5 things wrong with Illinois holding 30% of U.S. pension bond debt

Pension obligation bonds, like payday loans, are a sign of mismanaged finances. Illinois not only leads the nation for using that risky debt, it owes the bulk of it.

It is bad Illinois has the nation’s worst pension crisis, but state politicians have made it worse by using risky debt to delay the day of reckoning, and done so to the point that Illinois now owes 30% of the nation’s pension obligation bonds.

Pension obligation bonds are a form of debt used by state or local governments to fund their pension deficits. Illinois holds $21.6 billion of the nation’s $72 billion pension obligation bond debt.

The theory behind the bonds is that if a pension system can borrow money at a lower rate by selling bonds and earn a higher percentage from investing those funds, then it has realized a net gain using them. The issue is the gamble rarely works out that way, as the Government Finance Officers’ Association points out. Pension obligation bonds place taxpayer money at risk and often leave governments saddled with more debt rather than less. They often do not achieve a high enough return to justify their use.

Illinois’ five statewide retirement systems hold $144 billion in debt, according to official state reporting based on optimistic investment estimates. But Moody’s Investors Service says the true debt is $317 billion, which it calculates using more accurate methods common in the private sector.

Those state retirement systems only have 39 cents saved for every $1 in future promises they’ve made, which is the lowest pension funding ratio of any state. Each year, the state spends more than 25% of its budget on pensions, reducing resources available to spend on services such as public safety, education and anti-poverty programs.

Politicians created the pension crisis by enhancing pension benefits far beyond what is affordable and beyond what a typical private sector worker can hope to receive. Employees who spend their career in government, or work 30 years or more, receive pension benefits worth $2.3 million or more depending on the retirement system they are a part of. State workers who also receive Social Security average $1.7 million in lifetime benefits. More than half retire in their 50s.

Contributions from the public employees cover only about 5% of the cost of these benefits. Because employee contributions are fixed by law, any funding gaps over time must be covered by taxpayers.

Illinois state and local governments already spend the largest share of their revenue on pensions of all 50 states, more than double the national average. But despite its first-in-the-nation spending, Illinois also carries the largest pension debt burden and has the biggest gap between what it currently pays and what it would take to stop the debt from growing.

Similar to payday loans, the use of pension obligation bonds is often the last resort of a financially distressed entity. When politicians sell the bonds, they are betting the cash injection can be used by the pension fund to earn a higher rate of return than the interest rate which has to be paid on the bond, resulting in a net gain for the fund. This has rarely been achieved in practice. The bonds have only worsened the pension crisis in Illinois, leaving it one of the most indebted states with one of the worst-funded pensions.

Pension bonds have made Illinois debt problems worse

Illinois has a long history with using the bonds as a strategy to address its underfunded pension systems. It hasn’t worked out well for taxpayers. The state has borrowed a total of $17.2 billion since 2003, but repayment is estimated to cost nearly $31 billion.

There are five reasons why pension bonds have failed to solve Illinois’ pension problems and made them worse.

1) Using pension obligation bonds is gambling with taxpayer money

Instead of addressing underlying pension issues, the use of the bonds is, in effect, a gamble with taxpayer money. The theory behind the bonds is that if the pension can deploy the cash received from the bonds into higher-yielding asset classes, then the pension had a net gain from the use of bonds.

On the flip side, a lower gain than the interest which must be paid on the bond results in a net loss, leaving taxpayers on the hook for more than before. Ground is lost. This isn’t just theoretical: pension obligation bonds have a history of use, and a history of failure. Instead of using the bonds, the fundamental pension problems in Illinois must be addressed.

2) Illinois’ low credit rating, mainly thanks to pension issues, results in higher interest bonds

Illinois’ credit rating is still only two notches above junk status after its first upgrade in decades. This means when Illinois wants to borrow money via bond issuances, the interest rate on those bonds will be much higher than in more financially stable and secure states and jurisdictions. This only makes it more difficult for Illinois to use pension obligation bonds effectively because it is necessary to earn an even higher return than the high interest rates for the gamble to pay off.

The most effective way for the state to raise its credit rating would be to address the root cause of its financial problems and enact pension reform. Doing so would likely raise the state’s credit rating and allow it to secure lower interest rates. If that happened, pension bonds could be part of an overall solution – but only if they came after true structural reform.

3) Pension obligation bonds allow politicians to use creative accounting to shift money from pensions

While funds from the bonds typically go exclusively to funding pensions, they can also give politicians the ability to shift funds to other purposes.

That happened under former Gov. Rod Blagojevich in 2003, when the state borrowed $10 billion worth of the bonds. Not only did this leave the state with billions more to pay off than it earned, but the state used the bond proceeds to short the regular annual contribution by about $2 billion. In essence, instead of making a meaningful dent in the pension problems of Illinois, Blagojevich used the bonds and accounting gimmicks to further worsen the pension crisis and spend money elsewhere.

4) Pension obligation bonds can be a red flag to ratings agencies

The bonds can be viewed negatively by ratings agencies, especially when they aren’t accompanied by a plan to address the fundamental pension funding issues. Illinois finally received a credit upgrade for the first time in more than 20 years thanks largely to one-time federal stimulus funds from the pandemic. The use of the bonds risks letting Illinois slip back toward junk status by using a tool which has historically been shown to be disastrous both in and out of Illinois.

It should then be worrying that Gov. J.B. Pritzker has shown a willingness to use the bonds as a financial tool. While he has dropped plans for their use for now, it is possible they will be considered by his administration again.

