Before COVID-19 downturn, Illinois saw shrinking payrolls and nation’s worst loss of manufacturing jobs

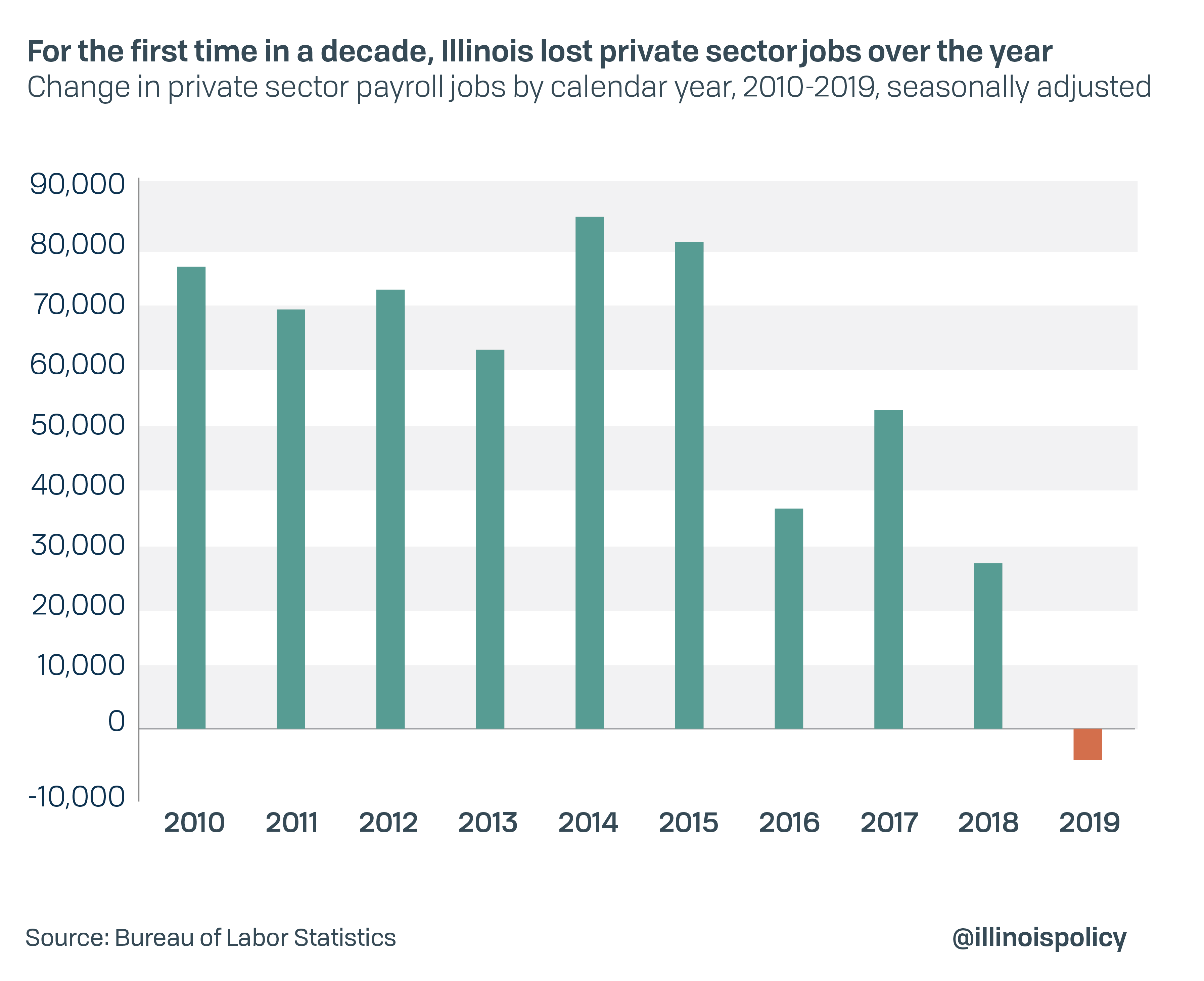

New data show Illinois lost private sector jobs amid a national economic expansion for the first year on record in 2019, a sign of the state’s deep structural problems in the run-up to the current market downturn.

The recent outbreak of COVID-19 and subsequent halt in economic activity has already resulted in the largest number of initial unemployment claims in U.S. history. This unprecedented market freeze will result in heavy job losses in Illinois and across the country.

