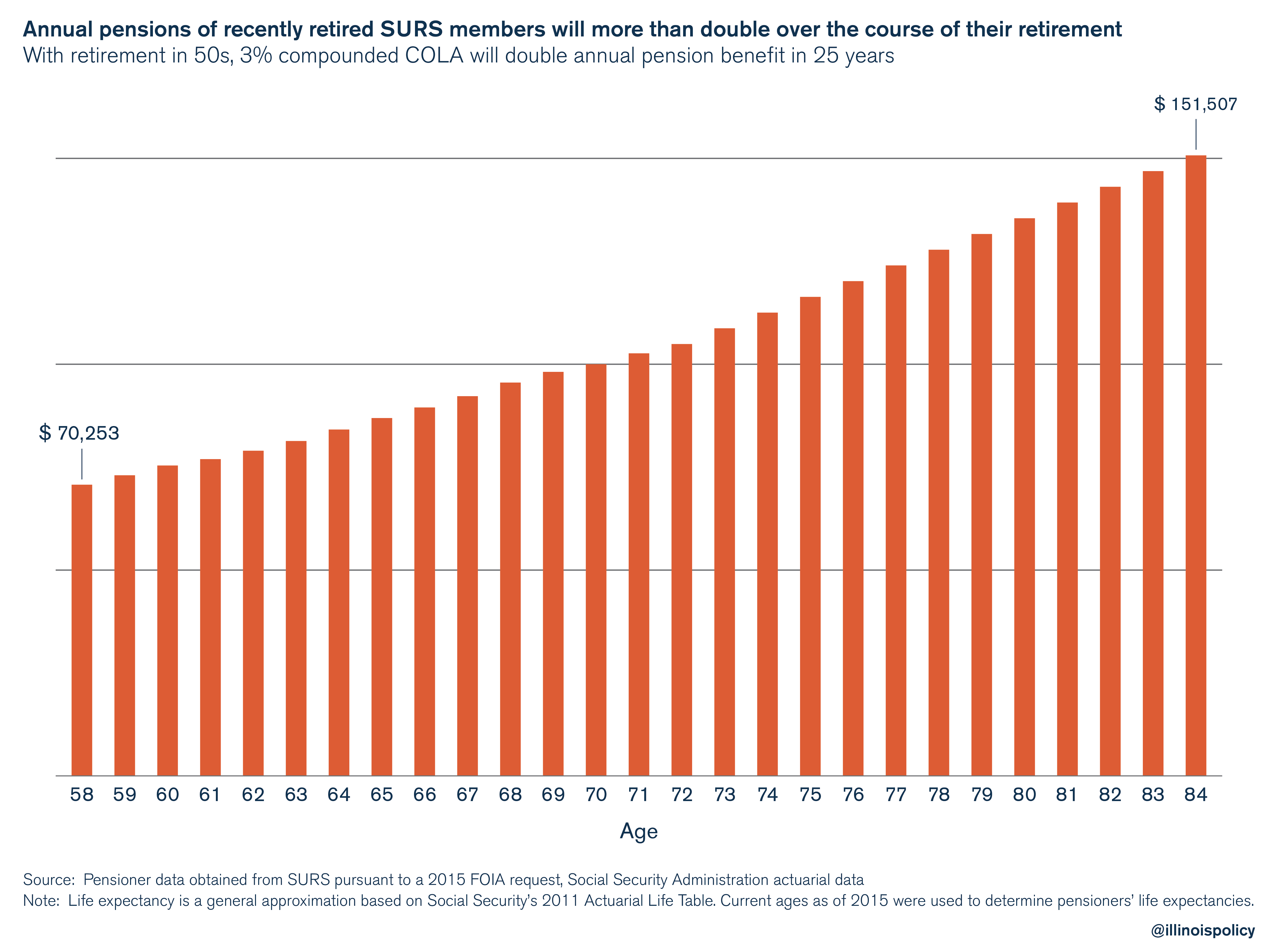

The 3 percent COLA allows a pensioner’s annual pension benefits to double in just 25 years. Today, thanks to the ability to retire in their 50s and increasing life expectancies, almost 60 percent of all current state pensioners can expect to spend 25 or more years collecting benefits and will live to see their annual pension benefits double in size over the course of their retirements.

