Egan-Jones on Chicago, S&P blames Moody’s and a message to bondholders

Taxpayers need protection when municipalities go bust.

Egan-Jones chimes in

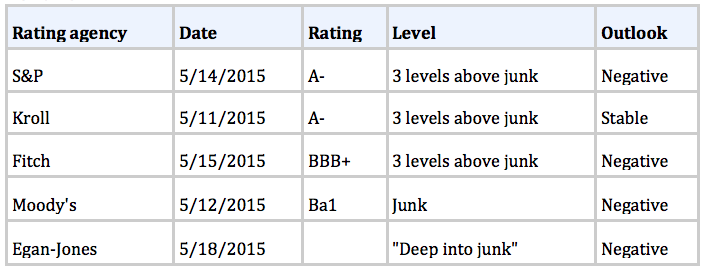

When I asked Sean Egan of the rating agency Egan-Jones how he would rate Chicago general-obligation bonds, “deep in junk territory” was his response.

Here is a table I put together of various rating agencies, incorporating Sean Egan’s remarks.

S&P blames Moody’s

Here’s an amusing take on passing the buck courtesy of Pensions & Investments on the debt downgrades:

“ ‘Chicago’s problem now is that it faces ‘short-term interference,’ S&P said. ‘That said, we recognize that the city has a diverse tax base and a management team that has good policies in place. These are an important foundation for any city that needs to address the challenges that this city is facing.’

“Lois Scott, the city’s chief financial officer, said in a statement: ‘The city of Chicago’s financial crisis is real, urgent, and has been decades in the making. The downgrade by Moody’s of the city’s credit — a decision they say was driven by the Illinois Supreme Court’s reversal of the state pension reform bill — has substantially magnified the city’s challenges and will add real costs to Chicago’s taxpayers. In fact, S&P noted Friday that its own downgrade is driven by the short-term pressures on the city’s fiscal position that were created by Moody’s actions earlier this week. However, unlike Moody’s, S&P recognizes the city’s efforts to not only address its legacy liabilities, but that it has the right tools in place to address the challenges it faces.’”

Rate shopping

For a discussion of how the U.S. Securities and Exchange Commission is to blame for the current environment of fantasy bond ratings, click here.

In that link I explain in detail how it is that one rating agency has Chicago “deep in junk” while others have Chicago rated A-.

99% haircut

As The Bond Buyer reports, “San Bernardino Chapter 9 plan gives bondholders worst cut of all”:

“San Bernardino, California, is now planning to give bondholders significantly worse treatment than they have received in any municipal bankruptcy to date, Moody’s Investors Service said in a comment piece Monday.

“The bankruptcy plan of adjustment city officials presented to the city council on Thursday ‘proposes to eliminate 99% of the principal value of its pension obligation bonds, while committing to pay 100% of its unfunded pension liability,’ Moody’s credit analysts wrote.

“‘The implication of the ruling is that the use of POB proceeds to fund pensions is irrelevant to how the bonds are to be treated in bankruptcy, and therefore retirees are under no obligation to share losses with bondholders,’ according to Moody’s.

“‘The ruling and the plan of adjustment are credit negative for San Bernardino’s POB investors.’ Moody’s wrote in the comment. San Bernardino proposed in its adjustment plan to only provide pension obligation bondholders with a 1% recovery.

In Stockton, POB holders received a roughly 41% recovery, while bondholder recovers in Vallejo were roughly 60%. Vallejo did not have POBs.

“‘By leaving pensions untouched, however, the city’s financial operations will remain strained by rising pension costs,’ Moody’s wrote about San Bernardino. ‘Under the city’s projections, pension costs will nearly double over 10 years to nearly 19% of expenditures.’”

Bondholders and taxpayers get short end of the stick

San Bernardino city officials made a purposeful decision punish bondholders and taxpayers:

“‘By leaving pensions untouched, however, the city’s financial operations will remain strained by rising pension costs. Under the city’s projections, pension costs will nearly double over 10 years to nearly 19% of expenditures,’ says Moody’s.”

Moody’s dramatically understates the problem because it does not factor in the likelihood of negative returns on stocks and bonds.

Conflict of interest

Federal bankruptcy courts ruled four times that cities can cut pensions. So far, cuts have been token. In the case of San Bernardino, nonexistent.

Why?

The answer is simple: a conflict of interest. City officials wanted to preserve their own ill-gotten and undeserved pensions.

Message to bondholders

The decisions in Detroit; Stockton, California; San Bernardino, California; and Vallejo, California, send a clear message to bondholders: Don’t buy or hold municipal bonds in any municipality plagued by pension woes. You’ll be sorry if you do.

That’s why I agree with this Chicago Tribune editorial by Henry J. Feinberg, who says, “pass a bankruptcy law, give taxpayers a chance.”

Pending Illinois legislation, House Bill 298, will allow Illinois municipalities to go bankrupt, a badly needed measure. Feinberg’s editorial seeks to amend HB 298 so people who hold Illinois bonds have a “secured first lien,” the fancy words needed in the law to make sure bondholders are first in line to get their money back.

My concern is not for bondholders. Rather, it’s for the taxpayers. In the great financial crisis bailing out the banks at taxpayer risk was precisely the wrong thing to do.

In this case, taxpayers are punished once again. They will have to pony up for inevitably higher borrowing costs. And the sorry situation is that none of the cities really solved any long-term problems.

In bankruptcy, the city could have at least done something to protect taxpayers down the road. Instead, corrupt and greedy city officials protected their own interests.

When the stock market takes another dive, and it will, San Bernardino pensions will again be deeply underfunded.

Another crisis coming

Since no long-term issues have been solved anywhere, expect another pension crisis down the road in a number of already-bankrupt California cities.

Meanwhile, I repeat my warning: Don’t buy or hold municipal bonds in any municipality plagued by pension woes.

Image credit: TheeErin