But newly released federal data show Illinois’ labor market was grinding to a halt before the outbreak, while most other states were experiencing robust jobs growth. In 2019, private sector payrolls in Illinois actually shrank for the first time in a decade.

Illinois leaders in January touted a growing and healthy state economy. That celebration has proven premature. The final 2019 numbers released by the Bureau of Labor Statistics, or BLS, on March 16 show Illinoisans suffered under one of the worst job markets in the nation last year. And monthly payroll numbers in 2020 suggest this trend has not improved in the run-up to the COVID-19 crisis.

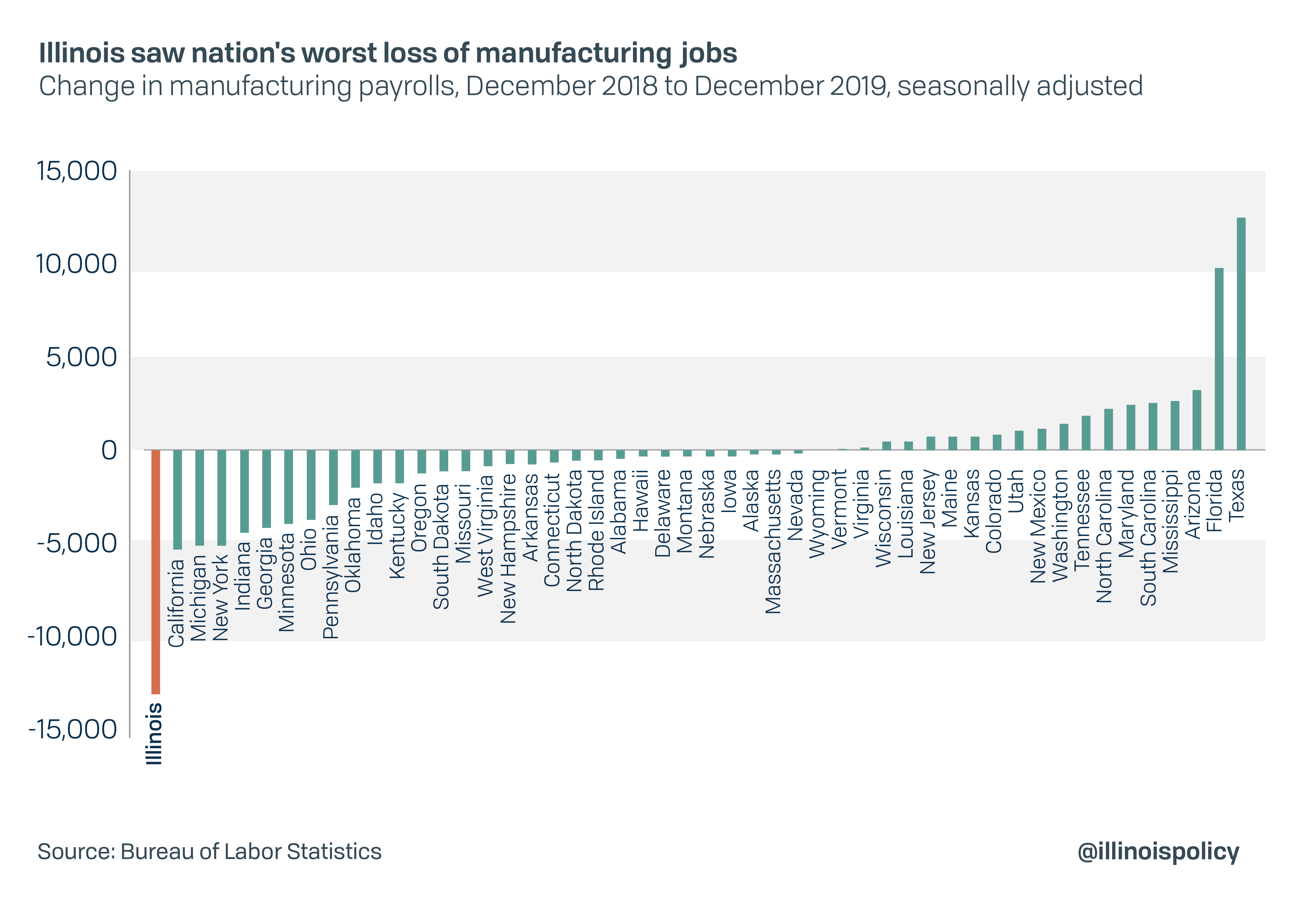

Blue-collar workers in Illinois’ manufacturing sector were especially hard-hit in 2019. Illinois lost 13,100 manufacturing jobs on net over the year – more than double the losses of any other state. In percentage terms, this 2.2% decline in manufacturing payrolls was third-worst in the nation behind Idaho and South Dakota.

