Passing the buck: Avoiding accountability for the teacher-retirement funding mess

Reforming Illinois’ Teachers’ Retirement System is the only hope for saving the pension fund from insolvency and providing the accountability and retirement security that teachers and taxpayers deserve.

If you want to know why Illinois is in such a mess, the answer is clear: It’s impossible to hold politicians accountable.

The Teachers’ Retirement System, or TRS, is governed by rules that are so convoluted that they almost seem designed to allow officials to avoid accountability.

Take the retirement fund that covers all Illinois teachers outside of Chicago. State politicians – not local officials – run the TRS. But all parties – from teachers to local school districts to the state – involved in the process have contributed in some way to the system’s precarious finances.

The system is supposed to operate under a straightforward premise: When an Illinois teacher earns credit toward a pension, the cost of that benefit is funded in part by an annual contribution to the pension fund. The employer puts in money, as does the employee. Everyone has skin in the game.

But that’s not how it works today.

On the employer side, even though school districts employ teachers and pay their salaries, local districts don’t contribute to the teachers’ pension fund. State government does.

That split makes no sense: One unit of government doles out benefits, while another pays for them. This setup has allowed the exploitation of teacher pensions and the taxpayers who fund them.

It’s why many local school districts have become infamous for handing out salaries and benefits that ratchet up teacher pensions. The districts know the state – and by extension state taxpayers – will pay the tab.

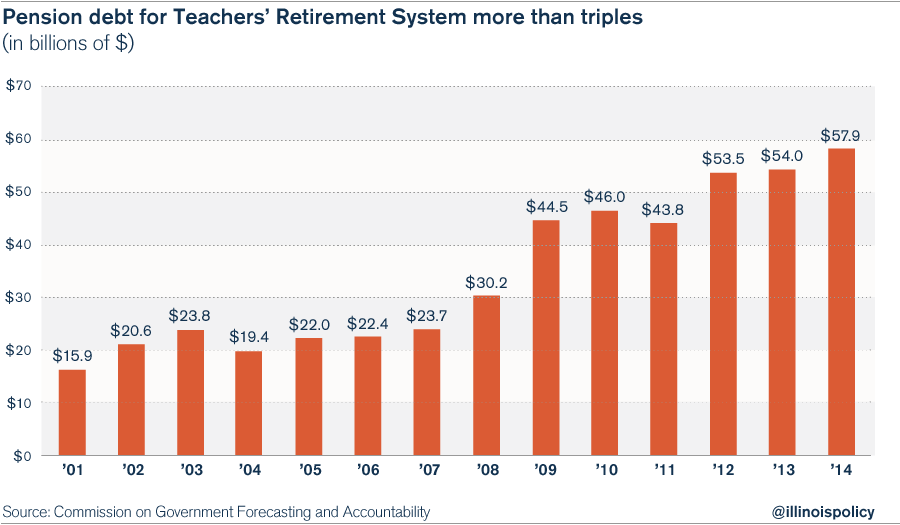

While local districts ramp up salaries, nobody has kept the state in check to ensure pensions are actually funded. Politicians have continuously underfunded teacher pensions. Today, TRS has just half the funds it needs to pay out its future retirement obligations to teachers. By any private-sector measure, the teachers’ pension system is already bankrupt.

On the employee side, the situation is just as bungled.

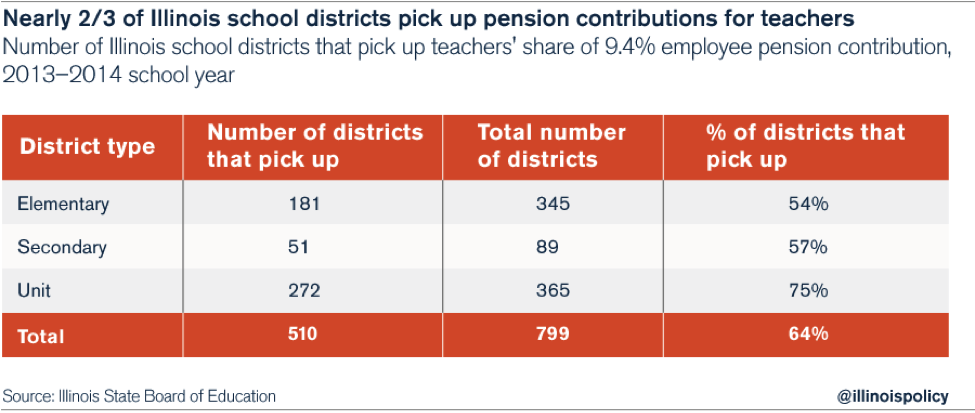

Illinois teachers are supposed to pay 9.4 percent of their salaries as their employee contributions to TRS. However, almost two-thirds of school districts in the state, as a benefit to teachers, pay some or all of their teachers’ required employee contributions through “pension pickups.” Nearly half of all school districts – in other words, local taxpayers – pay the entire teacher portion of these required pension contributions.

Since taxpayers cover the pickup costs, teachers have less incentive to hold anyone accountable for how the pension funds are performing.

The teacher-pension mess has destroyed teacher-retirement security and left taxpayers fearing billions of dollars in tax hikes.

However, there’s a simple solution to this lack of accountability, which is to do what should have been done long ago: have the school districts and employees pay what they ought. That means local districts should pay the employers’ share, and teachers should pay the employees’ share of pension costs.

This year, the state is scheduled to pay $1.96 billion into TRS. That’s the amount that should be paid by school districts every year going forward.

Of course, shifting that $1.96 billion onto local districts will mean added costs for them. According to the Illinois Policy Institute’s analysis, a school district could expect its total expenses to rise by an average of 3.7 percent if it were made responsible for paying its share of TRS’s annual $1.96 billion pension cost.

However, two-thirds of Illinois school districts could offset some or all of those extra costs – half could absorb all – by ending the practice of picking up the employee contributions for their teachers. Other districts would need to make cost-cutting adjustments to their budgets in order to make the payments.

Ending teacher pickups is a simple, responsible way for school districts to free up money to pay for the employer share of pensions going forward. And it’s not out of line to ask employees to pay their share of the costs associated with their own retirement benefits. That’s the standard across most industries, public and private.

For most employees in the private sector, retirement planning means contributing some of their earnings out of each paycheck to their personal retirement accounts. Employers often match employees’ contributions, and sometimes invest more. Similarly, the Social Security Administration requires working Americans and their employers each to contribute 6.2 percent of every paycheck to the Social Security Trust Funds.

But the best way to increase accountability would be to empower local districts to provide self-managed retirement plans, or SMPs, for teachers. Not only would SMPs make it difficult for state politicians to manipulate teacher retirements, but defined-contribution plans would also give districts more budget certainty.

More importantly, SMPs would allow teachers to hold local school districts accountable for the solvency of their pension funds.

The district’s contribution would be deposited each and every pay period into accounts that teachers would own and control. That means clear visibility of funding levels, and no more empty promises from state politicians.

And not only would teachers benefit, but taxpayers could take comfort in the fact that their tax dollars would pay for fixed, transparent contributions that go directly into teachers’ retirement accounts – leaving no opportunity for officials to divert money from the pension funds.

Taxpayers would know exactly where their money is going, and teachers would have the retirement security they deserve. That’s real accountability.