Illinois has highest cost of government in Midwest

The average Illinoisan works 208 days to pay the cost of government July 26 is Illinois’ Cost of Government Day, the date of the calendar year on which the average Illinois worker has earned enough gross income to pay off his or her share of the spending and regulatory burden imposed by government at the federal,...

The average Illinoisan works 208 days to pay the cost of government

July 26 is Illinois’ Cost of Government Day, the date of the calendar year on which the average Illinois worker has earned enough gross income to pay off his or her share of the spending and regulatory burden imposed by government at the federal, state and local levels.

This calculation is done each year by Americans for Tax Reform Foundation in Washington, D.C.

In 2012, the typical Illinoisan has worked 208 days to earn enough money to pay for the spending and regulatory burdens imposed by governments at all levels – 11 days longer than the average of all 50 states, July 15.

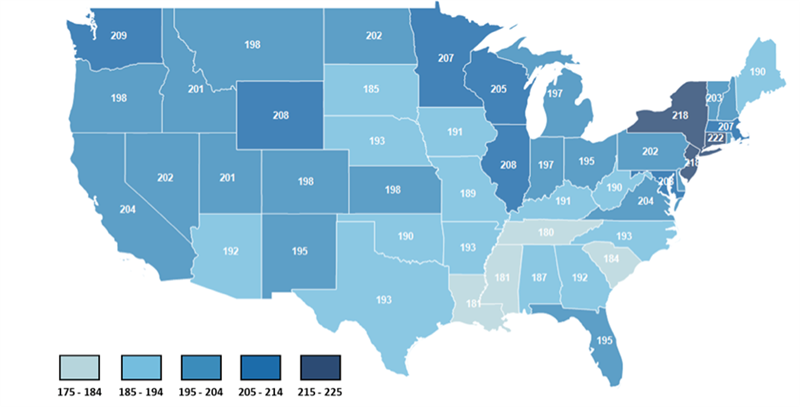

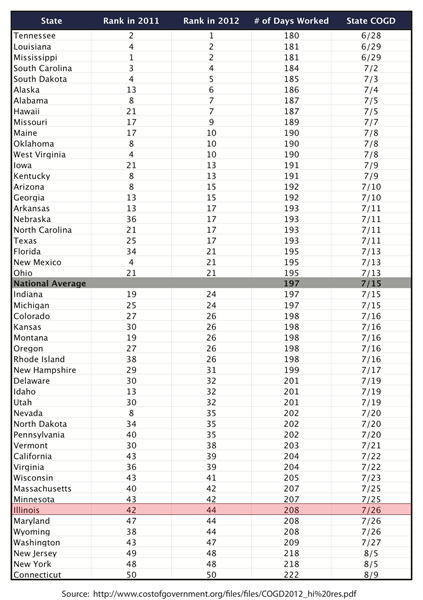

The graphic below shows how long taxpayers in each state must work to pay off their government burden. Illinois ranks 44th in the nation – 50 being worst – and its ranking fell two places since 2011. Illinois has the highest cost of government in the Midwest and is heading in the wrong direction.

Number of days to pay cost of government

Tennessee has the lowest cost of government (180 days), followed by Louisiana and Mississippi. But even in Tennessee a typical resident has to work until June 28 to pay their government costs!

Connecticut (222 days), New York and New Jersey have the highest cost of government. A typical resident of Connecticut must work into the second week of August to pay the burden.

High costs haven’t stopped Illinois lawmakers from piling on even more burdens. In 2011, Illinois legislators and Gov. Pat Quinn raised personal income taxes 67 percent and corporate income taxes 46 percent, allowing state spending to climb ever higher.

Illinois now has unpaid government bills of roughly $8 billion, which means spending will increase even more when these bills are finally paid. And unfunded public pension liabilities are $83 billion and unfunded public retiree health care costs are $54 billion.

People leave Illinois at a rate of one person every 10 minutes because they see better opportunities elsewhere. Illinois must become more competitive or it will continue to bleed people, income and investments to other states. An essential step is to get the cost of government under control and to do it quickly.

Below is the complete ranking: