Cook County beverage sales decline in wake of pop tax

A new report from Can the Tax and the Illinois Food Retailers Association shows that beverage sales for Cook County retailers are down since 2016.

Beverage sales in Cook County are down since August 2016, according to a new report put together by the Illinois Food Retailers Association and anti-sweetened beverage tax group, Can the Tax Coalition. Can the Tax is a group made up of citizens, businesses and community organizations opposed to the Cook County sweetened beverage tax, and is supported by the American Beverage Association.

The report examines sales numbers from August 2016 and August 2017 volunteered by 32 Cook County stores that participated in the analysis. Of those participating retailers, 75 percent experienced a beverage sales decline of 20 percent or more; 40 percent saw beverage sales decline by 30 percent or more; and 15 percent saw beverage sales decline by 40 percent or more, according to a press release from Can the Tax.

Cook County’s penny-per-ounce, sweetened beverage tax went into effect in August 2017, and it’s not surprising that it’s had an adverse effect on retailers. Cook County’s tax on sweetened beverages is more than five times higher than Illinois’ state tax on beer.

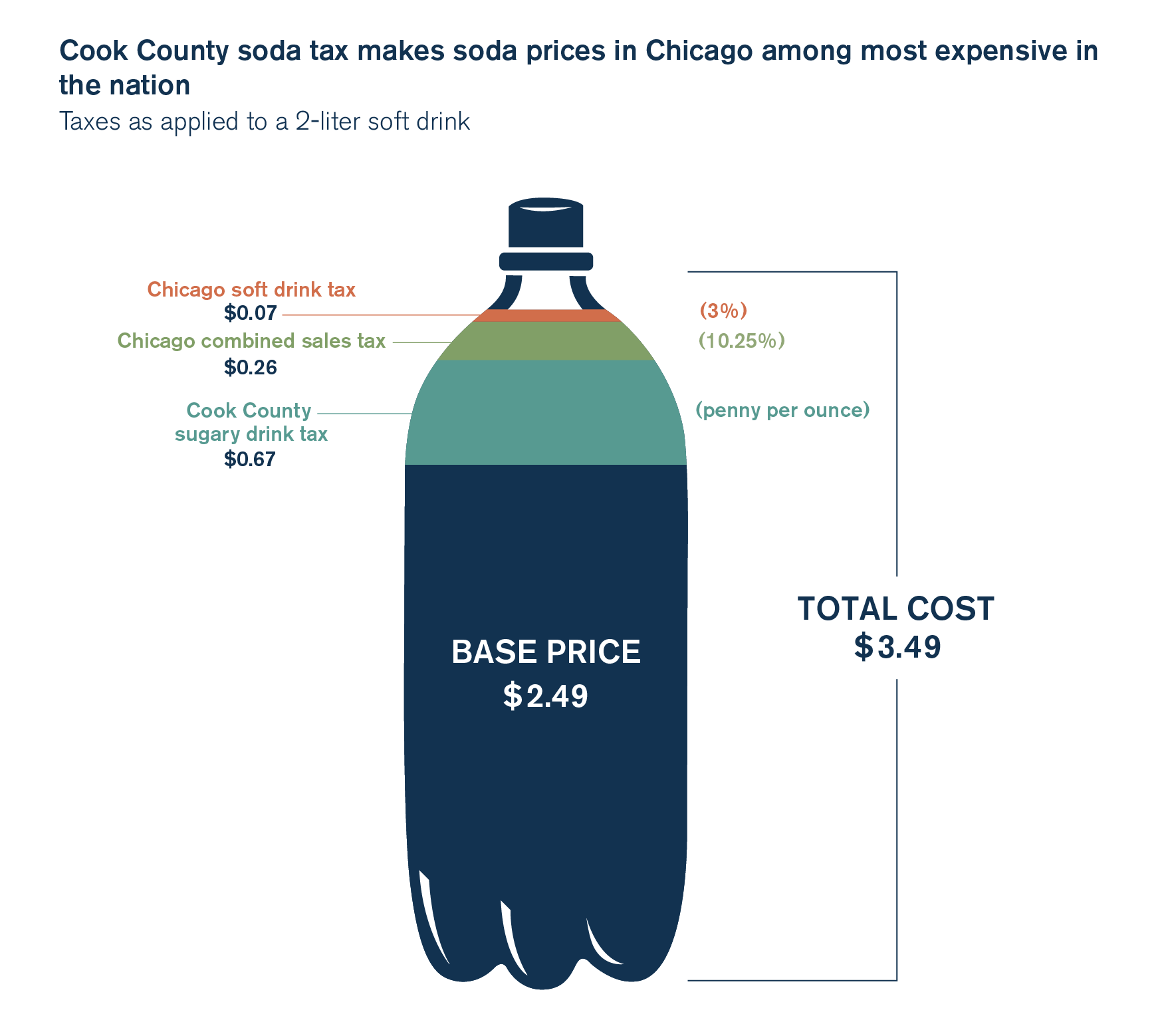

And Chicago residents are hit especially hard. In addition to paying the county’s sweetened beverage tax, Chicagoans already face a 3 percent tax on soft drinks. Along with Chicago’s combined sales tax rate of 10.25 percent, the highest of any major U.S. city, this makes soda sold in Chicago some of the most expensive in the nation. A two-liter bottle of pop with a base price of $2.49 now costs $3.49 in the Windy City, an effective 40 percent combined tax rate on soda.

“The beverage tax is as bad as we expected, but sales have declined at a much quicker pace than we anticipated,” said Frank Guiglio, district manager for Tony’s Fresh Market, in Can the Tax’s news release.

Retail workers are also expected to feel the pinch of declining sales.

“Lower sales means that we have to cut down hours from all employees,” said Laurie Tenuta, district manager for Valli Produce International Fresh Market. “It is not right for them to have to lose hours or have to suffer because of this tax.”

Though commonly called the “soda tax,” Cook County’s sweetened beverage tax applies to most beverages containing artificial sweetener or sugar that are not made to order for customers. This means that soft drinks, diet soda, energy drinks, sports drinks, ready-to-drink teas and coffees, juices that aren’t 100 percent fruit or vegetable juice, and fountain drinks are all subject to the tax.

This latest report is more bad news for Cook County commissioners who voted for the sweetened beverage tax. An August poll of Cook County registered voters commissioned by the Illinois Manufacturers’ Association showed that 87 percent of respondents opposed the tax.

A bipartisan effort to repeal the tax has already gained momentum among a group of Cook County commissioners. A hearing and vote on the tax is expected on Oct. 10.

And although sweetened-beverage tax advocate and former New York Mayor Michael Bloomberg has spent millions on a health-centered ad campaign in support of the new tax, there’s little evidence that this has been effective. A We Ask America poll of Cook County registered voters conducted in September showed that 87.5 percent of respondents believed that commissioners voted for the tax for nonhealth-related reasons.

And other lawmakers are starting to take notice. There are at least two separate bills in the Illinois General Assembly that would effectively repeal Cook County’s soda tax, and some are even saying that Illinois House Speaker Mike Madigan is working to undo the politically toxic tax.

Given the sweetened beverage tax’s widespread unpopularity and crushing impact on Cook County retailers, it’s not hard to see why such a move would be smart politics.