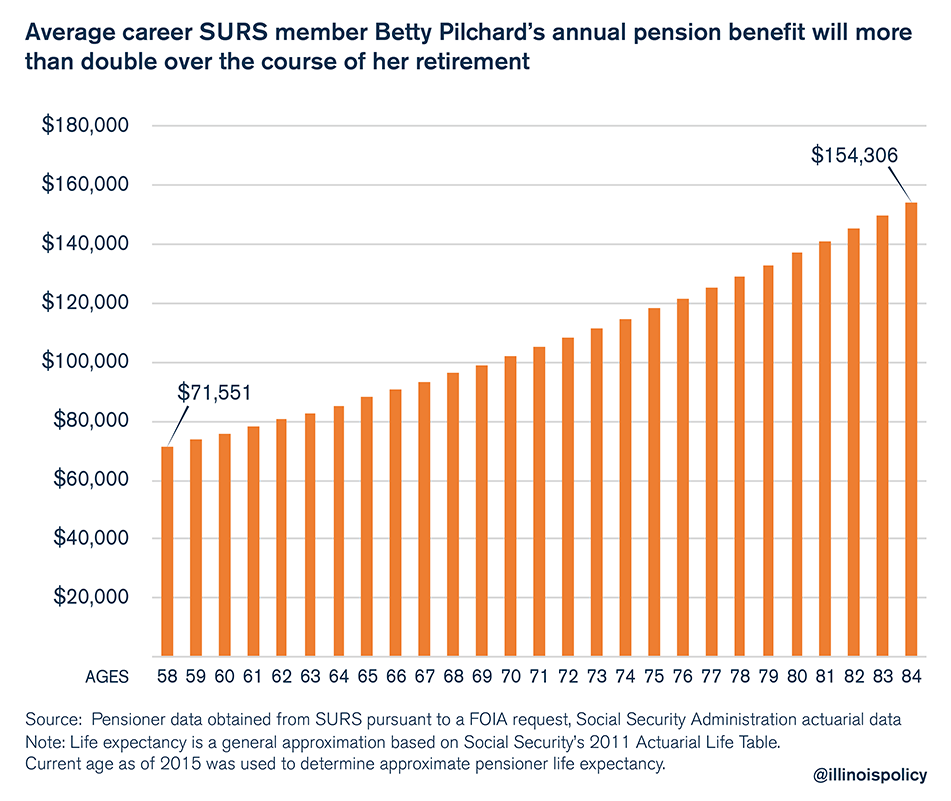

For an example of how retiring before age 60 and COLAs boost pension benefits, take a look at an average, recently retired, career university employee (retired since Jan. 1, 2013, with 30 years of service or more). Taking advantage of the state’s generous retirement-age rules, the university worker began collecting benefits at age 58 and received a starting pension of $70,253.

By the time that university worker reaches her approximate life expectancy of 84, her annual pension will have more than doubled to $151,507 a year.

In all, the average, career university-worker pensioner in this example will collect more than $2.8 million in pension benefits over her lifetime – all due to collecting benefits in her 50s combined with her automatic, 3 percent COLA increase.

And it’s not just retired university workers who become millionaire pensioners due to generous pension rules. A similar combination of early retirement and multimillion-dollar lifetime pension benefits occurs across Illinois’ state-run systems.

Teachers’ Retirement System

There are more than 103,700 current pensioners in TRS – Illinois’ largest state pension fund. TRS members include Illinois’ local teachers and other school district administrative staff, excluding those employed by Chicago School District 299.

Almost 70 percent of TRS’s current pensioners began collecting benefits in their 50s. The pensioners who retired that early currently receive average annual pension benefits of $57,086 and will end up collecting more than $1.5 million in average lifetime pension benefits.

The pension benefits that career TRS pensioners – of any retirement age – receive are even larger. The average recently retired, career teacher (retired since Jan. 1, 2013, with 30 years of service or more) retired at age 59, currently receives $73,300 in annual pension benefits, and can expect to receive over $2.2 million in lifetime benefits.

State Employees’ Retirement System

There are more than 55,600 current retirees in SERS. SERS members include employees of various state-level government offices and departments. Most employees in SERS are also enrolled in Social Security.

Over 50 percent of SERS’s current pensioners began collecting benefits in their 50s. The pensioners who retired that early currently receive average annual pension benefits of $43,533. The average annual pension received by such members is relatively low due to the fact that a majority of SERS retirees also receive Social Security benefits. However, such members will still end up collecting almost $1.5 million in lifetime pension benefits.  The pension benefits that career SERS retirees – of any retirement age – receive are even larger. The average recently retired, career state employee (retired since Jan. 1, 2013, with 30 years of service or more) retired at age 59, currently receives $50,000 in annual pension benefits, and can expect to receive over $1.6 million in lifetime benefits over and above what he or she will receive from Social Security.

The pension benefits that career SERS retirees – of any retirement age – receive are even larger. The average recently retired, career state employee (retired since Jan. 1, 2013, with 30 years of service or more) retired at age 59, currently receives $50,000 in annual pension benefits, and can expect to receive over $1.6 million in lifetime benefits over and above what he or she will receive from Social Security.

State Universities Retirement System

There are more than 52,600 current retirees in SURS. SURS members include professors, teachers, administrators, and many service and clerical workers employed in public universities, community colleges and other higher-education-related state agencies.

Fifty percent of SURS’s current pensioners began collecting benefits in their 50s. The pensioners who retired that early currently receive average annual pension benefits of $39,442. The average pension received by such SURS members is relatively low due to the fewer years of service those members completed compared with SERS and TRS pensioners. The average years of service completed for a SURS member retiring in his or her 50s is only 20 years, while SERS and TRS members’ years of service average closer to 30. However, SURS members who retired in their 50s will still end up collecting more than $1.2 million in lifetime pension benefits.

