Hidden bill: Chicago taxpayers and the Windy City crisis

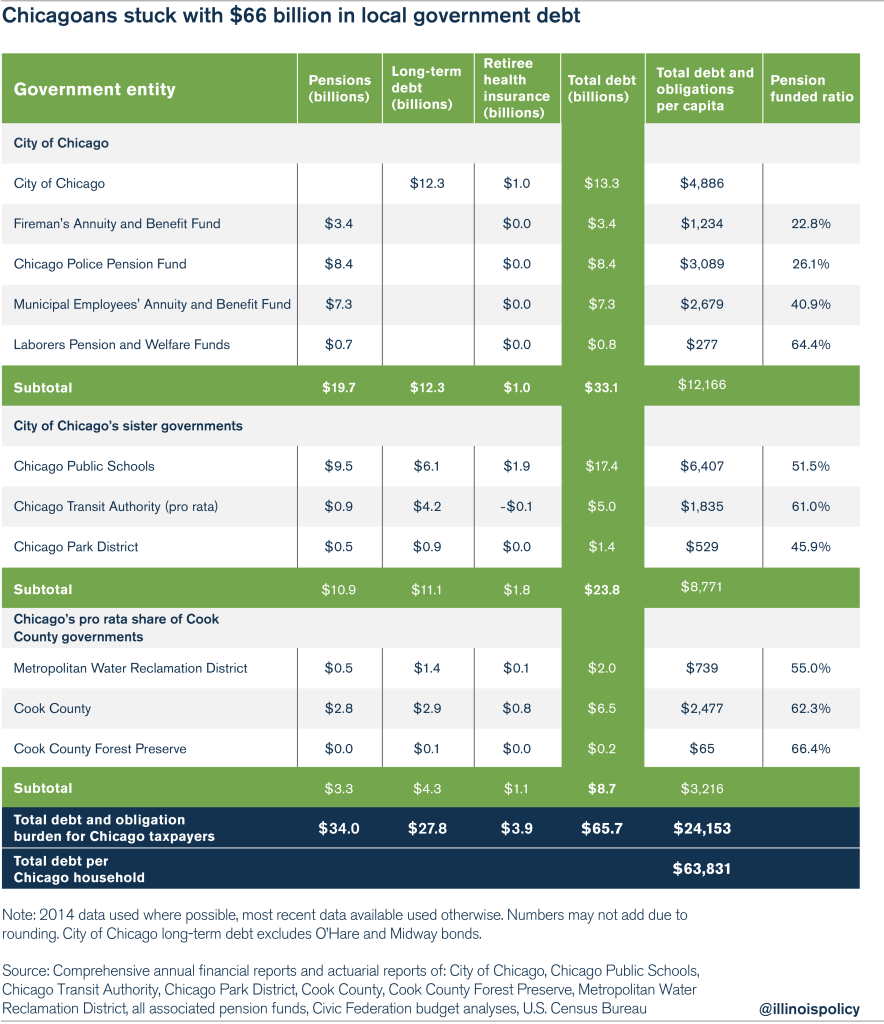

Each Chicago household is on the hook for more than $63,800 in future tax bills – much of it for services already rendered.

Cook County’s passage of a $473 million sales-tax hike to prop up its ailing government pension funds should have most Chicagoans worried.

That tax hike, which pushes Chicago’s combined sales-tax rate to a nation-high 10.25 percent, will be just the tip of the iceberg if structural pension, debt and spending reforms aren’t eventually implemented by the many government entities in the Chicago area.

At least 10 overlapping Chicago-area government pension funds are in dire straits – and they’re all looking for cash.

Without reforms, Chicago households will continue to be stuck with more than $35 billion in pension debt from the city’s many government entities. And when all other long-term debts and health-insurance debts are added in, each Chicago household is on the hook for nearly $64,000 in future tax bills – much of it for services already rendered.

Chicago’s four city-run pension funds, which include the police and fire retirement systems as well as the laborer and municipal pension funds, are nearly $20 billion underwater. The fire and police funds have just 23 and 26 percent of their required funding, respectively, and are just years from running out of cash. They are already bankrupt under any private-sector measure.

Chicago’s sister-government pension plans – those of the Chicago Public Schools, or CPS; Chicago Park District; Chicago Transit Authority; and Chicago’s share of Cook County’s plans – are more than $14 billion short. The funding levels for these systems are dangerously low, though not as severely as the city’s fire and police funds.

And apart from large pension shortfalls, Chicagoans are stuck with long-term borrowings that total nearly $28 billion. That growing debt is the result of years of mismanagement by the city and its sister governments.

The pension shortfalls and debt load have put the city’s and CPS’ operating budgets under tremendous strain. Both entities expect deficits of up to $1 billion each – due in part to a huge increase in pension payments both are required to make.

Financial institutions are very much aware of Chicago’s financial stresses. Moody’s Investors Service has downgraded the city four times since 2013, knocking it down seven spots to “junk-bond” status.

This, along with CPS’ own collapse into junk territory, has created unprecedented panic and distress for the city and CPS as they struggle to repay and refinance current obligations.

What do these billions in debt and pension shortfalls mean for people living in Chicago?

Adding it all up, Chicago’s 1 million-plus households are each stuck with nearly $64,000 in future taxes – mostly to pay for work already done.

Unfortunately, the stress on hard-working Chicagoans doesn’t end there.

Chicago also faces the risk that subsidies from the state of Illinois may be dramatically reduced. The units of government that operate within Chicago’s borders depend on billions of dollars in state funds. CPS receives more than $1.8 billion in state education support, and the Chicago Transit Authority receives millions more. Chicago also receives $420 million in funding as part of the Local Government Distributive Fund. Any cuts in those funds will only increase the pressure on Chicago’s finances.

Chicago’s fiscal squeeze has already threatened the city’s ability to provide core services. CPS recently announced it will lay off 1,400 employees as a result of increased pension contributions the district is required to make in the 2016 fiscal year. Those layoffs follow more than 3,000 pink slips and the closure of nearly 50 schools just two years ago.

The major risk for Chicago government is that when taxpayers feel they no longer receive value for the taxes they pay, they’ll leave. Chicago has already lost nearly 200,000 people since 2000 – meaning there are fewer taxpayers left to pick up the city’s growing debt.

It will take bold reform to stabilize Chicago’s finances, protect city taxpayers, make government-worker retirements secure and restore confidence in the city’s future.

Bold reform means a pension overhaul that ends the accrual of defined-benefit liabilities, protects what workers have already earned and empowers government workers with 401(k)-style retirement plans.

It means capping the growing debt burden and paying down existing debts in a responsible manner.

Finally, it means reining in spending and opening up union contracts to negotiate levels of benefits and wages that are in line with what Chicago taxpayers can afford.

That’s the fiscal path Chicago needs to create the future its residents deserve.