Homeowners in collar counties pay highest property taxes in Illinois

Residents of Chicago’s collar counties pay the highest property taxes in the state – and some of the highest in the country.

Taxpayers across Illinois pay some of the highest property taxes in the nation.

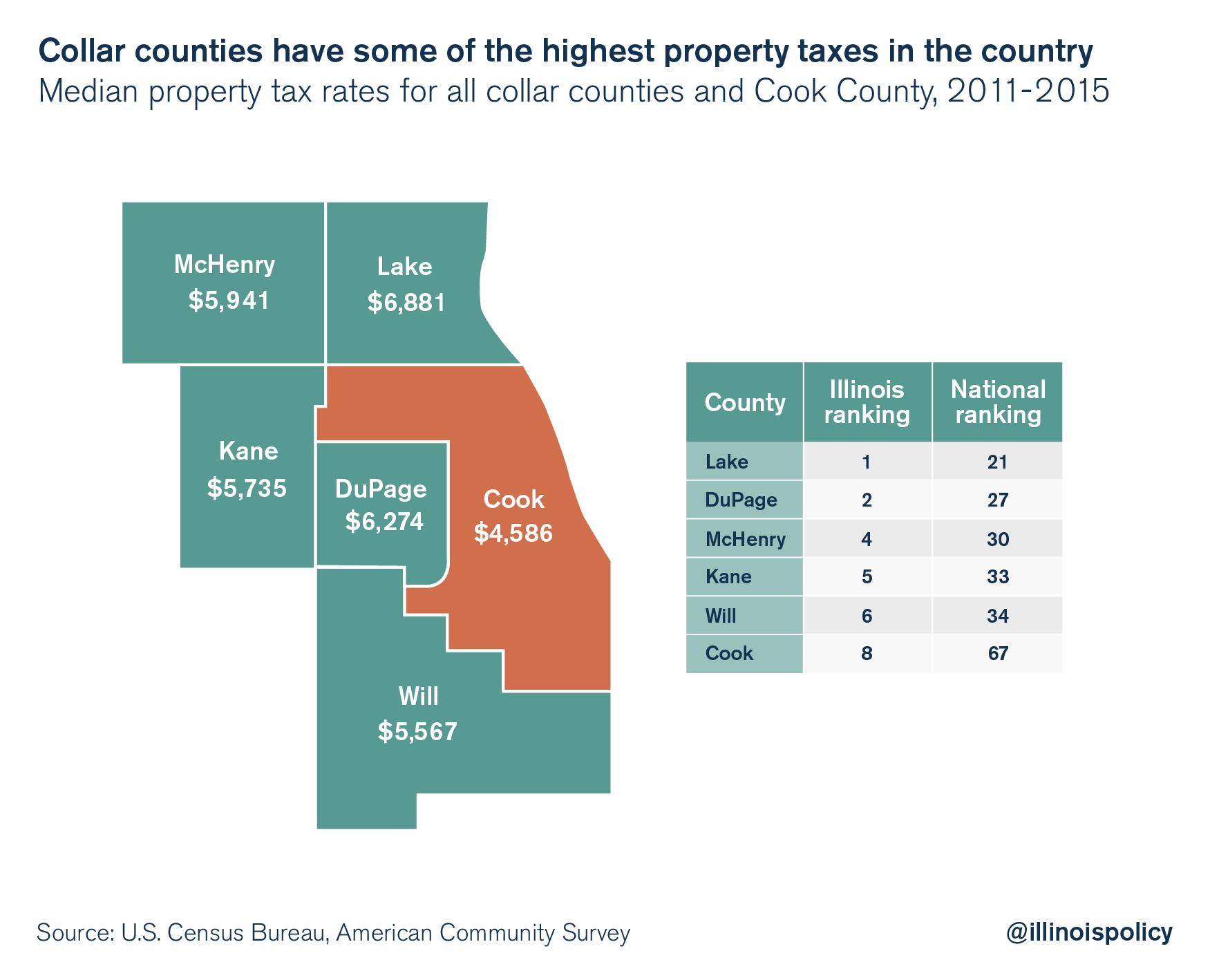

And in a state with a widespread property tax problem, residents of Chicago’s collar counties bear an especially heavy burden. Homeowners in these areas pay the highest property taxes in the state, and among the highest in the country, according to data from the nonpartisan Tax Foundation. The rankings are calculated based off median effective property tax rates.

Residents in Lake and DuPage counties pay the highest and second-highest property taxes in Illinois, respectively, and the 21st– and 27th-highest in the country. McHenry, Kane and Will counties rank fourth-, fifth- and sixth-highest in the state, respectively, and all are among the country’s top 35 counties for the highest median property taxes.

A median property tax bill for Lake County residents is close to $7,000, while in DuPage County, it exceeds $6,200. Residents of McHenry, Kane and Will pay nearly $6,000 on a median property tax bill.