The pension benefits that career SURS pensioners – of any retirement age – receive are far larger than the benefits of SURS workers who retired in their 50s. The average, recently retired, career university worker (retired since Jan. 1, 2013, with 30 years of service or more) retired at age 58, currently receives $71,600 in annual pension benefits, and can expect to receive nearly $2.3 million in lifetime benefits.

Judges’ Retirement System

There are more than 800 current pensioners in JRS. Members include judges and associate judges of the Illinois court system. Members of JRS can retire at age 60 with 10 years of service and still draw 35 percent of their final average salaries.

Over 35 percent of JRS’s current pensioners began collecting benefits in their 50s. The pensioners who retired that early currently receive average annual pension benefits of $126,000 and will end up collecting more than $3.5 million in lifetime pension benefits.

The pension benefits that career JRS pensioners – of any retirement age – receive are even larger. The average, recently retired, career judge (retired since Jan. 1, 2008, with 30 years of service or more) retired at age 70, currently receives $174,600 in annual pension benefits, and can expect to receive nearly $2.9 million in lifetime benefits.

General Assembly Retirement System

There are more than 300 current pensioners in GARS. GARS members include members of the Illinois General Assembly and other elected executive state officials.

Over 50 percent of GARS’s current pensioners began collecting benefits in their 50s. The pensioners who retired that early currently receive average annual pension benefits of $58,639 and will end up collecting almost $1.6 million in lifetime pension benefits.

The pension benefits that career GARS retirees – of any retirement age – receive are even larger. The average, recently retired, career lawmaker (retired since Jan. 1, 2008, with 30 years of service or more) retired at age 66, currently receives $134,400 in annual pension benefits, and can expect to receive $2.1 million in lifetime benefits.

Reforming benefits is a necessity

The pension benefits that politicians have granted government workers have resulted in a retirement system that is simply unfair to the taxpayers who pay for it.

Private-sector workers are expected to pay for the retirement of state pensioners who retire a decade earlier than those in the private sector and still receive million-dollar lifetime pension payouts.

Teachers, state employees, university workers, judges and lawmakers of the state’s five pension funds have done nothing wrong, but it’s clear that Illinois’ early-retirement benefit is no longer fair or affordable for Illinois taxpayers.

Illinois needs to end those benefits going forward – starting by moving new government workers onto 401(k)-style plans and giving existing workers the option to choose their own self-managed accounts.

Doing that, in addition to enacting a constitutional amendment allowing Illinois to reform the future pension benefits of current workers, is an important first step in fixing Illinois’ government-worker pensions.

COLAs are the biggest driver of unsustainable pension costs in Illinois

Illinois state pensioners get 3 percent, automatic cost-of-living adjustments, or COLAs, each year. That benefit allows retirees’ pensions to double in just 25 years.

In all, almost 60 percent of all current state pensioners can expect to spend 25 or more years collecting benefits and to see their annual pension benefits double in size. And state pensioners’ COLA benefits are not means-tested, meaning that six-figure pensioners also receive COLA increases. There are over 12,000 state pensioners who currently receive more than $100,000 in pension benefits – three times more than the maximum allowed Social Security benefit – yet those retirees receive the same automatic COLA that all other state pensioners do.

COLAs are imposing a growing financial burden on Illinois’ state pension systems due to the fact that state workers are living longer and are collecting pension benefits for longer periods of time than in the past. This perk is the biggest cost driver behind the state’s ever-growing pension crisis, which reached $111 billion in 2015, a record high.

