Decatur’s out-of-control pension costs

Our recent comprehensive report, “The crisis hits home: Illinois’ local pension problem,” reviewed the fiscal health of Illinois’ 114 largest cities to measure the impact of pension costs on taxpayers, city services and the security of city-worker pensions. Decatur received one of the lowest scores as a result of out-of-control pension costs. Here’s why: Taxpayers...

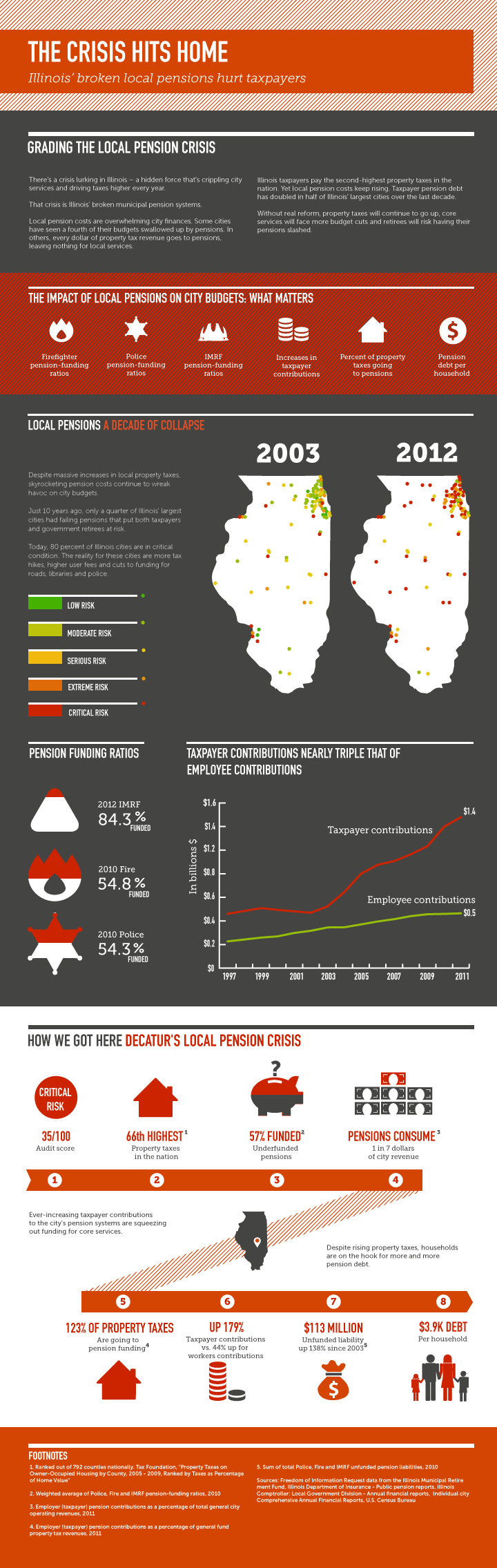

Our recent comprehensive report, “The crisis hits home: Illinois’ local pension problem,” reviewed the fiscal health of Illinois’ 114 largest cities to measure the impact of pension costs on taxpayers, city services and the security of city-worker pensions.

Decatur received one of the lowest scores as a result of out-of-control pension costs.

Here’s why:

Taxpayers are tapped out. Since 1999, taxpayer contributions toward city-worker pensions costs have tripled to more than $9 million, three times faster than the rate of inflation.

Taxpayers are now putting in $3.50 for every $1 city employees put into the pension system.

And yet Decatur households are on the hook for more than double the amount in city-worker pension debt compared to a decade ago.

Pension contributions are squeezing out core services. Pension costs are squeezing out spending for infrastructure and overall city core services. Contributions to pensions consumed 18 percent of the budget in 2012, double the amount in 1999.

City worker retirement funds continue to be underfunded. Collectively, Decatur’s pension funds have just more than 65 percent of what they need to pay for future obligations. And things will only get more difficult. The city is nearing a point where it will have more police and firefighter retirees drawing from the pension funds than active workers contributing to it.

A recent article by the Herald & Review highlighted some differences Decatur City Manager Ryan McCrady had with our report.

But McCrady agreed with the overall assessment – “the pension-funding problem is impacting city operations. It’s impacting our capital investments. I don’t disagree with [the Illinois Policy Institute] on any of that.”

Even the Herald & Review agreed: “Pension contributions have presented such a great financial challenge for the city in recent years that it has turned to other sources to supplement the money from property taxes.”

That was precisely the point of our report. Decatur’s general fund property tax revenues, those that aren’t already dedicated to items such as bond repayments, are no longer enough to pay for the city’s pensions.

McCrady and the Institute also agree that pension legislation must change. Today, cities have no control over pension benefits – they are dictated by state lawmakers.

“Basically, [state legislators] write the check and we put the money in the bank to cash it. That’s very frustrating,” McCrady said.

But McCrady also had a few concerns.

He felt our report was an attack on the city’s management of pensions. Far from it. The report highlights the impact of rising pension costs and calls for changes in state pension laws, but it doesn’t criticize city officials.

McCrady also questioned the Institute’s motivation for the report. He shouldn’t. City officials across the state are sounding the alarm about the growing pension crises in their own communities.

Our report gives a voice to their concerns.