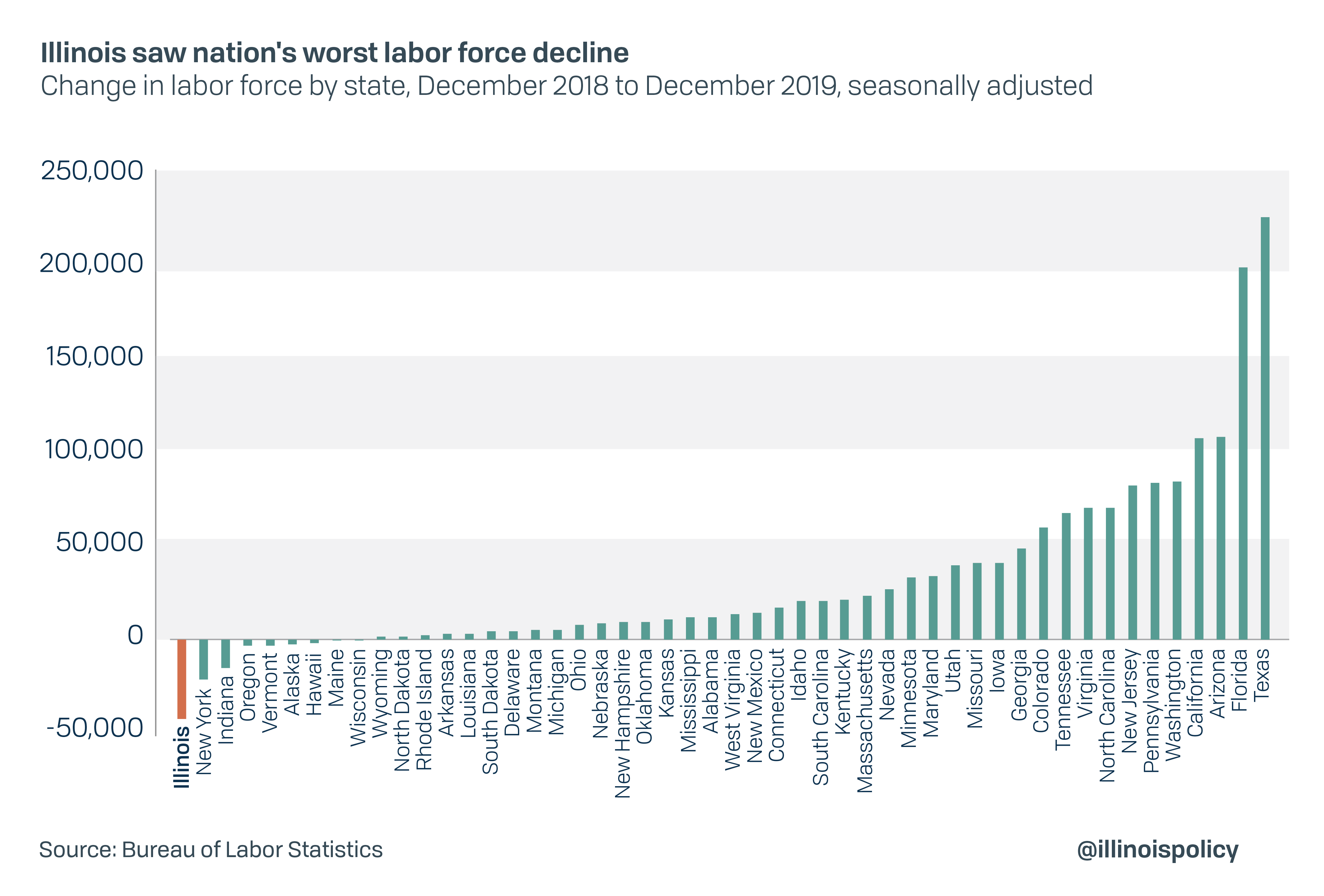

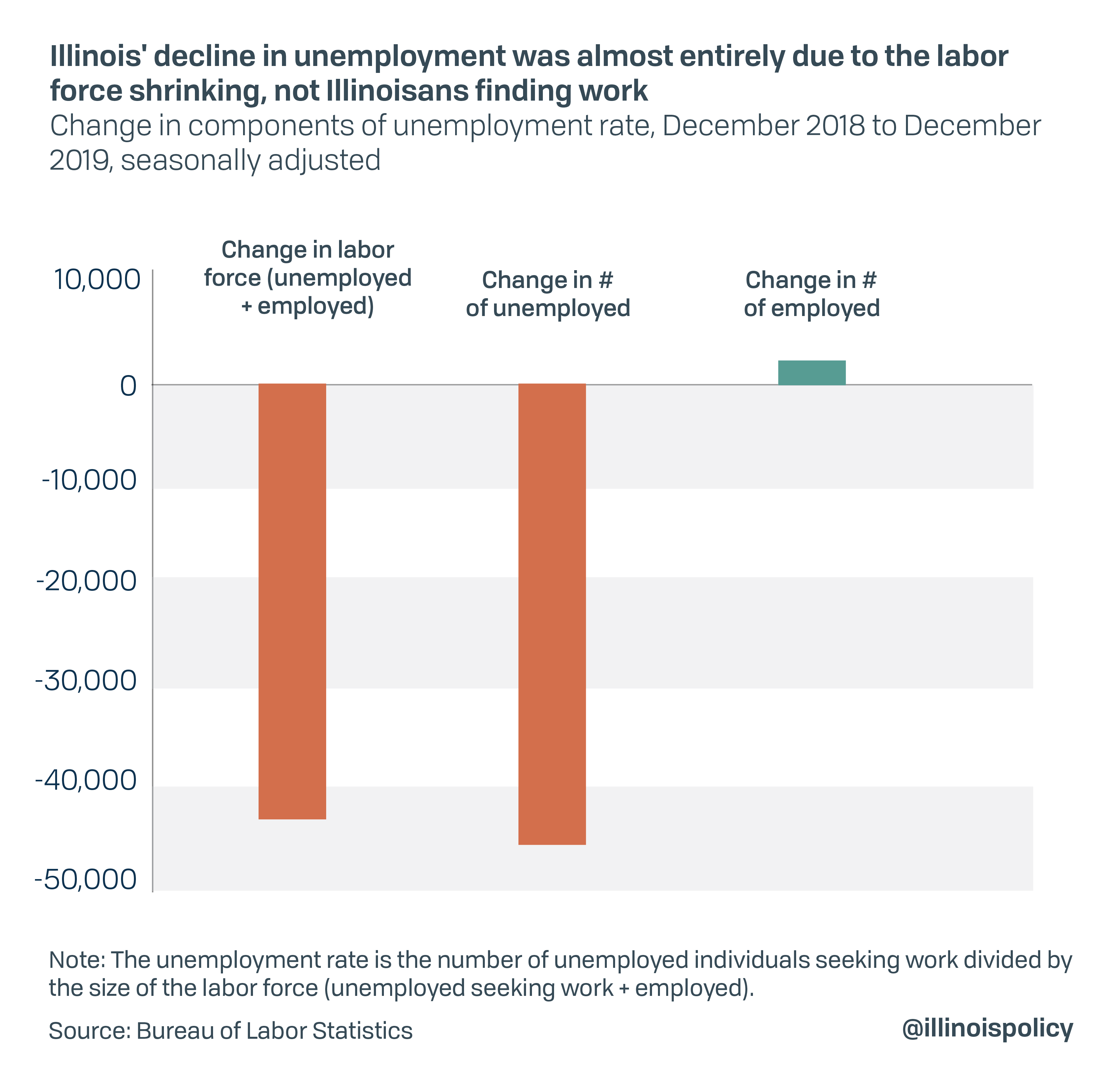

Another celebrated statistic earlier this year was Illinois’ unemployment rate, which declined to its lowest level in history in 2019.

