Fitch warns against CTBA’s reckless pension plan

Fitch Ratings has issued a warning about a pension plan pushed by one Illinois think tank, which includes no reform and would harm the state’s credit rating. The response from the Center for Tax and Budget Accountability proves how indefensible the plan really is.

One Chicago-based think tank is claiming an accounting game can solve Illinois’ worst-in-the-nation pension problem. And Illinois’ incoming governor may be taking it seriously.

Fitch Ratings, a credit ratings agency, warned that the plan could lead to further deterioration of the state’s near-junk credit rating. In the warning, Fitch echoed concerns voiced earlier by the Illinois Policy Institute.

The plan – pushed by the Center for Tax and Budget Accountability, or CTBA – fails to reform the system and risks repeating many of the mistakes that got Illinois into its pension mess to begin with.

The plan relies on massive new borrowing from pension obligation bonds, which both professional government finance organizations and ratings agencies warn against, and keeps the systems more underfunded for longer by reducing the funding target to 70 percent from 90 percent and extending the repayment ramp.

Springfield-based political blogger Rich Miller posted a response from CTBA that paints the group’s plan as an even worse deal for taxpayers than it originally appeared to be.

First, according to Daniel Hertz from the CTBA, getting an arbitrage benefit – or betting that the rate of return on pension fund investments is higher than the yield on the bond debt, thus saving money in the long term – is not even a goal of the plan.

Second, Fitch researchers noted that the CTBA plan uses proceeds from pension obligation bonds for budget relief. But Hertz claims the plan does not. He’s wrong, and here’s why:

While the CTBA plan actually makes pension contributions more expensive for taxpayers in the short run, it explicitly decreases contributions in the long run by lowering the funding target and extending the payment schedule. This is part of the basis for Fitch’s warning against the CTBA plan.

But the CTBA’s response gets even stranger from there.

Hertz acknowledges that a national recession is becoming “increasingly likely,” as the U.S. is currently in the 10th year of one of the longest economic expansions on record and a yield curve inversion, which often predicts recessions, appears imminent. This means now is the worst time to consider a pension obligation bond, since the arbitrage gamble seems sure to fail as investment returns for pension funds fall during a recession. CTBA’s plan is equivalent to going all in on a blackjack hand when you know the dealer has 21.

