Introduction

It pays to work for state government.

Compensation costs for state workers make up roughly one third of Illinois’ state budget. How much state workers are paid is largely decided by contracts with government employee unions, specifically Council 31 of the American Federation of State, County and Municipal Employees.

Since 2003, two consecutive Illinois governors – now disgraced former Gov. Rod Blagojevich and sitting Gov. Pat Quinn – have signed generous contracts with AFSCME.

These deals have resulted in dramatic growth in the state’s per-employee payroll costs, far above what typical Illinois households would have experienced in income growth during this same time period.

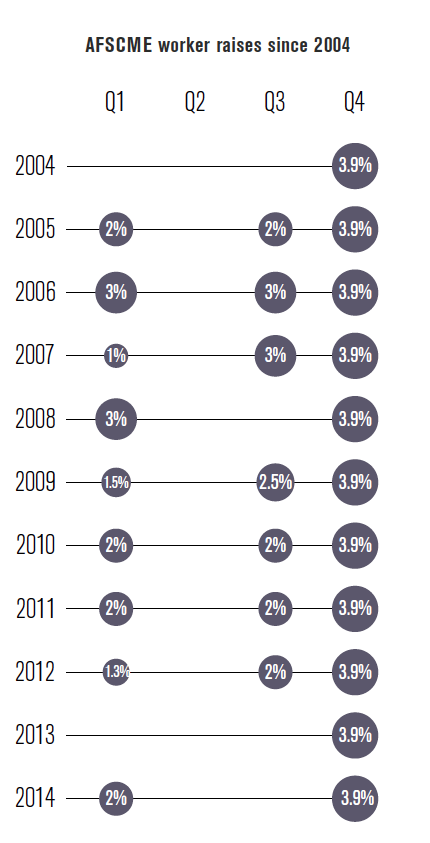

Between 2004 and 2014, the roughly 35,000 state-employee members of AFSCME received 27 separate raises.1 On average, employees received a raise nearly once every four and- a-half months. As a result, AFSCME members will have seen their annual income doubled in current dollars over the last 10 years.2 Meanwhile, the typical Illinois household’s income grew by only 15 percent – less than the rate of inflation.3

Union contracts include multiple mechanisms for raises

To some degree, the pay gap between state workers and their private-sector counterparts occurs because of poorly understood compensation schemes built into union contracts.

There are several types of wage increases buried within union contracts. On a regular basis, state employees receive two types of raises: step increases and general, or cost-of living, increases.

Step increases are automatic, annual raises that workers receive as they accumulate years of service in a particular job. A unionized state employee usually can count on receiving a step increase every year, typically on the anniversary of his or her start date. These are raises that have no connection to the employee’s performance, learning new skills or being promoted.

The second most common type of raise is a general, or cost of- living, increase. Union and elected officials bargain over these raises on top of step increases. In most union contracts, all employees receive these raises at the same time on dates specified in the contract.

Due to these practices, most state workers in Illinois have received up to three raises in a single year independent of learning any new skills or being promoted.

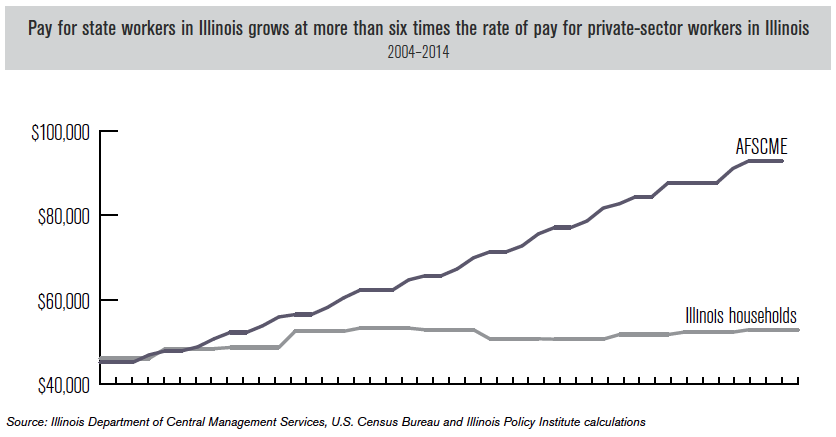

To better understand the context of these raises, compare the earnings trajectory of an Illinois AFSCME worker to that of a private-sector worker in Illinois. Suppose the two workers each begin their career in 2004 with a starting income of $45,153, the Illinois median household income in 2003.

Thanks to contract raises approved by various Illinois governors, by the end of 2014 that AFSCME worker would have a take-home pay of $96,498.5 The reason the AFSCME worker’s pay would more than double, in nominal terms, over the decade is due to the coupling of general and annual step increases over the years. If the AFSCME worker received only general increases during this time, his income would be approximately $63,000.

