Rahm’s budget plan phases in $2.5 billion in new taxes and fees over 4 years

Too bad it doesn’t solve any real problems.

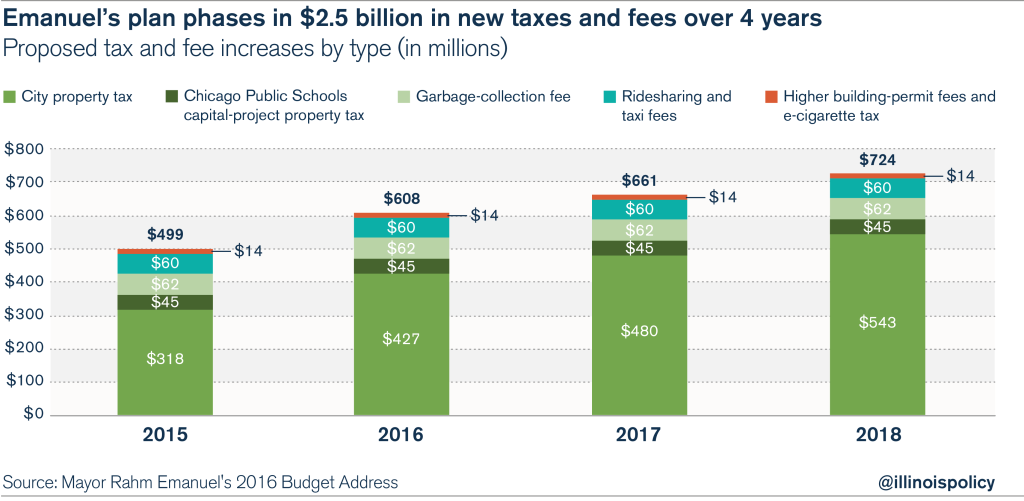

Chicago Mayor Rahm Emanuel’s historically high tax-and-fee proposal will cost taxpayers more than $2.5 billion over the next four years.

Emanuel has called for the largest-ever collection of taxes and fees in modern Chicago history in an attempt to plug the city’s $750 million budget hole, rather than making dramatic reforms to spending.

The mayor has confirmed Chicago’s 2016 budget will include the following hikes:

- A property-tax hike reaching $543 million over four years, to be phased in as follows:

- A $318 million increase in 2015

- An additional $109 million increase in 2016

- An additional $53 million increase in 2017

- An additional $63 million increase in 2018

- $45 million in property taxes to pay for capital projects at Chicago Public Schools, or CPS

- $62 million from a new garbage-collection fee

- $60 million from new fees on taxis and ridesharing services, such as Uber and Lyft

- $13 million from higher building-permit fees

- $1 million from a tax on e-cigarettes

But even with all of this new revenue, Emanuel’s budget plan is based on two assumptions that are not likely to pan out, including:

- The mayor assumes Springfield will approve his request to extend the timeline to repay police and fire pensions by 15 years. If state politicians decline this extension, city contributions to the police and fire pension funds will increase by $500 million in 2015 and 2016.

- Emanuel is also counting on the city’s reforms to the park district pension system being upheld by the courts. These reforms would gradually increase how much money Chicago Park District workers pay into the pension system to 12 percent of their paychecks, up from 9 percent. The plan would also raise the retirement age of those employees to 58 (the retirement age for private-sector works is 67). If these reforms are not upheld, the city’s pension debt will be higher.

What’s worse, these increases in taxes and fees aren’t nearly enough to fix the enormous budget deficit facing CPS and its nearly $10 billion pension shortfall.

Emanuel’s proposal is further proof that Chicago politicians will grasp at anything to make cosmetic changes to the city’s crumbling finances, rather than make difficult but necessary foundational reforms.

The mayor’s proposed tax hikes and fees won’t solve real problems for the city or CPS – they’ll just temporarily fill gaps in the city budget.

There are two reasons why these tax hikes will ultimately fail.

First, as massive as they are, these tax hikes are not nearly enough to cover the full amount of Chicago’s debts. Without real pension and spending reforms, still more property-tax hikes will be needed.

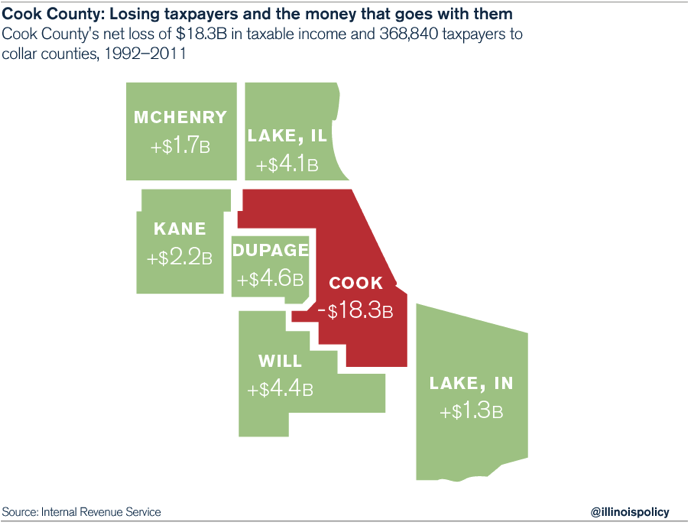

And second, the tax hikes will only serve to shrink Chicago’s tax base, as more residents may flee what was recently named the seventh-most expensive city in the world. More taxes will only accelerate the out-migration of residents that has been going on for decades and has been a boon for Chicago’s collar counties and Lake County, Indiana.

According to Internal Revenue Service data, Cook County lost a net of 379,000 taxpayers to its six neighboring counties from 1992 through 2012, costing the city more than $19 billion in taxable income. When dependents are included, Cook County lost nearly a million people on net during that time period.

In 2011 alone – the first year of Illinois’ historic 67 percent income-tax hike – Cook County lost 9,600 taxpayers and 18,000 dependents on net, which means the county lost nearly 28,000 more people than it gained.

These taxpayers, on net, took more than $900 million in adjusted gross income with them that year.

And the exodus got much worse in 2012, when Cook lost nearly $2 billion in adjusted gross income due to out-migration, and more than 15,000 taxpayers on net.

Chicagoans know these tax hikes and fees won’t be used to pay for improved services such as better roads, classroom needs or increased public safety. Instead, these fees and taxes will only go to pay for old debts and services already rendered, particularly government-worker pensions.

When Emanuel was elected, everyone expected him to take on bold reforms. He would be the one to finally take on government-worker unions and enact the pension and spending reforms former Mayor Richard Daley avoided.

After more than four years in office, Emanuel has abandoned his reform-minded persona. The mayor’s massive tax-hike proposal is the easy way out: sending the bill to taxpayers.