Illinois’ economic policies disproportionately hurt youth and minorities

Gov. Pat Quinn noted in his State of the State address that “economic growth always starts with more jobs,” and that “we’ve seen progress on this front.” But it’s unclear who is experiencing progress in Illinois. Unemployment rates for youths are at crisis levels and rising, while minority rates are barely better. The Illinois Department...

Gov. Pat Quinn noted in his State of the State address that “economic growth always starts with more jobs,” and that “we’ve seen progress on this front.”

But it’s unclear who is experiencing progress in Illinois. Unemployment rates for youths are at crisis levels and rising, while minority rates are barely better.

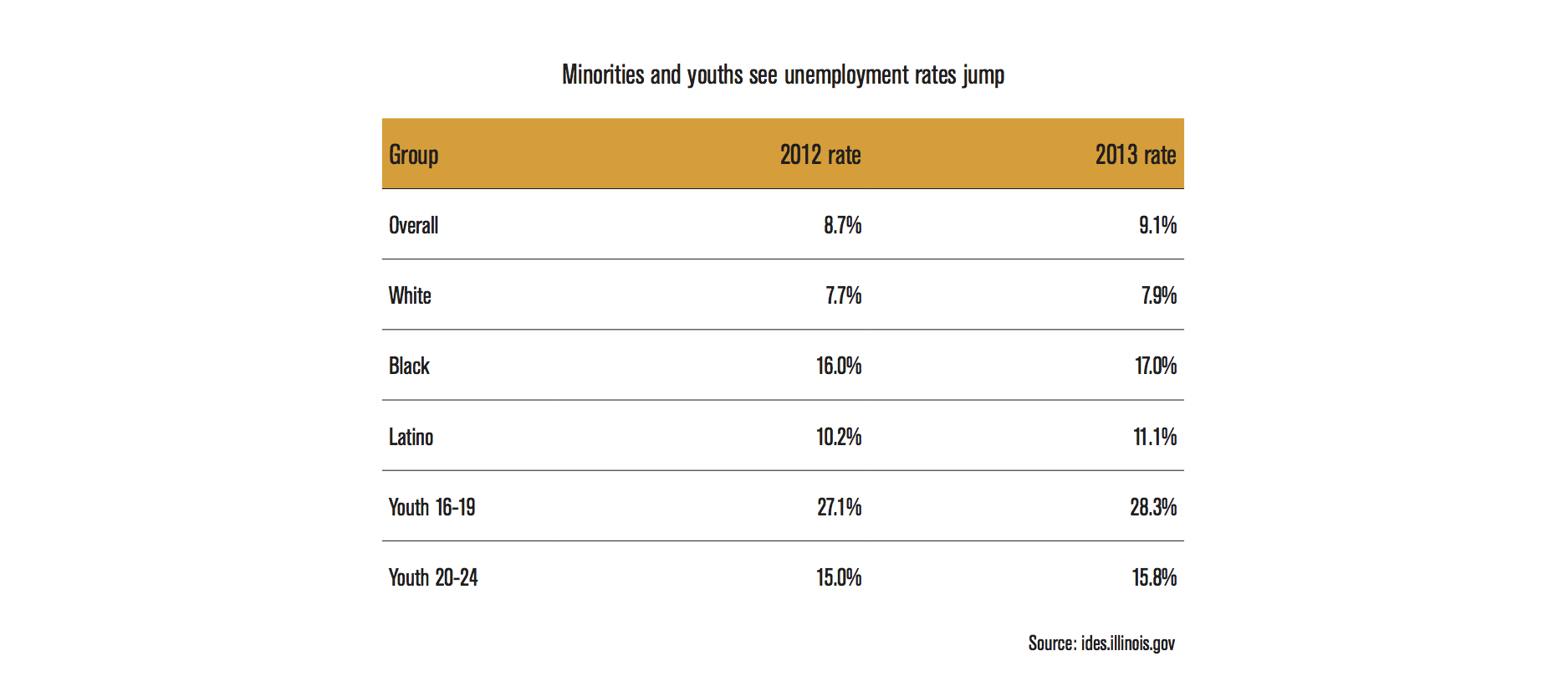

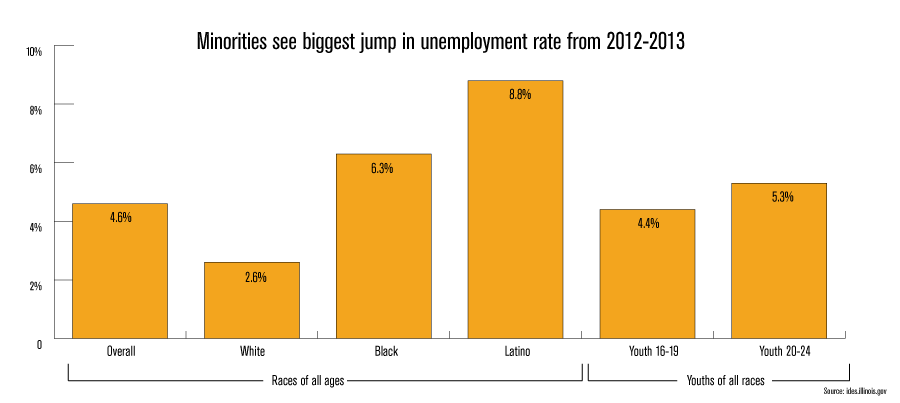

The Illinois Department of Employment Security, or IDES, released earlier this year the 2013 annual averages of unemployment by age and ethnic group. Compared to the previous year, the report shows that minorities and youths were hurt by the state’s policy failures.

Minority and youth rates were already high in 2012, and the year-over-year change shows that these groups took the biggest hit in 2013.

Youth rates will not decline from crisis levels if the governor and state lawmakers continue to agitate for a higher minimum wage. Employers don’t know whether young and unskilled workers will cost $8.25 per hour or $10.10 per hour. Many youths lose out on their first opportunities at entry-level work because of this state policy uncertainty. If a minimum-wage hike actually passes, it will cost the state 10,500 youth employment opportunities, and economists suggest that black, male teens would be hurt most.

Trickle-down government planning is hurting minorities and is failing everyone. Illinois’ history of cronyism benefits only concentrated corporate interests, while continued forced unionism in the state benefits organized labor at the expense of the rest of the workforce, driving businesses out of Illinois. The fourth-highest workers’ comp costs, fourth-highest corporate tax rate, sixth-highest tort liability costs and ninth-highest regulatory costs cause economic hardship, and that pain falls on the Illinois’ most vulnerable residents.

The specter of a progressive tax hike represents more of the same, and would ultimately hurt the most vulnerable. And this tax hike would encourage the well-off to leave the state, as they are already doing.