Hidden pension ‘tax’ costs each Illinoisan more than $1,400 per year

Illinoisans pay a hidden pension tax. Eliminating that cost would free up resources to help Illinois recover from the COVID-19 recession while also raising the state’s long-term economic potential.

Illinois’ pension crisis eats more than a quarter of the state budget, drives up property tax bills and is the No. 1 reason Illinois has the worst credit rating in the nation.

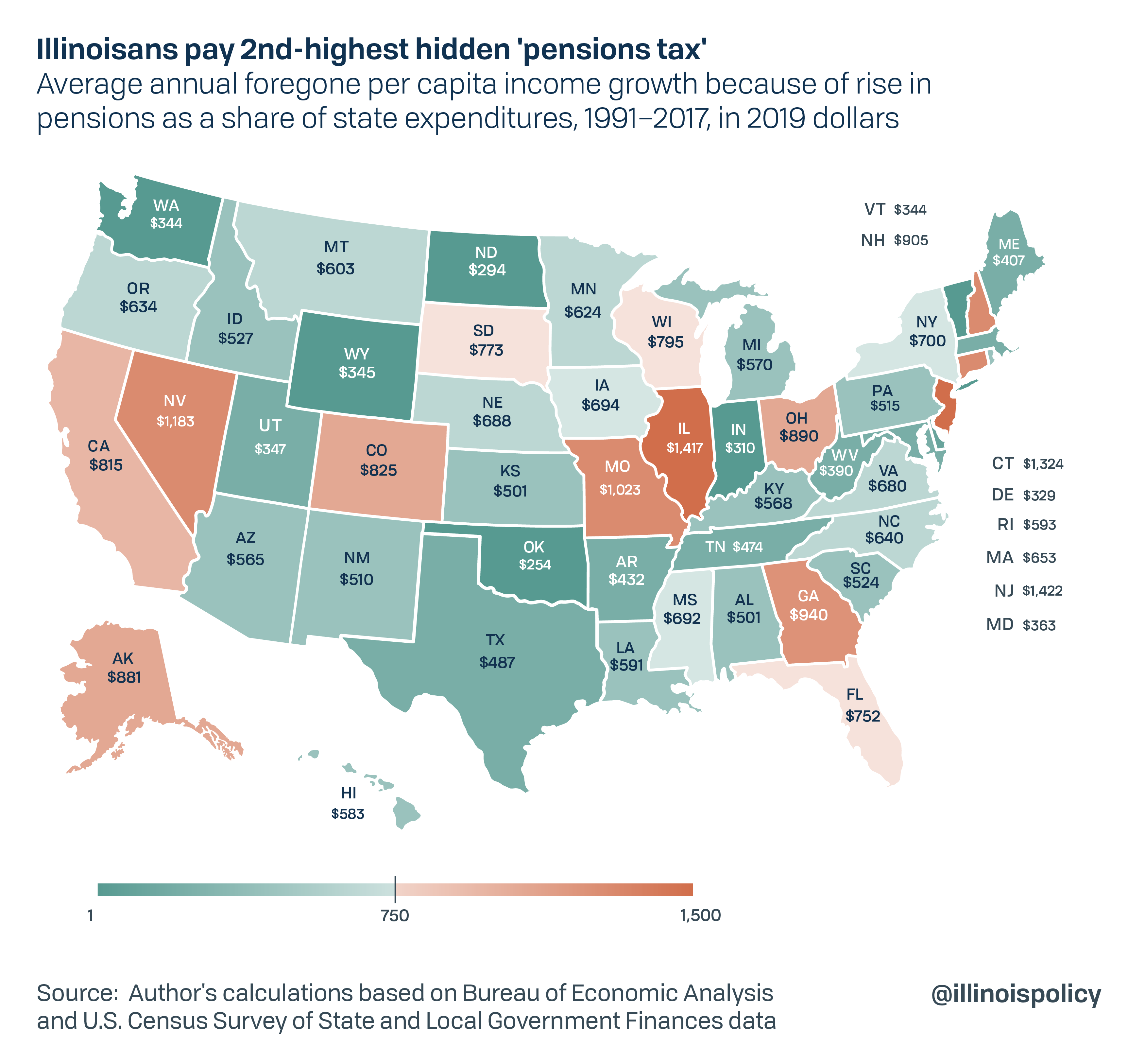

But the state’s overly generous and severely indebted pension system has another, hidden cost: it lowers income growth by roughly $1,417 – per person, per year on average.

