Chicago has nation’s worst travel tax burden

There’s nothing like summer in Chicago – after months of winter weather, the city awakens and becomes a haven for residents and tourists alike. But travelers who come to the city take in its splendor at a high price, on top of what they pay for hotel rooms, dinner and entertainment. Out-of-towners shell out more...

There’s nothing like summer in Chicago – after months of winter weather, the city awakens and becomes a haven for residents and tourists alike.

But travelers who come to the city take in its splendor at a high price, on top of what they pay for hotel rooms, dinner and entertainment.

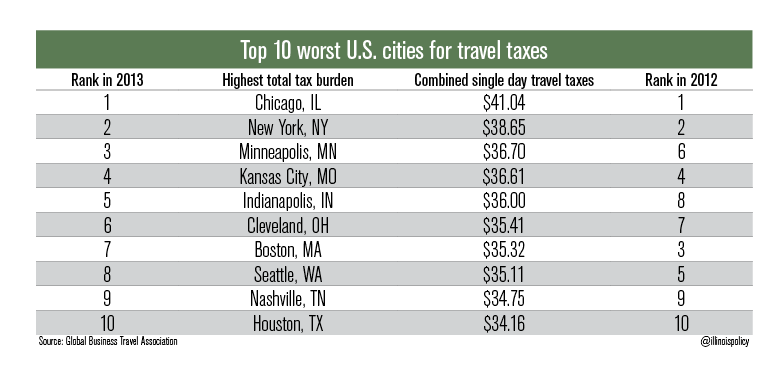

Out-of-towners shell out more than $40 in travel taxes each day they’re here.

That makes Chicago the worst city in the nation for travel taxes, according to the Global Business Travel Association, an Alexandria, Va.-based nonprofit that tracks business travel data and trends. GBTA’s study ranks the top 50 U.S. markets by overall travel tax burden, including general sales tax and discriminatory travel taxes, and by discriminatory travel tax burden, excluding general sales taxes to count only taxes that target car rentals, hotel stays and meals.

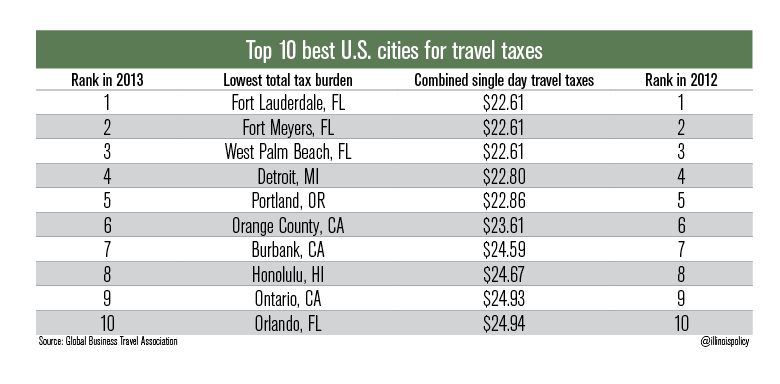

On the opposite end of the spectrum are three Florida cities: West Palm Beach, Fort Lauderdale and Fort Myers, where travel taxes total $23 per day.

It’s no secret that the city of Chicago is looking anywhere for new revenue sources to plug its $63.2 billion shortfall in government-pension funding, health insurance and other debt.

But city leaders should be careful not to squeeze travelers too hard.