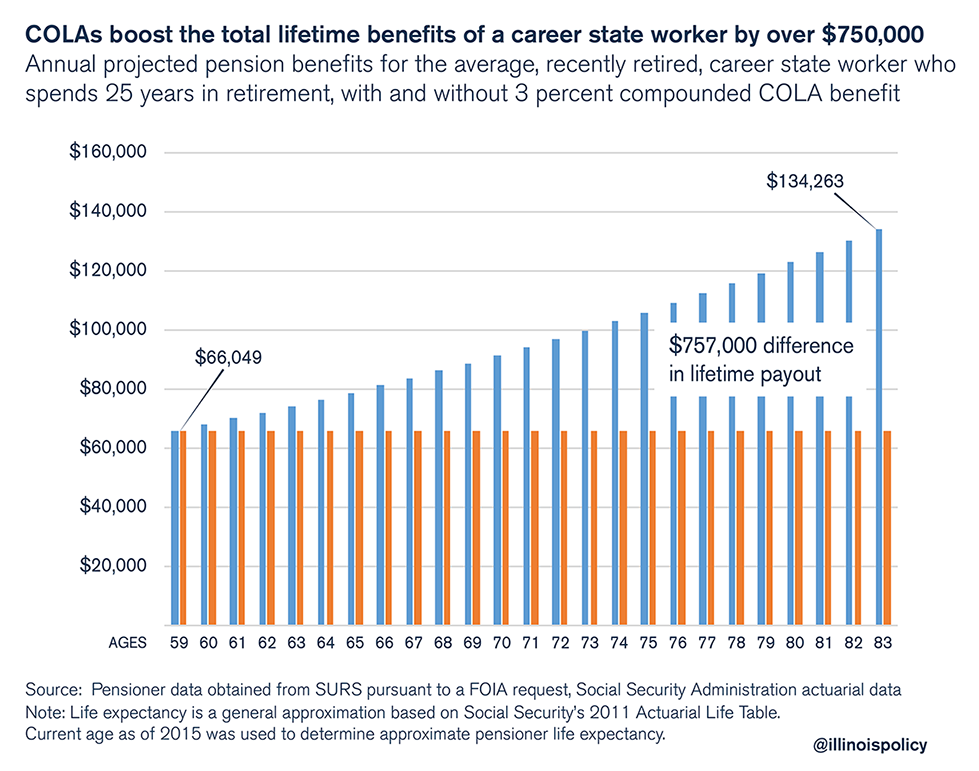

- Automatic COLAs end up boosting the lifetime pensions of the average, recently retired, career state worker (retired since Jan. 1, 2013, with 30 years of service) by over $750,000.

- Almost 60 percent of state pensioners can expect to see their annual pension benefit double in size, based on approximate life expectancies.

- COLAs will cost the state pension systems approximately $270 million (excluding the COLA costs of nonregular retirees such as disabled and survivor annuitants, etc.) in 2016 alone.

This is fundamentally unfair to Illinois taxpayers. Most private-sector retirees rely on their 401(k) retirement funds, which don’t provide COLAs, and Social Security, which provides far smaller annual benefits and limited annual COLA increases based on the rate of inflation.

Despite that, private-sector workers are expected to fund the pensions of state pensioners, many of whom will live to see their annual benefits double in size over the course of their retirements thanks to COLA increases. Proponents of COLAs argue this benefit is necessary to protect pensioners who receive meager pensions. But six-figure pensioners receive COLAs, too. It’s time to means-test this benefit, which will help stabilize Illinois’ flailing defined-benefit pension systems.

Beyond means-testing the COLA benefits, Illinois must also fundamentally reform the pension systems themselves. The state should start by enacting a constitutional amendment allowing pension benefits to be reformed going forward, moving new government workers onto 401(k)-style plans, and giving existing workers the option to have their own self-managed accounts.

Public vs. private-sector COLAS

Illinois state pensions

Illinois provides retirement benefits to more than 213,000 government pensioners participating in the five state-run pension systems. As a benefit, the systems provide pensioners with an automatic COLA that increases their annual pension benefits every year. Illinois’ COLAs are:

- Annual – Retiree pensions increase each year by 3 percent.

- Automatic – Pensions grow automatically each year regardless of the size of a retiree’s pension or the actual rate of inflation.

- Compounded – Each year the 3 percent increase is applied to the previous year’s pension total, meaning the pension builds upon itself every year.

As an additional rule, pensioners in the Teachers’ Retirement System, or TRS, and General Assembly Retirement System, or GARS, cannot receive COLA increases to their annual pension benefits until they reach ages 61 and 60, respectively. However, pensioners in the State Employees’ Retirement System, or SERS, State Universities Retirement System, or SURS, and Judges’ Retirement System, or JRS, receive annual COLA increases regardless of their ages.

COLAs are imposing a growing financial burden on the state pension systems due to the fact that state workers are living longer and are collecting pension benefits for longer periods of time than in the past.

The 3 percent COLA benefit allows a pensioner’s annual pension benefits to double in just 25 years. Today, thanks to the ability to retire in their 50s and increasing life expectancies, almost 60 percent of all current state pensioners can expect to spend 25 or more years collecting benefits and will live to see their annual pension benefits double in size over the course of their retirements.

That doubling of annual pension benefits due to COLAs will result in many state pensioners receiving million- or multimillion-dollar pension payouts over their retirements. The average state pensioner (including pensioners who only worked a few years for the state) currently receives $44,600 in annual pension benefits and will collect $1.2 million in lifetime benefits.

COLAs have an even bigger impact on the average pension benefits of recently retired, career state workers (retired since Jan. 1, 2013, with 30 years of service). On average, the career state pensioner currently receives $66,800 in annual pension benefits and will collect over $2 million in total benefits over his or her lifetime.

In all, 53 percent of the over 213,000 state pensioners in Illinois can expect to receive lifetime pension benefits of more than $1 million. Almost 40,000 (18 percent of all pensioners) will receive $2 million or more in benefits.

COLAs in the private sector

The COLA benefits granted to the average private-sector worker are quite different compared with those of Illinois’ state pensioners.

Private-sector workers with private retirement accounts don’t receive automatic COLAs – their annual retirement benefits are entirely based on what was contributed to their accounts and what they earned on investments over the course of their careers. Other private-sector retirees rely on Social Security to provide, in whole or in part, for their retirement.

The average annual Social Security payment for current private-sector retirees in 2015 was only $15,936, and the average retiree will receive approximately only $400,000 in lifetime retirement benefits from Social Security.4 Social Security’s COLA increases are based on the rate of inflation. That means that in years of low or negative inflation – such as in 2009, 2010, 2015 and now in 2016 – Social Security beneficiaries receive no annual increases to their retirement benefits.

