2011 income-tax hike turned Illinois into a top 5 state for total tax burden, new study shows

Illinoisans handed over a larger portion of their earnings to state and local governments than did taxpayers in 45 lower-tax states in fiscal year 2012, according to a new Tax Foundation study.

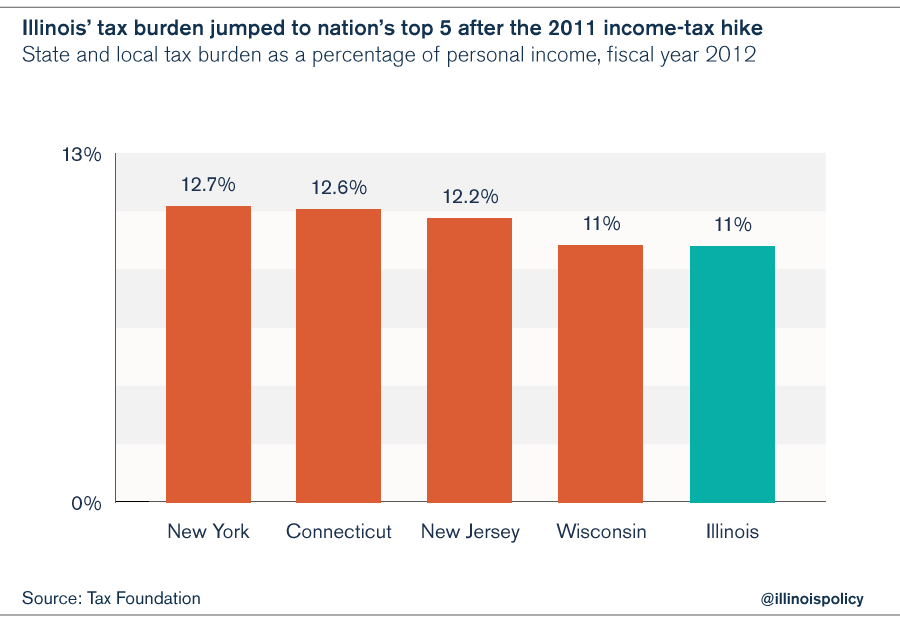

During the first full year of Illinois’ 2011 income-tax hike, Illinoisans suffered under the weight of the fifth-highest overall tax burden of any state, according to a new study released Jan. 20 by the nonpartisan Tax Foundation. The rankings show that Illinoisans handed over a larger portion of their earnings to state and local governments than did workers in 45 lower-tax states in fiscal year 2012. Only taxpayers in New York, Connecticut, New Jersey and Wisconsin were punished with heavier tax burdens than taxpayers in the Land of Lincoln.

Illinois’ 2011 income-tax hike raised the state’s income tax to 5 percent from 3 percent for individuals, and to 9.5 percent from 7.3 percent for corporations. This made the Land of Lincoln less attractive for businesses, residents and new jobs. Thus, it’s not surprising that Illinois has seen record levels of out-migration in every year after the 2011 income-tax hike, with Illinois now losing one person every five minutes to another state, on net.

The Tax Foundation report shows that as Illinois’ income-tax hikes took effect, Illinois’ tax burden jumped. Illinois’ ranking increased to the fifth-highest tax burden in fiscal year 2012 from the 10th-highest tax burden in fiscal year 2011.

These new rankings provide a critical framework when considering proposals for an additional income-tax hike in Illinois. In a Dec. 9 speech to the City Club of Chicago, Illinois House of Representatives Speaker Mike Madigan said the income-tax rate should return to the 5 percent level it occupied before it sunsetted to 3.75 percent in January 2015. But raising the income-tax rate would repeat the mistake that saddled Illinoisans with the fifth-worst taxpayer burden in the country.

In his statement, Madigan proposed raising income taxes:

A good place to begin, good place to begin, would be the level we were at before the income tax expired. Starting there, you can go in whatever direction you want to go.

If Madigan has his way and the General Assembly hikes the income tax back to 5 percent for individuals and 9.5 percent for corporations, Illinois would almost certainly jump to the No. 4 spot in the tax-burden rankings. That’s because Illinois (No. 5) and Wisconsin (No. 4) finished in a nearly dead heat in the fiscal year 2012 rankings. And since fiscal year 2012, Wisconsin cut more than $2 billion in taxes over four years, including:

- Reduction of income-tax rates for all tax brackets and elimination of one tax bracket in 2013

- Reduction of income-tax rates for the lowest tax bracket in 2014

- $500 million in property-tax cuts

- Elimination of all income taxation for manufacturers

Meanwhile, as Wisconsin has cut taxes, Illinois localities have raised taxes. In 2015, Chicago and Cook County together raised at least 12 different taxes to increase residents’ overall tax burden by more than $1.1 billion per year.

As local government cost drivers persist in the absence of necessary reforms, Illinois’ local tax burden will continue to grow through increased sales, property and other taxes. But setting aside the local tax burden for now, this fact should be clear: If Madigan gets his way and Illinois raises income-tax rates back up to 2011-2014 levels, Illinois will very likely become the fourth-most heavily taxed state in the U.S.

That’s no prescription for recovery, growth or a brighter future. Madigan’s plan would simply worsen Illinois’ already painful tax and regulatory burden, driving more businesses and taxpayers to become economic refugees from their home state.