But federal data show this decline was not driven by Illinoisans finding jobs. Rather, it was almost entirely the result of a shrinking labor force – meaning Illinoisans gave up on finding a job or left the state altogether. Illinois’ labor force shrunk by nearly 43,500 people over the year, the worst raw decline of any state in the nation.

This concerning trend in the labor force has also continued into 2020.

As nation expanded private sector payrolls, Illinois shrank

The BLS initially reported Illinois added 45,000 total nonfarm payroll jobs, including 31,600 private sector jobs, from December 2018 to December 2019. However, the preliminary data were revised in March to show the state only added 5,100 total jobs and actually shed 5,200 jobs in the private sector.

This stands as the only year of the past decade where Illinois lost private sector jobs. It’s also the first year since the BLS began reporting this data in 1990 that Illinois lost private sector jobs amid a national economic expansion.

Illinois’ weak performance was an outlier – no state saw a larger raw decline in its labor force. The Land of Lincoln was one of only seven states that experienced a decline in private-sector jobs, and one of only nine to see a decline in the labor force.

Illinois private sector jobs growth ranked 46th in the nation in 2019, beating out only West Virginia, Louisiana, Vermont and Hawaii. When including public sector payrolls, Illinois ranked 43rd for overall jobs growth.

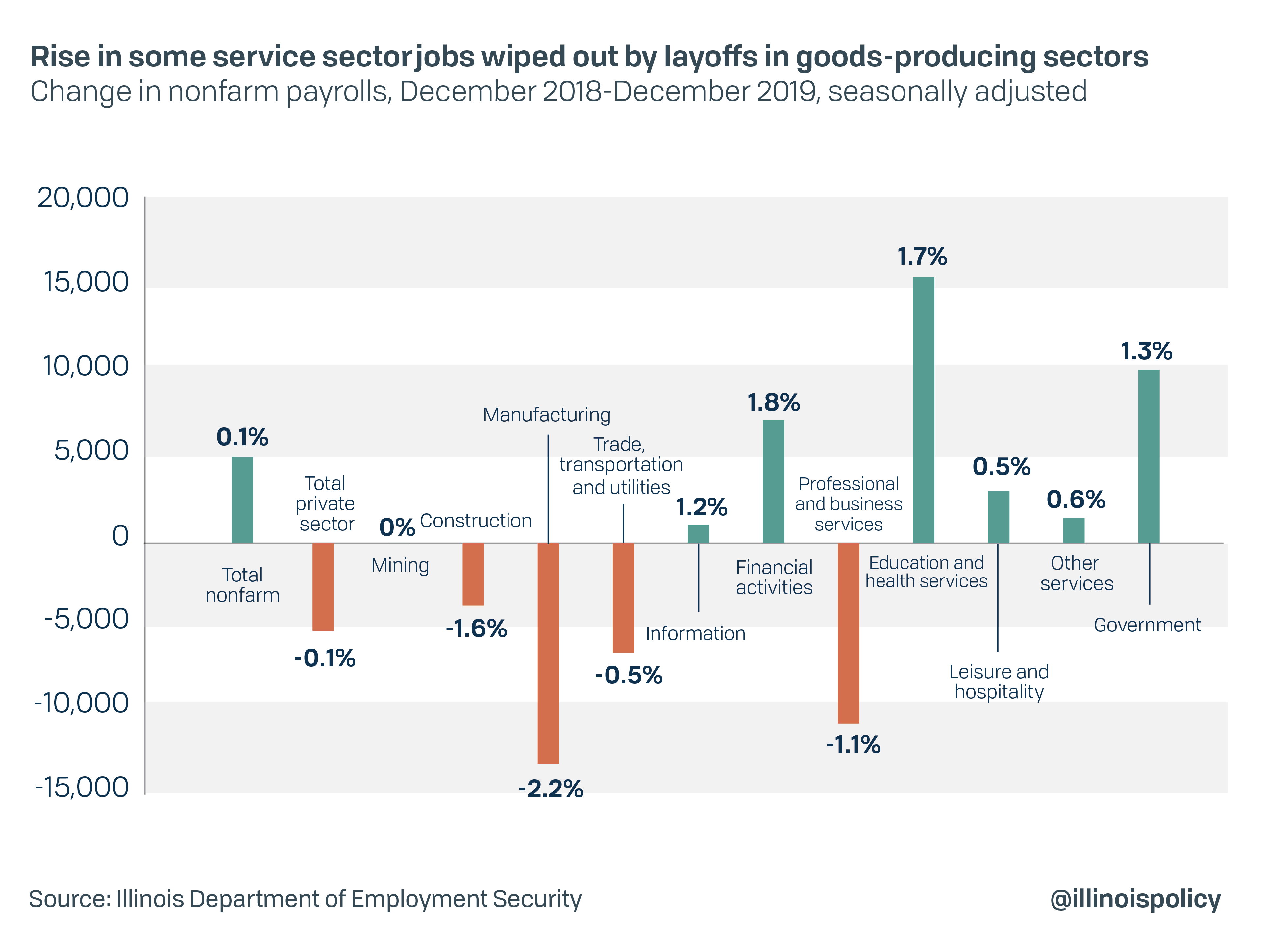

The sectors of the state’s economy that did add jobs were predominately service industries.

The strongest performance was from the financial activities sector, which gained 7,300 positions (+1.8%); followed by the educational and health sector, adding 15,800 jobs (+1.7%); government saw the next largest increase, expanding payrolls by 10,300 (+1.3%); while the information sector added 1,100 jobs (+1.2%); Other services then added 1,500 positions (+0.6%); and leisure and hospitality gained 3,100 jobs (+0.5%).

Meanwhile, several sectors experienced heavy losses over the year, causing the state to actually lose private sector jobs on net. The sector with the biggest contraction in payrolls was the manufacturing industry, which shed 13,100 jobs (-2.2%); construction shed 3,700 positions (-1.6%); professional and business services lost 10,700 jobs (-1.1%); and trade, transportation and utilities lost 6,500 jobs (-0.5%).

Private sector jobs growth is an important measure of the health of the state’s labor market, as public payrolls in Illinois, and the taxes needed to finance them, were already likely negatively affecting private sector jobs growth prior to the decline.

