Shell game: Chicago considers plan to borrow $10B to pay off pension debt

Previous pension obligation bonds in Illinois have increased costs to taxpayers and done nothing to solve the fiscal challenges created by the pension system.

The city of Chicago is considering a plan to borrow $10 billion from the bond market to make increased pension payments and reduce unfunded pension liabilities. The plan does nothing to reduce the size of pension liabilities – it merely swaps one type of debt for another.

City officials hope that by injecting more cash into the pension system now, they can leverage a higher rate of return in the pension funds than the interest they will have to pay on the $10 billion bond issuance.

A similar plan for the state pension funds failed to result in long-term savings. Former Govs. Rod Blagojevich and Pat Quinn issued pension obligation bonds to pay into state pension funds in 2003, 2010 and 2011. The total of $17.2 billion in borrowing is expected to cost $30.8 billion to repay, according to the most recent projections. In other words, the last time lawmakers used pension obligation bonds, it increased the cost of pensions to taxpayers by about $13.6 billion.

According to Bond Buyer, the Government Finance Officers Association recommends against the use of pension obligation bonds.

While Chicago Chief Financial Officer Carole Brown said she is vetting the idea with outside investment bankers, it is worth pointing out that those investors stand to benefit from the proposal while facing little to no risk. Officials suggest the plan may leverage a financial vehicle known as securitization, putting taxpayers on the hook by dedicating specific revenue streams to ensure the bonds are repaid. In other words, bondholders would be guaranteed repayment while taxpayers face the prospect of service cuts or tax hikes in the event of a downturn.

According to the Chicago Tribune, other investors are against the idea altogether due to the history of failure of pension obligation bonds, and one of Mayor Rahm Emanuel’s challengers in the upcoming election, Paul Vallas, has already criticized the idea as “kicking the can down the road.”

The city’s four pension funds are currently causing a financial crisis, with $27.6 billion in unfunded liabilities and just about 26 cents on hand for every dollar of pension benefit currently promised. Chicago taxpayers’ share of pension debt is actually even larger because of an additional $14.2 billion of unfunded liabilities accumulated by four independently managed Chicago pension funds which are not part of the city’s budget.

In total, Chicago pension systems are nearly $42 billion in the red.

Moody’s Investors Service currently gives the city a junk credit rating.

A $10 billion bond issuance would do little to solve the city’s pension funding woes, increasing the funding ratio to just 53 percent in the four Chicago-controlled funds, while leaving the systems with $17.6 billion in unfunded liabilities.

Worse, if the pension funds fail to meet their targeted investment rate of returns – a likely scenario if a national recession strikes over the next few years – the long-term cost to taxpayers could increase relative to the status quo as the interest cost of repaying the bonds exceeds what the funds make on investments.

