QUOTE OF THE DAY

What happens if states and cities with rising pension obligations have trouble finding investors for their bonds? The local politicos needn’t worry because Sen. Charles Schumer (D., N.Y.) is leaning on federal regulators to ease their fiscal pain.

Mr. Schumer has launched his campaign in response to a new federal rule that does notforce big banks to lend to municipalities. Regulators at the Federal Reserve, Federal Deposit Insurance Corporation and Treasury recently decided not to include state and muni debt in the category of “high quality liquid assets” that banks must hold in case of emergency.

The point of this new liquidity rule is to make sure that in times of market stress big banks have on hand instruments they can easily convert into cash to meet their obligations. In the past banks generally haven’t considered muni paper to be of the highest quality, and with good reason. The regulators note that many muni issues simply do not enjoy deep and liquid trading markets and “financial data from municipal issuers can be inconsistent and vary in timing.”

Barrons: Illinois Pays the Price for a Bad Reputation

A bad reputation could be proving very expensive for Illinois.

Citing a report published earlier this year by the Fiscal Futures Project, analysts at Merrill Lynch warn that the Prairie State pays a risk premium on its general obligation bonds that is disproportionate with its actual default risk.

As Merrill Lynch writes:

While Illinois has “over the last decade, experienced severe fiscal stress,” the findings of the study “suggest that the investors in the municipal secondary markets demand a risk premium for Illinois general obligation debt that is greater than the financial, economic, and fiscal conditions warrant…due to concerns related to the budgetary politics enveloping the state.” This translates, according to the study, to a 7-21-basis-point premium over non-Illinois general obligation debt. “Specifically, all held equal, Illinois general obligation bonds carried interest rates 21, 12 and seven basis points higher for bonds maturing in 5, 10 and 20 years, respectively.”

Chicago Tribune: Wait continues for mobile ticketing on Metra

Accustomed to train delays, Metra riders shouldn’t be shocked to learn that a long-promised test of “paperless” ticketing has been pushed back again.

A pilot program to introduce mobile ticketing using smartphones isn’t likely to be rolled out until the end of the year at the earliest, more likely 2015, Metra officials said.

“When you’re dealing with a project of this magnitude, it’s not as easy as saying, ‘Let’s get it done by the end of the year,'” Metra Executive Director Don Orseno said.

Metra officials predicted in 2012 that a pilot program would be launched the following year. This January, officials envisioned having a tryout for the much-anticipated system this fall.

The Atlantic: It’s Time to Put Humans Back in Charge of Government

The Veterans Affairs scandal of falsified waiting lists is the latest of a never-ending stream of government ineptitude. Every season brings a new headline of failures: the botched roll-out of Obamacare involved 55 uncoordinated IT vendors; a White House report in February found that barely 3 percent of the $800 billion stimulus plan went to rebuild transportation infrastructure; and aMarch Washington Post report describes how federal pensions are processed by hand in a deep cave in Pennsylvania.

The reflexive reaction is to demand detailed laws and rules to make sure things don’t go wrong again. But shackling public choices with ironclad rules, ironically, is a main cause of the problems. Dictating correctness in advance supplants the one factor that is indispensable to all successful endeavors—human responsibility. “Nothing that’s good works by itself,” as Thomas Edison put it. “You’ve got to make the damn thing work.”

Responsibility is nowhere in modern government. Who’s responsible for the budget deficits? Nobody: Program budgets are set in legal concrete. Who’s responsible for failing to fix America’s decrepit infrastructure? Nobody. Who’s responsible for not managing civil servants sensibly? You get the idea.

Chicago Tribune: Land of Lincoln Health to shuffle leadership

Land of Lincoln Health, the startup insurer funded in part by a $160 million federal loan, is shuffling its leadership team ahead of the start of open enrollment in the second year of the Affordable Care Act.

The Chicago-based insurance cooperative, which is affiliated with the Metropolitan Chicago Healthcare Council, plans to announce Monday that Chief Executive Officer Daniel Yunker will step aside from day-to-day operations to take on additional responsibilities with the council. The move is effective Sept. 30.

Jason Montrie, who was formerly executive vice president of Land of Lincoln, will be elevated to president, taking the lead on the insurer’s strategic and operational functions.

Five Thirty Eight Economics: The American Middle Class Hasn’t Gotten A Raise In 15 Years

In 1988, the typical American adult was 40 years old, white and married, with a high school diploma. If he was a man, he probably worked full time. If she was a woman, she probably didn’t.

Twenty-five years later, Americans are older, more diverse and more educated. We are less likely to be married and more likely to live alone. Work is divided more evenly between the sexes. One thing that hasn’t changed? The income of the median U.S. household is still just under $52,000.

The government’s release last week of income and poverty data for 2013 brought renewed attention to the apparent stagnation of the American middle class — not just since the financial crisis hit six years ago this month, but for much of the decade that preceded the crash. The report showed that the economic recovery has yet to translate into higher incomes for the typical American family. After adjusting for inflation, U.S. median household income is still 8 percent lower than it was before the recession, 9 percent lower than at its peak in 1999, and essentially unchanged since the end of the Reagan administration.

