5 reasons Illinois government-worker pensions are unfair to taxpayers

The outsized benefits received by retired government workers under the State Universities Retirement System and the unfair burden this places on taxpayers demonstrate the urgent need to reform Illinois’ government-worker pensions.

If you want to see just how unfair Illinois’ government-worker pensions have become to the average taxpayer who pays for them, look at one of the largest pension plans in Illinois – the State Universities Retirement System, or SURS.

That retirement plan may soon run out of money to pay the pensions of 52,000 public-university retirees, according to SURS Chief Investment Officer Daniel L. Allen. Allen recently reported that “SURS faces the real risk that the assets could be depleted in less than 10 years.”

SURS faces a funding shortfall of nearly $21.5 billion and has less than half the money it needs today to meet its future pension obligations.

While politicians’ underfunding of pensions usually gets all the blame for the government-worker pension crisis, overly generous retirement benefits granted by those same politicians also play a major role.

Here are five facts that underscore how SURS pension benefits create an unfair burden on taxpayers.

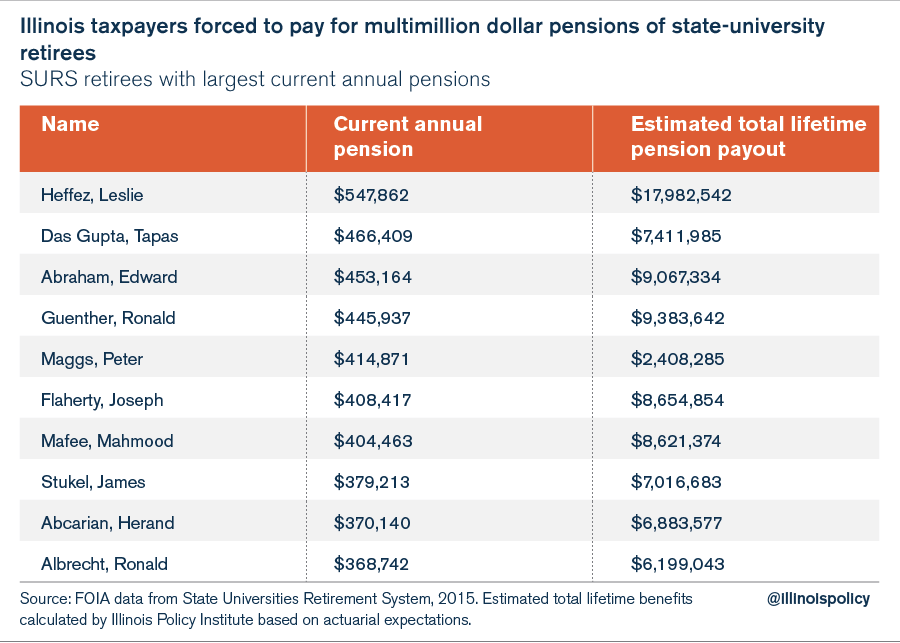

1. Illinoisans are being forced to pay for multimillionaire state pensioners.

More than 7,400 SURS retirees will receive more than $2 million during their retirements, based on actuarial life expectancies.

Among them is Leslie Heffez, a retired SURS employee, who draws a $547,000 annual pension. Assuming a current life expectancy of 81 years, Heffez will draw nearly $18 million in pension benefits over the course of retirement.

But it’s not just the top earners who have multimillion dollar pensions. The average SURS career worker (30 years or more of service) who has recently retired will receive a starting pension of $71,600 and also earn more than $2 million in retirement benefits. Those benefits are driven by the fact that many workers retire in their 50s and receive automatic 3 percent increases to their benefits for the rest of their lives.

Heffez and these SURS employees have done nothing wrong – their benefits are what their unions successfully negotiated with Illinois politicians. It’s the politicians who should be held accountable for granting benefits that the state and its taxpayers cannot afford.

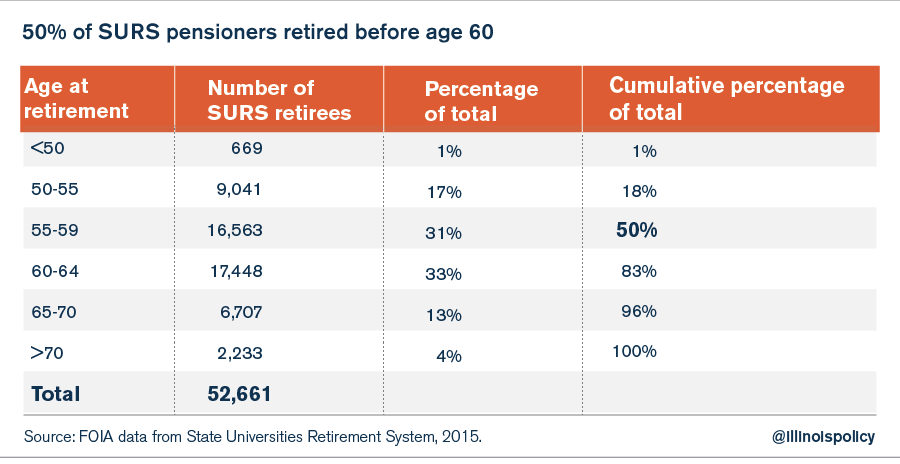

2. Half of all SURS retirees get to retire and draw benefits in their 50s, while the taxpayers who pay for them are working longer and longer.