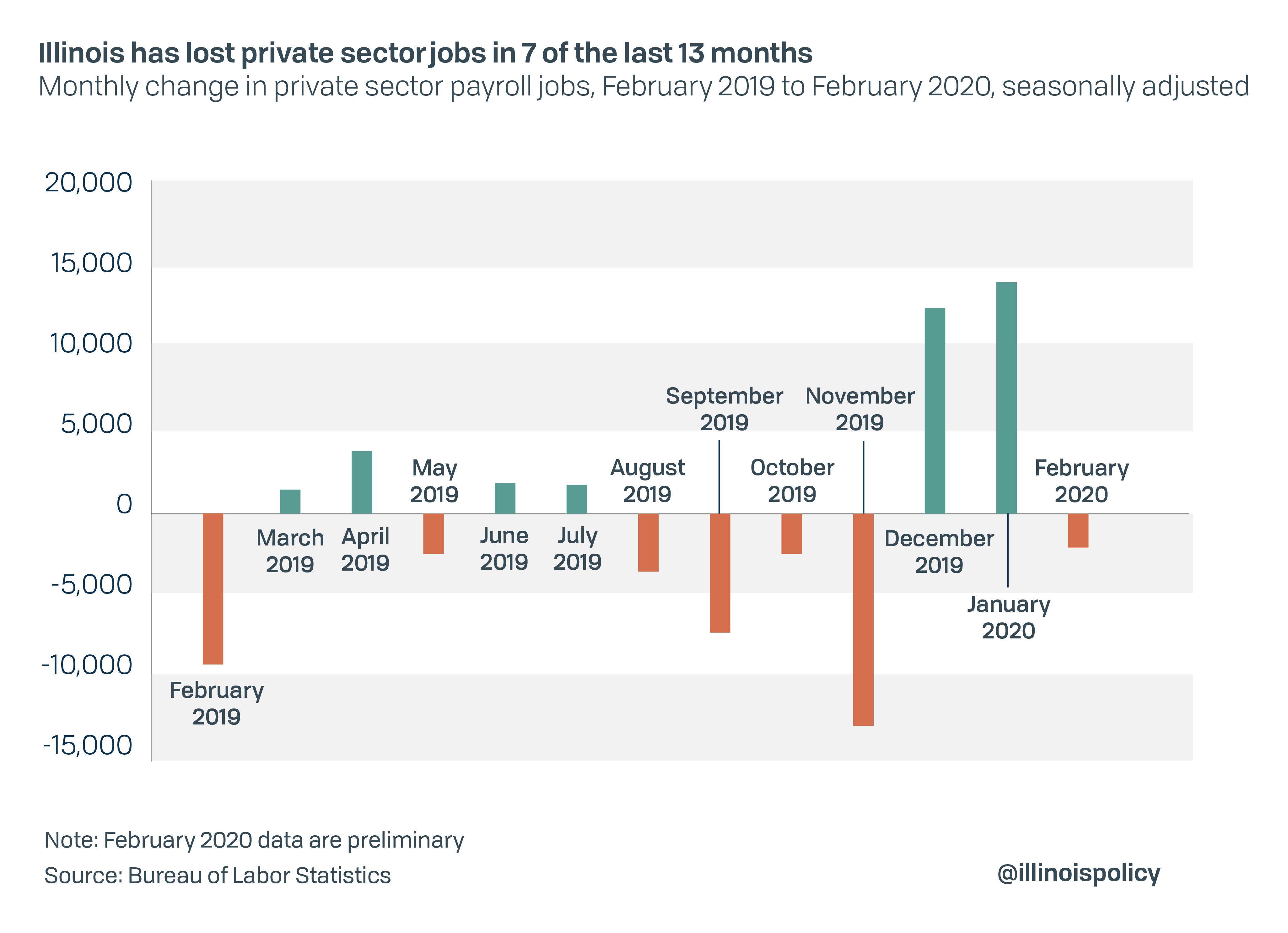

This disturbing downward trend became a normal part of the state’s monthly payroll numbers prior to the COVID-19 outbreak, with Illinois losing private sector jobs in seven of the previous 13 months on record.

Low unemployment rate masked rapid workforce dropout

Despite weak overall jobs growth, Illinois continued to experience a decline in the state’s unemployment rate in 2019. However, this was almost entirely due to more Illinoisans exiting the labor force altogether rather than finding job opportunities.

While the number of unemployed Illinoisans dropped by nearly 46,000 over the course of 2019, roughly 43,500 of that was due to Illinoisans giving up on their search for work in the state, while only 2,500 found jobs.

It should also be noted that Illinois’ population declined by 51,250 in 2019 according to U.S. Census Bureau data (which measures population change from July 2018 to July 2019) and it is very likely that many Illinoisans who exited the workforce left the state entirely during the year. That was the second-worst raw population decline in the nation behind New York, and third-worst in percentage terms behind West Virginia and Alaska.

The state’s labor force has continued to shrink in 2020. The number of employed Illinoisans declined by nearly 17,000 through February and the state’s labor force shrank by more than 34,000.

COVID-19 and the Illinois economy

Large swaths of the economy have been brought to a halt in order to combat the COVID-19 pandemic, and Illinois’ economy is likely to be hit even harder by the economic fallout than most other states. The state’s March jobs numbers – the first to reflect the impact of the pandemic – will be released April 16.

