Corporate pensions remain volatile as funding levels drop

The unpredictable and expensive nature of defined-benefit pension plans is why companies like Barnes & Noble Inc. and Allegheny Technologies recently chose to abandon traditional pension plans in favor of 401(k)-style plans.

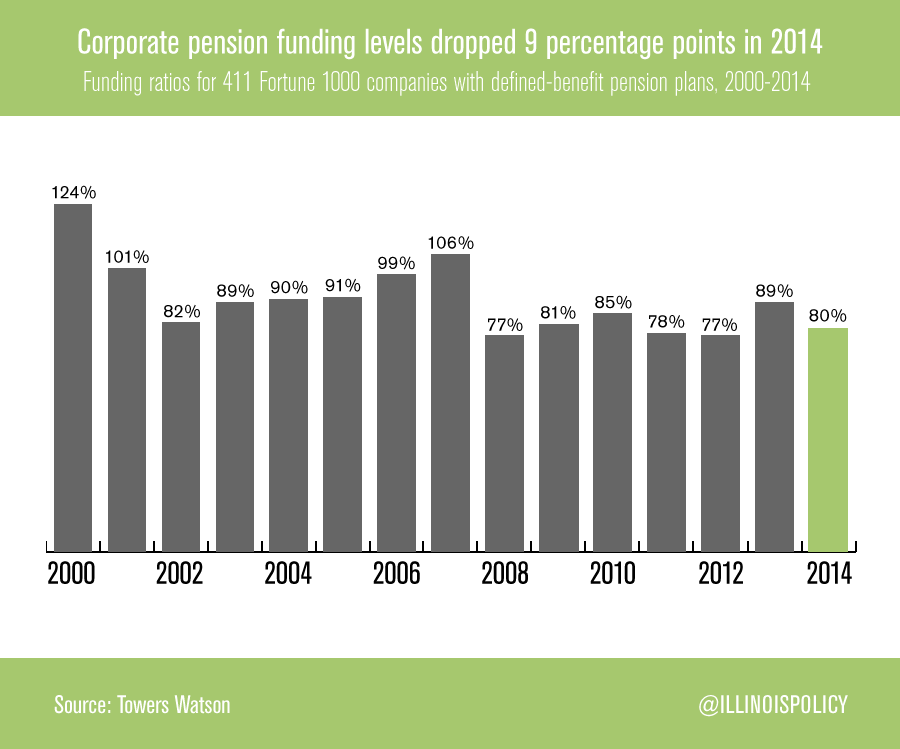

Even with the great market returns in 2014, many Fortune 1000 companies struggled to keep their pension plans funded.

The funding status of the nation’s largest corporate pension plans fell to 80 percent in 2014, down nine percentage points from the previous year, according to a recent Towers Watson report.

“Despite a rising stock market in 2014, funding levels for employer-sponsored pension plans dropped back to what we experienced just after the financial crisis,” said Alan Glickstein, a senior retirement consultant at Towers Watson.

The Towers Watson analysis found the pension deficit for these corporations increased to $343 billion last year. That’s more than twice the 2013 deficit.

Changes in actuarial assumptions are one of many factors that make it difficult for companies to budget for defined-benefit pension plans over the long run.

Close to half of the increased pension deficit for these Fortune 1000 companies in 2014 was due strengthening mortality assumptions – meaning people are living longer and drawing more pension benefits during their retirement.

The unpredictable and expensive nature of defined-benefit pension plans is why companies like Barnes & Noble Inc. and Allegheny Technologies recently chose to abandon traditional pension plans in favor of 401(k)-style plans.

Self-managed plans like 401(k)s make it easier for companies to develop long-term budgets. Instead of the quickly growing and unpredictable costs associated with traditional pension plans, 401(k)-style retirement plans are a known cost – a fixed percentage of payrolls each year. Self-managed plans also give workers more control and ownership over their retirements.

Most of the private sector recognizes these benefits, having already made the transition to 401(k)-style plans en masse. State governments across the country should follow their lead.