Tax Day: Where do Illinoisans’ state tax dollars go?

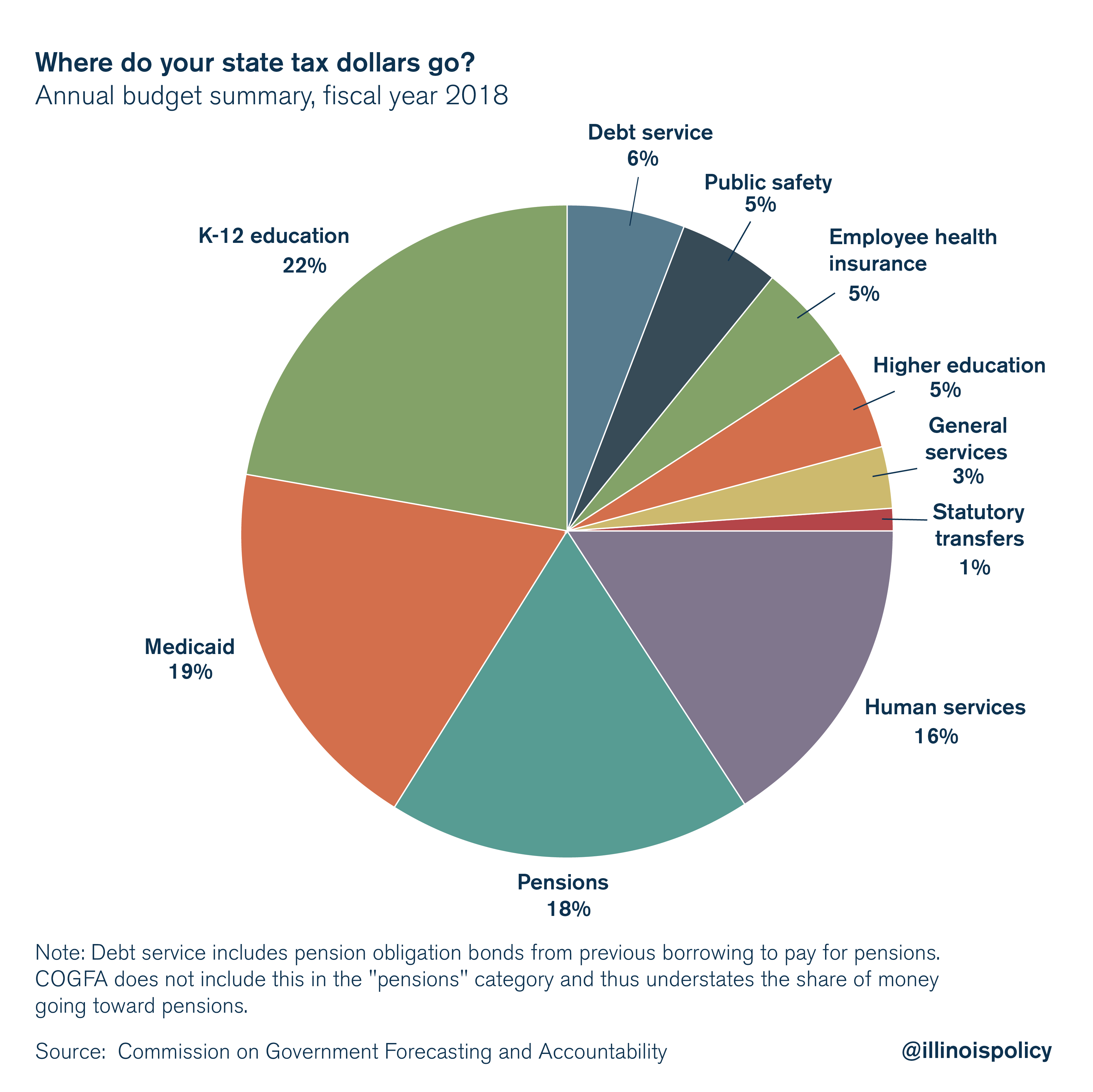

Pensions and employee health insurance costs consumed nearly a quarter of Illinois’ fiscal year 2018 budget.

Today is Tax Day. With one of highest overall state and local tax burdens in the nation, Illinois taxpayers may be wondering: Where does all that money go?

Illinois state spending can be broken down into several broad categories. Funds for spending include not just money from taxes, but also money from licensing or user fees, penalties from regulatory actions and more. But for the purposes of tracking tax dollars, there’s one group of funds to look at in particular: general funds. The “big three” taxes – personal income tax, corporate income tax and sales taxes – generally account for more than three-quarters of all general fund revenue.

Right off the bat, about 25 percent of general fund state revenue is consumed by government employee health insurance and pensions, according to the state budget summary for fiscal year 2018 prepared by the Commission on Government Forecasting and Accountability. That leaves only 75 percent of tax dollars to divide up among core government services such as education, social services and public safety.

And the problem has grown worse over time.

According to the Governor’s Office of Management and Budget, growth in spending on government worker pensions and employee health insurance has far outpaced spending in every other area. From 2000 to 2018:

- Spending on pensions has grown 663 percent

- Spending on employee health insurance has grown 215 percent

- Spending on preschool through high school education has grown 65 percent

- All other spending has grown by just 16 percent

This is an unsustainable path for Illinois. Moody’s Investors Service has said Illinois owes $250 billion in pension debt. Unless the state structurally reforms its pension systems and addresses the growth in employee benefits, government worker retirement and benefit costs will increasingly crowd out core government services.