The problem

At the end of fiscal year 2013, Illinois had accumulated more than $100 billion in state pension debt. Although the General Assembly enacted Senate Bill 1 in December 2013, the bill will – at best – reduce the unfunded liability to $80 billion, roughly where it was during the pension crisis in 2011.

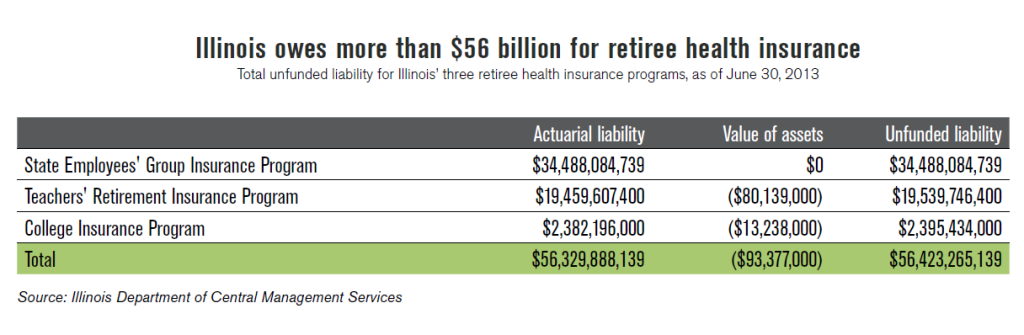

But pension debt is only part of the story. Although less publicized, Illinois has also taken on billions of dollars in debt to provide health insurance to government pensioners. The state now has an unfunded liability of more than $56.4 billion for these generous health insurance benefits.

Career retirees from state government and public universities pay little toward the cost of their health insurance. These retirees receive health insurance through the State Employees’ Group Insurance Program, or SEGIP, which operates as the state’s largest retiree health insurance program. Although the General Assembly gave Gov. Pat Quinn the authority to increase retirees’ share of premiums in this program, the governor made only minor changes. Taxpayers still pick up most of the tab. In fiscal year 2014, the state paid nearly $900 million for this benefit.

Downstate and suburban teachers and school district employees also receive generous health insurance subsidies. Although state government covers only a third of those costs, the Teachers’ Retirement Insurance Program, or TRIP, still costs the state’s General Fund upward of $100 million per year. Taxpayers are responsible for additional contributions made by their local school districts. The state also pays more than $4 million per year to the small but insolvent College Insurance Program, or CIP, which covers higher education employees not enrolled in SEGIP. Taxpayers make additional contributions to this program through their local community colleges.

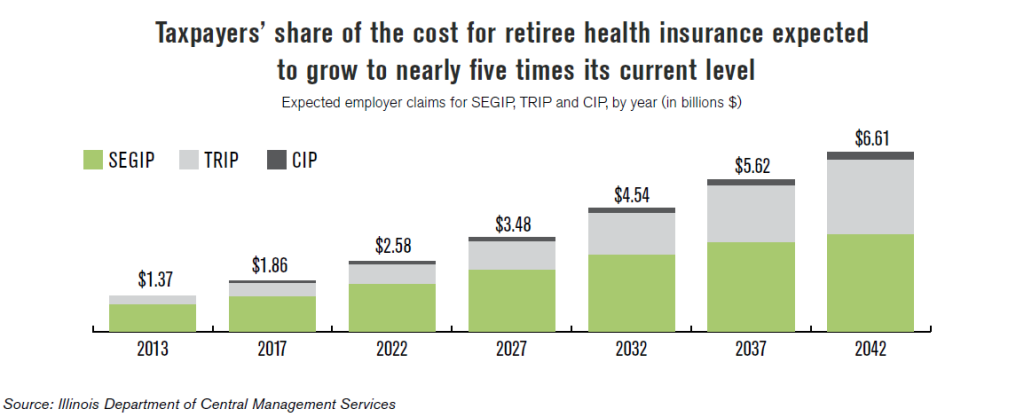

These problems are only expected to grow worse in the coming years. During the next 10 years, the total taxpayer share of the cost for these three programs is expected to grow to nearly $2.6 billion, up from $1.4 billion in 2013. Within the next 30 years, the employer share of these costs is expected to top $6.6 billion, nearly five times what it was in 2013.

The solution

In the private sector, retired workers must fund their own health insurance in retirement, with relatively few exceptions. But in Illinois, state workers and university employees who

currently take the generous option of retiring in their mid-50s receive full health insurance coverage at virtually no charge, with state taxpayers picking up almost the entire cost.

In other states, public employees have a far different deal. On balance, government retirees pay 54 percent of their health insurance costs – still a perk far more generous than

what private sector employers can afford to provide their own retired workers.

Illinois could greatly reduce this growing liability if government retirees paid, on average, 54 percent of their own health insurance costs, as they do in other states. The Illinois Policy Institute has outlined a plan that would allow the state to provide means-tested health insurance benefits to public employees. Those collecting a modest retirement income would largely see their health insurance subsidies remain the same, while retired union heads or university executives collecting six-figure pensions would be required to cover their own health insurance costs.

Moving forward, the state could reduce this liability further and help remove the disincentive for workers to retire early by capping subsidies for new retirees at the supplement level and phasing out the subsidies for new hires altogether.

Additionally, the state should not be paying the employer share of insurance coverage for retirees of local school districts, universities or community colleges. By transitioning the remaining employer costs back to the local level, the state could save hundreds of millions of dollars per year.

Why this works

Although the state’s $56 billion debt for retiree health insurance is little known, it is growing rapidly and crowding out resources for other state priorities. The state can greatly reduce this burden by bringing benefits more in line with those of governmental employees in other states. Moreover, legal analyses suggest that such changes are entirely permissible under state law.

It’s possible to establish a new, more affordable system that’s fair and still provides health insurance assistance to current and future retirees. Such steps must be taken. Illinois must reduce its retirement costs if state government hopes to remain solvent and avoid further tax hikes.