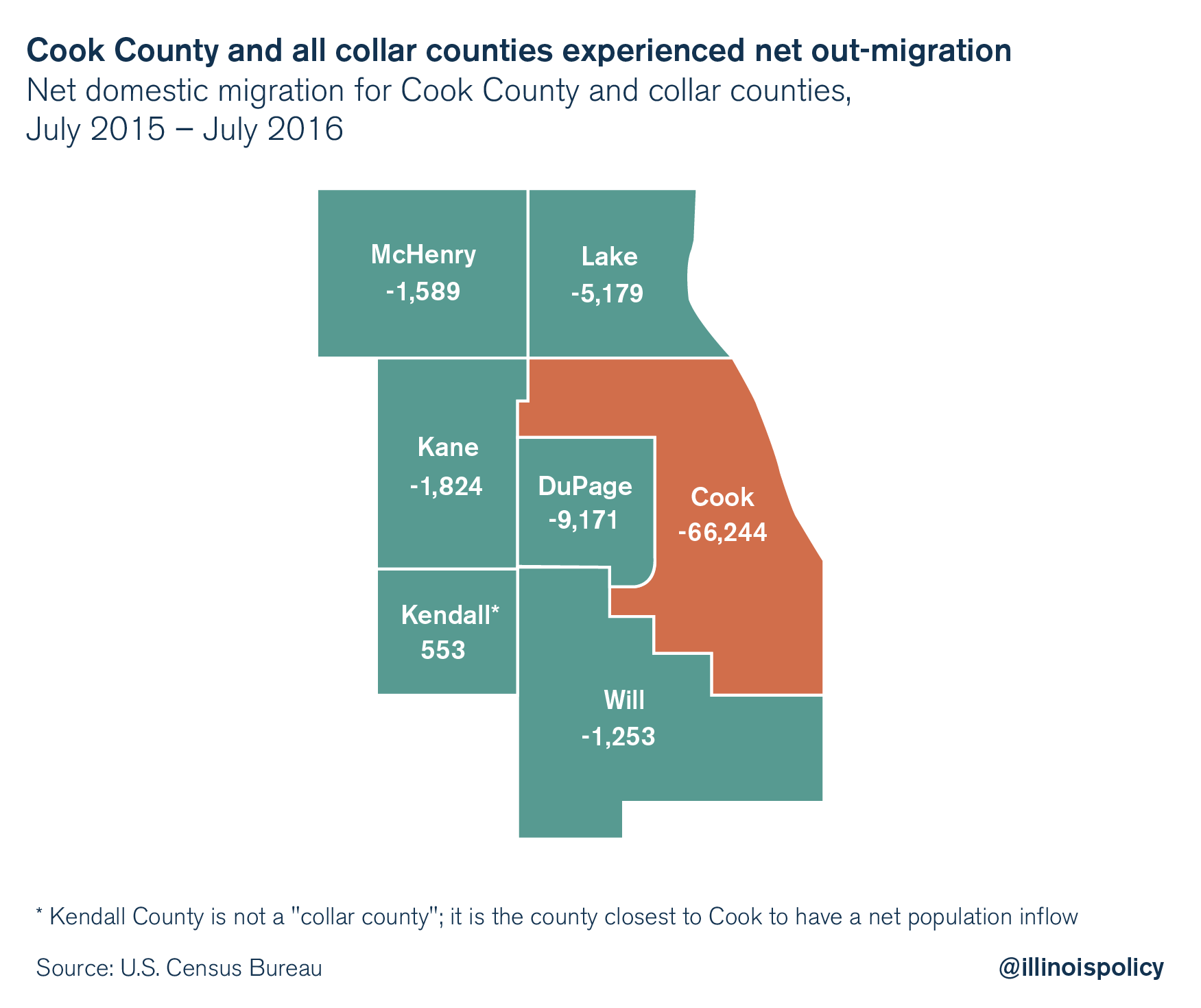

In response, taxpayers in the collar counties have said goodbye to the area – and the state – in large numbers.

In response, taxpayers in the collar counties have said goodbye to the area – and the state – in large numbers.

More than 9,000 people left DuPage County, on net, from July 2015 to July 2016, according to U.S. Census Bureau data, causing the county’s population to drop by more than 2,400 people. More than 5,000 people left Lake County in that same time period, on net, causing Lake’s population to shrink by nearly 400 people, and a net of more than 1,000 people left each of McHenry, Kane and Will counties between July 2015 and July 2016.

With property tax rates this high and residents fleeing the state, lawmakers representing these areas should seek to ease their constituents’ tax burden. But that hasn’t been the case.

The closest thing to property tax relief Illinois lawmakers brought forward in 2016 was House Bill 696, which would have frozen property taxes, but only for non-home rule taxing districts. And that’s a significant exception: Approximately 7.8 million Illinoisans, or roughly 60 percent of all state residents, live in home rule communities.

Several of HB 696’s co-sponsors represent home rule communities in the collar counties, including state Reps. Deb Conroy, D-Villa Park, who represents home rule municipality Glendale Heights in DuPage County; Natalie Manley, D-Joliet, whose district includes a home rule city in Will County; and Ron Sandack, a former Republican state representative who represented Downers Grove, a home rule village in DuPage County.

The bill passed the House 71-31, but never made it to the Senate floor.

A property tax freeze that excludes more than half the state’s population is not real reform. But a true, permanent property tax freeze for the entire state would be a positive step, especially for residents in the overtaxed collar counties. Unfortunately, so far in 2017, state senators have tinkered with only a watered-down, two-year property tax freeze, attached to multibillion-dollar tax hikes.

Lawmakers should know their constituents are looking for relief, and barring that, the exits. This is true across the state, but particularly in the collar counties, where the overwhelming property tax rates are pushing families out of their homes and out of the state.

Sign the petition

Demand property tax relief

It's time for homeowners to take control of property taxes in Illinois. Sign the petition to freeze property taxes.

Learn More >