QUOTE OF THE DAY

LIVESTREAM: Rand Paul in Chicago

Sen. Rand Paul in Chicago on April 22 at 11:00 a.m. discussing school choice.

Chicago Sun Times: Illinois morbidly obese with thousands of governments

The Illinois legislature’s “diet doctor” is asking his fattest patients to swallow a bitter streamlining pill and, as you might expect, the Rx is meeting a lot of resistance.

I’m talking about Rep. Jack Franks’ attempt to downsize a public sector that’s morbidly obese.

Illinois, as I’ve mentioned before, has nearly 7,000 separate units of government, which is 2,000 — or 40 percent — more than any other state.

New Republic: Health-care costs are rising—and the experts aren’t sure why

Last week’s news about Obamacare enrollment was great. But health care policy wonks have something else on their mind now: the cost of health care. It’s starting to rise more quickly than before. That could be a problem.

For the last four years or so, national health care expenditures—that is, all the money that Americans spend on medical services and supplies—has been growing at historically low rates. It’s gone up every year, as it almost always does, but only by 3 or 4 percent. That’s just a little bit more than inflation. Typically health care spending has risen more quickly. Sometimes, in the 1980s and again in the early 2000s, it’s risen much more quickly. Keep in mind that when national health care spending rises much more quickly than the economy is growing, you feel the impact—as relatively higher insurance premiums, higher out-of-pocket costs, and higher taxes to support government insurance programs. You may not have noticed it, but the recent slowdown has been good for your finances.

Chicago Tribune: Chicago cabbies group wants to join union

A group of Chicago cabbies announced another move today in their fight to get City Hall to raise taxi fares and take other steps to improve their bottom line, saying they will try to join a national union to strengthen their bargaining position.

Fayez Khozindar, chairman of the Chicago-based United Taxidrivers Community Council, said the group will seek to become an affiliate of the AFL-CIO, as have cabbie organizations from other cities.

Cab union officials from New York City and Philadelphia joined a handful of Chicago taxi drivers at a City Hall news conference today before the group delivered petitions to Mayor Rahm Emanuel’s office calling for better wages and working conditions. Cabdrivers have asked for an increase on the $1.80 per-mile charge but haven’t said specifically what they want.

Northwest Herald: Craver: Low taxes or big government, not both

Raise your hands if you believed state lawmakers three years ago when they swore on their ancestors’ graves that the 67 percent income tax increase would be temporary.

I thought so.

Predictably, state Democratic leadership is crying poor and asking that the increase be made permanent. Spending like drunken sailors will do that to any budget, public or private.

Real Clear Markets: Government Should Bring Some Truth to Pension Plans

Recently the New York Times ran a story on how some of what were supposed to be the safest pensions in the country were actually failing, potentially leaving retirees with little or none of their promised retirement income. This report extends a long line of evidence that defined benefit pensions are simply too risky for workers to rely upon. Government action to ban defined benefit pensions-those promising a set income upon retirement, usually a percentage of past earnings based on years worked-is a rather extreme intrusion of the government into what should be a free market for firms to offer a variety of compensation plans, but certainly the government needs to devise a far better and more stringent regulatory apparatus for such plans and, in the meantime, workers should demand their employers switch them to defined contribution plans.

The particular pension plans in the report are multiemployer plans, ones where many employers pool money together for workers with some unifying feature. Usually, these are union plans designed to provide uniform pensions to members of a union that work for lots of different employers. The thinking was that because lots of employers paid in, safety would be gained through diversification, similar to a stock portfolio. If one employer did not pay, the shortfall would be small (and often the other employers in such plans are required to make up that shortfall).

Unfortunately, such financial planning has proven as accurate as the models behind the infamous mortgage backed securities. Many of these multiemployer plans have failed and many more are in serious trouble. In general, government should allow free markets and if workers want to accept pensions, they should be allowed to do so. However, the government is essentially allowing employers to lie to workers and then break employment contracts later by not funding the promised pensions. Worse, the government collects insufficient premiums in order to guarantee the pensions, so taxpayers are potentially on the hook for the broken promises.

Chicago Tribune: Suburban, downstate mayors want pension relief, too

A coalition of suburban and downstate mayors is urging lawmakers to scale back pension benefits for police and firefighters, saying increasing costs have pushed towns and cities across Illinois to the brink of financial ruin.