By causing desperately needed public investments to decrease, a rising share of government expenditures to shore up unsustainable pension systems severely damages the state economy. It is workers who miss out on tens of thousands of dollars in take-home pay during their careers simply because they live and work in Illinois, where public pensions take priority. Every dollar spent on pensions is a dollar diverted away from services that most Illinoisans benefit from such as education, infrastructure and even direct government transfers to low-income families.

Not only has the pension crisis helped foster an environment where economic racial gaps are wider than the national average, the current economic downturn has disproportionately affected minority Illinoisans, even when compared to peers in other states. Employment of Black Illinoisans has declined by 15%, while 4.5% of the state’s working mothers have left the labor force entirely.

Amid the worst economic downturn in Illinois since the Great Depression, pension reform would relieve pressure on the state’s budget, boost the state’s economic prospects and help foster a more robust and equitable economic recovery. Removing the hidden pension tax would even do more for Illinoisans over the long run than the additional $1,400 federal stimulus check that’s part of the Biden administration’s current plan.

How pension costs hit Illinois paychecks

Measuring outcomes in all 50 states, research from the Illinois Policy Institute shows per capita personal income grows faster in states that spend less of their budget on pensions (see appendix). Illinois’ tremendous growth in pension expenditures during the past 30 years has cost each Illinoisan an estimated $1,417 in additional income every year since 1991, the second-highest cost in the nation.

The only state where pensions cost its residents more than Illinois is New Jersey, which is also severely indebted and faces massive unfunded pension liabilities. Following Illinois at No. 3 on the list is Connecticut, which is the only state in the past 30 years to switch from a flat to a progressive income tax structure. Since passing the progressive tax, Connecticut’s finances have continued to deteriorate and lawmakers have hiked taxes on all taxpayers including the state’s median earners – the middle class. Luckily for Illinoisans, voters in November thoroughly rejected Gov. J.B. Pritzker’s call for higher taxation via a progressive income tax hike. Although, newly elected House Speaker Emanuel “Chris” Welch has suggested lawmakers pursue another progressive income tax explicitly for pensions in the future.