More than 26,000 of SURS’ 52,000 retirees began drawing their pensions while they were still in their 50s. Given that workers are living increasingly longer, this is putting a tremendous strain on taxpayers and the pension plan.

At the same time, Americans in the private sector have accepted the reality of a retirement that comes later in life and no longer constitutes a complete exit from the workforce.

According to a poll from the Associated Press, 82 percent of working Americans age 50 or older say it is at least somewhat likely they will work during retirement. The survey also found that 47 percent of working survey respondents now expect to retire later than they previously thought and, on average, plan to quit working at about age 66.

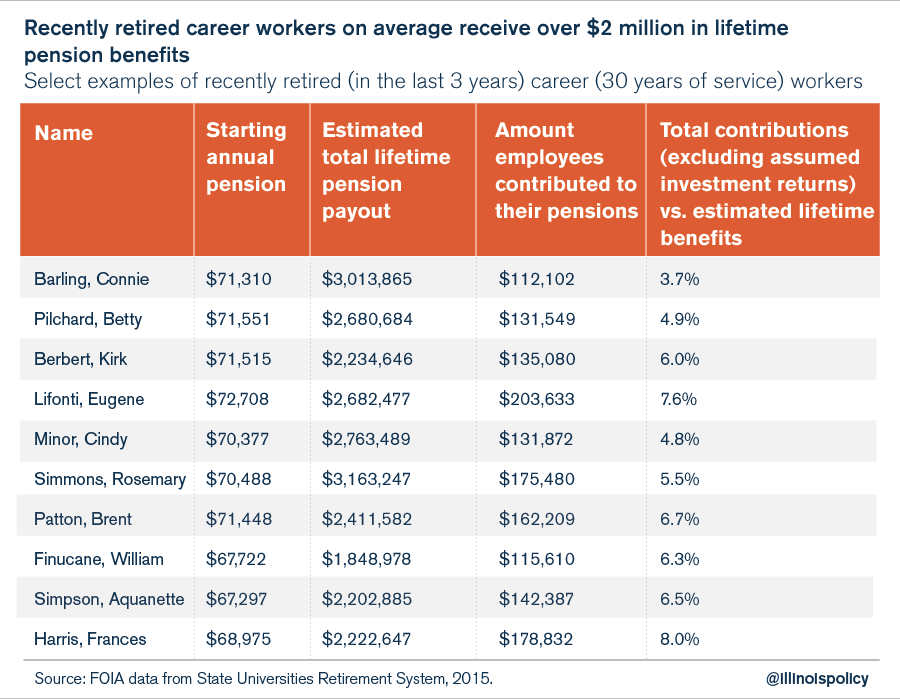

3. SURS employees contribute little toward their own retirements.

SURS employees typically contribute just 4 to 8 percent toward their own retirements – investment returns and taxpayers are expected to make up the rest.

The percentage that workers contribute is low because the benefits retirees receive are not based on what they actually contributed to the plan, but instead on their final salaries at the time of their retirement.

Based on that, most SURS retirees recover their contributed amount just four to six years into retirement. (The calculation includes the interest retirees earn on their contributions.) After that, taxpayers pay the retirees’ benefits for the rest of their lives.

