84,000 Illinoisans moved to states with no income tax from 2011-2014

The Land of Lincoln lost almost 84,000 residents and over $6.5 billion in taxable income to the seven states without an income tax while Illinois’ 2011 income tax hike was in effect.

If Illinois Senate leaders get their way, Illinoisans will be shelling out an even larger portion of their paychecks to the state in the near future.

Members of the Senate have proposed increasing the state’s personal income tax to 4.99 percent, up from the current 3.75 percent, as well as increasing the corporate income tax rate to 9.5 percent, up from the current 7.75 percent. If this proposed hike passes, all Illinois workers would have to pay up. A person earning a taxable income of $50,000 would have to pay an additional $620 on top of the income taxes he or she already pays to the state, bringing that person’s total income tax bill due to Illinois to $2,495, not including taxes due to the federal government.

Losing people

These proposed income tax hikes come while Illinois is experiencing a record out-migration crisis. In just one year – from 2015 through 2016 – Illinois lost 114,000 people on net to other states. In fact, Illinois is the only state in the Midwest with a shrinking population. Increasing the state’s income tax would only drive more people across state lines.

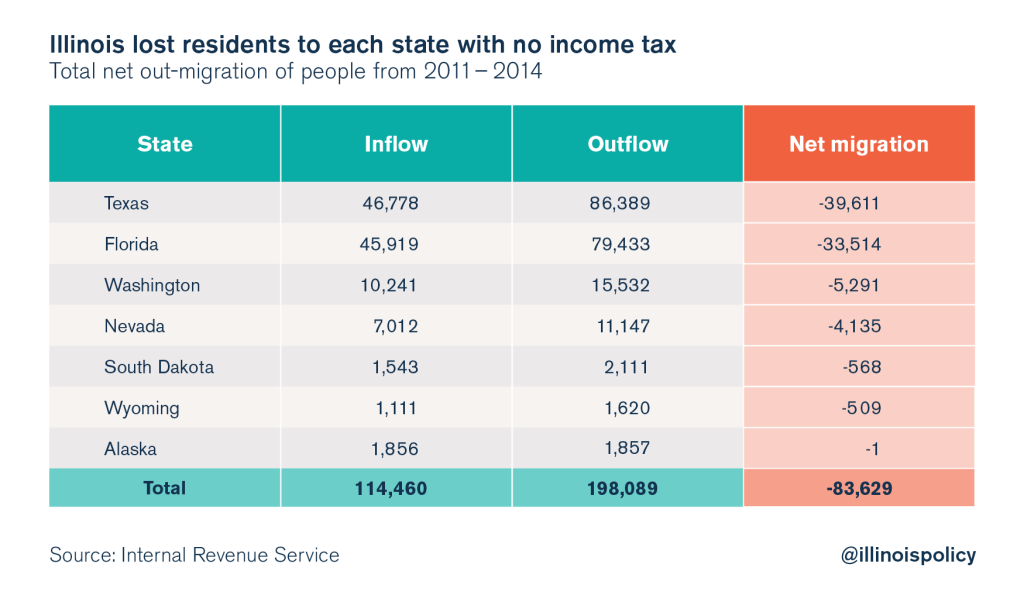

Illinois is not only losing residents to surrounding states, but it’s also losing people to states that do not tax income. According to migration data from the Internal Revenue Service, during the four-year period of the state’s last income tax hike – tax years 2011 through 2014 – Illinois lost a total of 250,000 people on net to out-migration. A third of those outbound Illinoisans, or about 84,000 people, moved to states with no income tax. This is significant, as there are only seven states without an income tax.

Illinois suffered the largest out-migration losses to Texas, losing about 39,600 people on net, and Florida, at a net loss of about 33,500 people. These states consistently gain Illinoisans due not only to the states’ friendlier tax environments, but also to their friendlier business and jobs climates. Chief Executive magazine ranked Texas and Florida among the best states in the nation for business, while Illinois ranked near the bottom. Texas and Washington have also gained significant numbers of millennials from Illinois.

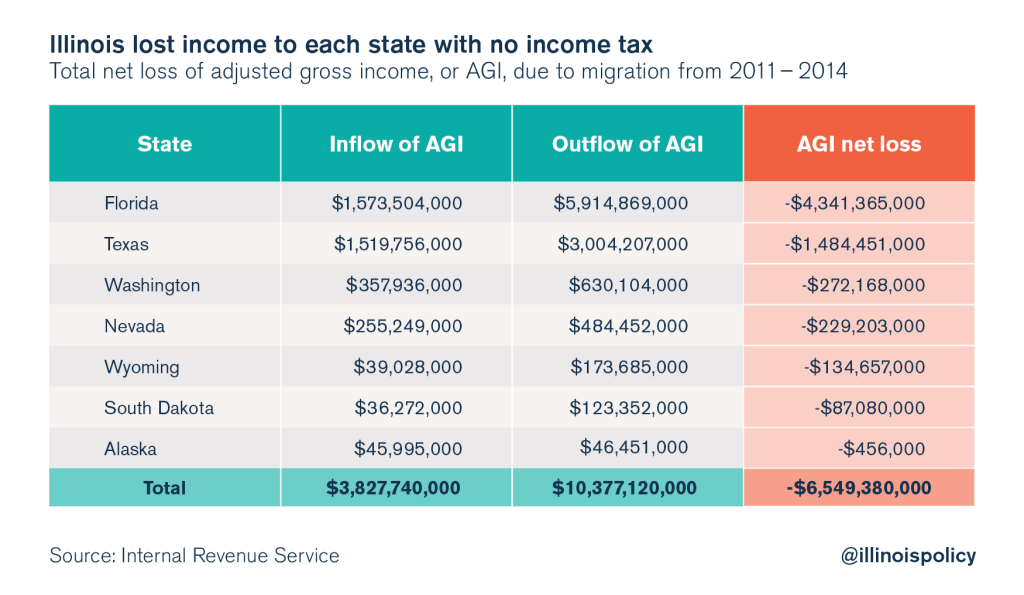

Losing taxable income

It doesn’t stop there. Illinois is also losing taxable income to these states. The nearly 84,000 Illinoisans who left for the seven states with no income tax took $6.5 billion of income with them. This is money that Illinois will no longer tax and that will no longer contribute to the Illinois economy.

When Illinoisans leave for states with no income tax, they also typically get to enjoy lower property taxes. This is because Illinois has some of the highest property taxes in the nation. Furthermore, Illinois taxpayers also pay among the highest sales taxes, in addition to various other taxes and fees.

Despite the overly burdensome taxes Illinoisans already pay, proponents of raising the income tax claim that the increase is justifiable because there are other states with higher income taxes than Illinois. That claim, however, does not take into account the multitude of other burdensome taxes Illinoisans must pay in addition to the income tax.

Illinoisans are voting with their feet in favor of states with lower tax burdens. To hike taxes would be unwise and counterproductive. Illinois legislative leaders need to make serious reforms so they can increase tax revenue by growing the tax base instead of raising taxes. Lawmakers should alleviate Illinois residents’ tax burden, not make it worse.