By contrast, Illinois’ state pensioners receive their 3 percent COLAs every year, regardless of the rate of inflation or the desperate financial state of Illinois’ pension systems.

How COLAs boost pensions unsustainably

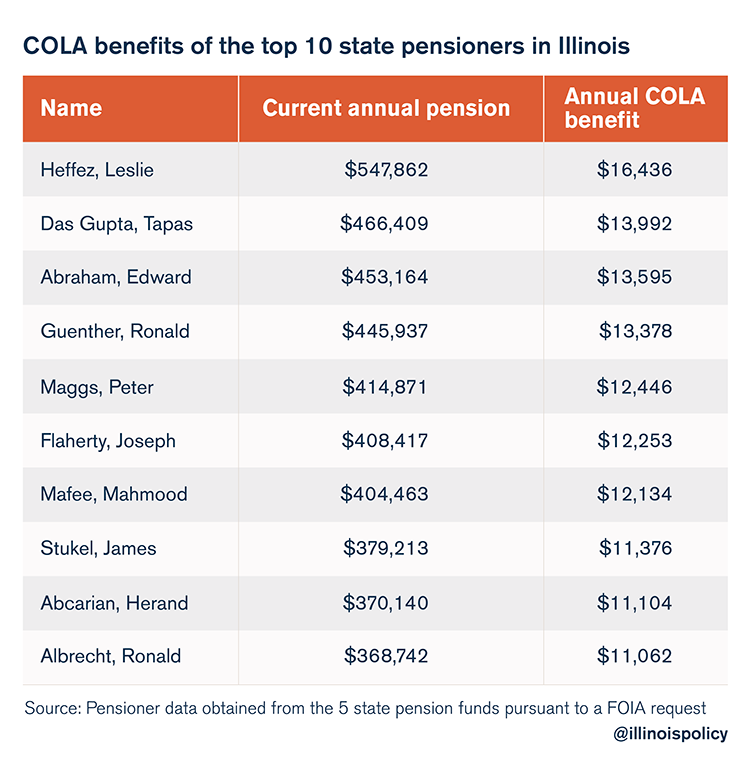

The 3 percent COLA boosted the average Illinois state pensioner’s $44,600 pension benefit by $1,338 in 2015. The average, recently retired career worker’s boost was even higher, increasing his or her $66,800 annual pension by almost $2,000. And for the state’s biggest pensioners, COLAs can increase pension benefits by $10,000 a year or more.

For example, take a look at the most highly compensated pensioner in the state, Leslie Heffez. Heffez, a retired SURS employee, received $548,000 in annual pension benefits in 2015. Assuming a current life expectancy of 81 years, he’ll draw nearly $18 million in pension benefits over the course of retirement.

Moreover, Heffez received a COLA of $16,436 in 2015, more than the average annual benefit a retiree receives from Social Security. That means Heffez’s pension increase was larger than an average American’s annual payment from Social Security.

And while Leslie Heffez is by far the top pensioner in the state, he’s not the only state pensioner who receives five- and high-four-figure COLA increases. In all, over 11,465 current state pensioners received COLA increases worth over $3,000 in 2015.

Examining the lifetime benefits of a recently retired, career university pensioner (retired since Jan. 1, 2013, with 30 years of service or more) can help convey exactly how COLAs drive up pensions.

Betty Pilchard, who retired from Heartland Community College in 2014, is a good example of such a pensioner. She retired at age 58 and received a starting annual pension benefit of $71,551.

By the time Pilchard reaches her approximate life expectancy of 84, her annual pension will have increased to $154,306 a year. This is because the 3 percent COLA she receives every year causes her original $71,551 annual benefit to build upon itself, doubling her benefit in 25 years, to $145,448 by the time she reaches age 82.

In all, Betty Pilchard will collect more than $2.9 million in pension benefits over her lifetime – largely due to the automatic, 3 percent COLA increase and being able to retire in her 50s. Without an annual COLA increase, Pilchard would receive $1.9 million in lifetime benefits, so COLAs end up boosting her lifetime pension benefits by $1 million.

Overall, automatic COLAs end up raising the lifetime pensions of the average, recently retired, career state worker (retired since Jan. 1, 2013, with 30 years of service) by over $750,000. Instead of receiving $1.65 million in lifetime benefits, the average career state worker who spends 25 years in retirement will receive over $2.4 million in overall benefits due to the boost COLAs provide.

Reforming benefits is a necessity

The pension benefits that politicians have granted government workers have resulted in a retirement system that is simply unfair and unaffordable for the taxpayers who pay for those workers’ retirements.

The 3 percent, automatic compounded COLAs are a particularly expensive benefit. This allows the pensions of retirees to double in just 25 years, causing Illinois pension costs to grow unsustainably. Overall, the COLA benefit costs the state pension systems approximately $270 million (excluding the COLA costs of nonregular retirees such as disabled and survivor annuitants, etc.) in 2016 alone – the approximate amount it took to boost current pensioners’ 2015 benefits by 3 percent.