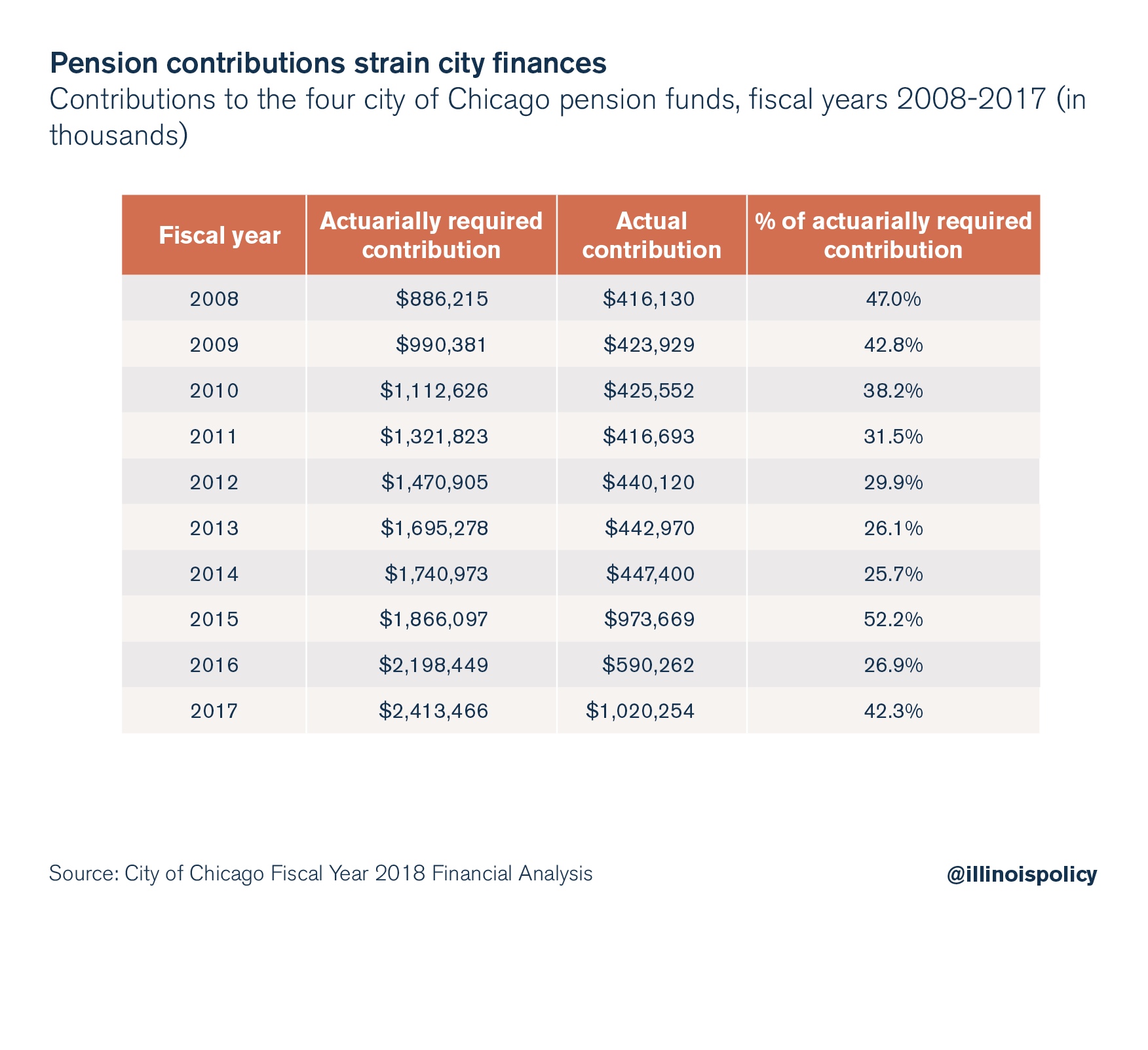

Chicago has struggled to make pension contributions since the last national recession, despite massive tax hikes including a property tax increase of $543 million over four years, new taxes on ridesharing and e-cigarettes, tax increases on water and sewer services and 911 calls, and hikes in fees ranging from garbage collection to building permits.

In addition to these fee and tax hikes, Emanuel has lobbied in the past for legislation – public acts 90-506 and 100-23 – allowing him to make reduced pension contributions from 2015 to 2021 to ease pressure on the city budget in the short term.

But knowingly skimping on contributions without reforming liabilities is what caused a pension crisis in Harvey, Illinois, which led to mass layoffs of police and firefighters. Although Chicago is not fully subject to the type of state revenue intercept that immediately precipitated the Harvey crisis and has significantly greater property wealth, many of the underlying financial pressures are the same. Increasing pension contributions coinciding with growing unfunded liabilities have harmed the city’s credit rating and threaten its ability to deliver core government services.

But knowingly skimping on contributions without reforming liabilities is what caused a pension crisis in Harvey, Illinois, which led to mass layoffs of police and firefighters. Although Chicago is not fully subject to the type of state revenue intercept that immediately precipitated the Harvey crisis and has significantly greater property wealth, many of the underlying financial pressures are the same. Increasing pension contributions coinciding with growing unfunded liabilities have harmed the city’s credit rating and threaten its ability to deliver core government services.

Chicago cannot continue to ignore its pension crisis or take half measures to fight it.