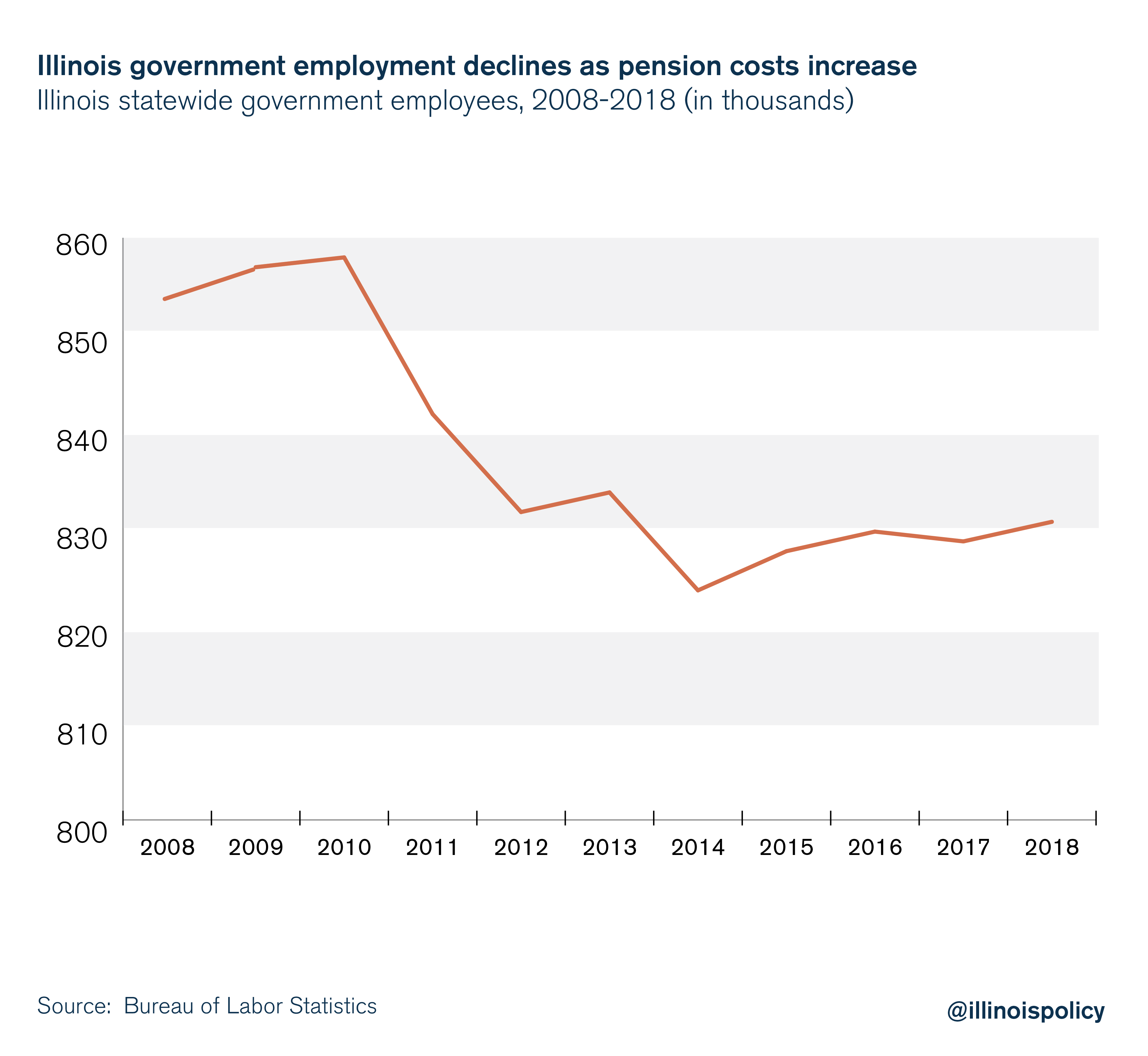

Finally, Hertz correctly notes pension payments are crowding out Illinois’ ability to provide core government services, but the CTBA plan is the opposite of what the state should do to ensure those services aren’t swallowed up by pension costs.

The reason for this is that the CTBA plan trades “soft debt” for “hard debt.” Pension benefits are soft debt, as they can be reduced through policy reform. Meanwhile, hard debt cannot be reduced except in the unlikely event of state bankruptcy.

The CTBA’s trade would mean prioritizing pension-related payments over core government spending on social services and education. Additionally, the CTBA plan makes pensions nearly $2 billion more expensive annually for at least a decade, accelerating the crowding out effect.

Fitch is right to warn lawmakers against adopting this reckless plan.

Unfortunately, Gov.-elect J.B. Pritzker is said to be “looking seriously” at this plan as a means of addressing the state’s $130 billion to $250 billion in unfunded pension liabilities.

Pritzker should abandon this no-reform pension proposal and instead support meaningful pension reform that starts with a constitutional amendment to allow changes to future, unearned benefits. Here are four reasons to reject the CTBA proposal:

1) The CTBA plan increases, not decreases, the cost of pensions in the short term

Even if the CTBA plan works as designed – which is unlikely for reasons detailed below – required contributions would increase for more than a decade compared to current law. According to CTBA’s projections, total pension costs would have increased for fiscal years 2019 through 2031 if the plan had been implemented for this year’s budget.

The requirement to increase rather than decrease pension contributions makes the CTBA plan a bad deal for taxpayers right off the bat for two key reasons.

