Quinn’s three-step plan to increase taxes

In 2011, the Illinois General Assembly passed a record income tax hike. The higher rates are legally required to partially sunset in 2015. That means all Illinois taxpayers are less than one year away from tax relief. But Quinn is back for more. He wants to increase taxes again on Illinois’ middle-class residents instead of...

In 2011, the Illinois General Assembly passed a record income tax hike. The higher rates are legally required to partially sunset in 2015. That means all Illinois taxpayers are less than one year away from tax relief.

But Quinn is back for more. He wants to increase taxes again on Illinois’ middle-class residents instead of allowing the rates to sunset next year.

Fortunately for Illinois taxpayers, Quinn wears his political playbook on his sleeve. His plan to raise taxes again is crystal clear.

Step 1: Position himself as a reformer

For Quinn to pass another tax hike, he must first sell himself as a reformer. His plan is to gain the trust of politicians and taxpayers alike by highlighting his successes as governor.

In Quinn’s budget address this year he said the truth is “we’ve taken some difficult steps to balance the budget.”

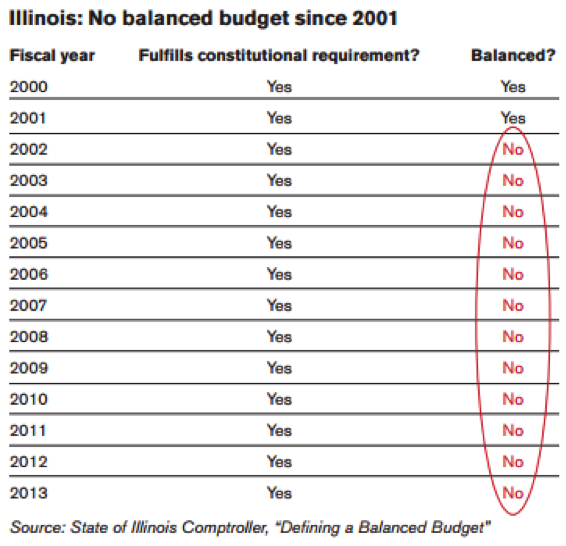

But that’s not even close to true. The fact is Illinois hasn’t had a balanced budget since 2001.

So don’t be fooled when you hear that the tax-hike revenue was used to stabilize Illinois’ finances or balance that state’s budget. The money only allowed politicians to balloon state spending and avoid making any real reform.

Step 2: Threaten massive budget cuts

Quinn’s second step is to use doomsday scenarios as scare tactics to dupe Illinoisans into paying higher taxes.

Quinn said recently: “If action is not taken to stabilize our revenue code…extreme and radical cuts will be imposed on education and critical public services. Cuts that will starve our schools and result in mass teacher layoffs, larger class sizes and higher property taxes.”

Quinn knows Illinoisans care about education. That’s why he tries to justify increasing taxes by playing up cuts to education funding as the alternative.

But how severe is the budget hole next year when the tax hike sunsets? About $1.8 billion, or a 5 percent drop.

Quinn’s argument is that a 5 percent drop in revenues will result in those doomsday scenarios highlighted above.

According to the governor’s own estimates, when the tax hike sunsets next year, the state’s General Fund Revenue will drop to about $35 billion. That’s more than the state spent just two years ago during the 2012 fiscal year – not quite the doomsday scenario Quinn is trying to sell.

Step 3: Raise taxes again

Quinn concluded his budget address this year with a plan to make permanent the temporary tax hike.

But by the end of the calendar year, the tax hike will have transferred more than $30 billion in new money from taxpayers to government. That’s more than what Illinois spends on core government services (e.g., education, health care, human services and public safety) in a full fiscal year.

Even with all of this extra money, Illinois’ finances are still a disaster. The extra revenue has only allowed lawmakers to skirt meaningful reforms as the state’s fiscal crises continue to worsen.

Quinn and the General Assembly owe it to taxpayers to let the tax hike sunset in 2015. It’s more than a promise – it’s the law.