Even those in charge of the pension systems – Dick Ingram, the head of TRS, for example – have recognized the financial damage that overgenerous benefits such as COLAs have done to the state pension funds: “What we’re saying is that [the unfunded liability] is so bad … that you have to start having those conversations,” Ingram told the Springfield State Journal-Register. “The reality is that if you look at the pension math, the single biggest cost is the COLA.”

This is fundamentally unfair to Illinois taxpayers, many of whom rely solely on Social Security – which provides far smaller annual benefits and limited annual COLA increases.

While the teachers, state employees, university workers, judges and lawmakers of the state’s five pension funds have done nothing wrong in receiving such benefits, it’s clear that those benefits cannot be provided by Illinois taxpayers to new state workers.

Suspending COLAs until Illinois’ pension systems return to full health would allow the state to reduce its pension debt by nearly one-third. But if COLAs must remain part of the pension system in some form, they should be means-tested. That means restricting COLA benefits to pensioners who need it, such as state pensioners who spent a career in public service and have limited annual pensions.

Beyond means-testing the COLA benefits, Illinois needs to begin a transition away from its broken pension systems – starting by moving new government workers to 401(k)-style plans and giving existing workers the option to have their own self-managed accounts.

Making these changes, in addition to adopting a constitutional amendment allowing Illinois to reform pension benefits going forward, is an important first step in fixing Illinois’ government-worker pensions.

Out of sync: Employee contributions vs. benefit payouts

The amount Illinois state workers contribute to their pensions is out of line with the generous payouts these workers receive in retirement.

Just consider: Recently retired, career state pensioners – defined in this report as members who retired as of Jan. 1, 2013, with 30 years of service or more. – directly contributed an average of $130,000 to the state pension systems over the course of their careers. On average, those same workers receive approximately $2.1 million in pension benefits over the course of their retirements. That means the average career state worker only directly contributed 6 percent of what he or she will get back in pension benefits over the course of retirement.

Though members of Illinois’ state-run pension systems have paid what was legally required of them under mutually agreed-upon contracts with the government, these pensioners have not truly paid their fair share.

Because of generous pension rules – workers receive pension benefits based on their last years of service (and not on what they contributed), employees can retire in their 50s with full benefits, and pensioners receive 3 percent compounded boosts to their benefits every year – the annual benefits that state pensioners receive quickly outstrip what they contributed over the course of their careers. In fact, the average career state pensioner makes back what he or she directly contributed after less than two years in retirement.

For the recently retired, career state workers in each pension system:

- In the Teachers’ Retirement System, or TRS, direct employee contributions equal only 7 percent of the $2.2 million in total benefits pensioners receive.

- In the State Employees’ Retirement System, or SERS, direct employee contributions equal only 4 percent of the $1.6 million in total benefits pensioners receive.

- In the State Universities Retirement System, or SURS, direct employee contributions equal only 7 percent of the $2.3 million in total benefits pensioners receive.

- In the Judges’ Retirement System, or JRS, direct employee contributions equal only 7 percent of the $2.9 million in total benefits pensioners receive.

- In the General Assembly Retirement System, or GARS, direct employee contributions equal only 10 percent of the $2.1 million in total benefits pensioners receive.

This disparity between contributions and payouts is fundamentally unfair to the Illinois taxpayers who must pay for them. Private-sector workers are expected to fund the pensions of government workers who will earn back what they contributed to the pension funds just two years into retirement.

And while the teachers, state workers, university workers, judges and lawmakers of the state’s five pension funds have done nothing wrong, it’s clear that politicians have made promises they can’t keep and that are no longer fair or affordable for Illinois taxpayers.

The only real solution is for Illinois to reform its state pension system – starting with enacting a constitutional amendment allowing Illinois to reform pension benefits going forward. In addition, the state should move new government workers onto 401(k)-style plans and give existing workers the option to have their own self-managed retirement accounts.

How state worker contributions and payouts became out of sync

Illinois provides retirement benefits to more than 213,000 government pensioners through five state-run pension systems.

Government-worker pensions in Illinois are defined-benefit retirement plans under which employees are supposed to receive annual benefits during retirement.

To fund the state systems, each employee and employer contribute a set percentage of the employee’s annual salary to a pension fund over the course of the employee’s career.

The employee contributes a fixed percentage of his or her salary (8 to 11.5 percent, depending on the fund) to the pension system from every paycheck. Because employees contribute to the pension funds over the course of their careers, their total contributions are based on their average salaries. But according to the state’s pension rules, the employees’ benefits aren’t based on those contributions.

Instead, pension benefits are based on an employee’s end-of-career salary, when a worker’s income is likely at its highest.

In the case of TRS, SERS and SURS, an employee’s initial annual pension benefit is based on the average of his or her four highest annual salaries in the employee’s last 10 years before retirement. For JRS and GARS pensioners, their starting pension benefits are determined by their salaries on their last day of service.

