Pritzker progressive income tax model would hike taxes on typical Illinois family

Gov. J.B. Pritzker has pointed admiringly to other Midwestern states’ progressive income tax structures, but taxes on the median Illinois family would go up under all of them.

It is no secret that Gov. J.B. Pritzker wants a progressive income tax for Illinois. What he has not made clear, though, is that a progressive income tax would mean higher taxes on the vast majority of Illinoisans under any of the structures the governor has mentioned.

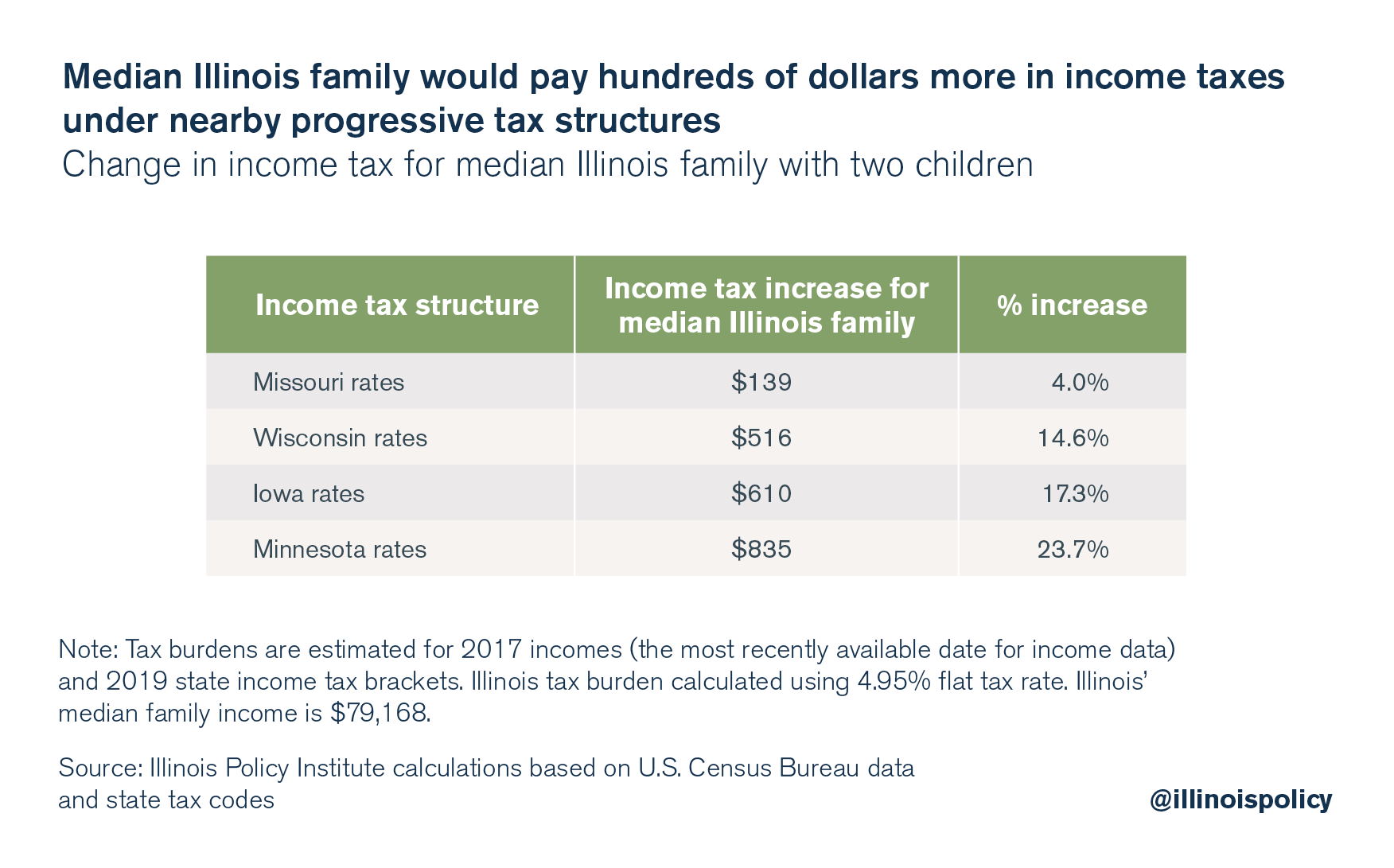

Pritzker said in his Feb. 20 budget address that he will fight to eliminate Illinois’ flat income tax protection and install progressive income tax rates. The governor also insisted his tax plan will bring about a middle-class tax cut. But copying the progressive income tax rates of other Midwestern states would bring about tax hikes of up to $835 a year for the typical Illinois family.

During his campaign, Pritzker pointed to other Midwestern states to give insight into what his preferred tax system would look like. During a radio interview in 2018, Pritzker said:

“You can look at … almost every state in the Midwest, from Minnesota, Wisconsin, Iowa, Missouri, you know, everybody’s got a progressive income tax, and if you look at all of those systems, I think that’s a reasonable way to look at how it works.”

But under each of these states’ tax regimes, the median family in Illinois with an annual income of $79,168 would see their income tax bill increase.

“[Illinois] can accomplish [a progressive income tax] with a more competitive rate structure than Wisconsin or Iowa,” Pritzker said in his budget address. But what he means by this is entirely unclear.

In fact, a recent Tax Foundation study on Wisconsin’s tax code recommended exchanging its progressive income tax for a flat income tax as one way to make the state more competitive. Both North Carolina and Kentucky have swapped their states’ progressive income tax for a flat income tax in recent years.

Calls to copy the progressive income tax structures of nearby states reveal the true cost of eliminating Illinois’ flat income tax protection: heavy tax hikes on middle-class families.

Indeed, the most recent progressive income tax rates filed by an Illinois lawmaker – House Bill 3522 in the 100th General Assembly – would have hiked income taxes on Illinoisans making as little as $17,300 a year.

But Illinoisans simply can’t afford another tax increase. In 2017 the General Assembly passed a 32 percent tax hike, which will inflict further damage on Illinois’ already weak economy. Further, progressive tax states experience slower jobs growth, wage growth and economic growth – and a larger gap between the rich and poor that is widening faster – compared to states without a progressive income tax.

Instead of hiking taxes yet again, the state needs to learn to do what taxpayers do every day: spend within their means. The Illinois Policy Institute’s Budget Solutions 2020 plan provides lawmakers a roadmap to a balanced budget without tax hikes.

Thankfully, lawmakers from both sides of the aisle have already introduced many of the tools Pritzker needs to balance the state budget in the current General Assembly, including a smart spending cap, school district efficiency and constitutional pension reform.

Topics on this page

Sign the petition

Stop the progressive income tax

Sign the petition today to tell your lawmaker to oppose the progressive income tax.

Learn More >