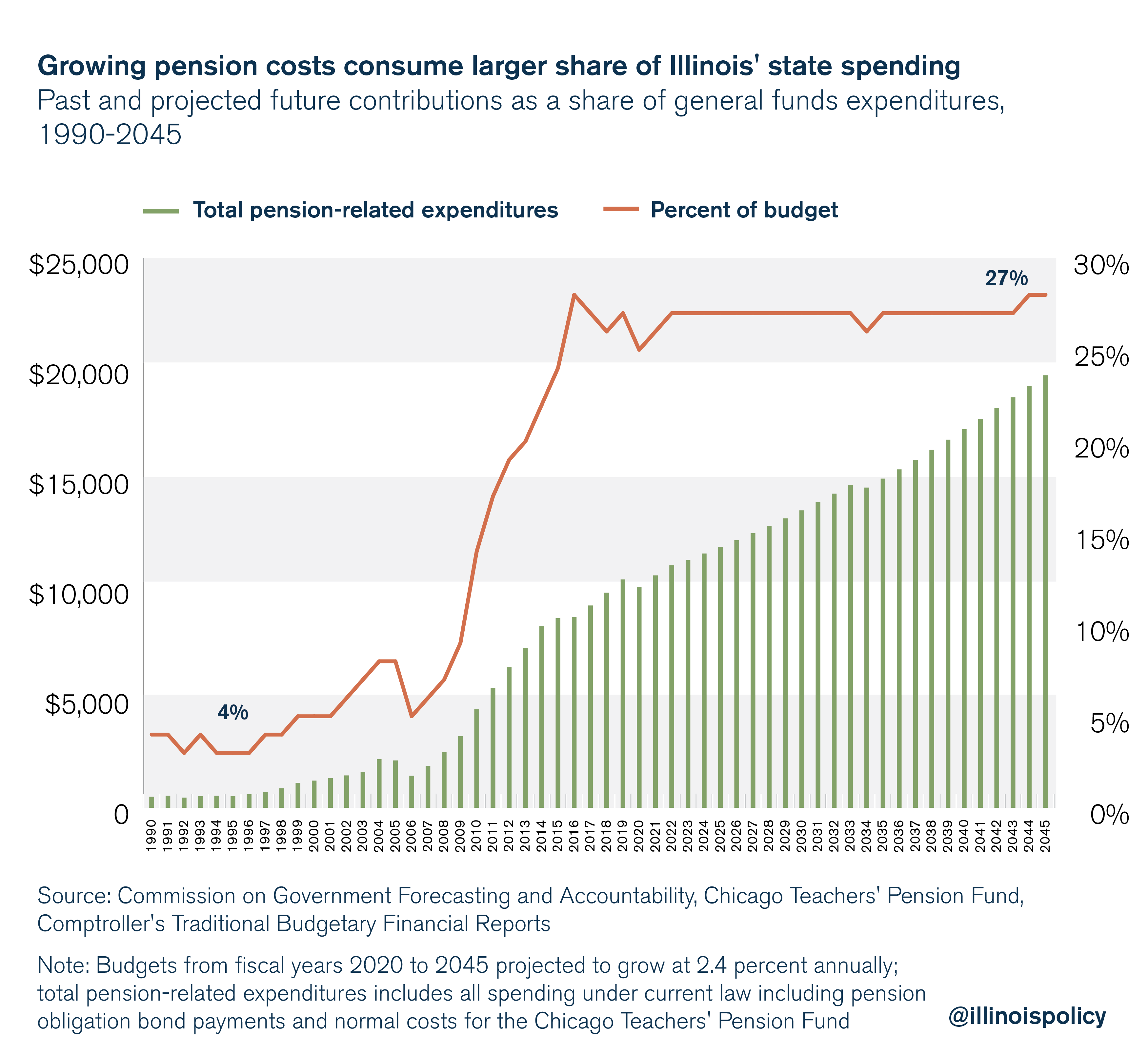

First, total pension related expenditures already exceed 25 percent of the state’s general revenue. Pensions as a share of total expenditures have been rising rapidly for decades, crowding out spending on core government services such as education and social services.

Illinois’ inability to both deliver essential services and consistently make the actuarially required pension contributions is a leading cause of its worst in the nation credit rating.

Second, Pritzker campaigned on increasing spending for numerous government programs, as well as creating several new programs. Broadly speaking, Pritzker has promised to spend more for infrastructure, education and social services.

As governor, Pritzker’s ability to fulfill these promises will depend on his ability to reduce the share of the budget going toward paying for yesterday’s government in the form of pensions.

According to WTTW, Pritzker has committed to balanced budgets without an income tax hike for his first two budget years. That is an achievable goal, but not if Pritzker adopts the CTBA pension plan requiring him to put nearly $2 billion more toward annual pension costs.

2) The CTBA plan violates best practices for pension funding according to actuaries

Illinois law currently requires the state to make contributions sufficient to reach a funding ratio of 90 percent by the year 2045. This standard already violates best practices set by the Actuarial Standards Board, which publishes uniform Actuarial Standards of Practice, or ASOPs.

The Illinois state actuary, part of the Office of the Auditor General, has consistently recommended adopting a funding plan in line with generally accepted actuarial principles. Specifically, the recommendation is for the state to move toward a repayment schedule that targets 100 percent funding over a period of no more than 20 years.

The CTBA plan moves in the opposite direction both by reducing the funding target and by increasing the timeline for repayment of pension debt well beyond the acceptable 20-year period.

