Gov. Quinn’s plan for Medicaid: hike taxes and cut access to care

Moments ago, Gov. Quinn released his plan to cut Medicaid spending by $2.7 billion. So what does that plan actually look like? It looks like a tax hike coupled with even worse access to care for the poor. Sen. Dale Righter and Rep. Patti Bellock have both voiced opposition to the Governor’s plan, and the Medicaid working...

Moments ago, Gov. Quinn released his plan to cut Medicaid spending by $2.7 billion. So what does that plan actually look like? It looks like a tax hike coupled with even worse access to care for the poor. Sen. Dale Righter and Rep. Patti Bellock have both voiced opposition to the Governor’s plan, and the Medicaid working group has asked for more time to come up with the needed savings.

New taxes

Quinn’s announcement made clear that he doesn’t plan to actually reduce spending by $2.7 billion. Instead, he’s relying on $700 million in new tax revenues to pay for more spending. He expects to get that revenue by hiking the cigarette tax an extra $1-per-pack. This means that Chicago residents will be hit with a whopping $4.66-per-pack in tobacco taxes.

We’ve previously highlighted why relying on tobacco taxes is bad policy. For starters, tobacco taxes are notoriously unreliable sources of revenue, rarely bringing in the money they’re expected to raise. When New Jersey raised its cigarette tax in 2006, tobacco revenues actually fell by $24 million. That’s because high excise taxes encourage consumers to travel to neighboring states with fewer taxes and encourages criminal enterprises to operate commercial smuggling rings. Both lead to lower volumes of taxable sales and ever-dwindling revenues. And when those revenues fall short, state taxpayers will be on the hook.

Huge rate cuts

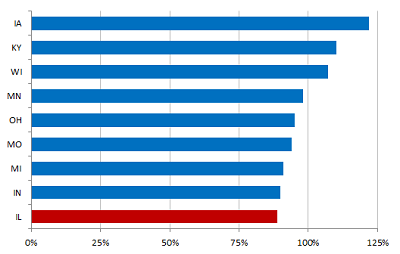

Quinn’s biggest reduction in spending is in the form of a huge rate cut to doctors and hospitals. But Illinois already has the lowest reimbursement rate in the region. In many cases, they don’t even cover the actual cost to provide services.

The program reimburses doctors so poorly that many simply cannot afford to take more Medicaid patients. This leaves most Medicaid patients competing with each other for fewer and fewer doctors willing to see them. In Chicago, for example, children with throat cancer have only a one-in-three chance of seeing a specialist if they’re enrolled in Medicaid. For those with juvenile diabetes or epilepsy, the odds of seeing a specialist are one-in-two. And even when they can get an appointment, they have to wait months just to see the doctor. Cutting those rates even further doesn’t solve the problem. It just leaves the poorest and most vulnerable with even fewer options to receive quality care.

Real solutions

The Medicaid program is spending more and more state tax dollars with less and less to show for it. That’s why Illinois needs comprehensive solutions that reduce spending, increase access to necessary care, empower patients to make healthier, cost-conscious choices and avoid trapping the poor into a system of government dependency. If Illinois is ever going to deliver quality care to the most vulnerable populations, it must completely redesign the program from the ground up in a way that meets the needs of our unique population.

Tax hikes and rate cuts don’t fix the problem. They make it worse.