Traditional pensions a bad fit for teachers, millennials in Illinois

More mobile than any generation before them, millennials need retirement plans, such as 401(k)s, that are just as flexible. But if you’re a millennial looking to become a state-government worker in Illinois, you may want to look elsewhere. Mobility isn’t a priority for state officials. Illinois almost exclusively offers its government workers traditional pension plans....

More mobile than any generation before them, millennials need retirement plans, such as 401(k)s, that are just as flexible.

But if you’re a millennial looking to become a state-government worker in Illinois, you may want to look elsewhere. Mobility isn’t a priority for state officials.

Illinois almost exclusively offers its government workers traditional pension plans. In addition to giving workers no ability to control their own retirement account, these pension plans require employees to work up to 10 years before becoming vested in their retirement plans. If they leave the job too soon, workers forfeit everything their employer contributed to their retirement savings.

Opponents of 401(k)s for government workers argue that pensions are necessary to attract qualified employees. However, pensions are not suited for a modern workforce that frequently changes jobs and is less likely to stay with an employer for decades.

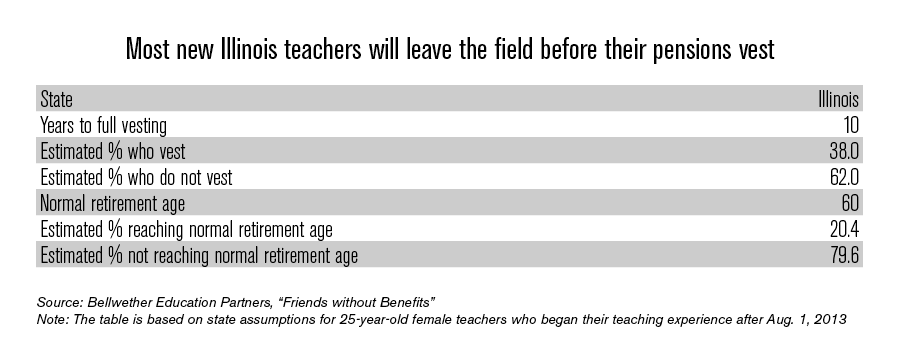

Traditional pension plans for government workers in Illinois actually discourage and penalize mobility. Illinois is one of several states with pension plans for new teachers that require 10 years of service before an employee is entitled to the employer’s matching contributions toward their retirement. It’s no surprise, then, that only 38 percent of Illinois’ new female teachers can expect to vest.

Consider a 26-year-old participating in the Illinois Teachers’ Retirement System. She began teaching in 2011, has three years of experience and must work another seven years (10 years total) before she is vested. If she chooses to leave this job before reaching that 10-year mark, she won’t receive a single dollar of the contributions her employer made toward her pension. She will get back her own contributions toward her pension, and that’s all. She, along with 62 percent of Illinois teachers that are expected to leave before vesting, will not even receive the interest that their own contributions earned.

This is simply not fair to teachers and other government employees in Illinois. Pension plans and their long vesting periods are outdated and aren’t keeping pace with the trends of the workforce.

The alternative is to offer teachers and other government workers 401(k)s that provide much better portability for retirement savings. Almost 40 percent of 401(k)s in the private sector offer immediate vesting, and the rest typically take only a few years.

An employee with a 401(k) in the private sector can leave her job and take all her retirement savings with her, including the employer’s matching contribution.

If it truly wants to attract 21st-century talent, state government needs to modernize its retirement plans – and that means embracing 401(k)s.