Democrats’ fake property tax freeze won’t save Illinois’ underwater housing market

A four-year freeze riddled with exceptions won’t help Illinois homeowners. Illinoisans need a long-term freeze on local property tax levies and a cap on the tax burden for individual homeowners.

One in 6 Illinois homes with a mortgage are seriously underwater. Illinois’ depopulation and rising property taxes have hammered Illinois home values, destroying the savings of thousands of families and driving others to put down roots in other states.

State and local governments have transformed Illinois’ housing market into a massive debt trap. Illinois’ legislature should enact a long-term property tax freeze as a basic measure to protect home values from further erosion. But instead of acting to protect homeowners, the only property tax legislation active in Springfield currently is a watered-down freeze that wouldn’t actually prevent taxes from rising.

Breaking down Illinois Democrats’ fake property tax freeze proposal

Senate Bill 484 is a fake property tax freeze proposal offered by Illinois Democrats. SB 484 is a bad faith gesture to Illinois families whose home values are already sinking under property taxes.

SB 484 is only a temporary property tax freeze, and it’s full of holes:

- Chicago is exempt.

- Chicago Public Schools and various other districts are exempt.

- Principal and interest on debt payments are exempt.

- Pension payments are exempt.

- The property tax freeze ends in 2020.

- Local governments are not given any control over their costs.

- The “freeze” is not a fair offset to an income tax increase of $1,200 per household.

The reason the bill contains so many exemptions is because lawmakers don’t want to change any of the spending drivers that force property taxes up. Debt service and pension payments take up a huge portion of current property tax revenues in many communities. Furthermore, if new debt service payments become exempt from the freeze, then local governments can just borrow money and spend it, and then raise property taxes to pay back the borrowed money.

SB 484’s exemption of Chicago and Chicago Public Schools would allow these governments to continue raising property taxes. This move is unsurprising, as Chicago and CPS are at the heart of the Democratic power base, and both are nearing bankruptcy.

Illinois’ housing market is incredibly weak, and property taxes are a major culprit