In other words, CTBA is supporting the same sort of kicking the can down the road that got Illinois into its pension mess. From the Edgar ramp to “asset smoothing,” Illinois has a long history of asking the next generation to pay the bill. As pointed out by actuary Elizabeth Bauer in Forbes, the CTBA plan is nothing more than a plan to keep the system more underfunded for longer.

3) The CTBA plan requires borrowing money through pension obligation bonds

At a time when borrowing costs are higher than ever as a result of Illinois’ worst-in-the-nation credit rating, the CTBA plan requires selling $11.2 billion in new bonds.

Pension obligation bonds, or POBs, are a gamble with taxpayer money.

Theoretically, POBs can save money via arbitrage, meaning the return on investment from pumping the new money into pension funds is higher than the interest paid on the bonds. In practice, this rarely works out. Citing a history of failure, credit ratings agency S&P Global Ratings considers the use of POBs to be a credit negative, according to an article published by OFI Global.

According to the most recent projections of Illinois’ last experiment with POBs, the total of $17.2 billion in borrowing – racked up under former Govs. Pat Quinn and Rod Blagojevich – will cost $30.8 billion to repay.

The Government Finance Officers Association, a nonpartisan professional services organization, has also come out against the use of POBs, citing the risk involved and history of failure.

Illinois cannot afford to gamble with taxpayer money when the state already has $7 billion in short term debt from unpaid bills and a structural deficit of at least $1.2 billion.

4) The CTBA plan does nothing to change the underlying cause of Illinois’ pension problem

Public debate around pensions is often backward-facing. Was this problem caused by underfunding or overpromising? This common question misses a simple truth: One follows from the other.

If someone took out a $1 million mortgage on a $40,000 annual income, the monthly mortgage payment would be $3,800 using today’s standard interest rate. Meanwhile, the borrower’s take-home pay after taxes would be just $2,650 per month. He would miss his payment every month. When the bank comes to repossess the home, is it because the borrower overpromised or underfunded his mortgage?

Clearly, both answers hold some degree of truth. But underfunding is a result of the fact that the required payments were unrealistic given the borrower’s ability to pay. According to Wirepoints, total pension liabilities, or the present value of current and future promised benefits, have grown 4.5 times faster than Illinoisans’ personal income and six times faster than state revenues since 1987. This means pension benefits are outpacing their funding source.

Defined-benefit pension systems also have several fundamental structural flaws.

First, the reliance of these systems on predictions about the future – such as expected rates of investment return, retiree mortality rates, and future salary and employment levels – make them unpredictable for lawmakers and prone to fiscal shocks during recessions. It’s exactly this vulnerability to differing assumptions that explains why Moody’s Investors Service estimates Illinois’ pension debt at $250 billion, nearly double the state’s official number.

Second, the amount an employee receives in retirement benefits is unconnected to the amount he or she pays in to the system. In fact, most workers contribute only about 4 to 8 percent of what they receive in retirement benefits – 8 to 16 percent including investment returns – and half will receive pensions worth over $1 million during the course of their retirement

CTBA’s plan includes absolutely no reforms to reduce the growth in pension liabilties going forward and no reforms to make the systems more predictable or sustainable. As a result, the CTBA proposal cannot be called a pension reform plan at all. It risks a future in which Illinois is in exactly the same position it’s in today if benefits grow faster than expected, which is not an unlikely scenario.