The private-sector worker, on the other hand, did not see his income more than double over the decade. Had the private sector worker’s salary tracked median household income growth from 2004 to 2014, he would earn $52,882 at the end of the year – 45 percent less than the state worker.6

Not only is compensation for state-government workers out of line with what their private-sector counterparts in Illinois are paid, but it also is out of line when compared to other government workers.

For example, social workers with no supervisory duties at Illinois’ Department of Children and Family Services, or DCFS, now earn an annual base salary in the top 10 percent7 among other similar social workers nationwide. Illinois DCFS workers are paid an average salary of $74,721, according to information provided by the state through a public document request. Meanwhile, the national average for that position is $46,870, according to the Bureau for Labor Statistics.

Moreover, an Illinois DCFS social worker without supervisory duties typically takes home more than base pay; standby, overtime and callback pay are common. When those additional perks are factored in, it is very common for this social worker to take home nearly $80,000 annually, plus retirement and health benefits.

Terms of contract have statewide implications

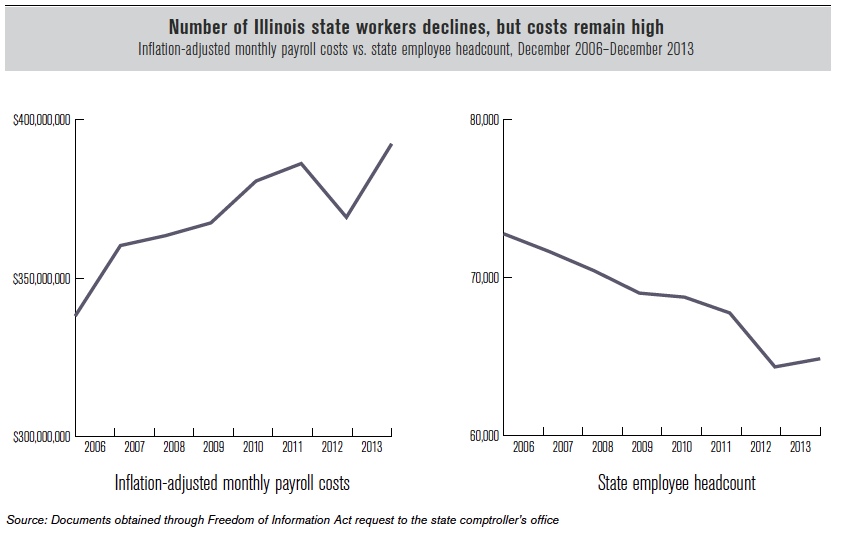

Compensation costs for state workers make up roughly one-third of Illinois’ budget. The AFSCME contract covers more than half of the state government’s workforce – which means wage increases seen by these union workers have a significant impact on the overall payroll budget for the state. In all, according to payroll data provided by the state comptroller, Illinois now spends an estimated $72,613 per state employee annually, up from $64,430 in 2006.8 Per-employee spending in state government is $5,000 higher than the salary of the average graduate-degree holder in Illinois.9

Since 2006, the Illinois state-government workforce has declined by 11 percent – to 64,854 from 72,751. Yet inflation adjusted monthly payroll costs have actually increased slightly, to $392 million in December 2013 from $391 million in December 2006.10

Illinois keeps cutting the number of employees on the state workforce, but due to immense wage growth, reducing headcount hasn’t resulted in lower payroll costs.

Without reform, Illinoisans can expect this trend to continue. This means the same or increasing costs to taxpayers while receiving diminished services.

Illinois must reform public employee compensation

Illinois has been in financial disarray for years. Private-sector workers in Illinois cannot afford another decade of union contracts filled with overly generous raises – especially when their own incomes are growing at a much slower pace than the salaries they are funding through state taxes. There are a few things Illinois can do to correct this unfair imbalance.

Public-sector pay must be corrected to align with the private sector. Going forward, all wage increases should be frozen for state workers until their compensation comes closer in line with market value.

Also, greater government transparency is crucial. Public union contracts should be open to public scrutiny before they’re approved. Once negotiated, contracts should be posted online for 14 days and given a public hearing before they are ratified.

For more than a decade, Illinois governors have signed overly generous contracts with the state’s largest government union. These contracts have doubled Illinois state workers’ income with an onslaught of 27 wage increases. Unions, in turn, have used the mandatory dues collected from state workers to increase their political prowess. Meanwhile, Illinois households’ growth in income has not kept up with the rate of inflation, and taxpayers are being crushed by the state’s mounting debt and poor economy.

Drastic growth in state workers’ income has meant higher costs and fewer state employees providing services. Illinois households can’t afford a continuation of this trend. They need reform now.