State Sen. Don Harmon’s progressive tax plan would hurt Illinois’ small businesses

State Sen. Don Harmon’s progressive tax hike proposal would be a massive tax increase on Illinois businesses. A recent Tax Foundation report shows that 61 percent of Illinois employers are pass-through entities – meaning their earnings are taxed at the personal income tax rate instead of the corporate income tax rate. Examples of pass-through entities...

State Sen. Don Harmon’s progressive tax hike proposal would be a massive tax increase on Illinois businesses.

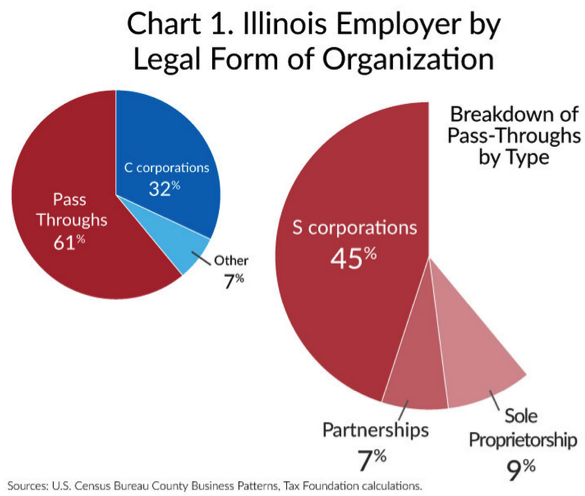

A recent Tax Foundation report shows that 61 percent of Illinois employers are pass-through entities – meaning their earnings are taxed at the personal income tax rate instead of the corporate income tax rate. Examples of pass-through entities include S corporations, sole proprietorships and partnerships.

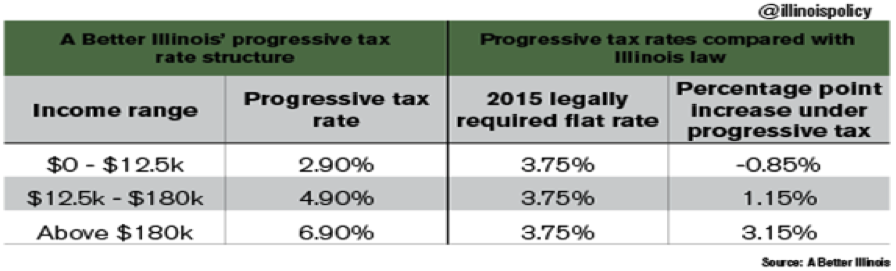

Under Illinois law, pass-through businesses will pay an income tax rate of 3.75 percent in 2015. But under the progressive tax-hike plan introduced by Harmon – and endorsed by A Better Illinois – a higher 4.9 percent applies to income earned after $12,500.

These rate increases make it more difficult for businesses to expand, hire more workers and retain existing workers.

In a recent interview, Illinois business owner Dennis Rieken explains why higher income tax rates would harm Illinois business. Dennis owns and operates Dick Van Dyke Appliance World, which has several locations throughout central Illinois.

“Jobs are created because businesses grow and expand,” Rieken said. “The thing that causes that is profit. Profit is not a dirty word, it’s what causes prosperity. When governments take that profit through taxation – take more and more profit away from a company – they can’t expand, they can’t grow, they can’t hire more people.”

Dennis’ statement hit the nail on the head. A progressive income tax would be a devastating blow to Illinois’ economy. And in a state with more than 1 million people unemployed or underemployed, the last thing Illinois needs is a tax structure that prevents businesses from growing and creating jobs.