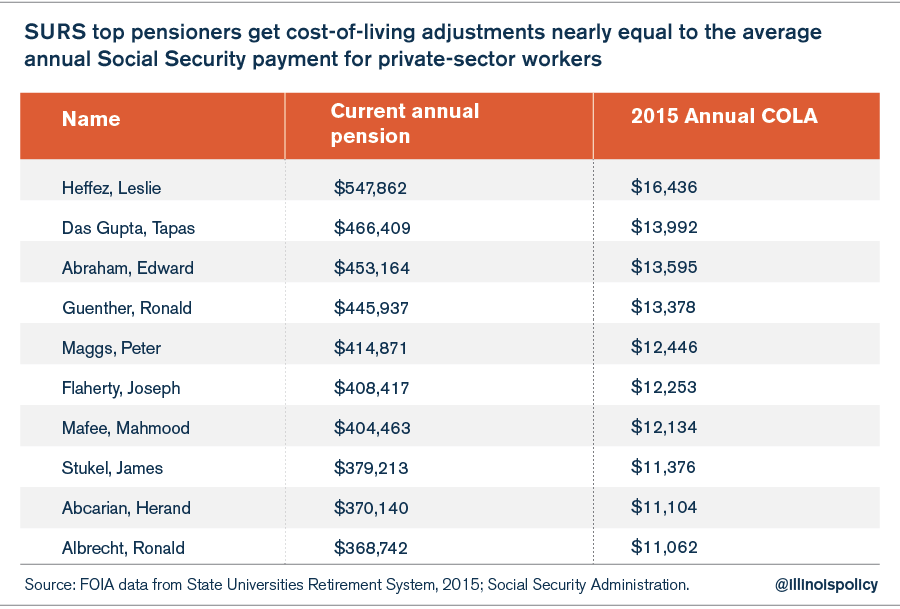

4. Cost-of-living adjustments aren’t means-tested.

The state’s government-worker pension plans are going broke but continue to pay out yearly cost-of-living adjustments, or COLAs, that aren’t means-tested.

Retirees with multimillion dollar pensions continue to see their retirement benefits rise each year through automatic COLAs. In fact, with the 3 percent automatic annual COLA that most retired government workers in Illinois receive, their yearly pension benefits double in 25 years.

Given that so many government workers retire in their 50s, most will actually see their yearly retirement incomes double.

And while this is problematic across all pensions, it’s particularly troublesome for the biggest pension earners. Heffez will earn a COLA of $16,000 in 2015, equal to the average annual Social Security payout for an average private-sector retiree. That means Heffez’s pension increase will be as large as an average American’s annual payment from Social Security.

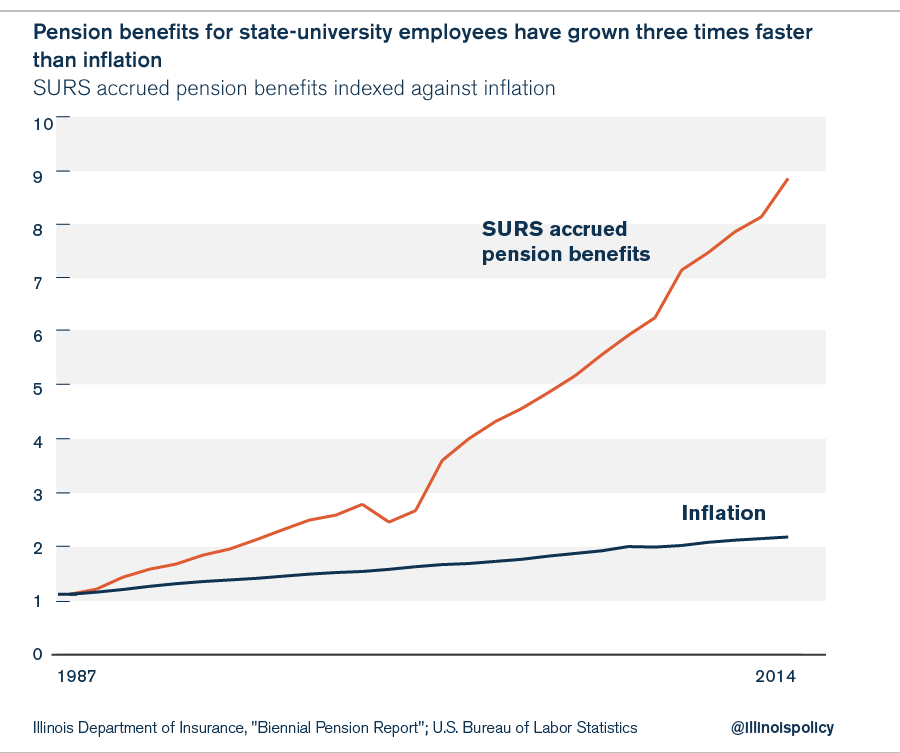

5. Illinois lawmakers allowed government-worker pension benefits to grow three times faster than the rate of inflation for nearly 25 years.

Total yearly accrued pension benefits for SURS retirees have grown at a yearly rate of 8.4 percent since 1987, while inflation has only grown 2.8 percent a year during that time.

SURS accrued benefits have skyrocketed to over $37 billion in 2014 from just $4.2 billion in 1987. That’s simply unsustainable for both the state budget and taxpayers’ wallets.

Reforming benefits is a necessity

The benefits politicians have granted government workers have made these pension plans simply unaffordable and unfair to the taxpayers of Illinois. While government workers have done nothing wrong by receiving these benefits, it’s clear that these benefits are no longer affordable for the taxpayers who are expected to fund them.

Illinois needs to end those benefits going forward – starting by moving new government workers onto 401(k)-style plans.

Doing that, in addition to other key reforms, is an important first step in fixing Illinois’ government-worker pensions.