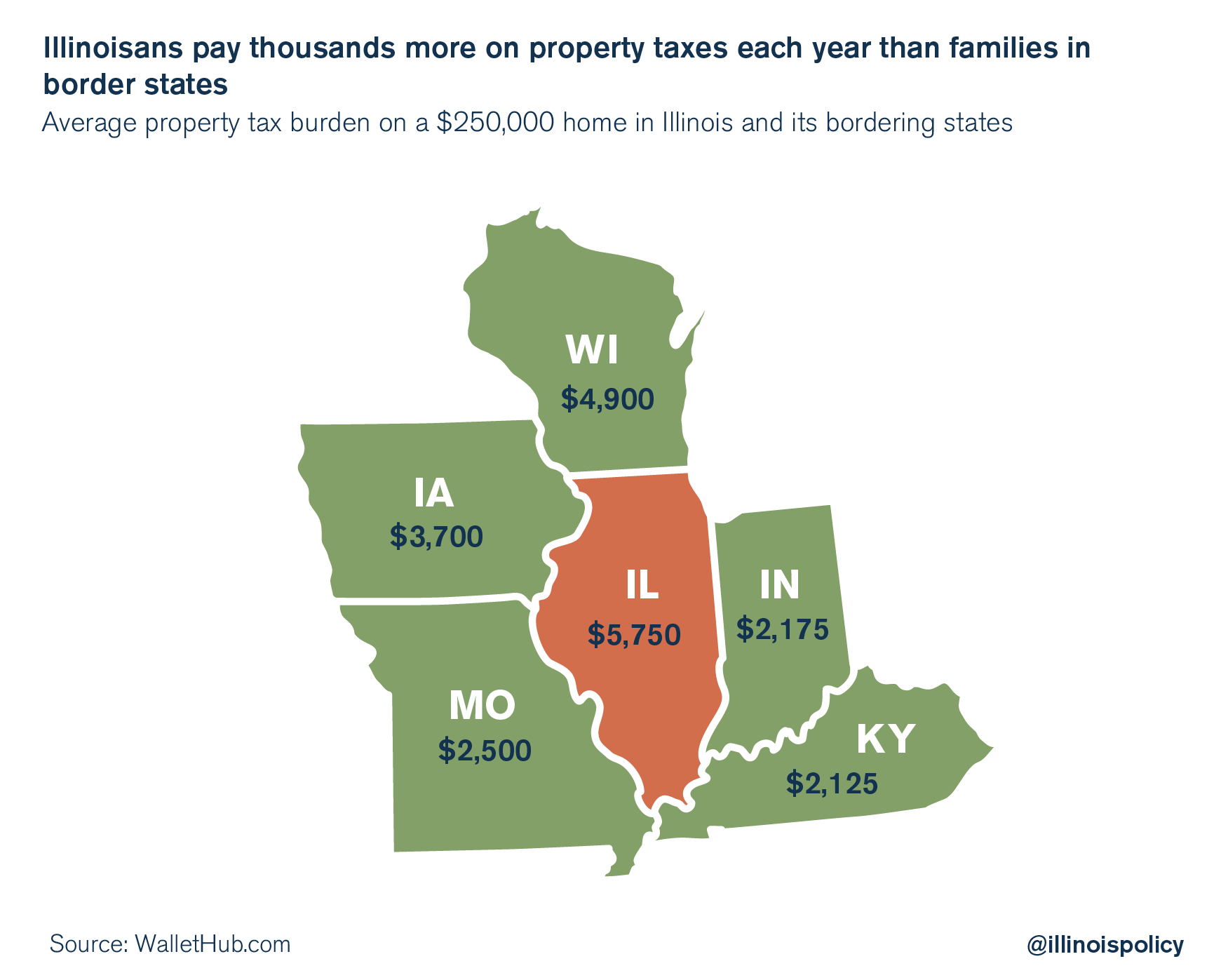

The fake property tax freeze that Illinois Democrats champion should be a nonstarter for families across the state who are seeing their property taxes rise and their home values fall. For example, for a $250,000 home in Illinois, a homeowner pays $5,750 in annual property taxes, on average, compared with $4,900 in Wisconsin, $3,700 in Iowa, $2,500 in Missouri, $2,175 in Indiana, and $2,125 in Kentucky, according to a WalletHub study.

Illinois’ crushing property taxes are driving down the value of homes, and Illinois’ depopulation is reducing demand for homes. As a result, Illinois homes are worth much less than they would be if they were in another state. Home values have been pushed down, leaving 1 in 6 Illinois mortgages deeply underwater.

Chicago in particular needs a property tax freeze because the Chicago area leads the nation in deeply underwater homes, according to CoreLogic data reported by Crain’s Chicago Business. New York City has more than three times the population of Chicago, but the Chicago area has twice as many underwater homes.