5) Pension obligation bonds do nothing to address fundamental pension issues plaguing Illinois

Despite issuing a credit upgrade, S&P Global Ratings acknowledged Illinois still has poorly funded public pensions and other serious financial pressures. Benefits have been overpromised beyond what Illinoisans can afford, with pension spending increasing over 500% in the past two decades. For comparison, education spending has barely increased 20% during the same period. While funding has been lacking, the root problem lies with the undeliverable promises past politicians made to Illinoisans. Pension obligation bonds only distract from this root problem and fail to address anything beyond politicians’ desire for frivolous spending.

Amend the Illinois Constitution to allow pension reform

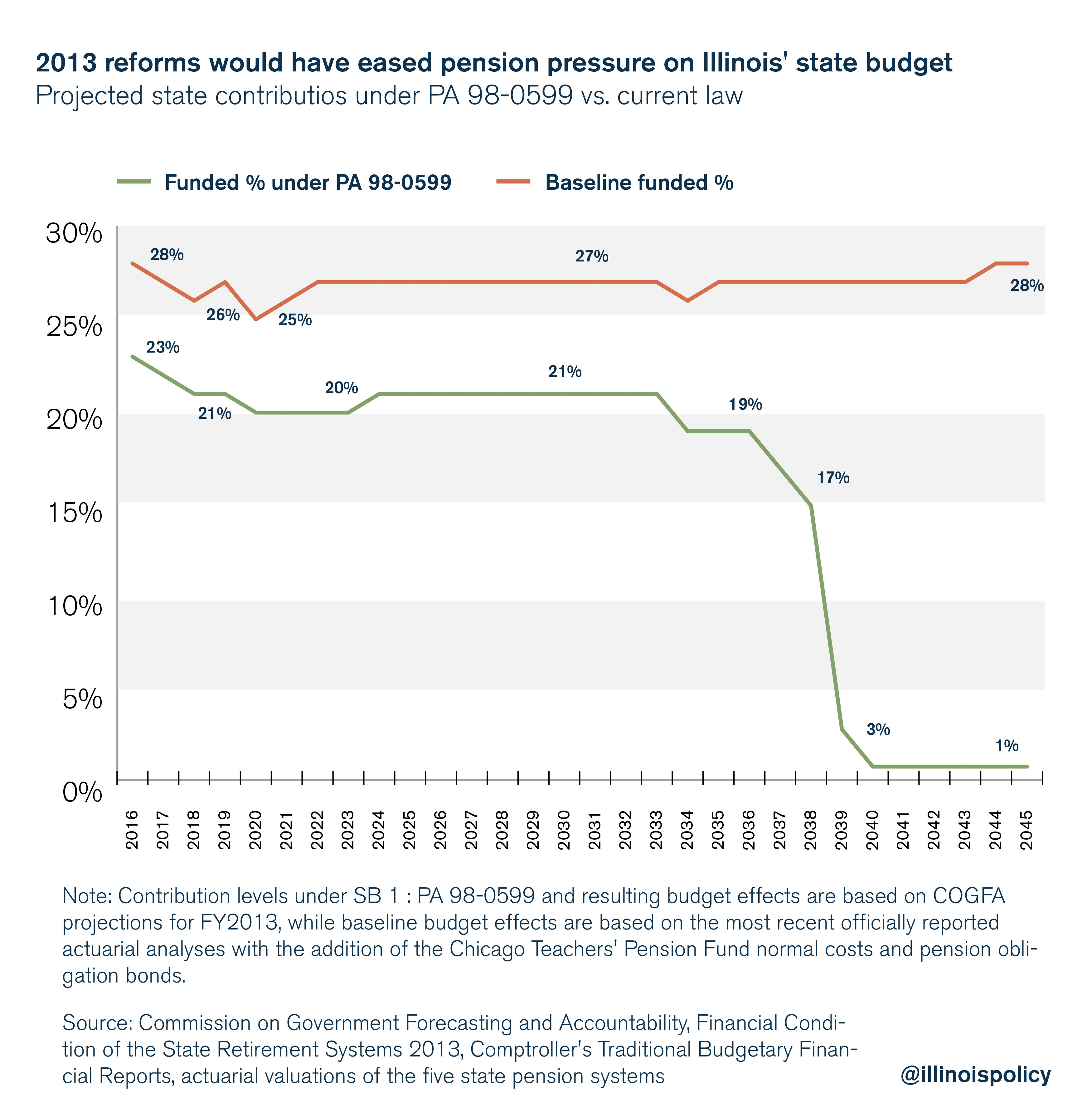

In 2013, Illinois took a significant step towards addressing the pension crisis by passing Public Act 98-0599. This bill protected any benefits that had already been earned by employees while it amended future benefits. The bill increased the retirement age, replaced 3% compounding annual raises with cost-of-living adjustments tied to inflation and capped maximum pensionable salaries. While not a solution, this bill provided a responsible roadmap addressing the financial issues in the pension system while preserving already earned benefits.

Unfortunately, the bill was declared unconstitutional by the Illinois Supreme Court in 2015 because it was interpreted as changing promised future benefits for pension recipients, even though this could potentially result in financial ruin for Illinois. As a result, a constitutional amendment is needed to allow changes to future pension benefits.

The Illinois Policy Institute has been a proponent of engaging in pension reform through a “hold harmless” amendment in the past. Such an amendment would preserve already earned benefits while making it possible to reduce future benefit growth so state retirement systems can be financially stable. Hold harmless pension reform would save the state $2.4 billion in the first year and over $50 billion through 2045. It would also result in all state pension plans being fully funded, rather than the current goal of 90% funding.

In a recent poll, 51% of Illinoisans supported a pension reform amendment “that would preserve state retirement benefits already earned by public employees but would also allow a reduction in the benefits earned in the future, whether by current or future employees.” Only 37% opposed such an amendment. In Chicago, support was at 55%.

It’s time for the Illinois General Assembly to stop the gambling and place a pension amendment on the ballot so Illinoisans can vote to allow responsible decisions about state pensions.