A better path for Pritzker to follow

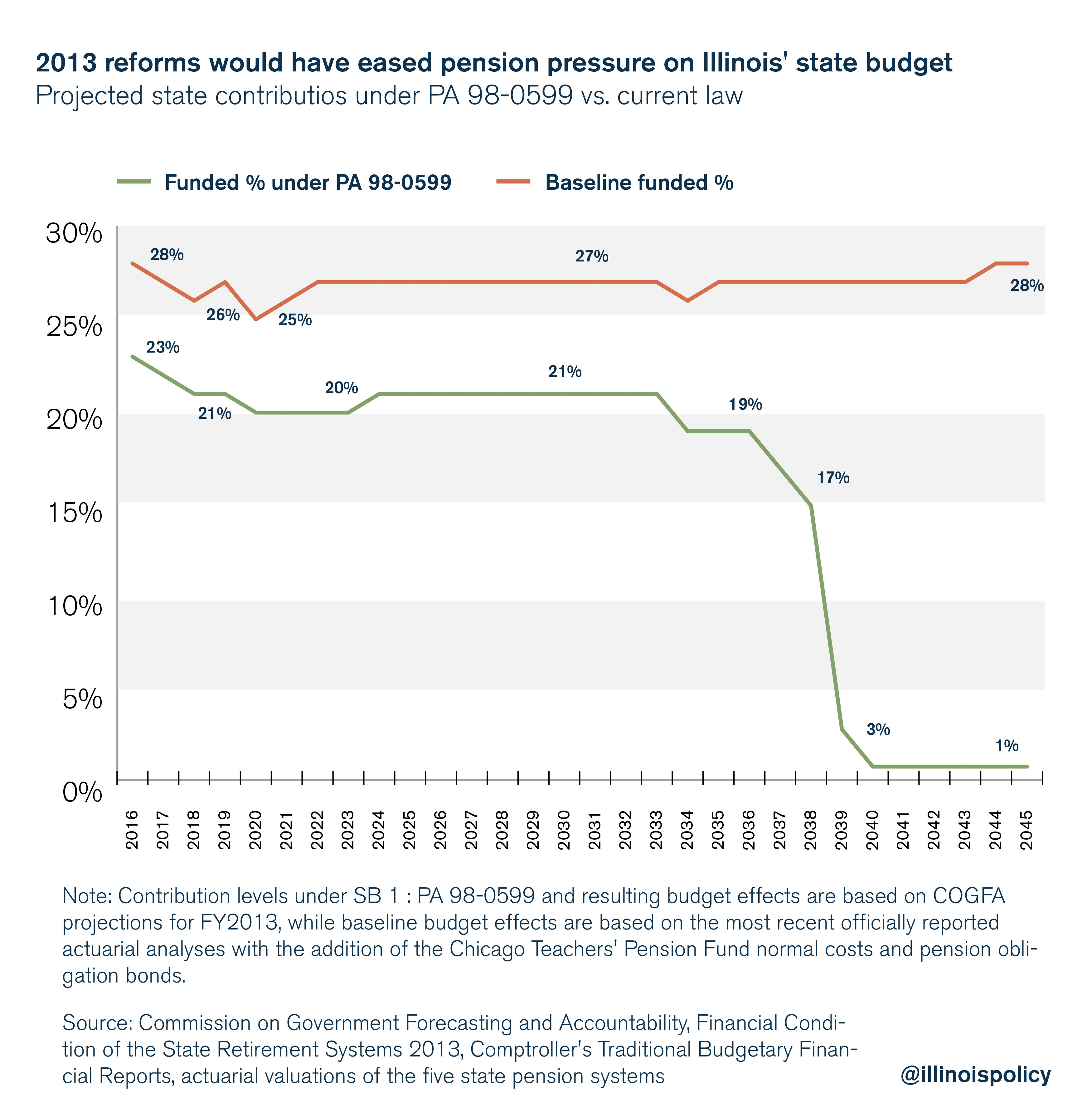

The 2013 effort to reform Illinois pensions provides a better road map for Pritzker to solve Illinois’ pension crisis and free up revenue for his desired spending. The plan was passed through a Democrat-controlled General Assembly and signed by Democratic former Gov. Pat Quinn.

Under the reform bill state lawmakers passed in 2013, no current worker would have received less than she is currently promised, and no retiree would have seen her monthly check decrease. The reform concepts – modifying cost-of-living adjustments, increasing retirement ages for younger workers and capping the maximum pensionable salary – would have only affected the rate of future benefit accruals.

While the measure was imperfect, the 2013 reforms would have had dramatic and positive effects on the state budget.

Unfortunately, the Illinois Supreme Court struck down the reforms in 2015, citing the state constitution’s restrictive pension clause. Had the reforms survived, they would have reduced the state’s 2016 pension contribution by $1.2 billion and put the state on a path toward a more sustainable and affordable pension system.

A recent report from the Illinois Policy Institute lays out a path for building on and improving the 2013 reform model, starting with a constitutional amendment to protect earned benefits but allowing changes in the rate of future benefit accruals.

Without real pension reform, Illinoisans face a future in which state and local governments ask taxpayers to pay more for less, with continuing calls for tax hikes amid service cuts to pay for pensions. This is already happening in cities including Harvey, Peoria, Rockford, Chicago and Springfield, to name a few.

CTBA’s plan does nothing to solve the problem. Pritzker should disavow the no-reform plan and propose one that effectively addresses the crisis.