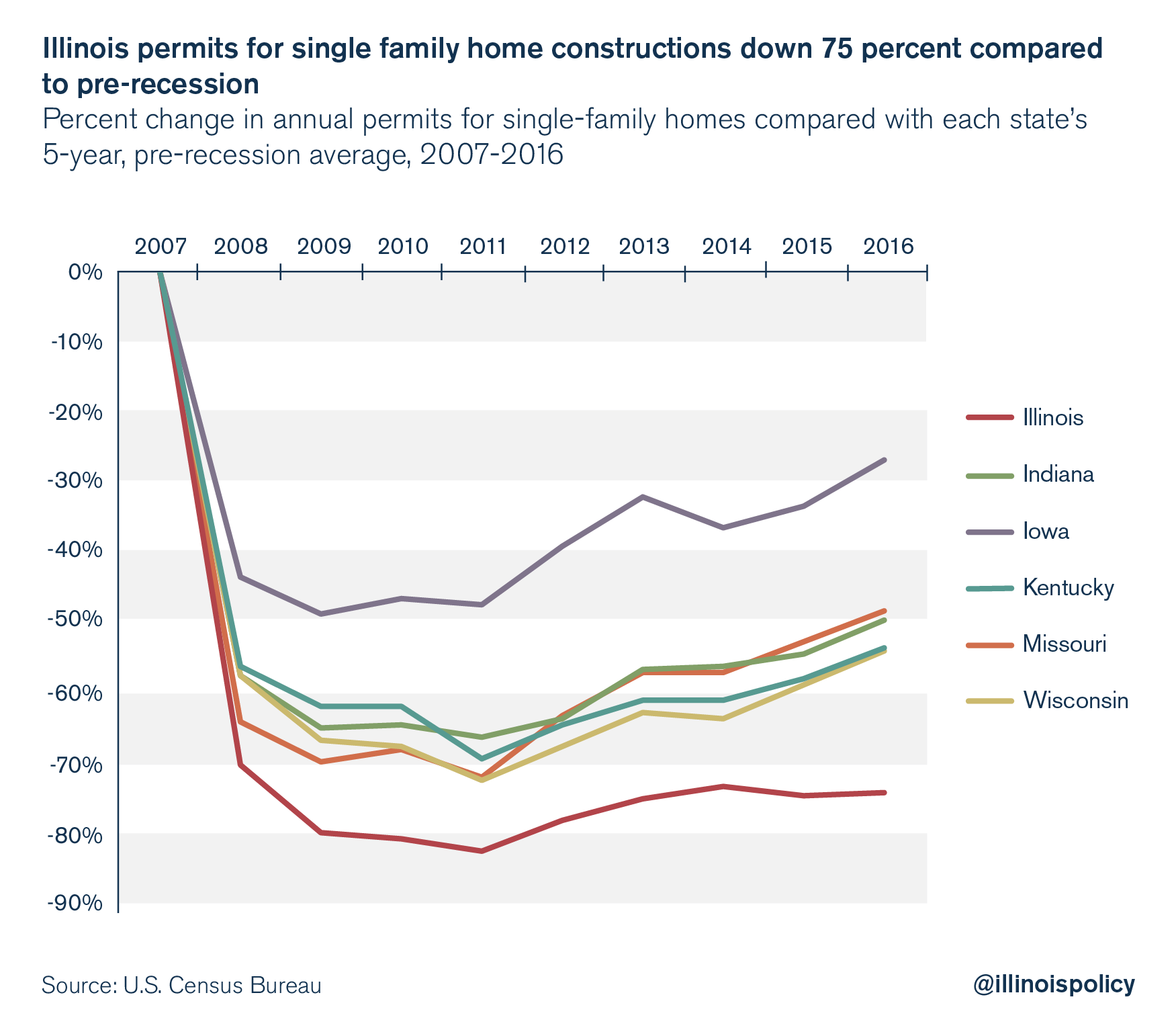

Families looking to put down roots know that buying a home in Illinois is a risky decision, making Illinois’ housing market one of the weakest in the country. In fact, Illinois has the largest decline in applications for single-family home building permits of any state. Housing permit applications are down 75 percent compared with before the Great Recession.

Illinois families deserve real solutions

Illinois families deserve a real property tax freeze that can turn into property tax reductions over time. In order for a property tax freeze to work, state lawmakers need to allow local governments to rein in their spending drivers.

For example, it is nearly impossible to achieve savings on union contracts, construction projects, workers’ compensation costs, pensions and duplicative units of local government without changes in state law.

Lawmakers should treat property taxes with the seriousness that families deserve, but right now they are treating the property tax issue like a political football. Legislators should make every change necessary to provide a longer-term property tax freeze that leads to lower taxes over time.

Property tax levies should be frozen for the long term, and the tax burden for individual homes should be capped in the short term. This would give homeowners security in knowing their individual property taxes can only decrease for several years, while local governments get the tools necessary to stay within the limits of the levy and then to lower the levy over time. The only exemption that should exist is a public vote to raise property taxes.

The failure to enact meaningful property tax relief will allow Illinois’ housing market to deteriorate. Illinoisans should demand that lawmakers commit to protecting home ownership in the Land of Lincoln.