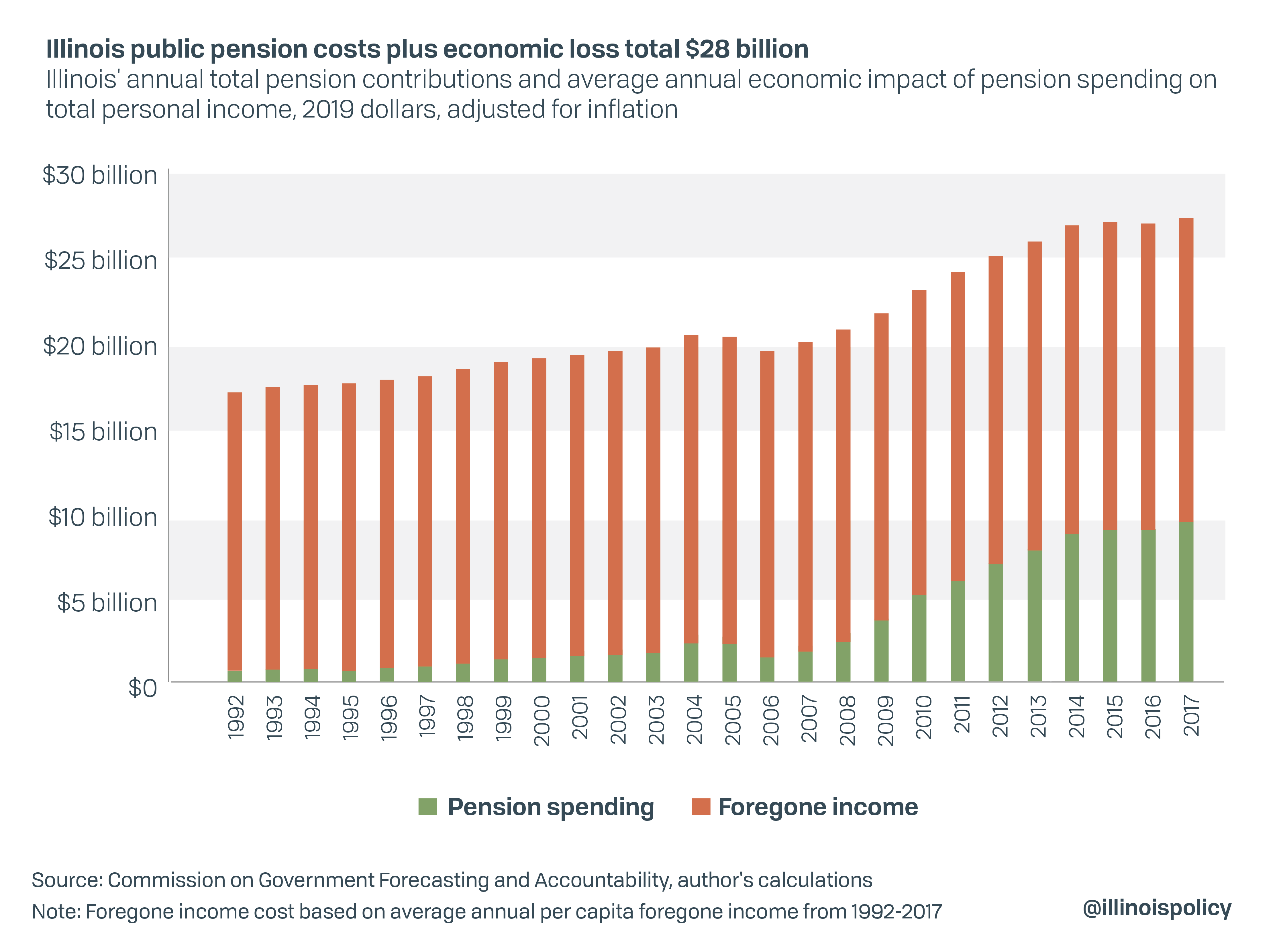

When lost economic activity is combined with the tax dollars devoted to pensions, Illinois’ total pension costs have soared to nearly $28 billion annually.

Despite the record increase in pension expenditures in the past several decades, Illinois’ pension system remains the nation’s worst by multiple measures. According to Moody’s Investors Service, Illinois’ pension debt was equal to 500% of the state’s revenues in fiscal year 2018 and almost 30% of the entire state economy, both the highest rates in the nation. At the same time, Illinois’ credit rating has been in precipitous decline and now sits at the lowest credit rating in the nation.

As pension debt continues to increase, so do required pension contributions. Pension contributions now consume 26.5% of the state’s general funds budget, up from less than 4% during the years 1990 through 1997.

The state has increased pension spending by more than 500% during the past 20 years, adjusting for inflation. Health insurance spending has gone up 127%.

To put that into perspective, most state leaders say education is their priority. However, education spending has gone up only 21% during that time. All other spending, adjusted for inflation, including social spending for the disadvantaged, has dropped 32% since 2000. In the most recent budget, spending on education was cut in real terms because the budget was not adjusted for inflation.

Amid the severe economic contraction induced by COVID-19 and associated state-mandated lockdowns, Pritzker signed the state’s 20th consecutive deficit budget. At the time, the $43 billion spending plan was out of balance by nearly $6 billion as economic fallout from COVID-19 blew a large hole in expected revenue collections for the coming fiscal year.

In April, Pritzker’s own Office of Management and Budget predicted revenues would drop by more than $4.6 billion for fiscal year 2021. A stress test conducted by Moody’s Analytics projected an even steeper drop in total revenue of between $5.2 billion and $6.9 billion, depending on the severity of the economic contraction. Illinois had neither cash reserves nor a plan to handle the crisis, outside of hoping for a federal rescue or raising taxes while cutting services in the midst of a severe recession. Luckily, revenue declines were not as severe as initially feared, with more recent revenue projections revised upwards by $2.3 billion for the current fiscal year 2021, which “closes” this year’s $3.9 billion deficit if December’s $2 billion in borrowing from the federal reserve is counted as revenue.

That same month, Illinois Senate President Don Harmon asked the federal government for a $44 billion bailout, of which at least $10 billion would go toward the state’s pension debt. Meanwhile, Pritzker has continually advocated for tax increases, first in the form of the $3.4 billion progressive income tax hike that voters rejected and removing small business tax relief passed in Congress, and now by advocating the closure of “loopholes” for businesses which were put in place to incentivize job creation. Even more recently, newly elected House Speaker Welch has suggested lawmakers pursue another progressive income tax explicitly for pensions in the future.

