Illinois’ business tax climate

Illinois’ poor public policies continue to hammer the state’s business climate. This week the Tax Foundation released its 2013 State Business Tax Climate Index, confirming the state’s worsening position. Illinois dropped a full 13 places, to 29th, from 16th just since 2011. Illinois now ranks worse than most of its neighbors. The Tax Foundation ranks states based on...

Illinois’ poor public policies continue to hammer the state’s business climate. This week the Tax Foundation released its 2013 State Business Tax Climate Index, confirming the state’s worsening position. Illinois dropped a full 13 places, to 29th, from 16th just since 2011. Illinois now ranks worse than most of its neighbors.

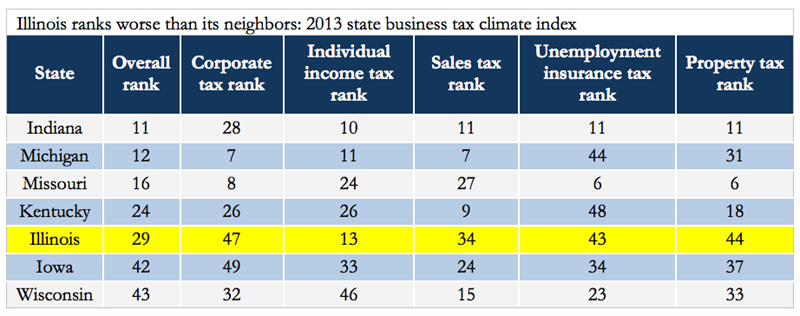

The Tax Foundation ranks states based on 118 different variables that fit into five broad categories: corporate tax, individual income tax, sales tax, unemployment insurance and property tax. Here’s how Illinois ranks relative to its neighboring states:

Illinois businesses and consumers are suffering – operating in a state that ranks 47th in corporate taxes, 34thin sales taxes, 43rd in unemployment insurance and 44th in property taxes.

The only category propping up Illinois’ rank is the individual income tax, which accounts for a third of the total index score. Illinois, Indiana and Michigan score well in this category because of their flat rate income tax structure.

Unfortunately, Gov. Quinn is looking cut the legs out from Illinois’ only positive category. He wants to end Illinois’ flat tax regime and introduce a progressive income tax.

Implementing a progressive income tax would further destroy Illinois’ entrepreneurial activity and would have detrimental effects on the state’s business climate. The tax foundation correctly argues that a progressive income tax discourages entry into self-employment, reduces investment and hiring and provides a disincentive for individuals to work.

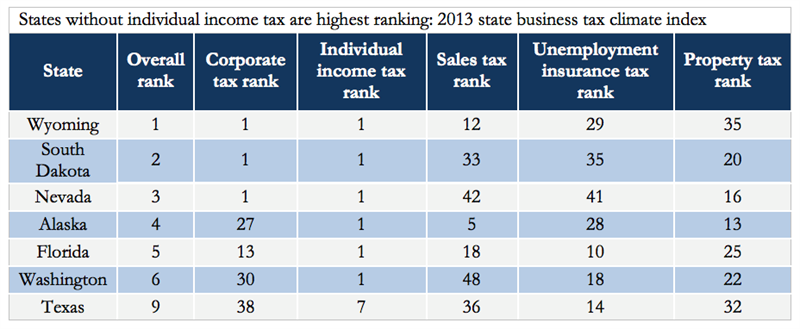

Instead of worsening Illinois’ business climate, Gov. Quinn should push for Illinois to join the seven states without an individual income tax.

States without an individual income tax are the highest ranking states in this category. More importantly, these states are among the highest ranking states in the entire business climate index.

The point is this: states that embrace neutrality in their tax code and allow individuals and businesses to keep more of their income are simply more competitive than states with discriminatory tax structures.

Instead of flirting with the idea of destroying Illinois’ business climate with a progressive income tax, lawmakers should make Illinois a better place to live and do business by removing the individual income tax altogether.