Because state pensioners’ contributions are based on their average salaries even though their starting pension benefits are based on their end-of-career salaries, the system faces a disturbing disconnect: Employee contributions have no relation to the pension benefits former employees receive during their retirements.

The average, recently retired, career state worker contributed nearly $130,000 to the pension system over the course of his or her career but receives a starting annual pension of $66,800. That means an average career pensioner will make back in annual benefits what he or she contributed to the pension funds after spending less than two years in retirement.

In total, the average career worker’s direct employee contributions only pay for 6 percent of the over $2 million in pension benefits that pensioner can expect to receive in retirement.

Even after giving workers credit for the interest they earn on their employee contributions (which approximately doubles the total amount of a pensioner’s employee contribution), career state pensioners make back what they contributed after only four years of retirement. And they still end up only contributing an estimated 12 to15 percent of what they will earn in annual benefits during their retirements.

The generous rules that govern workers’ pension benefits also fuel the massive difference between state workers’ contributions and their benefit payouts. The fact that over 60 percent of state pensioners retire in their 50s, that a majority of state pensioners will spend more time in retirement than they spent working for the state, and that pensioners receive automatic, 3 percent boosts to their pensions every year causes many state workers to become millionaire pensioners.

In all, 53 percent of the over 213,000 state retirees in Illinois can expect to receive pension benefits of more than $1 million over the course of their retirements. Almost 40,000 (18 percent of all retirees) will receive $2 million or more in benefits.

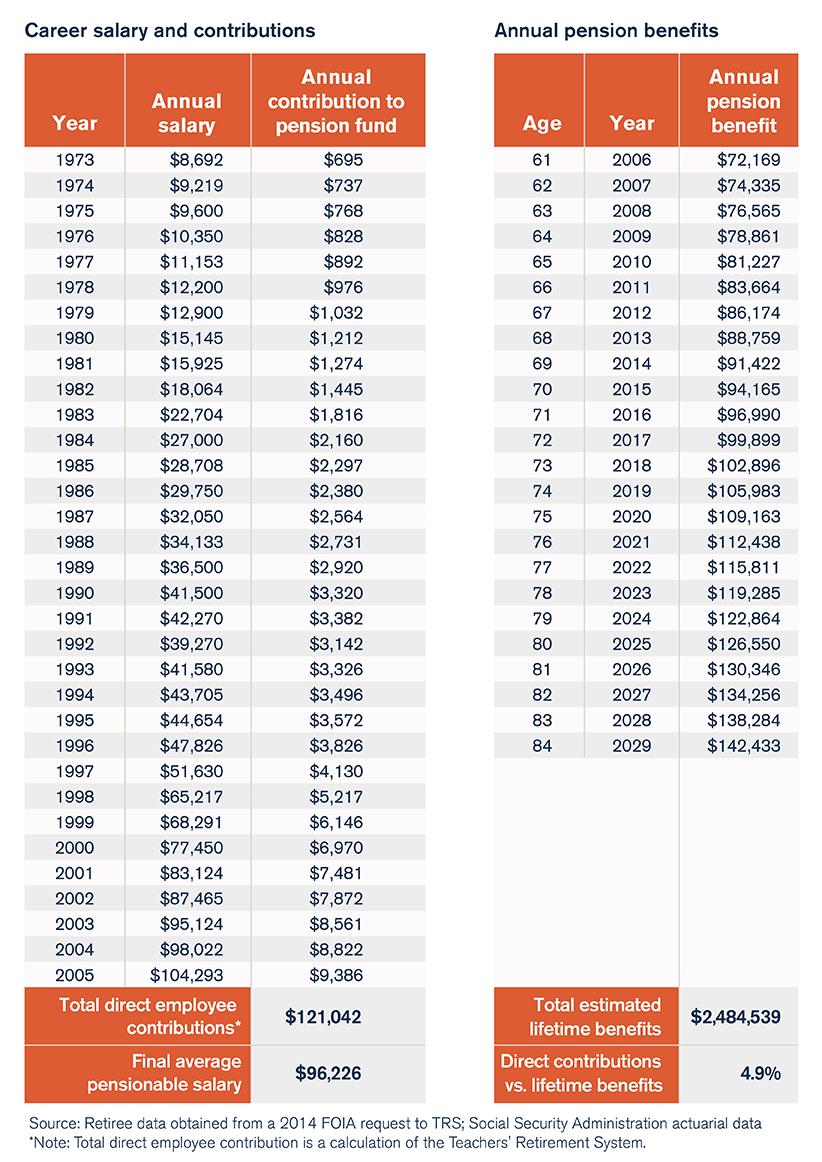

Case study: How employee contributions and payouts become out of sync

To see just how an employee’s contributions and payouts end up so out of sync, take a look at the salary history of a typical, retired member of TRS.

Michael Cox spent over 33 years working as a teacher, retiring in 2005 at the age of 60. His final average pensionable salary (the average of this last four consecutive highest salaries: $87,465, $95,124, $98,022, $104,293) equaled $96,226.

