Many St. Clair County residents would face higher sales tax rates than Chicago if sales tax proposals pass

If voters approve proposals to raise St. Clair County sales taxes by a combined 2 percent, people in some parts of St. Clair County would face total sales taxes of over 11 percent.

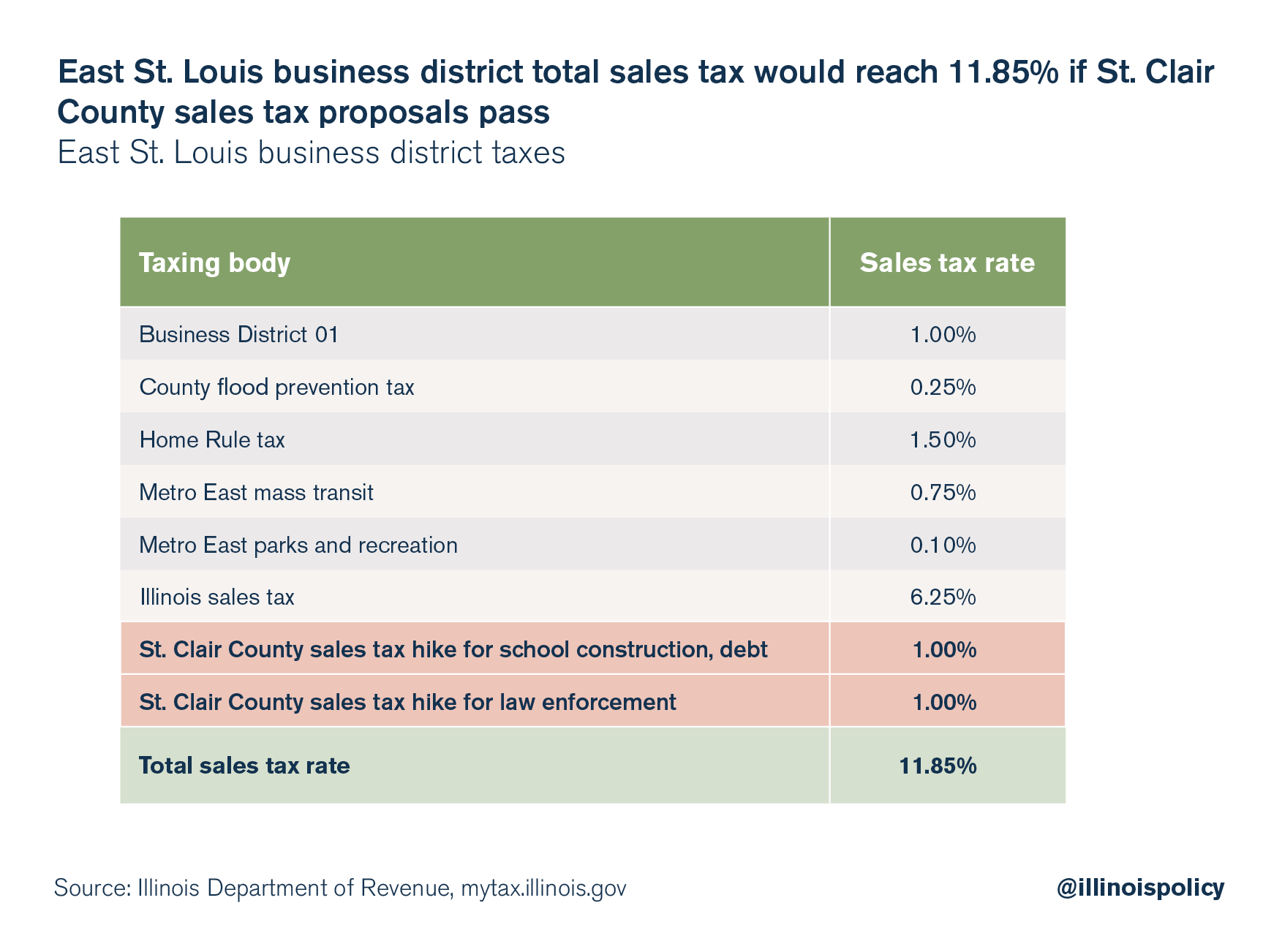

On April 4, St. Clair County residents will vote on a combined 2 percent increase in sales taxes. This includes a 1 percent increase designated for schools, and a 1 percent increase designated for public safety, according to the Belleville News-Democrat. If both proposed increases pass, shoppers in parts of St. Clair County may see rates of up to 11.85 percent – higher than Chicago’s 10.25 percent combined sales tax rate, the highest of any major U.S. city. However, this new tax will not be levied on certain items, such as groceries, pharmaceuticals or cars, according to the News-Democrat.

If voters approve of both proposals, these sales tax increases are expected to bring in a combined $44 million, which will be split between school facility projects and debt and public safety purposes. The school-related tax would be allocated among the school districts within the county based on the number of students they have. The public safety-related tax would go to measures such as enhancements to police departments.

These increases would be in addition to the sales taxes the state and municipalities already impose. Illinois’ combined state and average local sales tax rate ranks highest in the Midwest, according to a new report from the nonpartisan Tax Foundation. While the state imposes a 6.25 percent sales tax, St. Clair County imposes an additional 0.35 percent sales tax, which brings its base up to 6.6 percent.

In addition to the state and county sales taxes, many municipalities also levy their own sales taxes. Of the approximately 30 cities within the county, at least 24 levy their own additional sales taxes, which, when added to state and county taxes, result in total rates ranging from 7.35 percent to 9.85 percent. East St. Louis’ business district, for example, has a combined sales tax rate of 9.85 percent after the additional rates are included. If both proposed 1 percent increases pass, some taxpayers will be paying rates of 11.85 percent.

The taxes don’t stop there. On top of the high sales tax, St. Clair County residents pay various other taxes and fees. Illinois is home to some of the highest property taxes in the nation. If St. Clair County residents were to cross the Mississippi River and leave for Missouri, they would be paying significantly lower taxes for many items, such as gas, beer and wine. Compared with Illinois, Missouri has lower property and sales taxes, no estate taxes, and the lowest cigarette tax of any state. It’s no wonder Illinoisans are packing up and heading to Missouri in droves.

St. Clair County residents are also facing new tax proposals from state lawmakers, in addition to calls for local tax hikes. Illinois legislators have proposed new taxes on sugary beverages, internet streaming and an array of other services. The Illinois Senate’s “grand bargain” also proposes a hike on income taxes.

Illinois residents are drowning in taxes. Lawmakers in all levels of government need to take steps toward reducing the tax burden on Illinois taxpayers.