Detailing Rauner’s pension plan

Rauner’s initial pension proposal helps him achieve his goal of a balanced budget without tax increases. But it will take a comprehensive, 401(k)-style reform plan to solve the pension crisis once and for all.

Gov. Bruce Rauner’s first budget plan for the state of Illinois removed a $6.2 billion structural deficit without relying on tax increases.

The pension portion of his budget proposal focuses on reining in costs by making changes to the current state-run pension plans while also giving many government employees the opportunity to control at least part of their own retirements with 401(k)-style plans going forward.

According to the governor’s estimates, this approach reduces the state’s 2016 pension payment by $2.2 billion. The plan reduces the state’s total unfunded liability by an estimated $25 billion, to levels last seen in 2011. Should Senate Bill 1 – the pension law passed in 2013 that sits before the Illinois Supreme Court – be found constitutional, both the savings on the annual payment and the reduction in the unfunded liability from Rauner’s proposal could be even greater.

While Rauner’s new pension-reform plan achieves significant budget savings and helps balance the budget without tax increases, Rauner will still need to develop a plan that ultimately ends the state’s pension crisis by moving all new and current employees to a comprehensive 401(k)-style plan – a reform he proposed during his campaign.

Rauner’s current plan does partially introduce 401(k)-style plans by giving Tier 1 employees an optional “buyout” plan. The buyout would allow employees who started work before 2011 to enroll in a defined-contribution plan. Employees who choose this option will receive a lump-sum payment to be used as a starting balance for a defined-contribution plan in exchange for a voluntary reduction in their cost-of-living adjustments.

The details of the 401(k)-style plan are yet to be made public, so it’s difficult to know how attractive the benefits are. And it isn’t clear if this option will be available to current Tier 2 employees. The option to manage one’s own retirement fund should be given to all government workers.

The core of Rauner’s pension proposal caps the current Tier 1 pension plan (the plan for public employees hired before 2011) and moves Tier 1 employees into the state’s Tier 2 defined-benefit pension plan. Already-earned benefits would be protected and paid out under Tier 1, but all future benefits would be accrued under the Tier 2 plan.

The governor believes this approach is more likely to pass constitutional review, because it focuses on changing future benefits that have yet to be earned.

According to the governor’s budget book for fiscal year 2016, details of the plan also include changes to:

- Retirement age: Benefits earned before July 1, 2015, could be obtained at the retirement ages now in law, but payment of newly earned benefits could not commence until age 67.

- High-salaried pensions: A cap on the final average salary used to calculate benefits will be placed on newly earned benefits for high-salaried pensions. This cap increases annually.

- Salary spiking: To prevent late-career teacher salary spikes that drive up decades of benefits, the end-of-career salary cap will be changed from the current 6 percent per year to the prior year’s increase in the consumer price index. Any pension costs caused by salary increases above inflation will be paid by the local employer.

- Overtime pay: Going forward, overtime pay will not be counted in an employee’s final average salary. This reform also prevents expensive lifelong benefits triggered by short-term salary spiking.

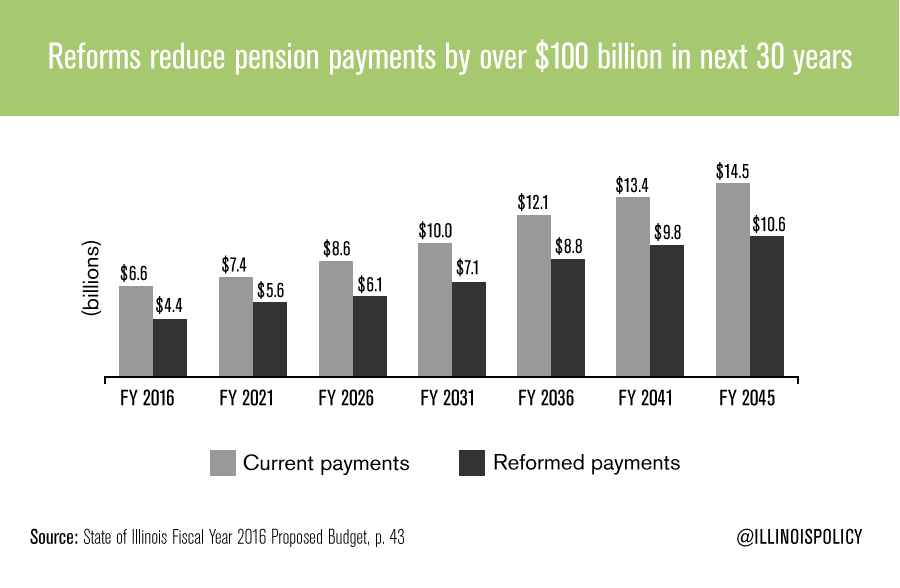

Rauner’s plan reduces pension payments by over $100 billion in the next 30 years. However, the plan maintains a repayment ramp. State contributions rise to $10.6 billion in 2045 from $4.4 billion in 2016. Future reform plans will need to address the repayment ramp in order to reduce pressure on future budgets.

Rauner’s initial pension proposal helps him achieve his target goal of a balanced budget without tax increases. But it will take a comprehensive 401(k)-style reform plan – one that caps the current politician-run, defined-benefit pension plans and moves all new and current public employees into 401(k)-style retirement plans going forward – to solve the pension crisis once and for all.

The General Assembly will need to move any reform attempts through the legislative process, and the Illinois Supreme Court has announced oral arguments on the constitutionality of Senate Bill 1 will be heard on March 11. The court’s ruling will have important implications for how Rauner and the General Assembly will handle pension reform in the near future.