Chicago’s collar counties should get their welcome mats ready

Expect Mayor Rahm Emanuel’s call for property tax hikes to be a boon for Chicago’s collar counties and Lake County, Ind. Cook County residents have been fleeing to neighboring counties for decades, and Emanuel’s proposed hikes – to prop up city pensions – will only increase the outflow. According to IRS data, Cook County lost...

Expect Mayor Rahm Emanuel’s call for property tax hikes to be a boon for Chicago’s collar counties and Lake County, Ind.

Cook County residents have been fleeing to neighboring counties for decades, and Emanuel’s proposed hikes – to prop up city pensions – will only increase the outflow.

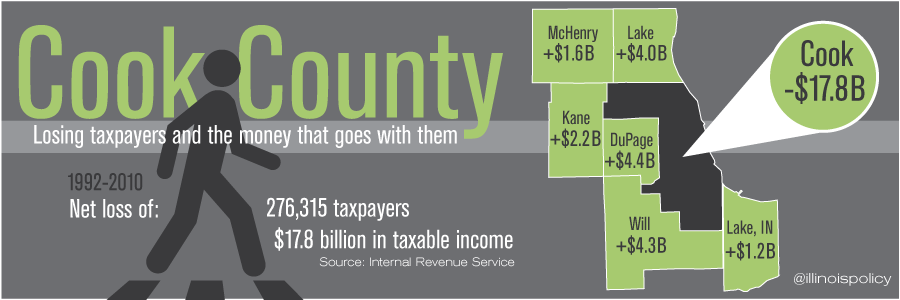

According to IRS data, Cook County lost a net of 276,000 taxpayers to its six neighboring counties from 1992 through 2010. When dependents are included, Cook County lost nearly 840,000 net people.

The mayor wants a five-year $750 million property tax increase as part of his plan to prop up two of City Hall’s pension funds. His plan doesn’t cover the city’s two sickest funds – police and fire. Emanuel’s plan also doesn’t cover the collapsing pension funds of Chicago’s sister governments – the Chicago Public Schools, the Chicago Transit Authority and the Chicago Park District.

If the mayor rolls out the same tax hike blueprint for all the pension funds, he’ll be asking for Chicagoans to pay billions more in property taxes.

Cook County’s pensions are also severely underfunded. Cook County Board President Toni Preckwinkle hinted recently that she wants tax hikes to help pay for her own pension “fix.”

So just how much in pension debt – and other long-term debt – are Chicagoans on the hook for? We recently tallied up the number, and every Chicago household faces a hidden bill of $61,000.

Emanuel’s call for property tax hikes means that bill is now coming due – but only for those who stick around to pay it.

Taxpayers with the means and the flexibility to leave Cook County can avoid the bill by simply picking up and moving, which is what many have done for more than 20 years.

A review of IRS data from 1992 to 2010 shows the top six counties to which residents of Cook County have fled. It also reveals how much money those residents took with them:

- DuPage County won a net 71,289 taxpayers who took more than $4.4 billion in taxable income with them.

- Will County won a net of 71,148 taxpayers who took $4.3 billion in taxable income with them.

- Lake County, Ill., won a net of 47,844 taxpayers who took $4 billion in taxable income with them.

- Kane County won a net of 32,772 taxpayers from Cook County. Those taxpayers took $2.2 billion in taxable income with them.

- McHenry County won a net of 25,713 taxpayers who took $1.6 billion in taxable income with them.

- Lake County, Ind., won a net of 27,549 taxpayers who took $1.2 billion in taxable income with them

In the absence of real pension and spending reforms that avoid tax hikes, the Chicagoans who remain will need to prepare for higher property taxes, higher fees and more service cuts.

Unless they too choose to leave.