Because he earned 35 years of service credit (33 years worked plus two years of sick-leave credit), Cox received 75 percent of his final average salary as his starting annual pension of $72,169. (The TRS pension formula provides 2.2 percent for every year of service credit, up to a maximum of 75 percent of a pensioner’s final average salary.)

By the time Cox reaches his approximate life expectancy of 84, his annual pension will have doubled to over $140,000 a year.

This is because the 3 percent COLA he receives every year causes his original $72,169 annual benefit to build upon itself, essentially doubling his benefit over the 24-year expected length of his retirement.

In all, Michael Cox can expect to collect more than $2.4 million in pension benefits over the course of his retirement.

In comparison, Cox only gave the pension system $121,042 in employee contributions during his teaching career. That equals only 5 percent of what he will receive from the pension fund over the course of his retirement. Put another way, having earned a starting pension of $72,000, Cox gained back what he contributed to the pension fund after spending less than two years in retirement.

In summary, Cox’s pension contributions are out of sync with his lifetime payout because:

- His pension contributions are based on the paychecks he received over the course of his teaching career. Thus, the amount he contributed to the pension system, $121,042, is based on his average career salary.

- His starting pension is not based on his average salary but on his end-of-career salary, which was at its highest point.

- Due to the rules of TRS’s pension formula, Cox received 75 percent of his final average salary, $96,226, as his starting annual pension: $72,169.

- Cox’s starting pension will grow by 3 percent every year due to the automatic, 3 percent COLA state pensioners receive annually.

- Over the course of his retirement, assuming an approximate life expectancy of 84, Cox can expect to receive more than $2.4 million in total pension benefits.

- In all, Cox will earn back what he gave in employee contributions in just two years of retirement. His direct employee contributions will only equal 5 percent of the benefits he can expect to receive over the course of his retirement.

- Even when given credit for the interest his contributions earned while invested by the pension fund, Cox still earned back what he contributed in just three years of retirement, and his contributions only equal 8 percent of what he will receive in total pension benefits.

Michael Cox and other state pensioners like him did nothing wrong in receiving such benefits. He paid – in the form of his employee contributions – what was legally required of him under mutually agreed-upon contracts and the rules of the pension system.

However, it certainly cannot be said that Cox and the rest of Illinois’ state pensioners have contributed their fair share to the pension funds. The average career state pensioner only directly contributed 6 percent of what he or she will get back over the course of retirement.

The state’s pension debt reached a record high of $111 billion in 2015. A significant portion of that debt is due to growing pension benefits. And, as Illinois’ Tier 1 workers (workers hired before Jan. 1, 2011) continue to retire in their 50s with generous salaries and live longer and longer in retirement, the burden on taxpayers is only going to worsen.

It’s clear the current system is unsustainable for Illinois taxpayers. To protect both state workers and taxpayers, Illinois should follow the example of the private sector and reform-minded states and move to a defined-contribution retirement system.

Reforming benefits is a necessity

In contrast to Illinois’ state-run pension plans, in a defined-contribution, or DC, plan such as a 401(k), both the employer and the employee contribute directly to a portable retirement account owned and controlled by the employee. The amount the employee accumulates during his entire career becomes the pool of funds he will have available for retirement. Once the employee retires, neither the employer nor taxpayers have any future obligation to fund the worker’s retirement.

Today, nearly 85 percent of private-sector employees are enrolled in some form of DC plan. The public sector, by contrast, continues to rely largely on defined-benefit plans.

That said, more and more states, most recently Oklahoma, have moved their workers to some form of DC plan in an attempt to get state budgets under control and give workers more ownership over their retirements. Kentucky Gov. Matt Bevin has also set his sights on 401(k)-style plans for new government workers.

But Illinois doesn’t have to look beyond its borders for a model 401(k)-style plan – one already exists right here. Today, almost 20,000 active and inactive members of SURS participate in a 401(k)-style plan. These state-university workers control their own retirement accounts, which aren’t part of Illinois’ increasingly insolvent state pension systems.

Conclusion

The benefits that politicians have granted government workers have resulted in a retirement system that is simply unfair to the taxpayers who pay for pensions.

Employee contributions are out of sync with payouts – the average state pensioner receives pension benefits equal to what he contributed after only two years in retirement (four years if investment returns are included).

That’s due to costly practices such as pension spiking, as well as pension rules that base starting pensions on the salaries earned in workers’ last years of service, allow 60 percent of pensioners to retire in their 50s, and grant automatic, 3 percent benefit boosts annually. As a result, many state workers become millionaire pensioners, and the average career state worker ends up contributing only 6 percent of what he or she receives in total pension benefits.

While the teachers, state employees, university workers, judges and lawmakers of the state’s five pension systems have done nothing wrong in receiving such benefits, it’s clear that politicians have made promises they can’t keep – and that Illinois taxpayers cannot afford to fund.

Illinois needs to begin moving away from its broken pension systems – starting by moving new government workers to 401(k)-style plans and giving existing workers the option to have their own self-managed accounts.

Doing that, in addition to enacting a constitutional amendment allowing Illinois to reform pension benefits going forward, is an important first step in fixing Illinois’ government-worker pensions.