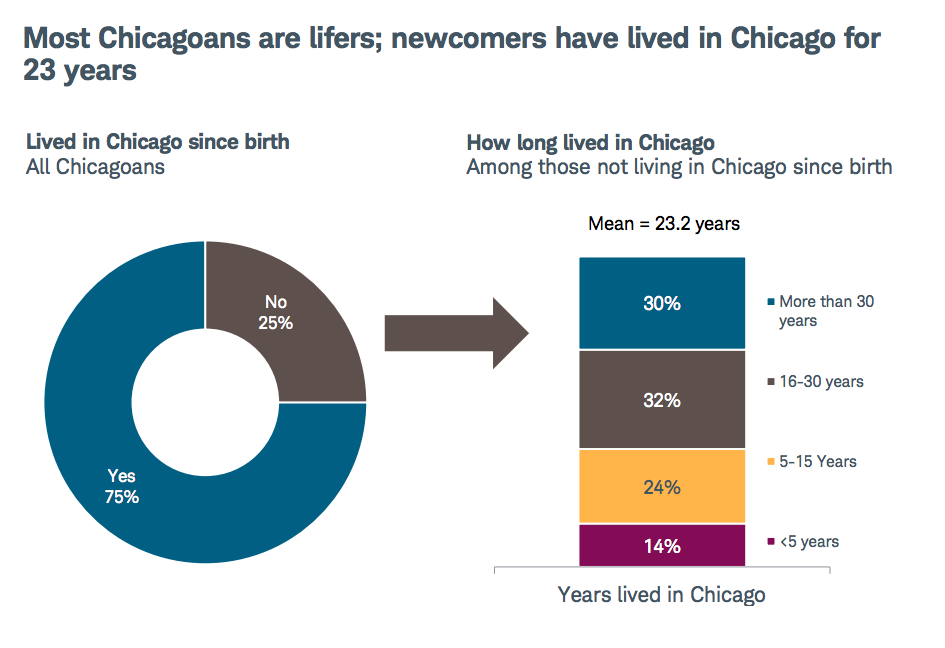

Charles Schwab: The View from Chicago

1,000 residents share their perspectives on life in Chicagoland, the local economy and personal finances.

Yahoo Finance: IRS Lets Thieves Scam Taxpayers Out of $5.2 Billion

Scam artists conned the federal government out of at least $5.2 billion in fraudulent tax refunds last year—and though that estimate is shocking enough—the amount is likely much higher, auditors warned on Monday.

Identity tax refund fraud has ballooned in recent years as electronic filing gives thieves an easy way to use STOLEN SOCIAL SECURITY NUMBERS and simply file phony tax returns. Though the electronic filing has made the tedious process more bearable and user-friendly for taxpayers, it has also made it much easier for criminals to scam the system.

Daily Herald: Chicago Symphony Orchestra considering Naperville for a summer home

The Chicago Symphony Orchestra is considering a privately owned site in Naperville as a location for a permanent outdoor concert venue.

But DuPage County Board Chairman Dan Cronin says a lot has to happen before the proposal becomes a reality.

“It’s not a done a deal. It’s far from it,” Cronin said. “They have to think about exactly how much money it’s going to cost, what’s feasible, what’s practical.”

Tech Crunch: Lyft Acquires Shared Ride Startup Hitch To Bolster Its Lyft Line Service

Shared rides are becoming all the rage, with new transportation companies all offering their users a way to lower fares while splitting their commute with a stranger. One of the first services to focus on that capability was a startup called Hitch, which launched before Lyft Line, before UberPool and before Sidecar Shared Rides. The Hitch founders today will be joining one-time competitor Lyft in order to boost that company’s own shared ride offering.

Terms of the deal weren’t disclosed, but Hitch will be shutting down and its founders will be working to bring some of what they had built into the Lyft Line product. This isn’t the first talent acquisition Lyft has made to support its shared rides initiative. Earlier this year, the company brought on board the team behind Rover to help build the Lyft Line product.

Like the Rover guys, Hitch’s founders Snir Kodesh and Noam Szpiro got their start by building a San Francisco-based ride aggregation service called Corral Rides. The idea was that it would bring together access to services like Uber, Lyft, and SideCar, as well as public transportation times, all on a single app. But it didn’t take long before competing companies shut down access to their services.

Chicago Tribune: Emanuel wants to decriminalize pot statewide

Mayor Rahm Emanuel on Tuesday plans to call on state lawmakers to decriminalize marijuana possession statewide and to reduce the penalty to a misdemeanor for those caught with 1 gram or less of any controlled substance, according to City Hall sources familiar with the plan.

Chicago already passed a law in 2012 that allowed police to issue tickets of $250 to $500 for someone caught with 15 grams or less of pot — the equivalent of about 25 cigarette-sized joints. Emanuel will recommend at a state legislative hearing Tuesday that lawmakers apply the provision to all of Illinois, Emanuel administration sources said late Monday.

The idea of changing possession of small amounts of any controlled substance from a felony to a misdemeanor is a new step for Emanuel, although such reductions in sentencing have been pushed by other elected officials, including Cook County Board President Toni Preckwinkle.

Crain’s Chicago: U.S. cracks down on overseas tax moves

The U.S. Treasury Department announced steps that will make it harder for U.S. companies to move their addresses outside the country to reduce their taxes, clamping down on the practice known as inversions.

The rules, which apply to deals that close today or after, include a prohibition on “hopscotch” loans that let companies access foreign cash without paying U.S. taxes and curbs on actions that companies can take to make an inversion attractive for tax purposes.

Treasury Secretary Jacob J. Lew told reporters on a conference call today that he wanted to make companies think twice before considering an inversion. He said Treasury also is reviewing other potential actions it can take.

CARTOON OF THE DAY