Instead of those measures, a state constitutional amendment that allows for modest pension reform, such as replacing guaranteed 3% compounding annual benefit increases with a true cost-of-living adjustment tied to inflation, could free up state resources and provide a boost for Illinois’ economic recovery.

By cutting investments in education, cash assistance to the poor and other services to preserve unaffordable pension benefits, Pritzker and lawmakers are sending a clear and disturbing signal to taxpayers about what they value most.

Quantifying the hidden cost of Illinois pensions

Most economists agree how governments spend taxpayer dollars matters for economic growth. It is difficult for a highly indebted government to boost growth, especially during an economic slowdown, through additional spending. Instead, a more effective approach would be to change the composition of its expenditures.

Using data from the Bureau of Economic Analysis and the U.S. Census Bureau, the Illinois Policy Institute found that in U.S. states, economic growth is negatively associated with the share of government funds spent on pensions. The massive increase in Illinois’ pension system has resulted in an estimated $1,417 hidden tax on each Illinoisan annually. That’s because research shows higher pension-related expenditures lower the growth rate of per capita personal income. Each year Illinois government increases pension spending, Illinoisans experience less growth in their incomes.

States that on average spent a larger share of their budgets on pensions grew less than other states during the past two decades, the evidence suggests (see appendix). The negative relationship between pension contributions and per capita income growth is statistically significant even after controlling for the initial level of income, levels of government spending, population growth and other factors specific to each state.

According to economic research, pension reform can improve economic growth by increasing labor supply and household consumption. The most important contributor to growth is an increase in the retirement age. Encouraging longer working lives with higher earned income increases household spending during working years. In addition, delayed retirement leads to lower pension costs.

Lastly, research published in the Journal of Macroeconomics shows population aging leads to a higher pension-to-gross-domestic-product ratio at the expense of public education. While this is true in most jurisdictions, the state of Illinois, with a voter population that is similar to the rest of the nation, is clearly an outlier.

Illinois prioritizes pensions over classrooms despite having a population similar in age to the nation. Pension spending has increased by more than 500% when compared to just a 21% increase for education in the past 20 years. The shift in spending priorities toward pensions at the expense of educating youngsters and other services is associated with persistently lower economic growth.

This is unfortunate because a number of studies have found a positive correlation between economic growth and the share of government expenditures on primary and secondary education. In Pritzker’s current budget, education spending was cut, and pension spending increased. The same thing is planned for his proposed fiscal year 2022 budget. Meanwhile, as millions of Illinoisans were applying for unemployment, government workers were given pay raises, which ultimately will raise future pension costs and make finding a job harderfor private sector workers.

Turning it around

Government spending not only reveals politicians’ true priorities, but it also has consequences for residents beyond what they see in their tax bills. Illinois’ outsized pension spending has lowered Illinoisans’ incomes by an average $1,417 each year.

Making matters worse, even though voters thoroughly rejected Pritzker’s $3.7 billion income tax hike, Welch has suggested lawmakers pursue another progressive income tax explicitly for pensions. This approach has been tried before to no avail, and a tax hike during a nationwide economic slowdown could be disastrous. Instead of enacting modest pension reforms, lawmakers have pursued massive tax hikes that have largely gone to finance additional pension spending. Despite the large, rapid increase in state pension spending, state pension debt has ballooned to $261 million, according to Moody’s Investors Service.

In order to allow for a robust economic expansion, Illinois must avoid more disastrous tax hikes, which have failed and will fail to make a dent in Illinois’ pension debt. They should pursue pension reform.

In the short run, pension reform would help to fix the state’s finances by freeing up resources to ensure core public services are not cut and provide desperately needed stimulus to help the majority of Illinoisans weather the current economic storm. In the long run, pension reform would provide a path to pay down state debt, free up funds for desperately needed new investments that raise economic growth and reduce the tax burden.

Until the state addresses the problem through constitutional pension reform that preserves earned benefits while curbing the growth in future liabilities, contributions to its five pension systems will continue to burden Illinois taxpayers and crowd out spending for core government services on which Illinoisans depend. It will also take that extra $1,417 from their pockets each year, even though they will never see it.