A group of 25 local government leaders gathered in Chicago Monday to call for changes, saying legislators only addressed portions of the pension problem when they passed sweeping retirement changes for state workers and, more recently, some city employees. The state pension measure is being challenged in court, while the measure addressing Chicago public pensions is awaiting action by Gov. Pat Quinn.

While legislation with specific ideas has yet to be drafted, the mayors said they’d like to see changes in three key areas: lowering the annual 3 percent compounded cost of living adjustments, raising the retirement age and consolidating the number of pension boards that handle investments.

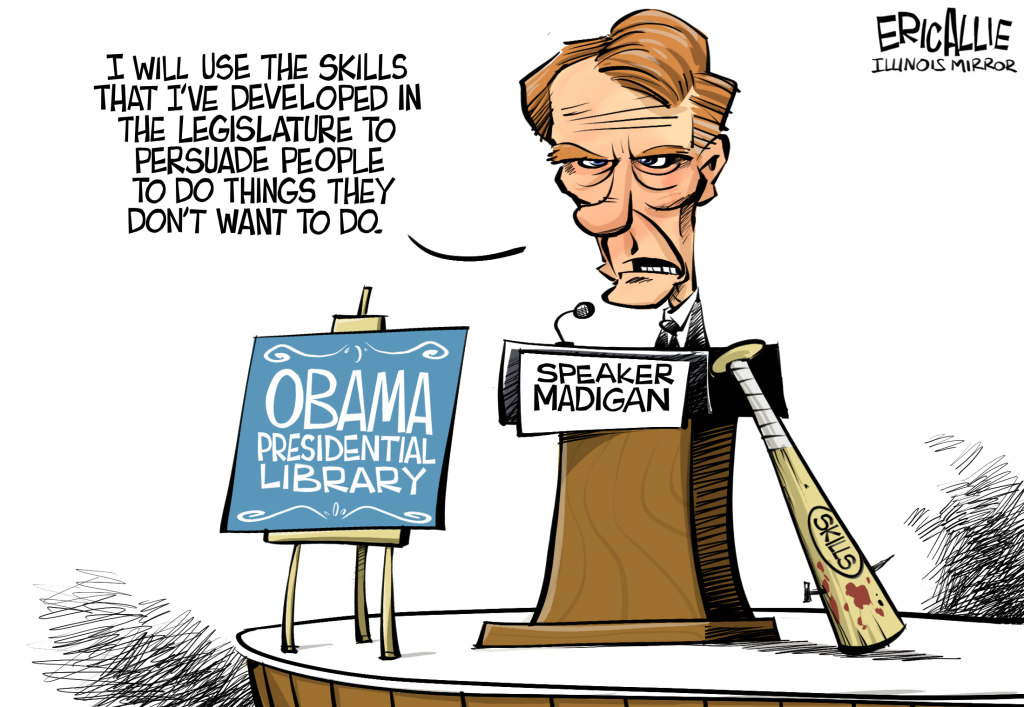

In a move seemingly bankrupt of ethics — even when applying the wink-and-a-handshake standards of Illinois politics — a legislative panel voted last week to give up to $100 million in state funds to entice President Barack Obama to build his presidential library in the state.

The official record said the decision was made in a unanimous 9-0 vote.

But those pesky questions so loathed by the political hierarchy started to emerge. Key among them was how nine people could have voted when there were only four people in attendance.

The answer was sickeningly illogical.

WSJ: The UAW Retreats in Tennessee

The United Auto Workers staged a face-saving strategic retreat on Monday in its campaign to organize Volkswagen‘s VOW3.XE +1.20% plant in Chattanooga, Tennessee. That’s good news for workers and car makers in the South but maybe not for Detroit’s Big Three.

The UAW surprised nearly everyone by dropping the appeal it had made to the National Labor Relations Board after workers at the VW plant voted 712 to 626 in February to reject the union. UAW chief Bob King cited the NLRB’s “historically dysfunctional and complex process” that would drag on for months, though President Obama’s NLRB is the most labor friendly in decades.

Mr. King also blamed Tennessee Gov. Bill Haslam and Senator Bob Corker for fighting the union’s attempt to organize the plant and refusing “to participate in a transparent legal discovery process.” But the two politicians had merely exercised their First Amendment rights in publicly noting the threat to business in the state if the UAW prevailed.

CARTOON OF THE DAY