Rock Island committee backs progressive tax plan that would hike taxes on residents

The Rock Island County Government Affairs Committee recently passed a resolution urging lawmakers in Springfield to increase taxes on middle-class families. The sales pitch for a progressive income tax in Rock Island – as well as cities and counties across the state – is that it would reduce taxes for middle-class residents. That’s simply not...

The Rock Island County Government Affairs Committee recently passed a resolution urging lawmakers in Springfield to increase taxes on middle-class families.

The sales pitch for a progressive income tax in Rock Island – as well as cities and counties across the state – is that it would reduce taxes for middle-class residents.

That’s simply not true.

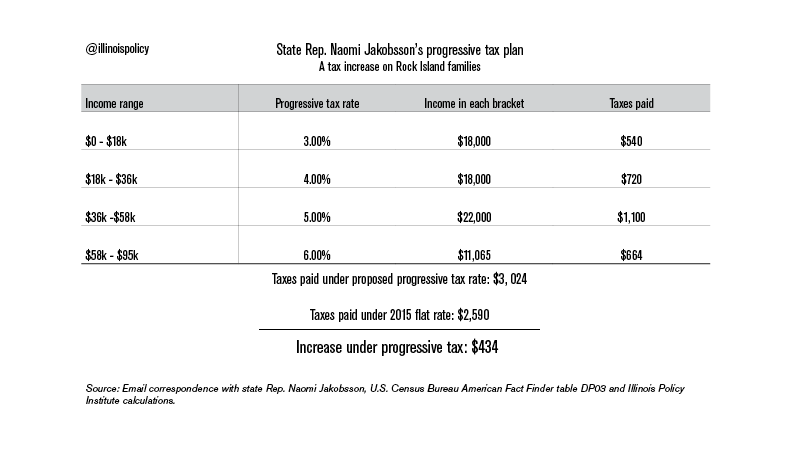

Look no further than the progressive tax rates endorsed by state Rep. Naomi Jakobsson, the chief proponent of a progressive income tax increase in Illinois

Under Illinois law, the individual income tax rate will be 3.75 percent in 2015. Under Jakobsson’s progressive income tax plan, a higher 4 percent rate kicks in on any income earned after $18,000. That income tax rate targets hardworking Illinoisans.

Jakobsson’s progressive tax rates also attack the middle class. Her 5 percent tax rate applies to income earned after $36,000. When an Illinoisan earns more than $58,000, Jakobsson’s tax rates jump to 6 percent, and again to 7 percent on income earned after $95,000 – nearly double the rate Illinoisans will pay in 2015.

So what does that mean for families in Rock Island?

According to 2012 Census data, the average family in Rock Island County earns about $75,356. After a few standard exemptions, the average taxable income for the family can come in around $69,065.

Compared with Illinois law, the average Rock Island family would see their income tax bill increase by more than $400 dollars under a progressive income tax in 2015.

State and local officials will continue to sell their progressive income tax in Illinois for something it isn’t. The reality is a progressive income tax would be a tax increase on Illinois’ middle-class families.