Given the crisis posed by COVID-19, state lawmakers must focus their immediate attention on key public health measures, as well as preventing more job losses and small business closures during the economic freeze.

But when the public health threat subsides, Illinois must ensure it is in the best possible position to recover. Pursuing policies that foster a healthy labor market for employers and employees will be crucial.

Declining public-sector investments despite recent tax hikes, a high overall tax burden, and correspondingly weak labor and housing markets have been the primary reasons Illinois’ economy has struggled while other states have grown.

These are the challenges Illinois leaders must address if they want to provide better opportunities for families across the state.

Unfortunately, lawmakers are considering a major income tax hike, a move that would cost the state even more job opportunities. Further, that tax hike would potentially take effect just as the state starts its recovery from the current, severe market downturn.

Specifically, lawmakers are asking Illinoisans to approve a $3.7 billion progressive income tax hike on the Nov. 3 ballot. Around 100,000 of the state’s largest jobs creators – small businesses known as “pass-through” entities – would see a tax increase under the plan. These are some of businesses most vulnerable to the current downturn.

The state’s immediate future is unclear, as leaders work to address an unprecedented public health crisis. But in the long term, Illinois must do everything possible to alleviate tax burdens – and the uncertainty that comes with tax hikes – for individuals and businesses struggling to recover.