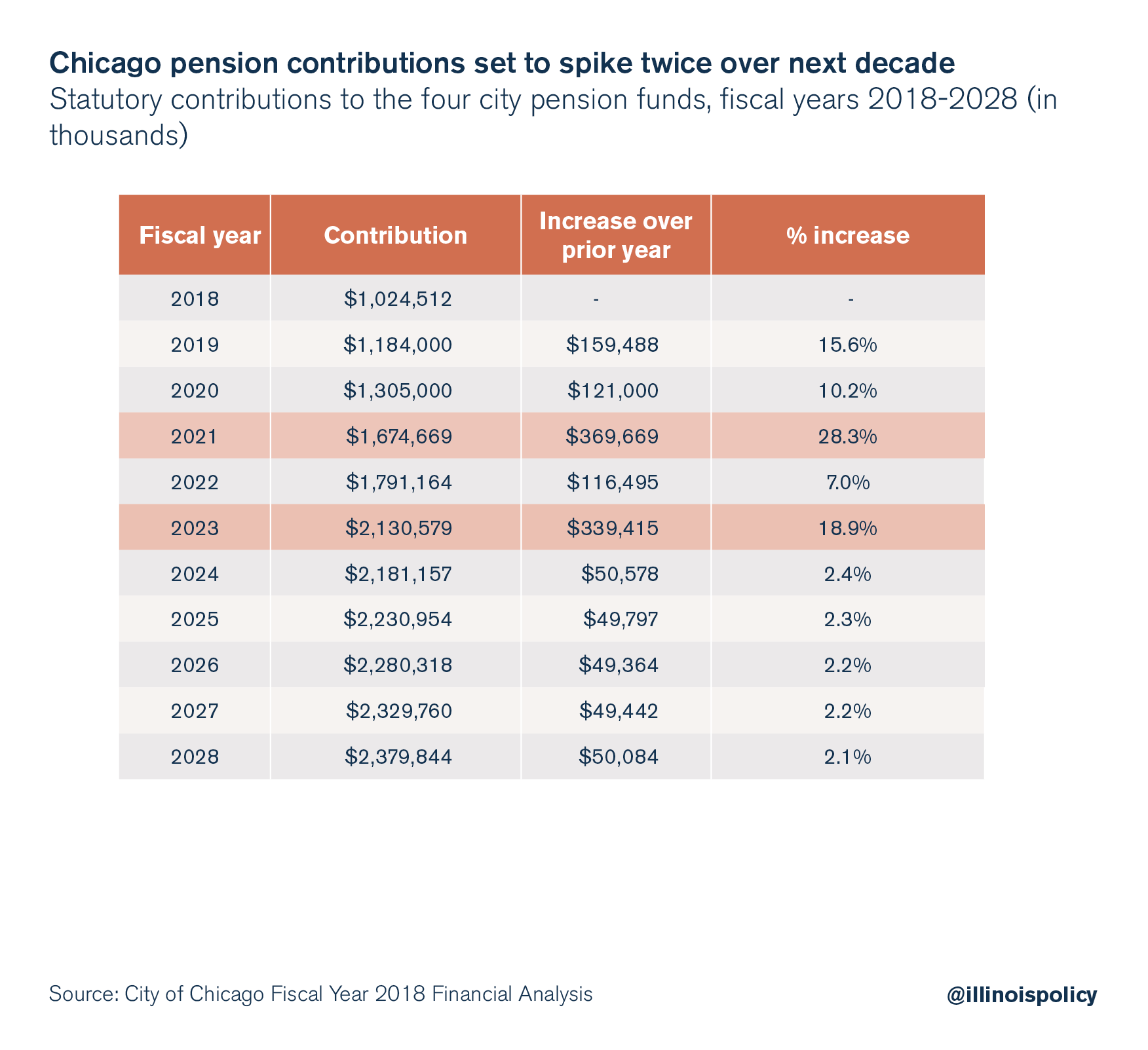

Unfortunately, the city appears to be repeating some of the mistakes the state of Illinois made in managing its own pension systems. In the mid-1990s, Gov. Jim Edgar implemented a system known as the Edgar ramp, which artificially reduced payments during his term of office and increased them for his successors. The scheme had severe negative effects on the health of the state pension systems, similar to what the Rahm ramp has done already in Chicago.

Under Emanuel’s pension funding schedule, contributions are set to spike sharply in the next several years.

Swapping debt and kicking the can down the road with backloaded contribution schedules will never solve the pension problem at the state or local levels.

Illinois’ and Chicago’s only viable option is meaningful pension reform that starts with a constitutional amendment to allow changes to unearned, future benefits. Changes should include raising retirement ages for younger workers, capping maximum pensionable salary, and doing away with guaranteed permanent benefit increases in favor of a true cost of living adjustment pegged to inflation.

An attempted reform effort to the Chicago Park District pension fund that followed the model of future benefits changes would have made significant reductions in the liability, but was struck down as unconstitutional in 2018.

This demonstrates the necessity of a constitutional amendment – not more financial shell games – in putting Chicago’s pension systems on a path to fiscal health.